by Calculated Risk on 6/03/2009 09:53:00 AM

Wednesday, June 03, 2009

Bernanke testifies before the House Budget Committee at 10 AM ET

Prepared testimony will follow below the video links ...

Here is the CNBC feed.

And a live feed from C-SPAN.

Prepared Testimony: Current economic and financial conditions and the federal budget

The U.S. economy has contracted sharply since last fall, with real gross domestic product (GDP) having dropped at an average annual rate of about 6 percent during the fourth quarter of 2008 and the first quarter of this year. Among the enormous costs of the downturn is the loss of nearly 6 million jobs since the beginning of 2008. The most recent information on the labor market--the number of new and continuing claims for unemployment insurance through late May--suggests that sizable job losses and further increases in unemployment are likely over the next few months.

However, the recent data also suggest that the pace of economic contraction may be slowing. Notably, consumer spending, which dropped sharply in the second half of last year, has been roughly flat since the turn of the year, and consumer sentiment has improved. In coming months, households' spending power will be boosted by the fiscal stimulus program. Nonetheless, a number of factors are likely to continue to weigh on consumer spending, among them the weak labor market, the declines in equity and housing wealth that households have experienced over the past two years, and still-tight credit conditions.

Activity in the housing market, after a long period of decline, has also shown some signs of bottoming. Sales of existing homes have been fairly stable since late last year, and sales of new homes seem to have flattened out in the past couple of monthly readings, though both remain at depressed levels. Meanwhile, construction of new homes has been sufficiently restrained to allow the backlog of unsold new homes to decline--a precondition for any recovery in homebuilding.

Businesses remain very cautious and continue to reduce their workforces and capital investments. On a more positive note, firms are making progress in shedding the unwanted inventories that they accumulated following last fall's sharp downturn in sales. The Commerce Department estimates that the pace of inventory liquidation quickened in the first quarter, accounting for a sizable portion of the reported decline in real GDP in that period. As inventory stocks move into better alignment with sales, firms should become more willing to increase production.

We continue to expect overall economic activity to bottom out, and then to turn up later this year. Our assessments that consumer spending and housing demand will stabilize and that the pace of inventory liquidation will slow are key building blocks of that forecast.

...

Even after a recovery gets under way, the rate of growth of real economic activity is likely to remain below its longer-run potential for a while, implying that the current slack in resource utilization will increase further. We expect that the recovery will only gradually gain momentum and that economic slack will diminish slowly. In particular, businesses are likely to be cautious about hiring, and the unemployment rate is likely to rise for a time, even after economic growth resumes.

MBA: Mortgage Rates Increase Sharply, Refinance Applications Decline

by Calculated Risk on 6/03/2009 09:00:00 AM

The MBA reports:

The Market Composite Index, a measure of mortgage loan application volume, was 658.7, a decrease of 16.2 percent on a seasonally adjusted basis from 786.0 one week earlier.The Purchase Index is now at the level of the late '90s.

...

The Refinance Index decreased 24.1 percent to 2953.6 from 3890.4 the previous week and the seasonally adjusted Purchase Index increased 4.3 percent to 267.7 from 256.6 one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.25 percent from 4.81 percent ...

emphasis added

Note: the refinance index declined as mortgage rates increased, but the index is still very high.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Although we can't compare directly to earlier periods because of the changes in the index, this shows no pick up in overall sales activity.

ADP Shows Private Employment Decreased 532,000 in May

by Calculated Risk on 6/03/2009 08:38:00 AM

Nonfarm private employment decreased 532,000 from April to May 2009 on a seasonally adjusted basis, according to the ADP National Employment Report®. The estimated change of employment from March to April was revised by 54,000, from a decline of 491,000 to a decline of 545,000.Note this is private employment only (not government). ADP tracks the BLS report over time, but is not a good predictor of the BLS numbers on a monthly basis.

...

May’s ADP Report estimates nonfarm private employment in the service-providing sector fell by 265,000. Employment in the goods-producing sector declined 267,000, with employment in the manufacturing sector dropping 149,000, its thirty-ninth consecutive monthly decline.

...

In May, construction employment dropped 108,000. This was its twenty-eighth consecutive monthly decline, and brings the total decline in construction jobs since the peak in January 2007 to 1,345,000. Employment in the financial services sector dropped 32,000, the eighteenth consecutive monthly decline.

Tuesday, June 02, 2009

Foreclosures and the Home ATM

by Calculated Risk on 6/02/2009 10:51:00 PM

"Credit is so loose today that I can buy the groceries I need on a credit card, eat the food tonight, discard the food by tomorrow at noon and finance my debt on a 30-year, amortized loan. How stupid is that? But people do it all the time - and then they wonder why they're in foreclosure."And today from Peter Goodman at the NY Times: Promised Help Is Elusive for Some Homeowners. This article is about homeowners struggling to get loan modifications, but this section reminded me of that Denver Post article:

Mortgage Broker quoted in Denver Post, March 30, 2005 (link no longer works)

Ms. Ulery, 63, is the face of the latest wave of troubled American homeowners, a surge of people in financial danger not because of reckless gambling on real estate, but because of lost income.So far so good ... but:

Far from being one of those who used easy-money loans to speculate on homes proliferating across the desert soil of greater Phoenix, she has lived in the same modest, stucco-sided condo in suburban Mesa for a dozen years. She bought the two-bedroom home in 1997 for $77,500.

Like tens of millions of other American homeowners, she added to her mortgage balance as the value of her condo swelled, at one point exceeding $200,000. She refinanced to pay off some credit cards and settle into a 30-year, fixed-rate loan. Later, she took out a home equity line of credit to buy a new Hyundai. She refinanced again in 2007, borrowing $20,000, mostly for a new roof.Money is fungible, but a general guideline is to match the term of the debt with the useful life of the asset. A 30 year loan for a house. A 5 to 7 year loan for a car. Pay cash for lunch.

Then - if the useful life and debt term match - when it comes time to replace the asset, the debt will have been retired. But this article provides an example of buying lunch on your credit card, paying off the credit card with a larger mortgage and essentially financing lunch for 30 years!

And I'm sorry, but I'd call excessive use of the Home ATM as gambling.

TARP: Looking for the Exit

by Calculated Risk on 6/02/2009 07:39:00 PM

From Bloomberg: Fed Said to Raise Standards for Banks’ TARP Repayment

Federal Reserve officials surprised bankers in the past week by demanding they raise specific amounts of new capital before repaying taxpayer funds, applying a more stringent assessment than the stress tests in May.From the WSJ: Banks' Telethon Is Nearly Over

JPMorgan Chase & Co. and American Express Co. were told they need to boost common equity ... Morgan Stanley was directed to raise more funds after already selling stock to cover its stress-test shortfall. One firm was told only yesterday ...

J.P. Morgan Chase & Co., Morgan Stanley, American Express Co. and regional bank KeyCorp said Tuesday they sold a combined $8.7 billion in common stock. That pushed the total ... to at least $65 billion since the [stress test] results were announced May 7.This will be interesting next week. I don't expect to see BofA, Wells Fargo, Citi or GMAC on the list. Heck, GMAC was queued up at the FDIC lending facility today.

Homebuilder Cancellation Rate

by Calculated Risk on 6/02/2009 06:26:00 PM

"Our contract cancellation rate of 24% for the second quarter is at a more normalized level, the likes of which we have not reported since the third quarter of 2005,"The surge in cancellation rates was an important story after the bubble burst. Now it appears cancellation rates might be returning to more normal levels.

Ara K. Hovnanian, President and CEO Hovnanian Enterprises, June 2, 2000

The following graph shows the average cancellation rates for some selected homebuilders that I've been tracking.

Click on graph for larger image in new window.

Click on graph for larger image in new window.There appears to be a seasonal pattern (fewer cancellations in Q1), but most of the builders are reporting the lowest cancellation rates since the bubble burst.

The cancellation rate could rise again if mortgage rates move higher, but this is a little bit of good news for the builders. Here are a couple of comments I posted last month:

Pulte: The cancellation rate improved to 21% for the first quarter of 2009 compared with 47% for the fourth quarter of 2008 and 28% for the first quarter of 2008.

D.R. Horton: The Company’s cancellation rate (cancelled sales orders divided by gross sales orders) for the second quarter of fiscal 2009 was 30%.

These cancellation rates are still above normal (Note: "Normal" for Horton is in the 16% to 20% range, so 30% is still high.), but these are the lowest cancellation rates for most builders since late 2005 or early 2006.

Graphs: Auto Sales in May

by Calculated Risk on 6/02/2009 04:01:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for May (red, light vehicle sales of 9.91 million SAAR from AutoData Corp).

May was the best month of 2009 (on seasonally adjusted basis), but sales are still on pace to be the worst since 1967. The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The small increase in May hardly shows up on the graph.

In 1967 there were 103 million drivers; now there are about twice that many (205.7 million licensed drivers in 2007). Compared to the number of drivers, the current sales rate is the lowest since the BEA started tracking auto sales.

GM May U.S. vehicle sales off 29%, Toyota off 40.7%

by Calculated Risk on 6/02/2009 02:04:00 PM

From MarketWatch: GM May U.S. vehicle sales drop 29%

GM ... reported a 29% drop in May U.S. light vehicle sales ... GM posted sales of 190,881 vehicles, down from 268,892 a year ago.Also from MarketWatch: Toyota U.S. May sales fall 40.7%

Toyota said ... May U.S. sales declined 40.7% to 152,583 vehicles from 257,406 a year agoMore on auto sales soon (with a graph of course)

Ford Sales Off 24.2% in May

by Calculated Risk on 6/02/2009 11:54:00 AM

From MarketWatch: Ford U.S. May sales fall 24.2%

Ford Motor Co. said Tuesday that total U.S. May sales fell 24.2% to 161,531 vehicles from 213,238 a year ago. ... Ford said it will increase North American production by 10,000 vehicles to 445,000 in the second quarter, and by 42,000 vehicles to 460,000 vehicles in the third quarterNote: This is year-over-year (May 2009 vs. May 2008)

Previous months:

Ford April U.S. vehicle sales off 31.3%

Ford U.S. March sales dropped 40.9%

February Ford sales were off 46.3% YoY

January off 42.1%

December off 32.4%

November off 31%

Pending Home Sales Index Increases

by Calculated Risk on 6/02/2009 10:00:00 AM

From the NAR: Pending Home Sales Up for Three Months in a Row

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in April, rose 6.7 percent to 90.3 from a reading of 84.6 in March, and is 3.2 percent above April 2008 when it was 87.5.This is for contracts signed in April and that are expected to close in late May or June.

...

[Lawrence Yun, NAR chief economist] cautions that the reporting sample for pending home sales is smaller than that of existing-home sales, so it is subject to greater variability. “In addition, the relationship between contracts on pending home sales and closings on existing-home sales is taking longer than in the past for several reasons,” he said. “Mortgage processing time has increased, it is taking many months to close on those homes requiring short sales with lender approval, and some sales are falling through at the last moment.”

Note: Ignore the "affordability index". That just means interest rates were low in April.

NY Times: Foreclosures: No End in Sight

by Calculated Risk on 6/02/2009 08:42:00 AM

NY Times Editorial: Foreclosures: No End in Sight

A continuing steep drop in home prices combined with rising unemployment is powering a new wave of foreclosures. Unfortunately, there’s little evidence, so far, that the Obama administration’s anti-foreclosure plan will be able to stop it.In previous housing busts, foreclosures continued to rise until prices finally bottomed. And prices will fall - and foreclosures rise - for some time. There is no end in sight.

...

One of the biggest problems is that the plan focuses almost entirely on lowering monthly payments. But overly onerous payments are only part of the problem. For 15.4 million “underwater” borrowers — those who owe more on their mortgages than their homes are worth — a lack of home equity puts them at risk of default, even if their monthly payments have been reduced. They have no cushion to fall back on in the event of a setback, like job loss or illness.

...

There will be no recovery until there is a halt in the relentless rise in foreclosures. Foreclosures threaten millions of families with financial ruin. By driving prices down, they sap the wealth of all homeowners. They exacerbate bank losses, putting pressure on the still fragile financial system. Lower monthly payments are a balm, but they are no substitute for home equity. And until more Americans can find a good job and a steady paycheck, the number of foreclosures will continue to rise.

Late Night Futures

by Calculated Risk on 6/02/2009 12:22:00 AM

Here is an open thread for discussion.

The automakers will release May sales results Tuesday. There is a good chance that sales in May were below the February 9.3 million seasonally adjusted annual rate (SAAR). To find a lower sales month, we need to go back to December 1981: 9.05 million SAAR. May could be the lowest sales month since 1970 ...

U.S. futures are flat.

Futures from barchart.com

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

And the Asian markets are almost up 1% or so.

Best to all.

Monday, June 01, 2009

GM News

by Calculated Risk on 6/01/2009 09:30:00 PM

Just some excerpts ...

From the WSJ: Filings Reveal Depth of Problems

General Motors Corp.'s $82.2 billion in assets and $172 billion in liabilities spell out the extent of its problems and sheer breadth of the 101-year-old giant's bankruptcy.More details from Bloomberg: GM Files Bankruptcy to Spin Off More Competitive Firm

In a torrent of filings at the U.S. Bankruptcy Court in Manhattan, GM's mind-numbing scale is evident: It has 463 subsidiaries and has built 450 million cars and trucks over the years. It employs 235,000 people worldwide. This includes 91,000 in the United States, which it pays $476 million each month, and 493,000 retirees with various benefits. It spends $50 billion a year buying parts and services from 11,500 vendors in North America.

From the WSJ: GM to Announce Tentative Hummer Sale

General Motors Corp., fresh off filing for bankruptcy protection Monday, will start its second day of court proceedings by announcing the tentative sale of the Hummer brand ...Auto sales for May will be announced tomorrow. The bankruptcy of Chrysler - and now GM - will probably depress auto sales further for a few months, although probably not by much.

Property tax relief in Los Angeles

by Calculated Risk on 6/01/2009 06:29:00 PM

From the LA Times: Property tax relief coming for more than 330,000 L.A. County homeowners

... The Los Angeles County assessor’s office this morning announced that it has finished an automatic review of assessments for 473,000 homes purchased between July 1, 2003 and June 30, 2008 -- which account for about 28% of homes countywide.According to the Case-Shiller home price index, prices in Los Angeles are back to the July 2003 level, and I'd think that just about every home purchased between July 2003 and July 2008 would be worth less today - not just 70%. Unfortunately for homeowners - and tax collectors - prices will probably fall further.

County officials reduced assessments on about 70% of properties reviewed. Homeowners getting a break should soon get a letter in the mail. The average property tax savings is $1,400 for owners of single family homes and $1,100 for condominium owners, county officials said.

Those receiving reductions included owners of 256,000 single family homes and 77,000 condo owners. The average reduction in value was $126,000 for single family homes; $96,000 for condos.

The reduction in assessments means a loss of $440 million in tax revenue, a 1% drop county officials anticipated in last month’s proposed budget, said Assessor Rick Auerbach.

The good news is only 28% of all homes in Los Angeles county were purchased during the height of the bubble! Of course other homeowners probably used the Home ATM (cash out refinance or HELOC) and are underwater too.

Fed Outlines TARP Repayment Rules

by Calculated Risk on 6/01/2009 04:28:00 PM

Note: this is for the 19 largest banks.

From the Fed:

The Federal Reserve Board on Monday outlined the criteria it will use to evaluate applications to redeem U.S. Treasury capital from the 19 bank holding companies (BHC) that participated in the Supervisory Capital Assessment Program (SCAP).

Redemption approvals for an initial set of these large bank holding companies are expected to be announced during the week of June 8. Applications will be evaluated periodically thereafter. Any banking organization wishing to redeem U.S. Treasury capital must first obtain approval from its primary federal supervisor, which then forwards approved applications to the Treasury Department.

Any BHC seeking to redeem U.S. Treasury capital must demonstrate an ability to access the long-term debt markets without reliance on the Federal Deposit Insurance Corporation's Temporary Liquidity Guarantee Program (TLGP), and must successfully demonstrate access to public equity markets.

In addition, the Federal Reserve's review of a BHC's application to redeem U.S. Treasury capital will include consideration of the following:•Whether a BHC can redeem its Treasury capital and remain in a position to continue to fulfill its role as an intermediary that facilitates lending to creditworthy households and businesses;Finally, all BHCs must have a robust longer-term capital assessment and management process geared toward achieving and maintaining a prudent level and composition of capital commensurate with the BHC's business activities and firm-wide risk profile.

•Whether, after redeeming its Treasury capital, a BHC will be able to maintain capital levels that are consistent with supervisory expectations;

•Whether a BHC will be able to continue to serve as a source of financial and managerial strength and support to its subsidiary bank(s) after the redemption; and

•Whether a BHC and its bank subsidiaries will be able to meet its ongoing funding requirements and its obligations to counterparties while reducing reliance on government capital and the TLGP.

emphasis added

Stock Market Update

by Calculated Risk on 6/01/2009 04:00:00 PM

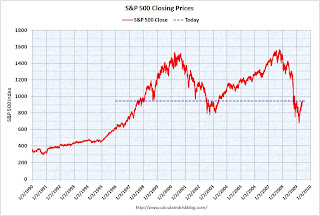

By popular demand ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The S&P 500 is up almost 40% from the bottom (267 points), and still off almost 40% from the peak (622 points below the max).

This puts the recent rally into perspective. The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

More on Consumption in April

by Calculated Risk on 6/01/2009 01:18:00 PM

The following graph shows real Personal Consumption Expenditures (PCE) through April (2000 dollars). Note that the y-axis doesn't start at zero to better show the change. Click on graph for larger image in new window.

Click on graph for larger image in new window.

PCE declined sharply in Q3 and Q4 2008, and rebounded slightly in Q1 2009.

Q2 2009 is off to a weak start, with PCE in April below the levels of Q1. Although it is possible that PCE will pick up in May and June, it seems likely that PCE will be negative in Q2 (although not the cliff diving of the 2nd half of 2008).

Usually PCE and Residential Investment (RI) lead the economy out of recession, and right now both remain weak. As households increase their savings rate to repair their balance sheets, it seems unlikely that PCE will increase significantly any time soon.

Just a reminder - the end to cliff diving is not the same thing as "green shoots".

Construction Spending in April

by Calculated Risk on 6/01/2009 10:17:00 AM

Private residential construction spending is 63.2% below the peak of early 2006.

Private non-residential construction spending is 4.4% below the peak of last September. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending was up slightly in April (compared to March), and nonresidential spending has peaked and will probably decline sharply over the next two years. The second graph shows the year-over-year change for private residential and nonresidential construction spending.

The second graph shows the year-over-year change for private residential and nonresidential construction spending.

Nonresidential spending is essentially flat on a year-over-year basis, and will turn strongly negative as projects are completed. Residential construction spending is still declining YoY, although the YoY change is starting to be less negative.

As I've noted before, these will probably be two key stories for 2009: the collapse in private non-residential construction, and the probable bottom for residential construction spending. Both stories are just developing ...

From the Census Bureau: April 2009 Construction at $968.7 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $657.3 billion, 1.4 percent (±1.3%) above the revised March estimate of $648.2 billion. Residential construction was at a seasonally adjusted annual rate of $249.2 billion in April, 0.7 percent (±1.3%)* above the revised March estimate of $247.4 billion. Nonresidential construction was at a seasonally adjusted annual rate of $408.2 billion in April, 1.8 percent (±1.3%) above the revised March estimate of $400.8 billion.

ISM Manufacturing Shows Contraction in May

by Calculated Risk on 6/01/2009 10:00:00 AM

From the Institute for Supply Management: May 2009 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector failed to grow in May for the 16th consecutive month, while the overall economy grew for the first time following seven months of decline, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.As noted, any reading below 50 shows contraction, although the pace of contraction has slowed.

...

Manufacturing contracted in May as the PMI registered 42.8 percent, which is 2.7 percentage points higher than the 40.1 percent reported in April. This is the 16th consecutive month of contraction in the manufacturing sector. A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting.

A PMI in excess of 41.2 percent, over a period of time, generally indicates an expansion of the overall economy. Therefore, the PMI indicates growth in the overall economy following seven months of decline, and continuing contraction in the manufacturing sector.

...

"While employment and inventories continue to decline at a rapid rate and the sector continued to contract during the month, there are signs of improvement. May is the first month of growth in the New Orders Index since November 2007, with nine of 18 industries reporting growth. New orders are considered a leading indicator, and the index has risen rapidly after bottoming at 23.1 percent in December 2008. Also, the Customers' Inventories Index remained below 50 percent for the second consecutive month, offering encouragement that supply chains are starting to free themselves of excess inventories as nine industries report their customers' inventories as 'too low'. The prices that manufacturers pay for raw materials and services continued to decline, but at a slower rate than in April."

emphasis added

Consumption Down, Saving Rate Increases in April

by Calculated Risk on 6/01/2009 08:44:00 AM

From the BEA: Personal Income and Outlays, April 2009

Personal income increased $58.2 billion, or 0.5 percent, and disposable personal income (DPI) increased $121.8 billion, or 1.1 percent, in April, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) decreased $5.4 billion, or 0.1 percent. ... The pattern of changes in income reflect, in part, the pattern of reduced personal current taxes and increased government social benefit payments associated with the American Recovery and Reinvestment Act of 2009.A few points:

...

Real PCE -- PCE adjusted to remove price changes -- decreased 0.1 percent in April, compared with a decrease of 0.3 percent in March.

...

Personal saving as a percentage of disposable personal income was 5.7 percent in April, compared with 4.5 percent in March.

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the April Personal Income report. The saving rate was 5.7% in April. (5.1% with average)

The saving rate was boosted by the stimulus package, but this suggests households are saving substantially more than during the last few years (when the saving rate was close to zero). The saving rate will probably continue to rise (an aging population usually pushes the saving rate higher) and a rising saving rate will repair household balance sheets, but this will also keep pressure on personal consumption.