by Calculated Risk on 10/31/2008 09:33:00 PM

Friday, October 31, 2008

FDIC Bank Failures

Just to put the 17 bank failures this year into perspective, here are insured bank failures by year since the FDIC was founded: Click on graph for larger image in new window.

Click on graph for larger image in new window.

Of course the size of the failed banks, and the cost to the FDIC, also matter.

The failure today, Freedom Bank, was a small bank by asset size ($287 million). Still the size of the cost to the FDIC is pretty amazing compared to the size of the bank (cost estimated at between $80 million and $104 million). Many analysts expect over 100 bank failures. Dr. Roubini expects "hundreds of banks" to fail in the cycle. If so, we are just getting started.

Note: there are 8,451 FDIC insured banks as of Q3 2008.

Bank Failure #17: Freedom Bank, Bradenton, Florida

by Calculated Risk on 10/31/2008 06:41:00 PM

From the FDIC: Fifth Third Bank Acquires All the Deposits of Freedom Bank, Bradenton, Florida

Freedom Bank, Bradenton, Florida, was closed today by the Commissioner of the Florida Office of Financial Regulation, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Fifth Third Bank, Grand Rapids, Michigan, to assume all of the deposits of Freedom Bank.Happy Halloween!

...

As of October 17, 2008, Freedom Bank had total assets of $287 million and total deposits of $254 million. Fifth Third agreed to assume all the deposits for a premium of 1.16 percent. In addition to assuming the failed bank's deposits, Fifth Third will purchase approximately $36 million of assets. The FDIC will retain the remaining assets for later disposition.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be between $80 million and $104 million. Fifth Third's acquisition of all deposits was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives. The last failure in Florida was First Priority Bank, Bradenton, which was closed on August 1, 2008. Freedom Bank is the seventeenth FDIC-insured institution to be closed this year.

IMF to Bailout Pakistan

by Calculated Risk on 10/31/2008 04:34:00 PM

Form the Telegraph: Pakistan to receive $9bn from IMF in fight against bankruptcy

Pakistan is to receive a $9bn (£5.5bn) bail-out loan from the International Monetary Fund as the country has three weeks to stave off bankruptcy. ... The IMF agreed in principle to a billion dollar economic stabilisation plan for Pakistan during a week-long meeting with Pakistani officials in Dubai ... Pakistan needs at least $4bn to avoid defaulting on its foreign debts ...Iceland, Hungary, Ukraine and Pakistan ... the list is growing.

Credit Crisis Indicators: Some Progress

by Calculated Risk on 10/31/2008 02:17:00 PM

The London interbank offered rate, or Libor, for three month loans in dollars slid 0.16 point to 3.03 percent, the 15th consecutive drop, according to the British Bankers' Association.The rate peaked at 4.81875% on Oct. 10.

Usually the 3 month trades below the target Fed Funds rate by around 25 bps, so this is too low with the Fed funds rate at 1.0%. However, the effective Fed Funds rate is even lower (0.36% yesterday), so a 3 month yield of 0.42% is in the right range. I'd like to see the effective funds rate closer to the target rate.

I'd like to see the spread move back down to 1.0 or lower - at least below 2.0.

Here is a list of SFP sales. No announcement today. no progress.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper - and increasing the spread between AA and A2/P2 CP. So this indicator is a little misleading right now. Still, if the credit crisis eases, I'd expect a significant decline in this spread.

The LIBOR is down and the TED spread is off a little, but the A2P2 spread is at a record high probably because of the Fed buying CP - so there is some progress.

Residential Investment and Home Improvement

by Calculated Risk on 10/31/2008 11:49:00 AM

We frequently discuss "residential investment" (RI) without mentioning the components of RI according to the Bureau of Economic Analysis (BEA). Residential investment includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the various components of RI as a percent of GDP for the last 50 years. The most important components are investment in single family structures followed by home improvement.

Investment in home improvement ($175.2 billion SAAR) is almost at the same level as investment in single family structures ($176.0 billion SAAR) in Q3 2008.

Let's take a closer look at these two key components of RI: As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales (related to RI in single family structures).

As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales (related to RI in single family structures).

Currently investment in single family structures is at 1.22% of GDP, significantly below the average of the last 50 years of 2.35% - and just above the record low in 1982 of 1.20%.

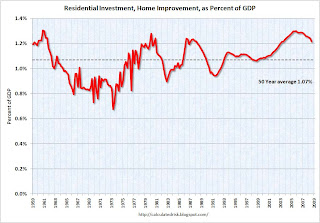

But what about home improvement? The third graph shows home improvement investment as a percent of GDP.

The third graph shows home improvement investment as a percent of GDP.

Home improvement is at 1.21% of GDP, off the high of 1.3% in Q4 2005 - but still well above the average of the last 50 years of 1.07%. Maybe lenders are boosting home improvement spending fixing up all those damaged REOs!

This would seem to suggest there is significant downside risk to home improvement spending over the next couple of years.

Frank: Bailout Funds are for Lending

by Calculated Risk on 10/31/2008 10:35:00 AM

From Reuters: Rep. Frank: bailout funds must be used for lending (hat tip Yal)

"I am deeply disappointed that a number of financial institutions are distorting the legislation that Congress passed at the president's request to respond to the credit crisis by making funds available for increased lending," Rep. Barney Frank said in a statement.But money is fungible, so how do we tell which funds are being used for which purpose?

"Any use of the these funds for any purpose other than lending -- for bonuses, for severance pay, for dividends, for acquisitions of other institutions, etc. -- is a violation of the terms of the Act."

Architecture Billings Index: Falls "precipitously"

by Calculated Risk on 10/31/2008 10:04:00 AM

I overlooked the ABI this month (hat tip Karl). Here is the American Institute of Architects billing index for September: Architecture Billings Index Falls More than Six Points Click on graph for larger image in new window.

Click on graph for larger image in new window.

Following three consecutive months of signs of greater stability in design activity, the Architecture Billings Index (ABI) fell precipitously, dropping more than six points. As a leading economic indicator of construction activity, the ABI shows an approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the September ABI rating was 41.4, down sharply from the 47.6 mark in August (any score above 50 indicates an increase in billings). The inquiries for new projects score was 51.0. This is also the first time in 2008 that the institutional sector has fallen below the 50 mark.The key here is that the index fell off a cliff in early 2008, and that there is "an approximate nine to twelve month lag time between architecture billings and construction spending". We should expect weaker non-residential structure investment in late 2008 and throughout 2009.

“With all of the anxiety and uncertainty in the credit market, the conditions are likely to get worse before they get better,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “Many architects are reporting that clients are delaying or canceling projects as a result of problems with project financing.”

emphasis added

Q3: Office, Malls and Lodging Investment

by Calculated Risk on 10/31/2008 09:04:00 AM

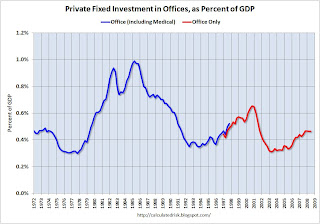

Here are a couple of graphs for non-residential structure investment based on the underlying details for the Q3 GDP report.

Based on tighter lending standards, rising vacancy rates (lower occupancy rate for hotels), and the Architectural Billing index, and declining non-residential construction spending, it appears there will be a sharp slowdown in investment in offices, malls and hotels at the end of 2008 and through 2009.

So far this slowdown is not showing up in the BEA numbers. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Investment in multimerchandise shopping structures (malls) increased slightly in Q3 2008, after peaking in Q4 2007.

Investment in lodging soared in Q3 to $48.3 billion (SAAR) from $36.5 billion (SAAR) in Q3 2007. This is probably due to builders rushing to finish projects.

This investment in lodging will probably decline sharply in the 2nd half of '08 and in '09 as builders cancel or postpone projects. As an example, from the WSJ: MGM Mirage Suspends Casino Projects as Profit Falls

Predevelopment work has been done on the MGM Grand Atlantic City, but the company will halt development until the economy and capital markets "are sufficiently improved," said Chairman and Chief Executive Terry Lanni.

He added that design and preconstruction work on its Las Vegas joint venture with Kerzner International and Istithmar is also being deferred.

MGM has been struggling to find financing to complete construction of its $11 billion CityCenter project on the Las Vegas Strip.

The second graph shows office investment as a percent of GDP since 1972. Office investment increased slightly in Q3 2008 in nominal dollars, but decreased slightly as a percent of GDP.

The second graph shows office investment as a percent of GDP since 1972. Office investment increased slightly in Q3 2008 in nominal dollars, but decreased slightly as a percent of GDP.With the office vacancy rate rising sharply, office investment will probably decline through 2009.

NOTE: In 1997, the Bureau of Economic Analysis changed the office category. In the earlier years, offices included medical offices. After '97, medical offices were not included (The BEA presented the data both ways in '97).

I expect investment in all three categories - malls, lodging and offices - to decline through 2009.

Real Personal Spending Declined Sharply in September

by Calculated Risk on 10/31/2008 08:37:00 AM

As expected - based on the advance GDP report - the BEA reports that real Personal Consumption Expenditures (PCE) declined sharply in September.

The year-over-year change in real PCE is now negative for the first time since 1991.

The change from June (third month of Q2) to September declined at a 3.9% annual rate, the fastest 3 month decline since 1991. Note: I look at the change in the same month in each quarter (June to September here) to compare to the quarterly GDP report.

Here is the story from the WSJ: Consumer Spending Declines

Quotes on Possible Treasury Mortgage Plan

by Calculated Risk on 10/31/2008 12:29:00 AM

A few quotes from David Streitfeld's piece in the NY Times: Mortgage Plan May Aid Many and Irk Others

“Why am I being punished for having bought a house I could afford? I am beginning to think I would have rocks in my head if I keep paying my mortgage.”

Todd Lawrence, homeowner, outside Norwich, Conn.

“If the lunch truly is free, the demand for free lunches will be large.”

Paul McCulley, PIMCO

“If the government says, ‘Prove that you can’t afford your house and we’ll redo your mortgage,’ then people are going to try to qualify.”

Peter Schiff, President of Euro Pacific Capital

“I guess they are forcing me to deliberately stop paying to look worse than I am. Crazy, don’t you think?”

Anonymous Countrywide borrower, Los Angeles