by Calculated Risk on 3/30/2009 10:28:00 PM

Monday, March 30, 2009

The End of the GM Hummer on Tuesday?

From the NY Times: A Dealer’s Big Bet Is on the Line as the Hummer Falls From Favor

Sales of Hummers over all have fallen so far — 51 percent last year, the worst drop in the industry — that General Motors is trying to find a buyer for the brand. Without one, the company might close Hummer. An announcement about Hummer’s fate may be made Tuesday.And from: Humbling a Giant

“It’s a brand that represents a lot of what people want to get away from,” said Rebecca Lindland, an analyst with the research firm I.H.S. Global Insight.

...

If Hummer is closed, it would be phased out “rather quickly,” G.M.’s president, Frederick A. Henderson, said last month.

For too long, [GM] sold too many models, under too many brands, in too many markets — with too few customers.There is much more in the 2nd article about the downsizing of GM. The Hummer will probably be history tomorrow.

...

The task force ... said Monday that G.M. had to drastically pare the broadest lineup of products offered by any car company.

“G.M. has retained too many unprofitable nameplates that tarnish its brands, distract the focus of its management team, demand increasingly scarce marketing dollars, and are a lingering drag on consumer perception, market share and margin,” the task force said in its report.

...

Instead of cutting eight brands down to four in the United States, G.M. may be left with Chevrolet and Cadillac.

How Iceland Went Mad

by Calculated Risk on 3/30/2009 08:06:00 PM

Most of the news today was about GM and Chrysler. See WSJ: Obama Favors Bankruptcy for GM, Chrysler and NY Times: Obama Issues Ultimatum to Struggling Automakers

Bankruptcy is likely.

For some interesting reading, there was an excellent article in the NY Magazine today about a software programmer who wrote some of the software for securitizing mortgages: see: My Manhattan Project

And here is a story from Michael Lewis writing in Vanity Fair on Iceland: Wall Street on the Tundra Short excerpt:

Iceland’s de facto bankruptcy—its currency (the krona) is kaput, its debt is 850 percent of G.D.P., its people are hoarding food and cash and blowing up their new Range Rovers for the insurance—resulted from a stunning collective madness. What led a tiny fishing nation, population 300,000, to decide, around 2003, to re-invent itself as a global financial power? In Reykjavík, where men are men, and the women seem to have completely given up on them, the author follows the peculiarly Icelandic logic behind the meltdown.

...

An entire nation without immediate experience or even distant memory of high finance had gazed upon the example of Wall Street and said, “We can do that.” For a brief moment it appeared that they could. In 2003, Iceland’s three biggest banks had assets of only a few billion dollars, about 100 percent of its gross domestic product. Over the next three and a half years they grew to over $140 billion and were so much greater than Iceland’s G.D.P. that it made no sense to calculate the percentage of it they accounted for. It was, as one economist put it to me, “the most rapid expansion of a banking system in the history of mankind.”

Autos: Cerberus Loses Equity, New GM CEO Says Bankruptcy "may be best option"

by Calculated Risk on 3/30/2009 05:59:00 PM

From the WSJ: Cerberus’s Equity in Chrysler’s Auto Company to Be Eliminated

Cerberus Capital Management will lose its equity stake in Chrysler ... as a condition of the Treasury Department’s bailout deal with the U.S. auto maker ...I wonder if any banks still hold Chrysler debt?

The New York private-equity firm purchased an 80% stake in Chrysler in 2007 ... In term sheets released by the Treasury Department on Monday, the government said Chrysler’s restructuring “at a minimum will require extinguishing the vast majority of Chrysler’s outstanding secured debt and all of its unsecured debt and equity.”

And from CNBC: New GM CEO: Bankruptcy May Be Best Option for Automaker

General Motors's new chief executive told CNBC that filing for Bankruptcy may be the best option for the struggling automaker. ... Henderson told reporters that the company would still prefer to restructure outside of court, but the level of support Washington is offering would help the company quickly restructure through bankruptcy.A bankruptcy sounds very likely.

Added: I think a reasonable role for government is to guarantee the warranties (so people keep buying cars) and provide DIP (debtor-in-possession) financing. There are many other issues too - like making sure the vendors don't all go bankrupt, and the U.S. Pension Benefit Guarantee Corp. (PBGC) will probably be taking significant losses on GM and Chrysler pensions.

Good thing the PBGC invested so wisely recently, see: Pension insurer shifted to stocks

Just months before the start of last year's stock market collapse, the federal agency that insures the retirement funds of 44 million Americans departed from its conservative investment strategy and decided to put much of its $64 billion insurance fund into stocks.Heckuva job.

Switching from a heavy reliance on bonds, the Pension Benefit Guaranty Corporation decided to pour billions of dollars into speculative investments such as stocks in emerging foreign markets, real estate, and private equity funds.

"My Manhattan Project"

by Calculated Risk on 3/30/2009 05:02:00 PM

For your reading enjoyment ... here is an article about a software programmer who wrote some of the software for securitizing mortgages.

From Michael Osinski in New York Magazine: My Manhattan Project How I helped build the bomb that blew up Wall Street

I have been called the devil by strangers and “the Facilitator” by friends. It’s not uncommon for people, when I tell them what I used to do, to ask if I feel guilty. I do, somewhat, and it nags at me. When I put it out of mind, it inevitably resurfaces, like a shipwreck at low tide. It’s been eight years since I compiled a program, but the last one lived on, becoming the industry standard that seeded itself into every investment bank in the world.

I wrote the software that turned mortgages into bonds

Because of the news, you probably know more about this than you ever wanted to. The packaging of heterogeneous home mortgages into uniform securities that can be accurately priced and exchanged has been singled out by many critics as one of the root causes of the mess we’re in. I don’t completely disagree. But in my view, and of course I’m inescapably biased, there’s nothing inherently flawed about securitization. Done correctly and conservatively, it increases the efficiency with which banks can loan money and tailor risks to the needs of investors. Once upon a time, this seemed like a very good idea, and it might well again, provided banks don’t resume writing mortgages to people who can’t afford them. Here’s one thing that’s definitely true: The software proved to be more sophisticated than the people who used it, and that has caused the whole world a lot of problems.

Market Cliff Diving and More

by Calculated Risk on 3/30/2009 04:00:00 PM

These swings are wild ...

DOW down 3.3% (254 points)

S&P 500 down 3.5% (28 points)

NASDAQ down 2.8% (43 points) Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

This is the 2nd worst S&P 500 / DOW bear market in the U.S. in 100 years.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. The second graph compares four significant bear markets: the Dow during the Great Depression, the NASDAQ, the Nikkei, and the current S&P 500.

See Doug's: "The Mega-Bear Quartet and L-Shaped Recoveries".

And since I haven't posted this for awhile, here are a few credit crisis indicators ...

The British Bankers' Association reported that the three-month dollar Libor rates were fixed at 1.2075%, down from Friday's 1.22%. The dollar LIBOR was at 1.31% just 10 days ago - so this is some improvement.

The LIBOR peaked at 4.81875% on Oct. 10th, and hit a cycle low of 1.0825% on Jan. 14th. There has been improvement in the A2P2 spread. This has declined to 0.92. This is far below the record (for this cycle) of 5.86 after Thanksgiving, but still above the normal spread.

There has been improvement in the A2P2 spread. This has declined to 0.92. This is far below the record (for this cycle) of 5.86 after Thanksgiving, but still above the normal spread.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

| Meanwhile the TED spread is holding steady at 108.7. This is the difference between the interbank rate for three month loans and the three month Treasury. The peak was 463 on Oct 10th and a normal spread is around 50 bps. The TED spread has been relatively flat for months (and is being impacted by the Fed and other Central Banks). |

House Prices: Round Trip to 1990

by Calculated Risk on 3/30/2009 02:52:00 PM

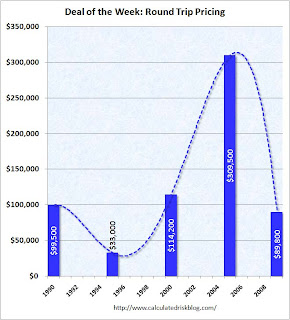

Zach Fox at the North County Times brings us another Deal of the Week: Riding the waves in Oceanside Click on graph for larger image in new window.

Click on graph for larger image in new window.

The featured 2 BR 2 BA condo sold for just under $100 thousand new in 1990. It went into foreclosure during the early '90s California housing bust, and was resold in 1995 for $33,000.

By 2000 the condo was above the original selling price. And then "rode the bubble" to an outrageous price. The condo went through foreclosure last year and sold in February for less than the original price in 1990! Adjust that return for inflation ...

Administration on GM, Chrysler

by Calculated Risk on 3/30/2009 12:16:00 PM

Update2: From MarketWatch: Corrected: Chrysler, Cerberus agree to Fiat deal framework

Update: The government is also backing warranties for GM and Chrysler. That is a key step towards bankruptcy. US backs warranties for GM, Chrysler (ht Stephen)

The US government Monday said it is guaranteeing the warranties of new vehicles bought from General Motors and Chrysler in a bid to boost consumer confidence and auto sales.From the WSJ: Obama Outlines Plans for GM, Chrysler

The Treasury Department said it had taken the temporary step to allay consumer worries about buying new cars from the two nearly bankrupt manufacturers that are on government life support. The new plan addresses fears that the new car warranties would be worthless if the companies collapse.

Warning that they can't depend on unending taxpayer dollars, President Barack Obama on Monday gave General Motors Corp. and Chrysler LLC a brief window to craft plans that would justify fresh government loans.MarketWatch has the Key White House findings Excerpt:

...

The administration says a "surgical" structured bankruptcy may be the only way forward for GM and Chrysler, and President Obama held out that prospect Monday.

"I know that when people even hear the word 'bankruptcy,' it can be a bit unsettling, so let me explain what I mean," he said. "What I am talking about is using our existing legal structure as a tool that, with the backing of the U.S. government, can make it easier for General Motors and Chrysler to quickly clear away old debts that are weighing them down so they can get back on their feet and onto a path to success; a tool that we can use, even as workers are staying on the job building cars that are being sold."

Viability of Existing Plans:

The plans submitted by GM and Chrysler on February 17, 2009 did not establish a credible path to viability. In their current form, they are not sufficient to justify a substantial new investment of taxpayer resources. Each will have a set period of time and an adequate amount of working capital to establish a new strategy for long-term economic viability.

General Motors:

While GM's current plan is not viable, the administration is confident that with a more fundamental restructuring, GM will emerge from this process as a stronger more competitive business. This process will include leadership changes at GM and an increased effort by the U.S. Treasury and outside advisors to assist with the company's restructuring effort. Rick Wagoner is stepping aside as Chairman and CEO. In this context, the Administration will provide GM with working capital for 60 days to develop a more aggressive restructuring plan and a credible strategy to implement such a plan. The Administration will stand behind GM's restructuring effort.

Chrysler:

After extensive consultation with financial and industry experts, the Administration has reluctantly concluded that Chrysler is not viable as a stand-alone company. However, Chrysler has reached an understanding with Fiat that could be the basis of a path to viability. Fiat is prepared to transfer valuable technology to Chrysler and, after extensive consultation with the Administration, has committed to building new fuel efficient cars and engines in U.S. factories. At the same time, however, there are substantial hurdles to overcome before this deal can become a reality. Therefore, the Administration will provide Chrysler with working capital for 30 days to conclude a definitive agreement with Fiat and secure the support of necessary stakeholders. If successful, the government will consider investing up to the additional $6 billion requested by Chrysler to help this partnership succeed. If an agreement is not reached, the government will not invest any additional taxpayer funds in Chrysler.emphasis added

CRE: 'Half Off' Sale for Boston’s John Hancock Tower

by Calculated Risk on 3/30/2009 10:57:00 AM

From Bloomberg: Boston’s John Hancock Tower May Be Sold for Half of 2006 Price (ht Brian)

Boston’s John Hancock Tower, the tallest skyscraper in New England, may be sold to lenders led by Normandy Real Estate Partners for about half the $1.3 billion paid in 2006 by Broadway Partners, which defaulted on its loan.This auction will give a good idea of how far commercial real estate prices have fallen.

Meanwhile, rents are falling too. From Bloomberg: Job cuts mean more office space available in Manhattan

The amount of Manhattan office space available for rent in the first quarter rose to 12 percent and rents fell as companies fired workers, FirstService Williams said.So much for those $100 per sq ft pro forma projections ...

The share of empty space plus occupied offices available for lease climbed from 10.9 percent at the end of 2008 ... The average rent sought by landlords fell to $65.18 a square foot from $74.49 in the fourth quarter, the company said.

FHA Mortgage Defaults Increase

by Calculated Risk on 3/30/2009 09:23:00 AM

From the WSJ: Mortgage Defaults, Delinquencies Rise

... A spokesman for the FHA said 7.5% of FHA loans were "seriously delinquent" at the end of February, up from 6.2% a year earlier. Seriously delinquent includes loans that are 90 days or more overdue, in the foreclosure process or in bankruptcy.

...

The FHA's share of the U.S. mortgage market soared to nearly a third of loans originated in last year's fourth quarter from about 2% in 2006 as a whole, according to Inside Mortgage Finance, a trade publication. That is increasing the risk to taxpayers if the FHA's reserves prove inadequate to cover default losses.

Government: GM, Chrysler "may well require" Bankruptcy

by Calculated Risk on 3/30/2009 01:11:00 AM

From the WSJ: Government Forces Out Wagoner at GM

The administration's auto team announced the departure of [General Motors Corp. Chief Executive Rick Wagoner] on Sunday. In a summary of its findings, the task force added that it doesn't believe Chrysler is viable as a stand-alone company, and suggested that the best chance for success for both GM and Chrysler "may well require utilizing the bankruptcy code in a quick and surgical way."On Chrysler:

The government said it would provide Chrysler with capital for 30 days to cut a workable arrangement with Fiat SpA, the Italian auto maker that has a tentative alliance with Chrysler.From the NY Times: U.S. Moves to Overhaul Ailing Carmakers

...

If the two reach a definitive alliance agreement, the government would consider investing up to $6 billion more in Chrysler. If the talks fail, the company would be allowed to collapse.

President Obama is scheduled to announce details of the auto package at the White House on Monday, but two senior officials, offering a preview on condition of anonymity, made clear that some form of bankruptcy — a quick, court-supervised restructuring, as they described it — could still be an option for one or both companies.On GM:

G.M., on the other hand, has made considerable progress in developing new energy-efficient cars and could survive if it can cut costs sharply, the task force reported. The administration is giving G.M. 60 days to present a cost-cutting plan and will provide taxpayer assistance to keep it afloat during that time.As expected, it sounds especially grim for Chrysler.