by Calculated Risk on 8/05/2009 08:09:00 PM

Wednesday, August 05, 2009

WaPo: Good Bank, Bad Bank for Fannie and Freddie?

From Zachary A. Goldfarb and David Cho at the WaPo: Administration Considers Splitting Fannie Mae, Freddie Mac

The Obama administration launched a broad government effort this week to overhaul mortgage giants Fannie Mae and Freddie Mac and is considering splitting the companies and putting their troubled assets in a new federally backed corporation, administration officials said.There are no details on a proposed structure.

...

The companies' regulator ... confirmed that the administration is discussing the "good bank bad bank" model.

Barry Gosin: State of Commercial Real Estate

by Calculated Risk on 8/05/2009 06:08:00 PM

Note: Corrected 2nd sentence: "Values were driven not by underlying demand ..."

Barry Gosin, CEO of Newmark Knight Frank: "The rise in rents were really never connected to real demand. Values were driven not by underlying demand, they were driven by liquidity, and cap rates, and the desire to invest in real estate. Then on the way down, our view is the rental market has relatively stabilized - how far do you go?"

CNBC: "Stabilized at what sort of levels?"

Gosin: "In some of the big cities where you had a tremendous runup, as much as 50% [off]. The rest of the countries where the rents are much lower, 15% to 20%."

CNBC: Oh my ...! (this section starts around 4:20)

Negative Equity: 16 Million Homeowners Underwater

by Calculated Risk on 8/05/2009 03:27:00 PM

Two separate reports ...

From Bloombeg: ‘Underwater’ U.S. Mortgages May Hit 48%, Deutsche Bank Reports

The percentage of properties “underwater” is forecast to rise to 48 percent, or 25 million homes, as property prices drop through the first quarter of 2011, according to [Deutsche Bank] analysts Karen Weaver and Ying Shen.I guess Deutsche Bank didn't get the memo about house prices finding a bottom.

Note: Deutsche Bank estimates 26% of homeowners are currently underwater, matching the data below from Economy.com. And Deutsche Bank sees the next wave hitting prime borrowersm, from the report:

While subprime and Option ARMs are currently the worst cohorts with underwater borrowers, we project that the next phase of the housing decline will have a far greater impact on prime borrowers (conforming and jumbo) ... By Q1 2011, we estimate that 41% of prime conforming borrowers and 46% of prime jumbo borrowers will be underwater, a significant increase over the percentage of these borrowers in Q1 2009. The impact of this is significant given that these markets have the largest share of the total mortgage market outstanding.From the WSJ: More Homeowners ‘Upside Down’ on Mortgages

Some 24% of owner-occupied homes had mortgage debt that exceeded the values of those homes at the end of June, according to data from Equifax and Moody’s Economy.com. That number rises to 32% when looking at the share of homeowners with mortgages that don’t have equity left in their homes.Mods won't help these

Overall, 16 million homeowners are “upside-down” on their mortgages, up from 10 million, or 15% of owner-occupied homes, one year ago.

Nearly 10% of owner-occupied homes now have mortgage debt with loan-to-value ratios of at least 125%, and roughly half of those homes have mortgage debt with loan-to-value ratios of 150% or more.

Although Deutsche Bank may be pessimistic on house prices, both reports suggests about 16 million homeowners are currently underwater, and probably another 5+ million have no equity.

WSJ: Taylor Bean to cease operations

by Calculated Risk on 8/05/2009 02:20:00 PM

WSJ Headline: Taylor Bean, 12th largest U.S. mortgage lender, to cease operations, won't fund mortgages in pipeline.

This is a significant story. Taylor Bean was the third largest FHA loan originator in May.

Update: Taylor Bean press release (ht Wayne)

TAYLOR BEAN MUST CEASE ALL ORIGINATION OPERATIONS EFFECTIVE IMMEDIATETLY

OCALA, FLORIDA – TAYLOR, BEAN & WHITAKER MORTGAGE CORP. (“TBW”) RECEIVED NOTIFICATION ON AUGUST 4, 2009 FROM THE U.S DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT, FREDDIE MAC AND GINNIE MAE (THE “AGENCIES”) THAT IT WAS BEING TERMINATED AND/OR SUSPENDED AS AN APPROVED SELLER AND/OR SERVICER FOR EACH OF THOSE RESPECTIVE FEDERAL AGENCIES. TBW HAS UNSUCCESSFULLY SOUGHT TO HAVE THE TERMINATION/SUSPENSION DECISIONS OF EACH OF THOSE AGENCIES REVERSED. AS A RESULT OF THESE ACTIONS, TBW MUST CEASE ALL ORIGINATION OPERATIONS EFFECTIVE IMMEDIATELY. REGRETTABLY, TBW WILL NOT BE ABLE TO CLOSE OR FUND ANY MORTGAGE LOANS CURRENTLY PENDING IN ITS PIPELINE. TBW IS COOPERATING WITH EACH OF THE AGENCIES WITH RESPECT TO ITS SERVICING OPERATIONS AND EXPECTS TO CONTINUE TO SERVICE MORTGAGE LOANS AS IT RESTRUCTURES ITS BUSINESS IN THE WAKE OF THESE EVENTS. WE UNDERSTAND THAT THIS COULD HAVE A SIGNIFICANT IMPACT ON OUR VALUED EMPLOYEES, CUSTOMERS AND COUNTERPARTIES, AND ARE VERY DISAPPOINTED THAT A LESS DRASTIC OPTION IS UNAVAILABLE.

BRE Properties: Rents to Decline well into 2010

by Calculated Risk on 8/05/2009 01:14:00 PM

"I think it is shaping up there is another leg down in terms of market rents and effective rents and that will be somewhere late this year or early [next] year where I think all the operators will move their rents down to basically handle the late stage of this recession."BRE is an apartment REIT in the West. Here are some comments from their conference call (hat tip Brian):

BRE CEO, Aug 5, 2009

“In our market footprint non farm jobs have decreased almost 800,000 or 5% year-over-year. We feel we are at the midpoint of the market cycle. Operating fundamentals will continue to be challenged until jobs stabilize. Past recession patterns and current forecast [suggest this will be] 15 to 18 months after GDP stabilizes, currently expected in the third or fourth quarter this year.This matches the data from the NMHC apartment market tightness survey released yesterday.

... our current views have not changed from the start of the year, specifically the rent curve should continue to decline well into 2010. Cumulative rent loss may be double digits and pricing power will not return until jobs turn positive which may be late 2010.

On the disposition front, we were successful in selling the two Sacramento assets that were classified as held for sale. One community sale occurred in June and the second in July generating growth proceeds of 65 million. The cap rate was 8.5%. ...

This environment calls to mind the Churchhill comment,”if you are going through hell, keep going.”

... we believe we are halfway through a tough two-year period for rents and operations.

Occupancy at the end of the second quarter was 95%, we are slightly north of that today. We have two positive variables available to us, higher traffic and favorable renewal rates.

... market rent in our communities is down 4% year-over-year and down 6% since September. Essentially all the market decline was realized during the end of the year in the first quarter. Rents have been flat since the end of March. Effective rents are down almost 9% from peak levels in '08.

..

Concessions and/or discount pricing are prevalent in all operating markets, available from private and public operators. Whether you call it a concession or effective rent, discounts are available. In this environment the customer is focused on the check writing experience so the concession is taking the form of the recurring discount off the monthly rent. ...

Historically we haven't used concessions. In most of our markets, they weren't necessary. They are proving useful [today] on two fronts. One, we needed to recover the occupancy line [in Q2] and wanted some immediate velocity. This proved successful. The concessions are also helping where we go from here. There is another leg down from people with job losses. Our view is to pick the appropriate time in each market to adjust rents and at that time begin to reduce concessions. The objective is to reduce concessions and discount at some point by the second half in 2010.

...

Renewals are running 55%. We don't lose many tenants to other properties, about 3%. Move outs to home purchases are running 8.5% down from 16% a year ago. Jobs are the drivers for move outs. If we combine job transfer, job loss, relocation, personal reasons and financial problems, these five factors total 30% of move out activity. Unscheduled move outs, evictions and skips are another 9%.

There remains a fairly healthy rent to own gap in our Orange County, Seattle and San Diego markets, in LA where there is virtually no and the Inland Empire is negative 15 to 20%. Phoenix is negative 5% and Denver has a positive rent to own gap.

...

Analyst: I'm trying to specifically narrow down what is going to cause another 5% [decline in rents] in an environment where job losses are decreasing?

BRE: We expect there to be continued sequential declines in job growth in all of our markets through at least the midpoint of 2010. Right now the economy.com forecast is showing that you go from negative sequential declines to a point of stabilization to a beginning of modest job growth through 2010 and into ' 11. We are using that forecast and erring on the side of conservatism. We are still [expecting] another leg down in rents. In February when we gave our comments we said we thought '09-'10 would be a two-year decline in a range of 10 to 15%. I think that's still where we are today. If it is not there, we will be thrilled and happy not to cut the rents all the way down. Right now I think it is shaping up there is another leg down in terms of market rents and effective rents and that will be somewhere late this year or early [next] year where I think all the operators will move their rents down to basically handle the late stage of this recession.

emphasis added

P&G: Expect Sales Flat or Down 3% in Calendar Q3

by Calculated Risk on 8/05/2009 12:16:00 PM

Yesterday I posted some comments from Multi-Color Corp. (makes labels mostly for consumer product companies): "While you would expect inventories to be replenished as the economy stabilizes, we have not seen a trend of increasing orders to date.”

Today, from the WSJ: P&G Sales, Profit Fall as Shoppers Opt for Cheaper Brands

P&G projected ... sales excluding acquisitions and divestitures would be flat to down 3% in the [Q3 2009]. On a conference call, company executives said results would improve sequentially after [Q3 2009].Some of this is classic consumer theory concerning inferior goods; as incomes fall, demand increases for generic products at the expense of more expensive brands.

... Sales of the higher-end, more discretionary line of Braun shavers fell sharply. But some of P&G's everyday brands also continued to see declines as consumers traded down to cheaper brands and private-label goods in grocery stores. ...

In recent years, Procter & Gamble has put more focus on higher-priced products, seeking to drive growth by getting consumers to trade up. That strategy has hurt the company during the recession as consumers cut discretionary spending in areas like beauty and traded down to cheaper pantry staples.

However it helps to remember that there is a usual temporal order1 for emerging from a recession.

| During Recession | Lags End of Recession | Significantly Lags End of Recession | |

| Residential Investment | Investment, Equipment & Software | Investment, non-residential Structures | |

| PCE | Unemployment2 | ||

Housing usually leads the economy both into and out of recessions (this was true for the Great Depression too). And even though new home sales and single family housing starts may have bottomed, it seems unlikely with the the huge overhang of excess inventory and high levels of distressed sales, that residential investment will pick up significantly any time soon. Note: Residential investment is mostly new home construction and home improvements.

And that leaves Personal Consumption Expenditures (PCE), and that is why the ISM non-manufacturing numbers this morning and the P&G numbers matter. Away from auto sales, it is hard to find much evidence of a pick up in consumer demand.

I've seen some argue for a business led recovery. That is the wrong order. Sure, there will probably be some inventory replenishment since some companies probably cut back too far, but most companies already have too much capacity, so after the inventory adjustement what will happen? They will not need to expand until their sales pick up significantly.

So I still think the keys are Residential Investment (RI) and PCE, and therefore I think the recovery will be sluggish. Note that CRE and non-residential investment in structures is a lagging indicator for the economy.

1 From a post in March, (see Business Cycle: Temporal Order for the order in and out of a recession).

2 In recent recessions, unemployment significantly lagged the end of the recession. That is very likely this time too.

ISM Non-Manufacturing Index Shows Contraction in July

by Calculated Risk on 8/05/2009 10:00:00 AM

From the Institute for Supply Management: July 2009 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector contracted in July, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.The service sector was still contracting in July, and contracting at a slightly faster pace than in June.

The NMI (Non-Manufacturing Index) registered 46.4 percent in July, 0.6 percentage point lower than the 47 percent registered in June, indicating contraction in the non-manufacturing sector for the 10th consecutive month, at a slightly faster rate. The Non-Manufacturing Business Activity Index decreased 3.7 percentage points to 46.1 percent. The New Orders Index decreased 0.5 percentage point to 48.1 percent, and the Employment Index decreased 1.9 percentage points to 41.5 percent. The Prices Index decreased 12.4 percentage points to 41.3 percent in July, indicating a significant decrease in prices paid from June. According to the NMI, seven non-manufacturing industries reported growth in July. The majority of respondents' comments reflect a sense of uncertainty and cautiousness about business conditions."

emphasis added

It can't be emphasized enough - this is for July. No recovery yet.

Other Employment Reports

by Calculated Risk on 8/05/2009 08:27:00 AM

ADP reports:

Nonfarm private employment decreased 371,000 from June to July 2009 on a seasonally adjusted basis, according to the ADP National Employment Report®. The estimated change of employment from May to June was revised by 10,000, from a decline of 473,000 to a decline of 463,000.Note: the BLS reported a 415,000 decrease in nonfarm private employment in June (-467,000 total nonfarm), so once again ADP was only marginally useful in predicting the BLS number.

On the Challenger job-cut report from CNBC: Planned layoffs accelerated in July

Planned layoffs at U.S. firms increased in July for the first time in six months, signaling more uneasy times for workers and a continued drag on consumer spending and the broader economy.The BLS reports Friday, and the consensus is for about 300,000 in reported job losses for July.

Planned job cuts announced by U.S. employers totaled 97,373 last month, up 31 percent from June when it had hit a 15-month low, according to a report released on Wednesday by global outplacement consultancy Challenger, Gray & Christmas, Inc.

July's announced job cuts brought the total so far this year to 994,048, 72 percent higher than the same span in 2008.

Tuesday, August 04, 2009

Farmland Values Decline

by Calculated Risk on 8/04/2009 11:59:00 PM

From the WSJ: Farm Real-Estate Values Post Rare Drop

The U.S. Agriculture Department said in its annual report that the value of all land and buildings on U.S. farms averaged $2,100 an acre Jan. 1, down 3.2% from last year. The decline in farm real-estate values was the first since 1987, the agency said.The Chicago Fed had a similar report a couple of months ago: Farmland Values and Credit Conditions

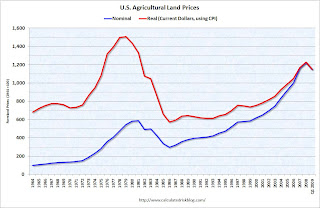

There was a quarterly decrease of 6 percent in the value of “good” agricultural land—the largest quarterly decline since 1985—according to a survey of 227 bankers in the Seventh Federal Reserve District on April 1, 2009. Also, the year-over-year increase in District farmland values eroded to just 2 percent in the first quarter of 2009.And here was a graph I posted in May based on the Chicago Fed report:

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graphs shows nominal and real farm prices based on data from the Chicago Fed.

In real terms, the current increase in farm prices wasn't as severe as the bubble in the late '70s and early '80s that led to numerous farm foreclosures in the U.S.

And as I noted in the earlier post, it was not surprising that John Mellencamp wrote "Rain On The Scarecrow" in 1985 after the farm bubble burst.

Resource: Failed Bank List with Enforcement Documents

by Calculated Risk on 8/04/2009 09:35:00 PM

ProPublica has a great table of failed banks with sortable columns by state, date and Federal regulator.

The database also includes links to public enforcement documents with the dates the documents were issued (Cease and Desist orders, Prompt Corrective Action directives, etc.).

As an example, Millennium State Bank of Texas was seized on July 2nd, 2009 and the FDIC entered a Cease and Desist order on the 19th of May 2009 FDIC. So the bank was closed less than two months after the Cease and Desist order was issued.

Other banks lasted longer, and a C&D isn't a guarantee of failure since some are cured.

A Federal Reserve Prompt Corrective Action (PCA) directive seems to have a very short leash. As an example BankFirst in South Dakota received a PCA directive on June 15th and was seized on July 17th.

If you go to the Federal Reserve enforcement list, you will see Written Agreements and Prompt Corrective Actions popping up fairly frequently. Here is one from yesterday:

The Federal Reserve Board on Monday announced the issuance of a Prompt Corrective Action Directive against Warren Bank, Warren, Michigan, a state chartered member bank.That makes Warren a BFF candidate in about a month. Also be on the lookout for Bank of Elmwood, Racine, Wisconsin (PCA on July 23rd).

A copy of the Directive is attached.

Attachment (51 KB PDF)

Note: the ProPublica list may be missing some enforcement documents. I found a Prompt Corrective Action for Community Bank of West Georgia on May 21st that isn't included - and the bank was seized a month later.