by Calculated Risk on 7/30/2009 11:15:00 PM

Thursday, July 30, 2009

CRE: Another Half Off Sale

Update as a response to some emails I've received: the "half off" is a running joke and not meant to be an exact amount - as I noted this deal was bought at auction by the lender for less than half the amount owed. And as we've discussed before, CRE loans sometimes have personal guarantees - so the lender could pursue the previous owner (it's hard to add all the caveats to every post). best to all

Actually more than half off of the loan amount ...

From Silicon Valley / San Jose Business Journal: Lender takes Palo Alto's Bordeaux Centre in auction (ht Ross)

Note: the building is actually in Sunnyvale.

California Bavarian Corp.’s Bordeaux Centre has been sold at auction to its lender Wrightwood Capital for less than $15 million.This is another never occupied commercial building - like the ones Jim the Realtor showed us in San Diego last night.

Developer Mark Mordell, president of Cal Bavarian, ... said he was told the campus sold for less than half the $34 million debt owed on the never-occupied, 124,000-square-foot project begun by Cal Bavarian in 2007 and finished in 2008

Auto: Cash-for-Clunkers to be Suspended

by Calculated Risk on 7/30/2009 07:52:00 PM

From the Detroit Free Press: Cash-for-clunkers program to be suspended (ht Basel Too)

The U.S. government will suspend the popular cash-for-clunkers program after less than four days in business, telling Congress that the plan would burn through its $950-million budget by midnight, several sources told the Free Press. ... auto dealers may have already arranged the sale of more than the 250,000 vehicles that federal officials expected the plan to generate.Sources tell me (no link) that showroom traffic jumped by about 33% at auto dealers over the last week to about the levels of last September. See the following graph:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for June (red, light vehicle sales of 9.69 million SAAR from AutoData Corp).

Light vehicle sales last September (before the collapse in October) were at a 12.46 million SAAR. Of course this is just one week of July at that sales rate ... and the program is now suspended. But that means July sales will probably be over 10 million SAAR for the first time this year.

Unemployed Over 26 Weeks

by Calculated Risk on 7/30/2009 04:45:00 PM

The DOL report this morning showed seasonally adjusted insured unemployment at 6.2 million, down from a peak of about 6.9 million. This raises the question (and frequent emails) of how many unemployed workers have exhausted their regular unemployment benefits (Note: most are still receiving extended benefits).

The monthly BLS report provides data on workers unemployed for 27 or more weeks, and those workers have exhausted their regular unemployment benefits (and maybe even the extended benefits). So here is a graph ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

According to the BLS, there are almost 4.4 million workers who have been unemployed for more than 26 weeks (and still want a job). This is 2.8% of the civilian workforce.

Notice the peak happens after a recession ends, and the of long term unemployed peaked about 18 months after the end of the last two recessions (because of the jobless recovery). This suggests that even if the current recession officially ended this month, the number of long term unemployed would probably continue to rise through the end of 2010.

Daily Show, A Lonely Condo Owner and the Market

by Calculated Risk on 7/30/2009 04:00:00 PM

Keeping with the recent theme of an end of market day mishmash ... first from the Daily Show (link here if embedded video loads slow)

And from the News-press.com: Downtown Fort Myers condo has 32 stories, and one lonely tale

Victor Vangelakos lives in a luxury condominium tower on the Caloosahatchee River. He never has to worry about the neighbors making too much noise.

There are no neighbors.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The S&P 500 is up 45.8% from the bottom (310 points), and still off 37% from the peak (578 points below the max).

The S&P 500 first hit this level in Feb 1998; over 11 years ago.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Hope Now: Mortgage Loss Mitigation Statistics

by Calculated Risk on 7/30/2009 03:26:00 PM

Hope Now released the Q2 Mortgage Loss Mitigation Statistics today.

Most of the data concerns modifications, but here are couple of graphs on delinquencies and foreclosures. Click on graph for larger image in new window.

Click on graph for larger image in new window.

There are now more than 3 million mortgage loans 60+ delinquent based on the Hope Now statistics. This covers approximately 85% of the total industry.

There are far more prime loans delinquent than subprime, although a much higher percentage of subprime (18.4%) vs prime (4.24%). The second graph shows foreclosure starts and completions.

The second graph shows foreclosure starts and completions.

Foreclosure starts are above 250 thousand per month, and completions close to 100 thousand per month. There is a lag between start and completion, and a number of loans cure or are modified - but it does appear completions will increase in the 2nd half of 2009 based on the surge in starts at the beginning of the year.

Just some data for everyone ...

Regulator: GSEs Unlikely to Fully Repay Bailout

by Calculated Risk on 7/30/2009 01:51:00 PM

From the WSJ: GSEs Unlikely to Repay U.S. in Full

... "My view is that some assets in the senior preferred will have to be left behind as they come out of conservatorship," Federal Housing Finance Agency Director James B. Lockhart said Thursday in response to a question at a panel discussion in Washington. "That will mean that some of the losses will never be repaid."I'm shocked!

The Treasury has agreed to pump $200 billion into each company in order to keep them solvent. In exchange, the government receives senior preferred stock that pays a 10% dividend. So far, it has injected $85 billion in total into the companies, but Lockhart said that figure was likely to rise in the coming months.

Fannie and Freddie together own or guarantee $5.4 trillion in mortgages. ...

Mr. Lockhart said Fannie and Freddie would likely see their reserves continue to decline next year, but could return to strong profits in two to three years.

Minnesota: Lenders Gone Wild

by Calculated Risk on 7/30/2009 12:26:00 PM

The Star Tribune has a series on small banks in trouble: Lenders Gone Wild

There are three parts:

Part 1: Minnesota’s small banks on the brink

In Minnesota, regulators have seized and closed two banks since 2008 and have ordered 16 others to clean up their balance sheets. Another 65 of the state's 430 banks and thrifts are on a secret watch list, and state banking officials expect more to fail as they are pulled down by bad real estate loans.That is more than the rumored (and denied) comment about 500 bank failures attributed to FDIC Chairman Bair.

...

Foresight Analytics estimates that the nation's 8,000 community banks will suffer losses of $60 billion related to commercial real estate in the next two to three years, and that about 713 banks across the country will fail. Under that scenario, about 19 banks in Minnesota will fail and commercial real estate losses could total more than $2 billion.

And this is a great warning:

Bank consultant Robert Viering, principal of River Point Group Inc. in Monticello, had that lesson drilled into him when he was a regional credit officer at the former Norwest Bank. A credit manual, circa 1990, warned him and his colleagues: "The pivotal issue in CRE lending is knowing when to stop. Restraint must be initiated by bankers because historically borrowers have been unable to recognize the warning signs. Commercial real estate lending should not be viewed as the cornerstone of a loan portfolio."Absolutely. The CRE developers just go crazy at the end of every boom; restraint must be initiated by bankers.

Part 2: Credit unions: where the credit flowed too freely

And Part 3 tomorrow: As loans grew, regulators shrank

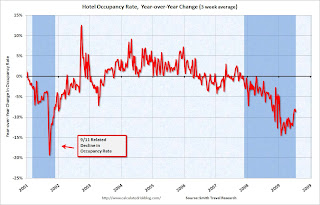

Hotel RevPAR Off 16.3 Percent YoY

by Calculated Risk on 7/30/2009 10:28:00 AM

From HotelNewsNow.com: STR reports US performance for week ending 18 July 2009

In year-over-year measurements, the industry’s occupancy fell 7.9 percent to end the week at 67.0 percent. Average daily rate dropped 9.1 percent to finish the week at US$98.13. Revenue per available room for the week decreased 16.3 percent to finish at US$65.77.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 8.7% from the same period in 2008.

The average daily rate is down 9.1%, and RevPAR is off 16.3% from the same week last year.

Comments: This is a multi-year slump. Although the occupancy rate was off 7.9 percent compared to last year, the occupancy rate is off about 12 percent compared to the same week in 2006 and 2007.

Also, business travel is off much more than leisure travel - so the summer months are not as weak as other times of the year. September will be the real test for business travel.

Weekly Unemployment Claims

by Calculated Risk on 7/30/2009 08:30:00 AM

Note: Earlier this month, the seasonally adjusted weekly claims were distorted by changes in the patterns of auto layoffs this year. That is now over.

The DOL reports on weekly unemployment insurance claims:

In the week ending July 25, the advance figure for seasonally adjusted initial claims was 584,000, an increase of 25,000 from the previous week's revised figure of 559,000. The 4-week moving average was 559,000, a decrease of 8,250 from the previous week's revised average of 567,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending July 18 was 6,197,000, a decrease of 54,000 from the preceding week's revised level of 6,251,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 8,250, and is now 99,750 below the peak of 16 weeks ago. It appears that initial weekly claims have peaked for this cycle.

The level of initial claims has fallen fairly quickly - but is still very high (over 580K), indicating significant weakness in the job market.

Just a reminder ... after earlier recessions (like '81), weekly claims fell quickly, but in the two most recent recessions, weekly claims declined a little and then stayed elevated for some time. I expect weekly claims to stay elevated following the current recession too.