by Calculated Risk on 6/02/2008 04:01:00 PM

Monday, June 02, 2008

BofA CEO: Countrywide Deal Remains "Compelling"

Ken Lewis is speaking on a conference call sponsored by Deutsche Bank today.

Greg Morcroft at MarketWatch has the details:

Countrywide deal remains "compelling transaction"-B of A CEO

Problem loans likely to peak this year: Bank of America CEO On problem loans:

"I think we'll see some spikes in the second quarter, then some leveling later this year, and some declines next year."And on CRE:

Lewis also said that the firm's commercial real estate loan portfolio remains in generally good shape ... "In commercial real estate, homebuilders is the spot we see the losses and the non-performers," he said. Other than that, he said, "we haven't seen many cracks in the commercial real estate portfolio."And on HELOCs: Bank of America targets 8 - 8.5% Tier 1 capital ratio

Lewis ... said he sees home equity losses going above 2% of the firm's home equity portfolio, and said credit card charge offs "could be slightly above 6% in the next quarter or two."So problem loans will "spike" in the second quarter, and then level off. Let me be the first to predict Q3 will "surprise" and be worse than Q2!

And on Countrywide: the deal may remain "compelling" to Lewis, but I wonder if he has asked why the Countrywide REO inventory is declining - while REOs for everyone else are increasing substantially? I've heard a rumor that Countrywide has simply stopped foreclosing on loans, and some analysts think they might be under reporting their delinquencies.

S&P: More Write Downs Coming for Morgan Stanley, Merrill and Lehman

by Calculated Risk on 6/02/2008 01:48:00 PM

From Bloomberg: Morgan Stanley, Merrill, Lehman Ratings Cut by S&P

Morgan Stanley, Merrill Lynch & Co. and Lehman Brothers Holdings Inc. had their credit ratings lowered by Standard & Poor's on expectations the securities firms will be forced again to write down the value of their assets.Also the outlooks for just about the entire large financial institutions sector are now negative.

...

``The negative actions reflect prospects of continued weakness in the investment banking business and the potential for more write-offs, though not of the magnitude of those of the past few quarters,'' Tanya Azarchs, an S&P analyst, said today in a statement.

Contained. Problems behind us. ... Not!

Lawrence Lindsey on Housing: It's Only Going to Get Worse

by Calculated Risk on 6/02/2008 12:12:00 PM

From Lawrence Lindsey: Everything you always wanted to know about the housing crash, but were afraid to ask.. Lindsey covers a number of topics (hence the title), but here are some short excerpts on inventory and demand:

There are 129 million housing units in the United States, comprising owner-occupied, rented, and vacant units. Of these, 18.5 million are empty. This vacancy rate is 2.5 percentage points higher than it has been at any point in the half century the data have been tracked, translating into at least 3 million too many empty housing units in the country. This number, moreover, is rising. This is the most intractable part of the real estate bubble, for we cannot find a true bottom to home prices until this inventory of empty units starts to clear, and we cannot find a bottom to the mortgage finance market until home prices bottom out.No question - there is a huge overhang of inventory in the U.S., but I think Lindsey's analysis overstates the problem. Here is my estimate:

*******************

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the homeowner vacancy rate since 1956. A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, so perhaps the vacancy rate has stabilized in the 2.7% to 2.9% range.

This leaves the homeowner vacancy rate almost 1.2% above normal, and with approximately 75 million homeowner occupied homes; this gives about 900 thousand excess vacant homes.

The rental vacancy rate increased to 10.1% in Q1 2008, from 9.6% in Q4. It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are 35.7 million rental units in the U.S. If the rental vacancy rate declined from 10.1% to 8%, there would be 2.1% X 35.7 million units or about 750,000 units absorbed.

The rental vacancy rate increased to 10.1% in Q1 2008, from 9.6% in Q4. It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are 35.7 million rental units in the U.S. If the rental vacancy rate declined from 10.1% to 8%, there would be 2.1% X 35.7 million units or about 750,000 units absorbed. This would suggest there are about 750 thousand excess rental units in the U.S. that need to be absorbed.

If we add this up: 750 thousand excess rental units, 900 thousand excess vacant homes, and 200 thousand excess new home inventory, this gives approximately 1.85 million excess housing units in the U.S. - very high, but well below Lindsey's estimate of 3 million units.

And Lindsey on demand:

The math of the housing market is fairly clear. Each year roughly half a million homes are destroyed to make better use of the land on which they sit. Population growth also helps whittle down inventory. The household formation years--ages 25 to 34--have 39.5 million people in them forming 19 million households, a group that creates demand for 1.8 to 1.9 million units each year. On the other hand, households pass from the scene later in life, and the homes they used to live in go onto the market. There are 11.6 million households of 65- to 74-year-olds and 9 million households of 75- to 84-year-olds. Their departure increases supply by around 1.1 million units per year. On net, therefore, demographic realities add about 850,000 units to demand on top of the half-million homes that are destroyed and removed from supply.It's important to understand that during a recession (or economic slowdown) fewer household are formed than normal, and also fewer housing units are demolished. Lindsey is estimating the demand for a normal economy (some people get confused by temporary changes in demand due to economic conditions, as opposed to the demand during more normal times).

The home building industry is in a deep recession, with additional yearly new home supply cut in half since 2006. But homebuilders are still adding nearly a million units per year. The math is simple: Build a million, tear down half a million, form 850,000 households, and the country only whittles down its excess inventory by 350,000 units per year. This is one reason to expect a further drop in new home construction, but it will still take years to get our housing inventory back to normal. The economic, social, and financial damage over that time could be staggering.

Once again, I think Lindsey is a little too pessimistic. But this does illustrate the key problem for housing; it will take years to work off the current excess inventory.

Price Distribution of Distressed Homes

by Calculated Risk on 6/02/2008 11:18:00 AM

Update: for Minneapolis, see Minneapolis: Price Distribution of Distressed Homes

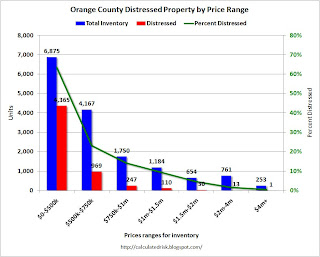

Jon Lansner at the O.C. Register writes: Distressed homes 63% of O.C.’s cheaper supply

As a percent of all listed homes for sale, distressed properties were 38.7% of the market last week vs. 36.7% two weeks earlier ...It appears distressed inventory is continuing to increase in Orange County similar to the national trend (see the WSJ: Number of Foreclosed Homes Keeps Rising). Note: distressed sales include short sales and REOs.

What is interesting is the numbers are broken down by price range. Here is a graph showing the numbers from Lansner:

Click on graph for larger image in new window.

Click on graph for larger image in new window.Not surprisingly, there are many more distressed homes for sale at the low end; over 70% of inventory is distressed in some of the poorer areas of Orange County (like Santa Ana). Although the lowest category for the graph is less than $500K, many of these distressed homes are probably significantly below the previous conforming limit and were probably purchased with subprime loans.

Naturally the areas with a higher percentage of distressed properties have seen faster price declines. Of course those areas also saw the most appreciation because of loose underwriting for subprime lending. Here is a graph (from a post on Saturday) showing the real Case-Shiller prices in Los Angeles for three price ranges.

This graph show the real Case-Shiller prices for homes in Los Angeles by price range.

This graph show the real Case-Shiller prices for homes in Los Angeles by price range. The low price range is less than $417,721 (current dollars). Prices in this range have fallen 34.9% from the peak in real terms.

The mid-range is $417,721 to $627,381. Prices have fallen 30.7% in real terms.

The high price range is above $627,381. Prices have fallen 22.8% in real terms.

Construction Spending Declines in April

by Calculated Risk on 6/02/2008 10:11:00 AM

Construction spending declined in April for residential, but increased to for non-residential private construction.

From the Census Bureau: March 2008 Construction Spending at $1,123.5 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $823.8 billion, 0.5 percent below the revised March estimate of $827.7 billion.

Residential construction was at a seasonally adjusted annual rate of $435.8 billion in April, 2.3 percent below the revised March estimate of $445.8 billion.

Nonresidential construction was at a seasonally adjusted annual rate of $388.0 billion in April, 1.6 percent above the revised March estimate of $381.8 billion.

Click on graph for larger image.

Click on graph for larger image. The graph shows private residential and nonresidential construction spending since 1993.

Over the last couple of years, as residential spending has declined, nonresidential has been very strong. It appeared earlier this year that the expected slowdown in non-residential spending had arrived.

However, non-residential spending in April set a new nominal record (seasonally adjusted annual rate). This is a little surprising given tighter lending standards and reduced capital spending plans.

Wachovia Ousts CEO

by Calculated Risk on 6/02/2008 09:33:00 AM

From the WSJ: Wachovia Ousts Thompson, Smith Will Be Interim CEO

[Wachovia] said Monday that board members have forced [CEO G. Kennedy Thompson] to retire from the company he has run for eight years.It was the acquisition of Option ARM lender Golden West in 2006 that caused many of these problems. Most losses to come ...

...

Wachovia posted bigger-than-expected losses in April, battered by sinking credit quality and the ill-timed acquisition in 2006 of Golden West Financial Corp., the Calabasas, Calif., mortgage lender.

HSBC On Mortgage Workouts

by Tanta on 6/02/2008 07:33:00 AM

The Chicago Tribune has a lengthy article out on HSBC's loan workout efforts. This is all rather confusing because HSBC uses the term "modification" the way everyone else I know uses the term "repayment plan," and then uses the term "restructuring" for what everybody else calls a "modification." With that in mind:

HSBC quickly stopped offering some of the riskiest loans, including stated-income mortgages, which require little documentation, and those generated by brokers, a channel where it had less control.I periodically hear people wondering if servicers of securities are doing modifications they wouldn't do on their own mortgage portfolio. I have believed all along that in fact portfolio lenders are much more aggressive about working out loans. They are also, I suspect, much faster at offloading REO quickly and taking the loss.

But trying to help homeowners stave off foreclosures through loan modifications or restructurings is taking longer than expected, McDonagh said.

A modification is generally temporary; after the end of a certain period, the loan resets to its original terms. A restructuring is a permanent redoing of the contract, including new terms and conditions.

"We typically would do six- to nine-month modifications" for troubled homeowners, he said. "Now we're looking out two to three years because, with the severity of the issues they've got, they need longer than six months to work things out."

The number of modifications and restructurings have been rising and represent 22 percent of its mortgage book, or about $18 billion.

Of that, $1.9 billion in modifications, in 11,900 loans, has occurred since late 2006 as part of a program to address the interest rate resets of adjustable-rate mortgages. . . .

HSBC Finance, which typically holds its mortgages on its books, ended 2007 with 9,627 foreclosed properties, up from 8,809 at the end of the third quarter, company records show. While the average number of days to sell a foreclosed property has dipped from 186 to 183 in the same time period, HSBC's losses on the sale of foreclosed real estate have climbed, losing 14 percent of their value in the fourth quarter, up from a 9 percent loss in the third quarter.

Every modification or restructuring is a full re-underwriting, with customers' latest financial situations reviewed.

"To make it work, they have to be upfront about their debts and sources of income," he said.

To a degree, HSBC relies on computerized analysis to decide whether a customer is suited to a mortgage modification.

But "at the end of the day, it's a personal negotiation because every customer's situation is different," he said. "It requires skilled" employees.

The question becomes whether the securitization rules or trustees themselves are hindering servicer efforts to work out loans, or whether servicers prioritize their workload with their portfolio loans first, then the securitized loans. I would guess it's a combination in a lot of cases.

Sunday, June 01, 2008

WSJ: Number of Foreclosed Homes Keeps Rising

by Calculated Risk on 6/01/2008 07:35:00 PM

From the WSJ: Number of Foreclosed Homes Keeps Rising

Lenders and investors in mortgages owned about 660,000 foreclosed homes in April, up from 493,000 in January and 231,000 in January 2007, according to First American CoreLogic ... The April total works out to about one in seven previously occupied homes available for sale nationwide.The lenders were slow to reduce prices at first, apparently hoping for "better market conditions". Now some lenders are getting aggressive as they realize that holding REOs means even greater losses as prices continue to fall.

... By cutting prices, lenders have managed to increase sales of such homes sharply in recent months in some cities hit hard by foreclosures ... Mark Zandi, chief economist at Moody's Economy.com, forecasts that the inventory of REO homes won't peak before the end of 2009.

...

The REO glut is weighing on house prices in many areas, as banks tend to cut prices faster than other sellers.

From anecdotal evidence, it appears the lenders are being aggressive on pricing at the low end, but are still reluctant to discount mid to higher priced homes. This will probably change as the REOs continue to pile up at the banks.

Comment Sytems

by Calculated Risk on 6/01/2008 03:26:00 PM

Once again Haloscan is having performance problems.

I've switched to JS-kit until Haloscan starts working again.

JS-kit has a number of new features (that I haven't tried), and allows for threading (replies to individual comments).

Let me know what you think. I'm open to suggestions - Haloscan's reliability is a major issue.

Best to all

REO Market Picking Up

by Calculated Risk on 6/01/2008 09:37:00 AM

From the LA Times: Sales of foreclosures are on the rise

THE MARKET may be down, but sales of bank-owned properties are picking up, with multiple offers being made in many cases as lenders drop their prices to move foreclosed homes off the books.Yes, some REO lenders are finally getting realistic with their pricing, and in areas with significant REO activity (and aggressive lenders) prices may be close to the eventual nominal bottom. This is one of the key points I made in House Price Mosaic.

...

"A $650,000 to $700,000 appraisal a year ago in some areas is now worth about $350,000. It took a while for the banks to adjust their mentality to that." [said Earl Bonawitz, general manager for Century 21 Wright in Temecula]

...

John Karevoll, an analyst with DataQuick Information Systems, also is seeing that REO prices have come down and more homes are closing escrow than a few months ago.

"The big question is whether we're in a recession," he said. "If we are, we're in for some more downturn. If we're not in a recession, it's likely that prices have found their bottom and that most of the declines are behind us. That's true for REOs and the market as a whole."

But this article misses a far more important point: house price changes vary widely by area, not just by state, but even within cities. Over time the equilibrium between different price ranges will return, but the price dynamics will be different. Areas with a large number of REOs have seen much faster price declines - and are probably closer to the price bottom. Areas with fewer REOs will exhibit "sticky prices" and the prices will probably decline for some time.