by Calculated Risk on 1/28/2009 10:53:00 AM

Wednesday, January 28, 2009

WSJ on Jumbo Loans

This article has a couple of scary charts on delinquent jumbo loans. The situation is especially grim in Florida with close to 17% of jumbo loans delinquent.

From the WSJ: Banks and Investors Face 'Jumbo' Threat (hat tip ShortCourage)

About 6.9% of prime "jumbo" loans were at least 90 days delinquent in December, according to LPS Applied Analytics, a mortgage-data research firm. The rate was up sharply from 2.6% a year earlier. In comparison, delinquencies of non-jumbo prime loans that qualify for backing by government agencies climbed to 2.1% from 0.8% in December 2007.I'm sure I'll receive a number of emails from mortgage brokers telling me they have a better deal (please no!), but it's no wonder sales of expensive homes have slowed significantly.

...

Conforming-loan limits top out at $625,000 in the highest-cost housing markets. To buy a more expensive home, buyers must put up larger down payments -- between 30% and 40% -- and pay higher mortgage rates. Rates on 30-year fixed jumbo mortgages stood at 6.87% last week, compared to 5.34% for conforming mortgages, a difference of 1.53 percentage points, according to HSH Associates, a financial publisher.

Report: FDIC May Run "Bad Bank"

by Calculated Risk on 1/28/2009 08:55:00 AM

From Bloomberg: FDIC May Run ‘Bad Bank’ in Plan to Purge Toxic Assets

The Federal Deposit Insurance Corp. may manage the so-called bad bank that the Obama administration is likely to set up ...There is much more in the article.

FDIC Chairman Sheila Bair is pushing to run the operation, which would buy the toxic assets clogging banks’ balance sheets ... President Barack Obama’s team may announce the outlines of its financial-rescue plan as early as next week, an administration official said.

...

The bad-bank initiative may allow the government to rewrite some of the mortgages that underpin banks’ bad debt, in the hopes of stemming a crisis that has stripped more than 1.3 million Americans of their homes. Some lenders may be taken over by regulators and some management teams could be ousted as the government seeks to provide a shield to taxpayers.

Tuesday, January 27, 2009

FOMC Statement: Will the Fed buy longer-term Treasuries?

by Calculated Risk on 1/27/2009 11:26:00 PM

Obviously the Fed will not cut the federal funds rate this month, however the Fed mentioned last month that they would evaluate buying longer-term Treasuries.

From the December Fed statement:

As previously announced, over the next few quarters the Federal Reserve will purchase large quantities of agency debt and mortgage-backed securities to provide support to the mortgage and housing markets, and it stands ready to expand its purchases of agency debt and mortgage-backed securities as conditions warrant. The Committee is also evaluating the potential benefits of purchasing longer-term Treasury securities. Early next year, the Federal Reserve will also implement the Term Asset-Backed Securities Loan Facility to facilitate the extension of credit to households and small businesses. The Federal Reserve will continue to consider ways of using its balance sheet to further support credit markets and economic activity.So I'd expect some sort of discussion or announcement about the evaluation. When the Fed issued the statement in December, the Ten Year was yielding 2.5% or so. Following the announcement, the yield declined to almost 2.0%, but is now back to 2.5% again.

emphasis added

Just something to look for in additional to the bleak outlook.

House Panel Approves Cram Downs

by Calculated Risk on 1/27/2009 07:08:00 PM

From the WSJ: U.S. House Panel Approves Mortgage Measure (hat tip Ken)

A measure to allow judges to reduce the principal amounts of mortgages for troubled borrowers in bankruptcy cleared a key hurdle Tuesday when it was approved by a U.S. House panel.Tanta argued that cram downs would help discipline lenders in the future. So I think she'd consider the concession to make the legislation applicable to only existing mortgages significant. Excerpting from Tanta's Just Say Yes To Cram Downs

...

Under the legislation, borrowers would be eligible to have a bankruptcy judge reduce the principal balance on their home loan -- a move known as a "cram down."

...

In key concessions to the banking industry, Mr. Conyers agreed to alter the legislation to allow court-ordered modifications only for existing mortgages and to require that borrowers contact their lender at least 15 days before filing bankruptcy.

...

In another change, the legislation will now require recipients of cram downs who resell their home within five years to share the proceeds with their lender.

I am fully in favor of removing restrictions on modifications of mortgage loans in Chapter 13, but not necessarily because that helps current borrowers out of a jam. I'm in favor of it because I think it will be part of a range of regulatory and legal changes that will help prevent future borrowers from getting into a lot of jams, which is to say that it will, contra MBA, actually help "stabilize" the residential mortgage market in the long term. Any industry that wants special treatment under the law because of the socially vital nature of its services needs to offer socially viable services, and since the industry has displayed no ability or willingness to quit partying on its own, then treat it like any other partier under BK law.

CNBC: "Bad bank" plan "gaining momentum"

by Calculated Risk on 1/27/2009 05:38:00 PM

From Steve Liesman at CNBC: Plan for Banks' Toxic Debt May Be Unveiled Next Week

The Obama administration is close to deciding on a plan to purchase bad—or non-performing and illiquid—assets from banks ... The plan could be announced early next week.I'm skeptical of a "model-pricing mechanism" that adjusts the price of non-performing assets higher because the government has a lower borrowing cost. What then happens to the government's borrowing costs in the future?

The so-called "bad bank" plan, would address the key problem of how to price the assets by using a model-pricing mechanism.

The model would take account of the government's ability to hold onto assets, even to maturity, and pay for the them with cheap funding. Result: the government might end up paying more than current market prices for the securities.

On the other hand, if the government paid less than the value at which the asset is carried on the bank's books, the bank would issue common equity to the government.

...

A Treasury official said nothing will be announced this week and would not comment "on specific policy decisions that have yet to be made."

SL Green: Manhattan Office Vacancy Rate to Hit 12%

by Calculated Risk on 1/27/2009 05:23:00 PM

From Bloomberg: New York Office Vacancies Rising to 12% by 2011, SL Green Says

Manhattan office vacancies may rise to 12 percent within 24 months, SL Green Realty Corp. Chief Executive Officer Marc Holliday said today on a conference call.From the SL Green conference call (hat tip Brian):

SL Green, New York’s biggest office landlord with 23.2 million square feet ...

“Clearly this is a market where we are relooking at the ways we lease and do business with tenants. We are more cautious today. We have increased our security deposit requirements for tenants that are less than obviously credit worthy and this is something that we have done in other bad markets. It's paid off for us. It's kept our credit losses to a minimum in good and bad market. We are also doing more net effective deals where we put out less capital and pay less commission on slightly lower rents but rents that still provide for uptick relative to prior escalated rents.Mayor Bloomberg released a report on the NY City economy in early November. Here is a graph of their projected vacancy rate and rents (close to the SL Green projections):

The market however is certainly feeling the pressure of job losses, Financial Services contraction, sublet space and a limited but growing number of business failures. We can't help but expect that vacancy rate in midtown is going to rise beyond where we had originally forecasted those vacancy rates to be at around ten to 12%. At the moment those rates seem to be at around eight to 9% vacant currently, maybe even 10% if you take into account whatever space we think will be coming available directly or indirectly online in 2009. And we think that that vacancy rate could easily now hit 12% or more over the next 24 months.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the actual and projected (by the NYC OMB) rents and office vacancy rate for NYC Class A buildings.

The vacancy rate is expected to rise from about 7.5% to 13%, and rents are expect to decline by 20% or more from the peak.

Roubini: Bloomberg Interview from Zurich

by Calculated Risk on 1/27/2009 02:24:00 PM

All this fiscal stimulus is necessary, cause the alternative is a depression.Roubini, Jan 27, 2009

Note: Listening to the Roubini interview (see video below), I think he is forecasting less than 6 million in net job losses in the U.S. this year because of the stimulus plan. Here is a quick transcript:

"At this rate we will could lose another 6 million jobs in 2009 on top of the 2.5 [million] lost the last year. The Obama plan wants to create 2 to 3 million jobs. By the means, even if you implement it, the job losses are going to be smaller. We are not going to create on net, we are going to have job losses falling to 200 to 250 [thousand] losses per month as opposed to 500 thousand. That is the best we can expect for this year. And I think the unemployment rate will keep on increasing even next year because it is a lagging indicator. The unemployment rate is going to peak above 9% sometime in 2010. It is pretty bleak."From Bloomberg: Roubini Sees ‘Nowhere to Hide’ From Global Slowdown

Global stock market declines are increasingly correlated and emerging economies will follow developed nations into a “severe recession,” according to New York University Professor Nouriel Roubini.

Roubini said economic growth in China will slow to less than 5 percent and the U.S. will lose 6 million jobs. The American economy will expand 1 percent at most in 2010 as private spending falls and unemployment climbs to at least 9 percent, he added.

...

Roubini said the U.S. government should nationalize the biggest banks because losses will exceed assets, threatening to push them into bankruptcy. The banks could be privatized again in two or three years, Roubini said. The professor reiterated his prediction that U.S. financial losses will more than triple to $3.6 trillion and that global equities will fall 20 percent this year from current levels.

DataQuick: Temporary Drop in California Foreclosure Activity

by Calculated Risk on 1/27/2009 01:40:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

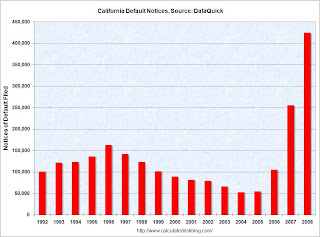

This graph shows the Notices of Default (NOD) by year in California from DataQuick.

There were a record 423,962 NODs filed in 2008, breaking the old record of 254,824 NODs in 2007.

The previous record had been in 1996 with 162,678 NODs filed. That was during the previous California housing bust in the early to mid-90s.

From DataQuick: Temporary Drop in California Foreclosure Activity

The number of mortgage default notices filed against California homeowners fell last quarter to its lowest level in more than a year, the temporary result of a procedural change that took effect in September, a real estate information service reported.

Lending institutions sent homeowners 75,230 default notices during the October-through-December period. That was down 20.2 percent from 94,240 for the prior three months, and down 7.7 percent from 81,550 for fourth-quarter 2007, according to MDA DataQuick.

Recorded default notices peaked in second-quarter 2008 at 121,673.

...

While recordings were back up to 39,993 in December it's unclear whether lenders were mainly playing catch-up, or whether a new wave of foreclosure activity was building.

"No one expected defaults to stay at the much lower levels we saw immediately after the new law took effect last fall. The bigger question is whether or not the housing market has hit a low and is dragging along bottom, or if the markets that so far have remained unaffected by the foreclosure problem are due for a fall. With today's atypical market trends, it's impossible to predict," said John Walsh, DataQuick president.

Most foreclosure activity was still concentrated in affordable inland areas where the availability of so-called subprime financing fueled a buying and refinancing frenzy in 2005/2006. Those sub-markets, which represent about 25 percent of the state's housing stock, account for more than 50 percent of the default activity. That ratio is the same now as a year ago, indicating that the problem has not yet migrated into more established, expensive markets.

Most of the loans that went into default last quarter were originated between October 2005 and January 2007. The median age was 29 months, up from 21 months a year earlier. More than three million home loans were originated in 2006. That dropped to two million in 2007, and 1.1 million last year.

The New Three D's of Housing

by Calculated Risk on 1/27/2009 11:59:00 AM

UPDATE: Several people has written to me saying this is nothing new. Maybe it should be the 4 D's Death, Disease, Divorce, Debt ... or more D's too (I've received several suggestions). Best to all!

Historically the Three D's of housing that forced homeowners to sell, or into foreclosure, were Death, Divorce, or Disease.

I've seen this revision a few times recently ...

“If you sell in this market, it’s usually one of the three D’s: death, divorce or debt.”Paul Brennan, regional director for the Hamptons at Elliman, Bloomberg, Jan 7, 2009 (hat tip Rick)

Really there are four D's right now.

FDIC to Tighten Interest Rate Restrictions on some Institutions

by Calculated Risk on 1/27/2009 11:14:00 AM

From the FDIC: FDIC to Tighten and Clarify Interest Rate Restrictions on Institutions That are Less Than Well-Capitalized

The Board of Directors of the Federal Deposit Insurance Corporation today proposed for comment a regulatory change in the way the FDIC administers its statutory restrictions on the deposit interest rates paid by banks that are less than Well Capitalized.This is an attempt to address the moral hazard issue related to deposit insurance. The FDIC is well aware of this problem:

Prompt Corrective Action requires the FDIC to prevent banks that are less than Well Capitalized from soliciting deposits at interest rates that significantly exceed prevailing rates.

Concerns about Moral Hazard. In the insurance context, the term "moral hazard" refers to the tendency of insured parties to take on more risk than they would if they had not been indemnified against losses. The argument is that deposit insurance reassures depositors that their money is safe and removes the incentive for depositors to critically evaluate the condition of their bank. With deposit insurance, unsound banks typically have little difficulty obtaining funds, and riskier banks can obtain funds at costs that are not commensurate with their levels of risk. Unless deposit insurance is properly priced to reflect risk, banks gain if they take on more risk because they need not pay creditors a fair risk–adjusted return. A truly risk–based assessment discourages such risky behavior. The moral hazard problem is particularly acute for insured depository institutions that are at or near insolvency but are allowed to operate freely because any losses are passed on to the insurer, whereas profits accrue to the owners. Thus problem institutions have an incentive to take excessive risks with insured deposits in the hope of returning to profitability.There are now 154 banks on the "less than Well Capitalized" list:

emphasis added

The proposed rule applies only to the small minority of banks that are less than well capitalized. As of third quarter 2008, there were 154 banks that reported being less than Well Capitalized, out of more than 8,300 banks nationwide.Bank Failure Fridays will be busy this year.