by Calculated Risk on 7/25/2009 08:25:00 PM

Saturday, July 25, 2009

California Budget: Good until the next drop in Revenue

From the San Diego Union: Calif. officials concerned about new budget woes

"It's entirely likely we will ultimately see further declines in revenue, which will almost certainly require further budget action," said Assembly Minority Leader Sam Blakeslee, a Republican from San Luis Obispo.Of course, one of the key elements of the new California budget is to have the state use money that is normally allocated to cities. So I expect layoffs at the local level in addition to the possibility of further state revenue declines.

...

Officials will also be watching monthly revenue reports from the Department of Finance and the controller's office to look for signs of new trouble in the months ahead.

New Home Sales, Single Family Starts and Housing Market Index

by Calculated Risk on 7/25/2009 03:46:00 PM

New Home sales for June are scheduled to be released on Monday morning by the Census Bureau. The consensus forecast is for 350 thousand sales on a Seasonally Adjusted Annual Rate (SAAR) basis, up slightly from the 342 thousand SAAR in May.

Since we already have the NAHB Housing Market Index (HMI) through July and single family housing starts through June - and since both series have increased recently - I thought it might be interesting to compare all three series. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the NAHB HMI (left scale) with new home sales and single family housing starts (right scale).

Both the new home sales and single family starts series are very noisy (month-to-month variability is high), so it is hard to use starts to predict sales on a monthly basis. However this does suggest a possible increase in sales over the next few months.

When comparing the HMI to single family starts, r-squared is 0.60.

For HMI to new home sales, r-squared is 0.42.

For single family starts to new home sales, r-squared is 0.85 (pretty high).

It looks like builder optimism (as measured by the HMI) is a little more related to building than selling. (Just a joke).

NOTE: For purposes of determining if starts are above or below sales, you have to use the quarterly data by intent. You can't compare the monthly total single family starts directly to new home sales, because single family starts include several categories not included in sales (like owner built units and high rise condos).

Growth Forecasts after the Great Recession

by Calculated Risk on 7/25/2009 12:49:00 PM

From David Altig at Macroblog: A look at the recovery

Earlier this week my boss, Atlanta Fed President Dennis Lockhart, weighed in with his views about the shape of the economic recovery to come while speaking at a meeting of the Nashville, Tenn., Rotary Club:Dr. Altig then compares current forecasts for the recovery with previous recoveries."The economy is stabilizing and recovery will begin in the second half. The recovery will be weak compared with historic recoveries from recession. The recovery will be weak because the economy must make structural adjustments before the healthiest possible rate of growth can be achieved."

Click on graph for larger image in new window.

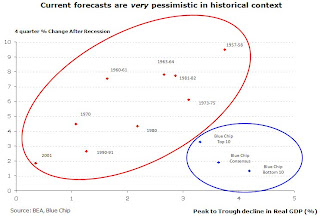

Click on graph for larger image in new window.The red dots are actual recessions, the blue dots are forecast following the current recession.

The Y-axis on this graph is the four quarter percent change in GDP following the end of a recession. The X-axis is the depth of the recession (measure in change in GDP from peak to trough).

Note that the blue dots don't line up because the forecasters have different views as to the eventual depth of the recession.

From Altig:

The chart plots the four-quarter growth rate of gross domestic product (GDP) from the trough of a recession against the depth of the corresponding contraction, as measured by the cumulative loss of GDP over the course of the downturn. The points within the red circle represent all previous postwar recessions, and they form a nice, neat, easily discernible pattern. That is, the pace of growth in the first year after a recession has, in our history, been reliably related to how bad the recession was. The deeper the recession, the faster the recovery.I think this recession (and sluggish recovery) will continue to make history, and that most of these forecasts are actually too optimistic (the bottom 10 blue chip is about my view).

The points within the blue circle are based on forecasts of GDP growth from the third quarter of this year through the third quarter of 2010, obtained from the latest issue of Blue Chip Economic Indicators (which reports survey results from "America's leading business economists"). From top left of the circle to bottom right, the points represent the 10 lowest forecasts of the most optimistic members of the 50 Blue Chip forecasting panel, the panel's consensus (or average) forecast, and the 10 highest forecasts of the most pessimistic panel participants.

I chose the third quarter as the reference point because nearly two-thirds of the Blue Chip respondents indicate that, in their view, the recession will indeed end in the third quarter of this year. Assuming this occurs, this recovery would appear to be a big outlier. Either we are about to continue making history—and not in a good way—or current guesses about the medium-term economy are way too pessimistic.

emphasis added

The Taylor Rule Debate

by Calculated Risk on 7/25/2009 09:11:00 AM

From Bloomberg: Taylor Says Fed Gets Rule Right, Goldman Doesn’t

Economists from Goldman Sachs Group Inc., Macroeconomic Advisers LLC, Deutsche Bank Securities Inc. and even the San Francisco Federal Reserve Bank argue the Taylor Rule, a pointer for finding the correct level for interest rates, suggests the Fed should be doing a lot more to stimulate the economy.And from Goldman's Hatzius (June 2nd, no link):

Taylor said his measure shows just the opposite: that Fed policy is appropriate, that central bankers are right to be considering how to withdraw their unprecedented monetary stimulus and that critics who say otherwise are misinterpreting his rule. The formula is designed to show the best rate for spurring growth without stoking inflation.

“They say they’re using the Taylor Rule, but they’re not,” Taylor, an economist at Stanford University in Stanford, California, said in an interview. “My rule does suggest a long time before we raise rates. But it also does suggest an earlier rate increase than you would think.”

[S]everal highly respected voices have weighed in on this debate, with arguments that imply a smaller need for Fed balance sheet expansion than suggested by our calculations. The first challenge came from Professor John Taylor—father of the eponymous rule—at an Atlanta Fed conference (see “Systemic Risk and the Role of Government,” May 12, 2009). Taylor argued that his rule implies a fed funds rate of +0.5%. He specifically attacked a reported Fed staff estimate of an “optimal” Taylor rate of -5% as having "... both the sign and the decimal point wrong.”Back in May, using then current data, Professor Taylor argued his rule implied a fed funds rate of plus 0.5 percent. Now Dr. Taylor argues current data suggest a rate of negative 0.955 percent.

What’s going on? The answer can be seen in a note published by Glenn Rudebusch of the San Francisco Fed [in May]; it justifies the Fed’s -5% figure and reads like a direct reaction to Taylor’s criticism, even though it does not reference his speech (see “The Fed’s Monetary Policy Response to the Current Crisis,” FRBSF Economic Letter 2009-17, May 22, 2009). The difference is fully explained by two choices. First, Taylor uses his “original” rule with an assumed (but not econometrically estimated) coefficient of 0.5 on both the output gap and the inflation gap, while the Fed uses an estimated rule with a bigger coefficient on the output gap. Second, Taylor uses current values for both gaps, while the Fed’s estimate of a -5% rate refers to a projection for the end of 2009, assuming a further rise in the output gap and a decline in core inflation.

Rudebusch uses a much larger coefficient for the output gap, and his method - with 9.5% unemployment - would suggest a -5.0% Fed Funds Rate currently. Since his method is also forward looking and assumes a higher unemployment rate later this year (very likely) Rudebusch approach suggests an even lower Fed Funds rate.

For the Fed Funds rate, with a zero bound, this debate doesn't matter right now - but it will matter in the future. But the debate does matter now for the Fed's other policies, as noted in the Bloomberg article:

Since the Fed can’t lower rates to less than zero, the Taylor rule means the central bank has to pump money into the economy through other methods, such as purchases of Treasuries, mortgage securities and agency bonds.Taylor argues the Fed doesn't need to use these other methods - at least not much - Rudebusch would argue these other methods are needed.

Note: Here is a spreadsheet for Rudebusch's Taylor rule method.

'Cash for Clunkers' Rules Released

by Calculated Risk on 7/25/2009 12:45:00 AM

From the LA Times: 'Cash for clunkers' rules are released, sparking a rush

The law creating the $1-billion program went into effect July 1, but many dealers were reluctant to participate until they got a look at the rules. The arrival of the 100-plus-page document Friday morning sparked a registration rush that overwhelmed the government's computers, resulting in waits of two hours or more, the National Automobile Dealers Assn. reported.The article mentions several rules to avoid fraud, and a requirement that the "clunker" be crushed. This should give a some boost to auto sales over the next few months.

The program is also exciting a fair amount of interest among consumers. Online auto information provider Edmunds.com said its traffic has been at record levels in recent weeks. Part of that comes from what may be the beginnings of a rebound in car sales, but the clunkers program is helping.

Friday, July 24, 2009

Video: Warren Buffett On CIT

by Calculated Risk on 7/24/2009 09:18:00 PM

It looks like seven was the winner barring a late seizure ... here are some comments from Buffett on CIT this morning:

Bank Failures 59 through 64: Six Bank Subsidiaries of Security Bank Corporation, Macon, Georgia

by Calculated Risk on 7/24/2009 06:10:00 PM

Gwinnett, North Fulton, Houston,

A Cat. Six Fail Storm

by Soylent Green is People

From the FDIC: State Bank and Trust Company, Pinehurst, Georgia, Assumes All of the Deposits of the Six Bank Subsidiaries of Security Bank Corporation, Macon, Georgia

The six bank subsidiaries of Security Bank Corporation, Macon, Georgia, were closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with State Bank and Trust Company, Pinehurst, Georgia, to assume all of the deposits of the six bank subsidiaries of Security Bank Corporation.That makes seven today ...

The six banks involved in today's transaction are: Security Bank of Bibb County, Macon, GA, with $1.2 billion in total assets and $1 billion in deposits; Security Bank of Houston County, Perry, GA, with $383 million in assets and $320 million in deposits; Security Bank of Jones County, Gray, GA, with $453 million in assets and $387 million in deposits; Security Bank of Gwinnett County, Suwanee, GA, with $322 million in assets and $292 million in deposits; Security Bank of North Metro, Woodstock, GA, with $224 million in assets and $212 million in deposits; and Security Bank of North Fulton, Alpharetta, GA, with $209 million in assets and $191 million in deposits.

...

As of March 31, 2009, the six banks had total assets of $2.8 billion and total deposits of approximately $2.4 billion. In addition to assuming all of the deposits of the failed bank, State Bank and Trust Company will acquire $2.4 billion in assets.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $807 million. ... The failure of the six banks brings the nation's total number this year to 64, and the total for Georgia to 16. The last FDIC-insured institution to be closed in the state was First Piedmont Bank, Winder, on July 17, 2009.

Bank Failure #58: Waterford Village Bank, Clarence, New York

by Calculated Risk on 7/24/2009 05:47:00 PM

Bankers caught breaking their trust

"Acting stupidly"

by Soylent Green is People

From the FDIC: Evans Bank, National Association, Angola, New York, Assumes All of the Deposits of Waterford Village Bank, Clarence, New York

Waterford Village Bank, Clarence, New York, was closed today by the New York State Banking Department, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...It is Friday and New York is on the FDIC map (not counting Lehman, Bear Stearns, etc.)

As of March 31, 2009, Waterford Village Bank had total assets of $61.4 million and total deposits of approximately $58 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $5.6 million. ... Waterford Village Bank is the 58th FDIC-insured institution to fail in the nation this year, and the first in New York. The last FDIC-insured institution to be closed in the state was Reliance Bank, White Plains, March 19, 2004.

Market and Bank Watch

by Calculated Risk on 7/24/2009 04:00:00 PM

Both Corus and Guaranty Bank (Texas) are on the mat being counted out.

Financial Guaranty has even agreed to be seized.

Apparently Corus bidders have a couple more weeks. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The S&P 500 is up 44.7% from the bottom (303 points), and still off 37.4% from the peak (586 points below the max).

This puts the recent rally into perspective. The S&P 500 first hit this level in Sept 1997; about 12 years ago. The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Double Up to Catch Up!

by Calculated Risk on 7/24/2009 01:50:00 PM

From the NY Times: California Pension Fund Hopes Riskier Bets Will Restore Its Health (ht several)

[Joseph A. Dear, the fund’s new head of investments] wants to embrace some potentially high-risk investments in hopes of higher returns. He aims to pour billions more into beaten-down private equity and hedge funds. Junk bonds and California real estate also ride high on his list. And then there are timber, commodities and infrastructure.The post title is an old gambling saying. Actually now is probably a better time to buy some of these assets than a few years ago.

That’s right, he wants to load up on many of the very assets that have been responsible for the fund’s recent plunge.