by Calculated Risk on 8/04/2009 07:21:00 PM

Tuesday, August 04, 2009

Taylor, Bean & Whitaker Suspended by FHA

From HUD: FHA Suspends Taylor, Bean & Whitaker Mortgage Corp. and Proposes to Sanction Two Top Officials

The Federal Housing Administration (FHA) today suspended Taylor, Bean and Whitaker Mortgage Corporation (TBW) of Ocala, Florida, thereby preventing the Company from originating and underwriting new FHA-insured mortgages. The Government National Mortgage Association (Ginnie Mae) is also defaulting and terminating TBW as an issuer in its Mortgage-Backed Securities (MBS) program and is ending TBW's ability to continue to service Ginnie Mae securities. This means that, effective immediately, TBW will not be able to issue Ginnie Mae securities, and Ginnie Mae will take control of TBW's nearly $25 billion Ginnie Mae portfolio.Taylor Bean is a major FHA lender, from the WSJ:

FHA and Ginnie Mae are imposing these actions because TBW failed to submit a required annual financial report and misrepresented that there were no unresolved issues with its independent auditor even though the auditor ceased its financial examination after discovering certain irregular transactions that raised concerns of fraud. FHA's suspension is also based on TBW's failure to disclose, and its false certifications concealing, that it was the subject of two examinations into its business practices in the past year.

"Today, we suspend one company but there is a very clear message that should be heard throughout the FHA lending world - operate within our standards or we won't do business with you," said HUD Secretary Shaun Donovan.

FHA Commissioner David Stevens said, "TBW failed to provide FHA with financial records that help us to protect the integrity of our insurance fund and our ability to continue a 75-year track record of promoting, preserving and protecting the American Dream. We were also troubled that the Company not only failed to disclose it was a target of a multi-state examination and a separate action by the Commonwealth of Kentucky, but then falsely certified that it had not been sanctioned by any state. FHA won't tolerate irresponsible lending practices."

Taylor Bean was the 12th largest U.S. mortgage lender in the first six months of this year, according to Inside Mortgage Finance, a trade publication. Among originators of FHA loans, Taylor Bean was the third largest in May, with a market share of 4%, according to the publication. Only Bank of America Corp. and Wells Fargo & Co. were larger.Taylor Bean was raided yesterday along with Colonial Bank by TARP inspectors. There is no indication if these actions are related.

Jim the Realtor: A CRE Foreclosure Cornucopia

by Calculated Risk on 8/04/2009 06:32:00 PM

Mostly CRE here ...

Setser takes post with National Economic Council

by Calculated Risk on 8/04/2009 05:14:00 PM

Dr. Brad Setser, author of the blog "Follow the Money", has taken a new job with the National Economic Council. Unfortunately this means no more blogging for Brad.

Here is an excerpt from Brad's farewell post: All great things have to end

Fundamentally this blog was about an issue – the United States’ trade deficit, the offsetting trade surpluses in other parts of the world and the capital flows that made this sustained “imbalance” possible. Most of my early blog posts argued, in one way or another, that taking on external debt to finance a housing and consumption boom wasn’t the best of ideas. Even if (or especially if) the deficit was financed by governments rather than private markets.Brad and I have had a number of great discussions over the years, and his blog always provided great information and insight. Brad's work really helped clarify the relationship between the U.S. current account deficit (trade deficit) and the housing bubble.

Brad, congratulations! Thanks for everything, and I wish you all the best at your new job!

Consumer Products: "No trend of increasing orders"

by Calculated Risk on 8/04/2009 04:11:00 PM

Brian sent me these comments from Multi-Color Corp. (this company makes labels mostly for consumer product companies: P&G was 19% of Q1 sales and Miller Beer was 13%.)

Multi-Color: “While there is increasing evidence that the worst of the recession may be over, we remain cautious about sales volume for the remainder of the year. While you would expect inventories to be replenished as the economy stabilizes, we have not seen a trend of increasing orders to date.”The end of cliff diving is not the same as green shoots!

Analyst: Just a few questions. The first would be can you talk about the phasing of order flow by month over the course of the quarter? And can you provide any color on how July trended?

Frank Gerace, Multi-Color CEO: Yes, order flow actually was pretty decent during the month of June, better than May, and then as July came in, July began looking more like May, so there was an improvement during June and then it kind of went back to the way it was looking in May. And what we're seeing now is just steady, stable, steady orders, no increases that we can speak of to date.

emphasis added

Homebuilder D.R. Horton: Good News, Bad News

by Calculated Risk on 8/04/2009 03:15:00 PM

From D.R. Horton:

D.R. Horton ... today reported a net loss for its third fiscal quarter ended June 30, 2009 of $142.3 million ... The quarterly results included $110.8 million in pre-tax charges to cost of sales for inventory impairments and write-offs of deposits and pre-acquisition costs related to land option contracts that the Company does not intend to pursue. The net loss for the same quarter of fiscal 2008 was $399.3 million ... Homebuilding revenue for the third quarter of fiscal 2009 totaled $914.1 million, compared to $1.4 billion in the same quarter of fiscal 2008. Homes closed totaled 4,240 homes, compared to 6,167 homes in the year ago quarter.Horton is the largest homebuilder in the U.S.

...

Donald R. Horton, Chairman of the Board, said, “Our net sales orders in the June quarter reflected a 22% sequential increase from our March quarter which was stronger than our usual seasonal trend. However, market conditions in the homebuilding industry are still challenging, characterized by rising foreclosures, high inventory levels of available homes, increasing unemployment, tight credit for homebuyers and weak consumer confidence."

...

The Company’s cancellation rate (cancelled sales orders divided by gross sales orders) for the third quarter of fiscal 2009 was 26%.

emphasis added

The bad news is they are still losing money and sales are way off from last year.

The good news is sales in calendar Q2 (fiscal Q3) were "stronger than [the] usual seasonal trend", and also cancellations are back to early 2006 levels.

The surge in cancellation rates was an important story after the bubble burst because the Census Bureau doesn't correct inventory levels if contracts are cancelled. Now it appears cancellation rates might be returning to more normal levels.

Note: What matters for inventory is the change in cancellation rate from a couple of quarters earlier, not the absolute level. For those interested in how the Census Bureau handles cancellations, see here.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the cancellation rate for Horton since the top of the housing bubble.

There appears to be a seasonal pattern (fewer cancellations in Q1), so this decline in calendar Q2 is definitely significant.

The cancellation rate could rise again if mortgage rates move higher, but this is a little bit of good news for the builders. These cancellation rates are still above normal (Note: "Normal" for Horton is in the 16% to 20% range, so 26% is still high.), but most of the home builders are reporting the lowest cancellation rates since late 2005 or early 2006.

The really bad news for Horton - and all homebuilders - is that sales will not rebound for the reasons outlined by Mr. Horton above, especially because of the huge overhang of excess inventory. In the low priced areas where inventory is currently low and activity high, most of the homes are selling below replacement cost and the builders can't compete. The big question for the builders is: Can they make money at these sales levels? I think the answer for many of them is no.

ABI: Personal Bankruptcy Filings up 34.3 Percent compared to July 2008

by Calculated Risk on 8/04/2009 12:25:00 PM

From the American Bankruptcy Institute: Consumer Bankruptcy Filings Reach Highest Monthly Total Since 2005 Bankruptcy Law Overhaul

U.S. consumer bankruptcy filings reached 126,434 in July, the highest monthly total since the Bankruptcy Abuse Prevention and Consumer Protection Act was implemented in October 2005, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). The July 2009 consumer filing total represented a 34.3 percent increase nationwide from the same period a year ago, and an 8.7 percent increase over the June 2009 consumer filing total of 116,365. Chapter 13 filings constituted 28.3 percent of all consumer cases in July, slightly above the June rate.

"Today's bankruptcy filing number reflects the sustained and growing financial stress on U.S. households," said ABI Executive Director Samuel J. Gerdano. "Rising unemployment on top of high pre-existing debt burdens is a formula for higher bankruptcies through the end of this year."

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, 2009 based on monthly data from the American Bankruptcy Institute.

The quarterly rate is close to the levels prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

There have been 802 thousand personal bankrutpcy filings through July 2009, and the American Bankruptcy Institute is predicting over 1.4 million new bankruptcies by year end - I'll take the over!

NMHC Quarterly Apartment Survey: Occupancy Continues to Decline, but Pace Slows

by Calculated Risk on 8/04/2009 10:49:00 AM

Note from NMHC: "Market Tightness Index reading above 50 indicates that, on balance, apartment markets around the country are getting tighter; a reading below 50 indicates that market conditions are getting looser; and a reading of 50 indicates that market conditions are unchanged."

So the increase in the index to 20 implies lower occupancy rates and lower rents - "looser" apartment conditions - but at a slower pace of contraction than the previous month.

From the National Multi Housing Council (NMHC): Apartment Market Conditions Stabilizing, But Not Improving, According to NMHC Quarterly Survey

The apartment market continues to struggle, but shows early signs of possibly stabilizing, according to the National Multi Housing Council’s latest Quarterly Survey of Apartment Market Conditions.

All four of the survey's market indexes covering occupancy, sales volume, equity finance and debt finance remained below 50 (indicating conditions were worse than three months ago), but three of the four increased from the last quarter, with only the debt index recording a decline.

“Apartment demand remains tethered to an economy that continues to shed jobs at a fairly rapid pace,” noted NMHC Chief Economist Mark Obrinsky. “Financing is beginning to stabilize, but the market is still a long way from ‘normal’.”

“The survey also suggests that transaction activity is mainly being restrained by uncertainty in apartment property values—whether they have ‘bottomed out’—and not financing constraints. Only when this uncertainty fades are we likely to see a significant upturn in apartment transactions.”

Fears of future property value declines are behind the difficulty apartment firms are having in obtaining equity financing. In a special survey question, 67 percent of respondents said potentially falling property values best explained the lack of equity availability.

...

The Market Tightness Index rose from 16 to 20. This was the eighth straight quarter in which the index has been below 50, but it also the third straight quarter in which the index measure has been rising, as greater shares of respondents are reporting that vacancies are unchanged from the previous quarter rather than even looser.

emphasis added

Click on graph for larger image in new window.

This graph shows the quarterly Apartment Tightness Index.

A reading below 50 suggests vacancies are rising. Based on limited historical data, I think this index will lead reported apartment rents by 6 months to 1 year. Or stated another way, rents will probably fall for 6 months to 1 year after this index reaches 50. Right now I expect rents to continue to decline through most of 2010.

Pending Home Sales Index Increases in June

by Calculated Risk on 8/04/2009 10:01:00 AM

From the NAR: Uptrend Continues in Pending Home Sales

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in June, rose 3.6 percent to 94.6 from an upwardly revised reading of 91.3 in May, and is 6.7 percent above June 2008 when it was 88.7.The increase in pending sales has been mostly from lower priced homes with demand from first time home buyers (taking advantage of the tax credit) and investors. As Yun notes, the demand from first time buyers will probably fade in another month or two.

...

"Activity has been consistently much stronger for lower priced homes,” [Lawrence Yun, NAR chief economist] said. “Because it may take as long as two months to close on a home after signing a contract, first-time buyers must act fairly soon to take advantage of the $8,000 tax credit because they must close on the sale by November 30.”

June PCE and Personal Saving

by Calculated Risk on 8/04/2009 08:31:00 AM

From the BEA: Personal Income and Outlays, June 2009

Personal income decreased $159.8 billion, or 1.3 percent, and disposable personal income (DPI) decreased $143.8 billion, or 1.3percent, in June, according to the Bureau of Economic Analysis.The temporary boost in the May saving numbers due to timing of American Recovery and Reinvestment Act of 2009 stimulus payments was reversed in June.

...

The June change in personal income reflects selected provisions of the American Recovery and Reinvestment Act of 2009, which boosted personal current transfer receipts in May much more than in June. Excluding these receipts ... personal income decreased $7.8 billion, or 0.1 percent, in June, following a decrease of $2.5 billion, or less than 0.1 percent, in May.

...

Real PCE -- PCE adjusted to remove price changes –- decreased 0.1 percent in June, in contrast to an increase of less than 0.1 percent in May.

...

Personal saving -- DPI less personal outlays -- was $504.8 billion in June, compared with $681.0 billion in May. Personal saving as a percentage of disposable personal income was 4.6 percent in June, compared with 6.2 percent in May.

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the June Personal Income report. The saving rate was 4.6% in June. (5.4% with three month average)

Households are saving substantially more than during the last few years (when the saving rate was around 1.0%). The saving rate will probably continue to rise (an aging population usually pushes the saving rate higher) and a rising saving rate will repair household balance sheets, but this will also keep pressure on personal consumption.

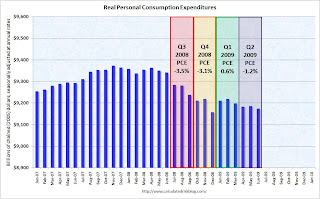

The following graph shows real Personal Consumption Expenditures (PCE) through June (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.The colored rectangles show the quarters, and the blue bars are the real monthly PCE.

PCE declined sharply in Q3 and Q4 2008 - the cliff diving - and has been relatively flat in Q1 and Q2 2009. Auto sales should gave a boost to PCE in Q3, but in general PCE will probably remain weak over the 2nd half of 2009 and into 2010 as households continue to repair their balance sheets.

Monday, August 03, 2009

Jim the Realtor: Prices falling at the high end

by Calculated Risk on 8/03/2009 10:30:00 PM

Prices are falling at the high end ...

"Poof, another notch down practically overnight ..."

Jim the Realtor: E-Ranch Balloon