by Calculated Risk on 5/29/2009 10:53:00 AM

Friday, May 29, 2009

Philly Fed State Coincident Indexes

Click on map for larger image.

Click on map for larger image.

Here is a map of the three month change in the Philly Fed state coincident indicators. All 50 states are showing declining three month activity.

This is the new definition of "Red states" and this is what a widespread recession looks like based on the Philly Fed states indexes.

On a one month basis, activity decreased in 45 states in April. Here is the Philadelphia Fed state coincident index release for April.

The Federal Reserve Bank of Philadelphia has released the coincident indexes for all 50 states for April 2009. In the past month, the indexes increased in three states, decreased in 45, and were unchanged in the other two, for a one-month diffusion index of -84. Over the past three months, the indexes decreased in all 50 states, for a three-month diffusion index of -100.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.Almost all states showed declining activity in April. Still a widespread recession ...

Home Sales Ratio: Existing to New

by Calculated Risk on 5/29/2009 10:02:00 AM

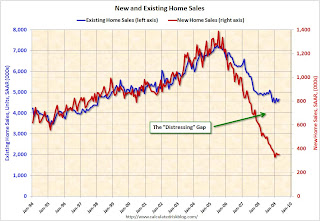

Yesterday I posted a graph labeled the distressing gap showing that existing home sales have held up much better during the housing bust than new home sales - probably because of distressed sales (foreclosure resales and short sales). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the same information, but as a ratio for existing home sales divided by new home sales (ht Michael)

The recent change in the ratio is probably related to distressed sales - home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.

Although distressed sales will stay elevated from some time, eventually I expect this ratio to decline - with a combination of falling existing home sales and eventually rising new home sales.  The second graph shows the ratio back to 1969 (annual data before 1994).

The second graph shows the ratio back to 1969 (annual data before 1994).

Note: the NAR has changed their data collection over time and the older data does not include condos: Single-family data collection began monthly in 1968, while condo data collection began quarterly in 1981; the series were combined in 1999 when monthly collection of condo data began.

Tim Duy: "A Return to a Nasty External Dynamic?"

by Calculated Risk on 5/29/2009 08:57:00 AM

From Tim Duy's Fed Watch: A Return to a Nasty External Dynamic?

An excerpt:

[W]e are stuck with two apparently contrasting views. On one hand, rising long rates and the related steepening of the yield curve should indicate improving economic conditions - after all, rising yields simply imply that market participants are gaining confidence to put their money to work in more risky endeavors. The steeper yield curve should boost bank earnings and, in time, encourage lending. On the other hand, higher yields may undermine support for the housing market, thus extending the downturn.And Duy concludes:

I want to believe that the rapid reversal of Treasury yields is a benign, even positive, event. This is likely the Fed's view; consequently, the[y] will hold steady on policy. Challenging this benign view is that the reversal appears to be lock step with a return to dynamics seen in 2007 and 2008 - exceedingly low US rates encouraging Dollar outflows, stepping up the pace of foreign central bank reserve accumulation and putting upward pressure on key commodity prices. I worry that policymakers have forgotten the external dynamic that was hidden by the crisis induced flight to Dollars last fall. Indeed, capital outflows (indicated by a foreign central bank effort to reverse those flows) would signal that much work still needs to be done to curtail US consumption to bring the global economy back into balance. Policymakers are unprepared for this possibility.A long post well worth reading.

Thursday, May 28, 2009

The U.K Stress Test Scenario

by Calculated Risk on 5/28/2009 11:52:00 PM

From The Times: House prices halved in FSA stress test

The key assumptions in the stress test were that the economy would shrink by 6 per cent from peak to trough with growth not returning until 2011 and trend growth not until 2012. The regulators also assumed unemployment rising to 12 per cent of the workforce, or 3.7 million people, which is 1.5 million more than the present number and would be a higher level of joblessness even than in the recession of the early 1980s.The U.S. more adverse scenario is for unemployment to rise to 10.4% and house prices (Case-Shiller Composite 10) to fall by almost half.

Finally, the FSA posited a 50 per cent fall in house prices from their peak and a 60 per cent fall in commercial property prices - office blocks and shops.

So far, house prices have fallen by 19 per cent from their peak in October 2007, according to the Nationwide Building Society.

...

Analysts said the stress test parameters were, if anything, not severe enough. The market is already expecting a peak-to-trough fall in GDP of 4.5 per cent and unemployment peaking at 10.5 per cent, “which is not significantly better than the assumptions made,” analysts at Credit Suisse commented. However, the house price scenario did look more extreme, it added.

And how about a 60% decline in commercial real estate? How would that impact the S&P CMBS assumptions?

Report: $75 billion of CMBS Market Capitalization Lost in Two Days

by Calculated Risk on 5/28/2009 08:35:00 PM

In a research note today, Citigroup analysts estimated that "more than $75 billion of CMBS market capitalization has been lost" since the S&P request for comment on changes to their U.S. CMBS rating methodology was issued two days ago.

S&P noted:

Our preliminary findings indicate that approximately 25%, 60%, and 90% of the most senior tranches (by count) within the 2005, 2006, and 2007 vintages, respectively, may be downgraded.Citigroup commented that the changes were "a complete surprise", "flawed", lacked "justification" and the "S&P methodology changes do not seem rational or predictable". Ouch.

Citi also noted that this will impact the CMBS legacy TALF announced last week by the Fed. According to Citi the "S&P changes could impact nearly 40% of the triple-A TALF eligible universe" and they expect the Fed to change their criteria.

Report: GM to File Bankruptcy Monday

by Calculated Risk on 5/28/2009 05:56:00 PM

From Bloomberg: GM Said to Plan June 1 Bankruptcy as Debt Plan Gains

General Motors Corp. ... plans to file for bankruptcy protection on June 1 and sell most of its assets to a new company, people familiar with the matter said.GM SEC Filing:

As provided in the Proposal, the U.S. Treasury has indicated that if holders of Notes of an amount satisfactory to the U.S. Treasury have provided (prior to 5:00 pm EDT on Saturday, May 30, 2009) statements of support satisfactory to the U.S. Treasury indicating that they will not oppose the 363 Sale (if conducted on terms substantially consistent with the Proposal), the U.S. Treasury currently would propose that New GM issue to Old GM as a portion of the consideration offered in connection with the 363 Sale 10% of the common equity of New GM and warrants to purchase an aggregate of 15% of the equity of New GM. The U.S. Treasury has indicated that if these statements of support are not received, the amount of common equity and warrants that it would propose be issued by New GM to Old GM would be substantially reduced or eliminated.Also from the NY Times: New G.M. Plan Gets Support From Key Bondholders

It sounds like they made the bondholders a deal they couldn't refuse.

ATA Truck Tonnage Index Declines 2.2 Percent in April

by Calculated Risk on 5/28/2009 04:00:00 PM

Press Release: ATA Truck Tonnage Index Fell Another 2.2 Percent in April (ht dryfly)

The American Trucking Associations' advance seasonally adjusted (SA) For-Hire Truck Tonnage Index fell 2.2 percent in April, after plunging 4.5 percent in March. April marked the second sequential decrease. In April, the SA tonnage index equaled just 99.2 (2000 = 100), which is its lowest level since November 2001. The not seasonally adjusted (NSA) index, which represents the change in tonnage actually hauled by the fleets before any seasonal adjustment, was down 2.9 percent from March. In April, the NSA index equaled 101.6.

Compared with April 2008, tonnage contracted 13.2 percent, which was the worst year-over-year decrease of the current cycle and the largest drop in thirteen years. In March 2009, tonnage dropped 12.2 percent from a year earlier.

ATA Chief Economist Bob Costello said truck tonnage is getting hit from both the recession and the massive inventory correction that the supply chain is currently undergoing. "While most key economic indictors are decreasing at a slower rate, the year-over-year contractions in truck tonnage accelerated because businesses are right-sizing their inventories, which means fewer truck shipments," Costello said. "The absolute dollar value of inventories has fallen, but sales have decreased as much or more, which means that inventories are still too high for the current level of sales. Until this correction is complete, freight will be tough for motor carriers." Costello added that truck freight has yet to hit bottom and it could be a few more months before this occurs.

emphasis added

| Click on graph for larger image in new window. This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. |

Berkshire Hathaway's Sokol: "No Green Shoots"

by Calculated Risk on 5/28/2009 02:41:00 PM

From Reuters: MidAmerican's Sokol sees US housing staying weak (ht Alexander, Cord)

David Sokol, chairman of Berkshire Hathaway Inc's MidAmerican Energy Holdings and a contender to succeed Warren Buffett, warned that the U.S. housing market still has a ways to go before bottoming out.

...

"As we look at the economy, I have to be honest: we're not seeing the green shoots," Sokol said ... "We think the official statistics of 10 to 12 months' backlog is actually nearly twice that amount," ...

"There is an enormous shadow backlog of about-to-be foreclosed homes and of individuals who need to sell but have time, and there are already six (for sale) signs on their block," he said.

... "It will be be mid-2011 before we see a balancing of the existing home sales market." He defined "balanced" as a six-month backlog.

New Home Sales: The Distressing Gap

by Calculated Risk on 5/28/2009 12:11:00 PM

For graphs based on the new home sales report this morning, please see: New Home Sales Flat in April

Yesterday, the National Association of Realtors (NAR) reported that "Distressed properties ... accounted for 45 percent of all sales in April". Distressed sales include REO sales (foreclosure resales) and short sales, and based on the 4.68 million existing home sales (SAAR) that puts distressed sales at a 2.1 million annual rate in April.

That fits with the MBA foreclosure and delinquency data released this morning that shows that "3.85% of all mortgages somewhere in the foreclosure process at the end of the first quarter".

All this distessed sales activity has created a gap between new and existing sales as shown in the following graph that I've jokingly labeled the "Distressing" gap.

This is an update including April new and existing home sales data. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows existing home sales (left axis) and new home sales (right axis) through March.

As I've noted before, I believe this gap was caused by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.

Over time, as we slowly work through the distressed inventory of existing homes, I expect existing home sales to fall further - See Existing Home Sales: Turnover Rate - and eventually for the distressing gap to close.

MBA: Mortgage Delinquencies, Foreclosures Hit Records

by Calculated Risk on 5/28/2009 10:21:00 AM

From Bloomberg: Mortgage Delinquencies, Foreclosures Hit Records on Job Cuts

... The U.S. delinquency rate jumped to a seasonally adjusted 9.12 percent and the share of loans entering foreclosure rose to 1.37 percent, the Mortgage Bankers Association said today. Both figures are the highest in records going back to 1972.We're all subprime now!

...

The inventory of new and old defaults rose to 3.85 percent, the MBA in Washington said. Prime fixed-rate mortgages given to the most creditworthy borrowers accounted for the biggest share of new foreclosures at 29 percent, and prime adjustable-rate mortgages were 24 percent, Brinkmann said. It shows the mortgage problem has shifted from a subprime issue to a job-loss problem, he said.

emphasis added

UPDATE: From MarketWatch: Foreclosures break another record in first quarter

Total foreclosure inventory was also up, with 3.85% of all mortgages somewhere in the foreclosure process at the end of the first quarter, compared with 3.3% in the fourth quarter -- also a record jump.Note: I haven't seen a copy of the MBA report yet.

...

While subprime, option ARM and Alt-A loans were a focus of the foreclosure problem initially, the foreclosure rate on prime fixed-rate loans has doubled in the last year.

"For the first time since the rapid growth of subprime lending, prime fixed-rate loans now represent the largest share of new foreclosures," Brinkmann said -- evidence, he added, of the impact that the recession and drops in employment are having on the foreclosure numbers.