by Calculated Risk on 6/28/2009 10:29:00 AM

Sunday, June 28, 2009

Boom Time: Personal Bankruptcies in SoCal

From the LA Times: Personal bankruptcies surge in Southern California

Going legally broke has made a big comeback -- especially in the Los Angeles area -- despite a mid-decade revision to the U.S. Bankruptcy Code intended to curb filings.Ahhh ... "adventuresome borrowers" ... sounds better than gamblers or speculators.

The number of Southern Californians seeking bankruptcy protection nearly doubled in 2008 from 2007 in the U.S. Bankruptcy Court's seven-county California Central District, by far the biggest increase in the nation.

Bankruptcy is still booming. Personal filings from January through April, the most recent month available, rose 75% in the Central District compared with the year-earlier period.

Bankruptcy experts attribute the growth mainly to the mortgage meltdown, which hit the region's adventuresome borrowers particularly hard.

| Click on cartoon for larger image in new window. Repeat: Cartoon from Eric G. Lewis, a freelance cartoonist living in Orange County, CA. |

Foreclosure Auction Bidding Wars

by Calculated Risk on 6/28/2009 01:31:00 AM

First from Matt Padilla: Frenzied bidding on discounted foreclosures

Whenever I attended auctions in 2007 and 2008, investors generally passed on properties. But on June 26 they jumped on houses and condos with discounts of greater than $100,000 on the debt and fees owed on each property.Normally lenders just bid what they are owed at auction, but I've been hearing for several months about some lenders bidding substantial under the amount owed. Jillayne discussed this a couple of months ago for an auction in Bellevue, WA.

For example, at least four people bid on a two-bedroom house in Anaheim on Zeyn Street. Winning bid: $206,000. Amount owed before foreclosure: $565,000. Discount: $359,000. ...

The discount is what the bank is willing to accept; it’s not directly related to the current market value, though I am sure the bank has a ballpark value in mind when it decides how much to accept.

...

A few other examples:

•Another property in Anaheim, a condominium on South Walnut, sold for $154,000, 57% off the debt owed of $358,000. At least three investors bid on it.

...

•A property on West Sunflower in Santa Ana went for $110,500, close to a third of $319,663 owed. ...

On a slightly different topic - many REOs are receiving multiple bids (because some lenders are trying to price them to start bidding wars). Here is a video from Jim the Realtor (after the ice cream truck bit) of an REO with 18 offers:

Saturday, June 27, 2009

Freddie Mac Delinquencies and Unemployment Rate

by Calculated Risk on 6/27/2009 09:37:00 PM

Yesterday I posted a graph of the Freddie Mac delinquency rate by month since 2005. I was asked if I could add the unemployment rate ... so by request ... Click on graph for large image.

Click on graph for large image.

This graph shows the Freddie Mac single family delinquency rate and the unemployment rate since 2005.

Note that the unemployment rate y-axis starts at 4% to match up the curves.

Here is the Freddie Mac portfolio data.

There are many reasons for the rising delinquency rate. Earlier today we discussed some new research suggesting a number of homeowners with negative equity are walking away from their homes ("ruthless default"). There are also negative events that can lead to delinquencies - like death, disease, and divorce - but one of the main drivers is probably loss of income.

New GM Agrees to Assume Future Product Liability Claims

by Calculated Risk on 6/27/2009 07:58:00 PM

From the WSJ: GM to Take on Future Product-Liability Claims (ht sportsfan, Basel Too)

General Motors Corp ... has agreed to assume legal responsibility for injuries drivers suffer from vehicle defects after the auto maker emerges from bankruptcy protection.This agreement doesn't cover current product liability plaintiffs - this just appears to cover future car-accident victims.

...

Under GM's original bankruptcy plan, the auto maker planned to leave such liabilities behind after selling its "good" assets to a "New GM" owned by the government. That meant future GM car-accident victims who believed faulty manufacturing caused their injuries would be unable to sue the New GM. Instead, they would have been treated as unsecured creditors, fighting over the remains of GM's old bankruptcy estate.

GM's move to take responsibility for future product-liability claims, outlined in a court filing late Friday evening, represents a partial victory for more than a dozen state attorneys general and several consumer advocacy groups.

...

Car-accident victims with pending lawsuits and those who had won damages against GM before it filed for bankruptcy would still be unable to bring claims against the new GM. They would remain with other unsecured creditors making claims against the "old GM." As GM's old estate winds down, those victims are likely to recover little or nothing.

Report: Hotel Values off 50% to 80% from Peak

by Calculated Risk on 6/27/2009 05:51:00 PM

From HotelNewsNow.com: California to see record number of hotel foreclosures

The number of California hotels in default or foreclosed on jumped 125% in the last 60 days. The state now has 31 hotels that have been foreclosed on and 175 in default, according to California-based Atlas Hospitality.Moody’s/REAL Commercial Property Price Indices showed CRE prices off almost 30% from the peak, but that was for office, industrial, apartments and retail. Hotels are even worse off, and a decline of 50% or more in appraised value from the peak seems possible with RevPAR off 20% and rising cap rates.

With 19.6% of the total, San Bernardino County leads the state in foreclosed hotels. Riverside County follows with 16.1% and San Diego County has 12.9%. Los Angeles County, with 12% of the total, has the most hotels in default. San Bernardino County is next with 9.7% and San Diego County follows with 8.0%.

...

No market or brand is immune in this downturn. In reviewing the hotels in default or foreclosed on, we found that over 75% of the loans originated from 2005 to 2007. During this period, over 2,500 California hotels either refinanced or obtained new purchase loan financing. Unfortunately, based on today’s market values, we estimate that none of these hotels have any equity remaining. The unprecedented decline in room revenues (California is down 21.5% year-to-date) combined with the jump in cap rates has resulted in a massive loss in values. We estimate that values are currently 50-80% lower than at the market’s peak in 2006-2007.

emphasis added

Once again the California's Inland Empire is getting crushed. (San Bernardino and Riverside counties in the article above)

New Research on Walking Away

by Calculated Risk on 6/27/2009 01:42:00 PM

Here is an interesting new paper on homeowners with negative equity walking away: Moral and Social Constraints to Strategic Default on Mortgages by Guiso, Sapienza and Zingales. (ht Bob_in_MA)

The WSJ Real Time Economics has a summary: When Is It Cheaper to Ditch a Home Than Pay?

The researchers found that homeowners start to default once their negative equity passes 10% of the home’s value. After that, they “walk away massively” after decreases of 15%. About 17% of households would default — even if they could pay the mortgage — when the equity shortfall hits 50% of the house’s value, they found.Walking away (what the researchers call a "strategic default" and the mortgage industry call a "ruthless default") is when the borrower decides to stop paying a mortgage even though they can still afford the payment. This has always been difficult to quantify. Whenever a lender calls a delinquent homeowner - if they can reach the homeowner - the homeowner always tells the lender some sob story about why they can't pay their mortgage (lost job, medical, rate reset, etc.). As the researchers note:

...

“Our research showed there is a multiplication effect, where the social pressure not to default is weakened when homeowners live in areas of high frequency of foreclosures or know others who defaulted strategically,” Zingales said. “The predisposition to default increases with the number of foreclosures in the same ZIP code.”

It is difficult to study the strategic default decision, because it is de facto an unobservable event. While we do observe defaults, we cannot observe whether a default is strategic. Strategic defaulters have all the incentives to disguise themselves as people who cannot afford to pay and so they will appear as non strategic defaulters in all the data.So the researchers conducted a survey to attempt to quantify the percent of strategic defaults. This has drawbacks - the questions are hypothetical and there are no actual monetary consequences - but the results seem somewhat reasonable.

emphasis added

Note: the researchers use Zillow for negative equity numbers, and I think those are overstated. I prefer the research of Mark Zandi at economy.com or estimates from First American CoreLogic.

I think one of the key points in the research are changing social norms - the more people a homeowner knows that he believes "walked away" the more open the homeowner will be to mailing in their keys. This is what I wrote in 2007:

One of the greatest fears for lenders (and investors in mortgage backed securities) is that it will become socially acceptable for upside down middle class Americans to walk away from their homes.This research suggests that this is happening in significant numbers.

This has led many people to suggest principle reductions (as opposed to payment modifications) is the only solution. Tom Petruno at the LA Times has more on this: Is it time for underwater homeowners to be given a get-out-of-debt-free card?

Government and private-lender attempts to stem the home foreclosure crisis so far have mostly focused on loan modifications or refinancing -- giving borrowers a temporary or permanent reduction in their monthly payments.And a final note, the researchers also touch on the recourse vs. non-recourse issue:

But some housing experts say the next wave of help will have to address the core problem for many homeowners: negative equity.

This camp believes that there is no alternative but outright forgiveness of a substantial chunk of mortgage debt for many people who are underwater in their homes and at risk of foreclosure.

While only few states have mandatory non-recourse mortgages (i.e., do not allow creditors to pursue borrowers who walk away from their mortgages for the difference between the amount of the mortgage and the resale value of the house), the cost of legal procedures is sufficiently high that most lenders are unwilling to sue a defaulted borrower unless he has significant wealth besides the home.And that fits with an email Tanta sent me in 2007 on recourse loans:

Back in my day working for a servicer, we never went after a borrower unless we thought the borrower defrauded us, willfully junked the property, or something like that. If it was just a nasty RE downturn, it rarely even made economic sense to do judicial FCs just to get a judgment the borrower was unlikely to able to pay. You could save so much time and money doing a non-judicial FC (if the state allowed it) that it was worth skipping the deficiency.

Norris on New and Existing Home Sales

by Calculated Risk on 6/27/2009 08:36:00 AM

From Floyd Norris at the NY Times: How Bad Is the Recession? Check New Home Sales

... For more than three decades, the sales volume of existing single-family homes and newly built houses tended to rise and fall by about the same percentage, as can be seen in the accompanying charts. To be sure, sales of new homes did tend to do a little worse during recessions, but the difference was small and short-lived.

...

At the peak of the housing boom in 2005, sales of both existing and new homes were running at twice the 1976 rate. This year, the sales rate for existing homes seems to have stabilized at about one-third higher than the 1976 rate. New-home sales also seem to have stabilized, but at about half the 1976 rate.

Excerpt from the New York Times.

Excerpt from the New York Times.Click on graph for NY Times Graphic.

Norris doesn't mention that the gap between the two series is a result of the extraordinary number of distressed existing home sales. This has pushed down new home sales (the builders can't compete with REO prices), and is keeping existing home sales elevated.

For more, see: Distressing Gap: Ratio of Existing to New Home Sales

I also linked to this post by Professor Brian Peterson earlier this week (including some thoughts prices): House Prices and New versus Existing Homes Sales

Friday, June 26, 2009

Gordon Brown as Susan Boyle

by Calculated Risk on 6/26/2009 11:59:00 PM

A little British humor ... with failed banks!

Note: if you don't know who Susan Boyle is, see Britains Got Talent 2009

Bank Failure #45: Mirae Bank, California Fails

by Calculated Risk on 6/26/2009 09:49:00 PM

A mirage of asset wealth

We now know the truth.

by Soylent Green is People

Update: From the FDIC:

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $50 million. Wilshire State Bank's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. Mirae Bank is the 45th FDIC-insured institution to fail in the nation this year, and the sixth in California.Press Release from the California Department of Financial Institutions (DFI)

The California Department of Financial Institutions (DFI) announced today that regulators have closed Mirae Bank, citing inadequate capital.No announcement from FDIC yet.

As of June 15, 2009, Mirae Bank, located in Southern California, had total assets of approximately $411.1 million and total deposits of approximately $338.5 million. The DFI has been closely monitoring the bank because of its inadequate capital level. The DFI had ordered it to increase its capital reserves to a safe and sound level but efforts by the bank to do so were unsuccessful.

Immediately following the closure, the DFI named the Federal Deposit Insurance Corporation (FDIC) as receiver of Mirae Bank. The depositors of Mirae Bank are protected by the FDIC. The FDIC has accepted a bid from Wilshire State Bank to assume all branch deposits and significantly all the assets of Mirae Bank.

Truck Tonnage Index Increased in May, Off 11% from May 2008

by Calculated Risk on 6/26/2009 08:16:00 PM

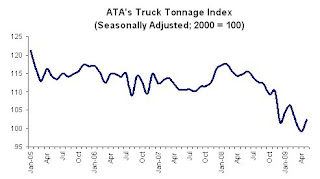

From the American Trucking Association: ATA Truck Tonnage Index Increased 3.2 Percent in May Click on graph for larger image in new window.

Click on graph for larger image in new window.

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index rose for the first time since February 2009, gaining 3.2 percent in May. May’s increase, which raised the SA index to 102.3, wasn’t large enough to offset the March through April cumulative reduction of 6.7 percent. ...

Compared with May 2008, tonnage contracted 11 percent, which was the best year-over-year result in three months. Despite the improvement from April’s 13.2 percent plunge, May’s decrease is still historically large.

ATA Chief Economist Bob Costello said the month-to-month improvement was encouraging, but cautioned that tonnage is unlikely to surge anytime soon. “I am hopeful that the worst is behind us, but I just don’t see anything on the economic horizon that suggests freight transportation is ready to explode,” Costello said. “The consumer is still facing too many headwinds, including employment losses, tight credit, rising fuel prices, and falling home values, to name a few, that will make it very difficult for household spending to jump in the near term.” He also noted that he doesn’t expect tonnage to deteriorate much further and that any growth in tonnage over the next few months is likely to be modest.

Note on the impact of trucking company failures on the index: Each month, ATA asks its membership the amount of tonnage each carrier hauled, including all types of freight. The indexes are calculated based on those responses. The sample includes an array of trucking companies, ranging from small fleets to multi-billion dollar carriers. When a company in the sample fails, we include its final month of operation and zero it out for the following month, with the assumption that the remaining carriers pick up that freight. As a result, it is close to a net wash and does not end up in a false increase. Nevertheless, some carriers are picking up freight from failures, and it may have boosted the index. Due to our correction mentioned above, however, it should be limited.

Trucking serves as a barometer of the U.S. economy, representing nearly 69 percent of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods ...

Bank Failures #43 & #44: MetroPacific Bank, Irvine, CA, Horizon Bank, Pine City, Minnesota

by Calculated Risk on 6/26/2009 07:28:00 PM

Local to CR, Soylent

Big Irvine implode.

Debt, Destruction, De-Leverage

A cliff dive too far.

both by Soylent Green is People

From the FDIC: Stearns Bank, National Association, St. Cloud, Minnesota, Assumes All of the Deposits of Horizon Bank, Pine City, Minnesota

Horizon Bank, Pine City, Minnesota, was closed today by the Minnesota Department of Commerce, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: Sunwest Bank, Tustin, California, Assumes All of the Deposits of MetroPacific Bank, Irvine, California

As of March 31, 2009, Horizon Bank had total assets of $87.6 million and total deposits of approximately $69.4 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $33.5 million. Stearns Bank's, N.A. acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. Horizon Bank is the 43rd FDIC-insured institution to fail in the nation this year, and the first in Minnesota.

MetroPacific Bank, Irvine, California was closed today by the California Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Four down today ...

As of June 8, 2009, MetroPacific Bank had total assets of $80 million and total deposits of approximately $73 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $29 million. Sunwest Bank's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. MetroPacific is the 44th FDIC-insured institution to fail in the nation this year, and the fifth in California.

Bank Failure #42: Neighborhood Community Bank, Newnan, Georgia

by Calculated Risk on 6/26/2009 06:28:00 PM

Fertile soil for bank failure

Bumper crop this year.

by Soylent Green is People

From the FDIC: CharterBank, West Point, Georgia Assumes All of the Deposits of Neighborhood Community Bank, Newnan, Georgia

Neighborhood Community Bank, Newnan, Georgia, was closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Newnan ... (or "Noonan") ... for you Caddyshack fans.

As of March 31, 2009, Neighborhood Community Bank had total assets of $221.6 million and total deposits of approximately $191.3 million. ...

The FDIC and CharterBank entered into a loss-share transaction on approximately $178.5 million of Neighborhood Community Bank's assets. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $66.7 million. CharterBank's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. Neighborhood Community Bank is the 42nd FDIC-insured institution to fail in the nation this year

Bank Failure #41: Community Bank of West Georgia, Villa Rica, Georgia

by Calculated Risk on 6/26/2009 05:46:00 PM

Zero rest for the wicked,

Neither for Blair's crew.

by Soylent Green is People

From the FDIC: FDIC Approves the Payout of Insured Deposits of Community Bank of West Georgia, Villa Rica, Georgia

Community Bank of West Georgia, Villa Rica, Georgia, was closed today by the Georgia Department of Banking and Finance, which appointed the FDIC as receiver. To protect the depositors, the Federal Deposit Insurance Corporation (FDIC) will mail checks to insured depositors for their insured funds on Monday morning, June 29th.This is another closing without a buyer - I think the third this year.

...

As of May 15, 2009, Community Bank of West Georgia had total assets of $199.4 million and total deposits of $182.5 million.

...

The FDIC estimates the cost of the failure to its Deposit Insurance Fund to be approximately $85 million. Community Bank of West Georgia is the 41st FDIC-insured institution to fail in the nation this year, and the eighth in Georgia.

JPMorgan, Citi Expanding Jumbo Lending

by Calculated Risk on 6/26/2009 03:32:00 PM

From Bloomberg: JPMorgan, Citigroup Expand in ‘Jumbo’ Home Mortgages

JPMorgan resumed buying new jumbo loans made by other lenders this month, after halting purchases in March, spokesman Tom Kelly said. ... Citigroup is again offering the loans through independent mortgage brokers, spokesman Mark Rodgers said.This will help a little - but the standards are pretty tight and there more problems coming for the mid-to-high end (like Option ARM recasts and few move-up buyers).

...

New jumbo lending, which includes refinancing as well as debt for home buyers, totaled $348 billion in 2007, before dropping to $98 billion last year as mortgage companies tightened standards, according to newsletter Inside Mortgage Finance. Jumbo lending slowed in the fourth quarter to $11 billion, or 4 percent of the mortgage market, the lowest quarterly amount since Inside Mortgage Finance started tracking that data in 1990.

...

Bank of America Corp. was the largest jumbo lender in the first quarter, with almost $9 billion in new loans, followed by Citigroup ...

More than 7 percent of prime-jumbo loans backing securities sold in 2006 and 2007 were at least 90 days late, Standard & Poor’s said yesterday.

Freddie Mac: Portfolio Shrinks, Delinquencies Rise

by Calculated Risk on 6/26/2009 02:02:00 PM

Click on graph for large image.

Click on graph for large image.

This graph shows the Freddie Mac single family delinquency rate since January 2005.

Here is the Freddie Mac portfolio data.

From Reuters: Freddie Mac May portfolio shrank annualized 9.9 pct (ht Ron)

Freddie Mac ... said its mortgage investment portfolio shrank by an annualized 9.9 percent rate in May, while delinquencies on loans it guarantees accelerated.

The portfolio decreased to $823.4 billion, for an annualized 5.6 percent increase year to date, the McLean, Virginia-based company said in its monthly volume summary.

In May 2008, the portfolio was $770.4 billion.

Delinquencies ... jumped to 2.62 percent of its book of business in May from 2.44 percent in April and 0.86 percent in May 2008.

...

Freddie Mac said refinance-loan purchase volume was $40.3 billion in May, down from April's $43.3 billion. March's $52 billion was its largest refinance month since 2003.

FDIC: 104 Cease and Desist Orders through May

by Calculated Risk on 6/26/2009 11:43:00 AM

The FDIC has been very busy issuing Cease and Desist orders this year. Through May, the FDIC has issued 104 Cease and Desist orders and this does not include any orders by the OCC or OTS. (ht Terry)

Most of these oreders are very similar - here is an excerpt:

IT IS HEREBY ORDERED, that the Bank, its institution-affiliated parties, as that term is defined in section 3(u) of the Act, 12 U.S.C. § 1813(u), and its successors and assigns, cease and desist from the following unsafe and unsound banking practices, as more fully set forth in the FDIC's Report of Visitation ...:All of these institutions are ordered to make changes - and some do, and then the cease and desist order is terminated (15 orders have been teriminated). The remaining are BFF candidates.

a) operating with management whose policies and practices are detrimental to the Bank and jeopardize the safety of its deposits;

(b) operating with a board of directors which has failed to provide adequate supervision over and direction to the active management of the Bank;

(c) operating with a large volume of poor quality loans;

(d) engaging in unsatisfactory lending and collection practices;

(e) operating in such a manner as to produce operating losses; and

(f) operating with inadequate provisions for liquidity.

emphasis added

Here are the FDIC press releases this year:

May Cease and Desist Orders (23)

April Cease and Desist Orders (24)

March Cease and Desist Orders (23)

February Cease and Desist Orders (21)

January Cease and Desist Orders (13)

NY Fed and AIG Deal

by Calculated Risk on 6/26/2009 10:22:00 AM

From the WaPo: N.Y. Fed to Trim AIG Debt, Receive $25 Billion Stake in Two Subsidiaries

American International Group announced yesterday that it has reached a deal to reduce its debt to the Federal Reserve Bank of New York by $25 billion.The Fed is now in the insurance business ...

[AIG] said that it would give the New York Fed preferred stakes in ... Asian-based American International Assurance, or AIA, and American Life Insurance Co., or Alico, which operates in more than 50 countries.

Under the agreement, AIG will split off AIA and Alico into separate company-owned entities called "special purpose vehicles," or SPVs. The New York Fed will receive preferred shares now valued at $25 billion -- $16 billion in AIA and $9 billion in Alico -- and in exchange will forgive an equal amount of AIG debt.

Personal Income and Outlays Boosted by Stimulus

by Calculated Risk on 6/26/2009 08:30:00 AM

From the BEA: Personal Income and Outlays, April 2009

Personal income increased $167.1 billion, or 1.4 percent, and disposable personal income (DPI) increased $178.1 billion, or 1.6 percent, in May, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $25.1 billion, or 0.3 percent. In April, personal income increased $78.3 billion, or 0.7 percent, DPI increased $140.0 billion, or 1.3 percent, and PCE increased $1.0 billion, or less than 0.1 percent, based on revised estimates. The pattern of changes in personal income and in DPI reflect, in part, the pattern of increased government social benefit payments associated with the American Recovery and Reinvestment Act of 2009.The May numbers were impacted by the American Recovery and Reinvestment Act of 2009. As an example, payments to seniors increased sharply and “Personal Current Transfers,” increased by $165 billion (annual rate). This boosted personal income.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in May, in contrast to a decrease of 0.1 percent in April.

...

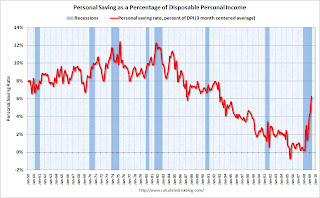

Personal saving -- DPI less personal outlays -- was $768.8 billion in May, compared with $608.5 billion in April. Personal saving as a percentage of disposable personal income was 6.9 percent in May, compared with 5.6 percent in April.

This also pushed up the saving rate sharply to the highest rate since Dec 1993 (but this is a temporary boost).

A couple points:

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the April Personal Income report. The saving rate was 6.9% in April. (6.3% with average)

The saving rate was boosted by the stimulus package, but this suggests households are saving substantially more than during the last few years (when the saving rate was close to zero). The saving rate will probably dip - the stimulus boost is unsustainable - but then continue to rise (an aging population usually pushes the saving rate higher) and a rising saving rate will repair household balance sheets, but this will also keep pressure on personal consumption.

The following graph shows real Personal Consumption Expenditures (PCE) through May (2000 dollars). Note that the y-axis doesn't start at zero to better show the change.

PCE declined sharply in Q3 and Q4 2008, and rebounded slightly in Q1 2009.

PCE declined sharply in Q3 and Q4 2008, and rebounded slightly in Q1 2009.Although PCE increased in May (compared to April), Q2 2009 is off to a somewhat weak start, with PCE in both April and May slightly below the levels of Q1. Although it is possible that PCE will pick up in June, it seems likely that PCE will be flat to slightly negative in Q2 (although not the cliff diving of the 2nd half of 2008). The two-month estimate suggests a real PCE decline of 0.7% in Q2 2009.

Usually PCE and Residential Investment (RI) lead the economy out of recession, and right now both remain weak. As households increase their savings rate to repair their balance sheets, it seems unlikely that PCE will increase significantly any time soon.

Thursday, June 25, 2009

The Leveraged Loan "Wall of Worry"

by Calculated Risk on 6/25/2009 11:51:00 PM

From the WSJ: Rates Low, Firms Race to Refinance Their Debts

[C]ompanies are seeking to sidestep what is likely to be the biggest-ever wave of loan refinancing among risky companies as $440 billion in debt comes due in a span of three years [from 2012 to 2014]. That is about 85% of the $518 billion in current leveraged loans outstanding ...The looming credit problems are not just Option ARMs and CRE loans; there are about $75 billion in leveraged coming due in 2012, another $150 billion in 2013 and close to $215 billion in 2014.

Some firms [are negotiating extensions]. Others are issuing junk bonds or stock, using the cash raised to repay some of their loans well ahead of schedule.

The pre-emptive moves demonstrate rising concern about the massive bubble of lending that developed from 2005 to 2007.

The credit bubble: the gift that keeps on giving.