by Calculated Risk on 5/28/2008 04:35:00 PM

Wednesday, May 28, 2008

CRE: Orange County Non-Residential Permits Value off 40%

From Jon Lansner at the O.C. Register: O.C.’s commercial construction down in ‘08

The Construction Industry Research Board reports ... that the estimated value of permits for non-residential construction fell nearly 40% this year so far from the same period in 2007. Permit values fell to just under $527 million so far this year. Last year, developers received permits for projects valued at $873 million from January through April.Just more evidence of the CRE bust.

Regional Bank Problems: KeyCorp

by Calculated Risk on 5/28/2008 01:04:00 PM

From Bloomberg: KeyCorp Slide Foretells Losses at `Delusional' Banks

KeyCorp ... doubl[ed] its forecast for loans that won't be repaid, prompting concern that regional banks have underestimated the cost of bad mortgages.And they are also having problem with home improvement loans. Here is the KeyCorp release from the 8-K SEC filing:

KeyCorp [said] debts may be as much as 1.3 percent of average total loans this year. The figure may rise even more, KeyCorp said, as the Cleveland-based company cuts holdings tied to homebuilders.

The revision by the Ohio bank, which last month quadrupled its provision for loan losses to $187 million, may foretell similar increases at U.S. commercial banks as home prices keep sliding, analysts said.

KeyCorp (the "Corporation") is updating its previous outlook for net loan charge-offs for 2008. The previous estimated range for net loan charge-offs was .65% to .90% of average loans. The Corporation now anticipates that net loan charge-offs will be in the range of 1.00% to 1.30% for 2008, with second quarter and potentially third quarter net charge-offs running above this range as the Corporation deals aggressively with reducing exposures in the residential homebuilder portfolio and anticipates elevated net loan charge-offs in its education and home improvement loan portfolios. The Corporation announced in the fourth quarter of 2007 that it had: (i) decided to cease conducting business with “out of footprint” nonrelationship homebuilders, (ii) recorded additional reserves to address continued weakness in the housing market, and (iii) decided to exit dealer-originated home improvement lending activities, which involve prime loans but are largely out-of-footprint.

More banks freeze home equity lines

by Calculated Risk on 5/28/2008 11:22:00 AM

From the Cleveland Plain Dealer: Banks freeze home equity lines as home values fall

While the practice started a few months ago in other parts of the country, it's just now hitting Northeast Ohio as banks from Fifth Third to Chase to AmTrust reduce their exposure to over-leveraged consumers. Most banks that haven't yet frozen home equity lines are looking at doing so.We are about to see mounting losses for lenders from HELOCs, and less consumer spending - especially for autos and home improvement - as lenders restrict HELOC borrowing.

...

AmTrust spokeswoman Donna Winfield said the bank's move to freeze equity lines here "was across the board" in areas where property values have declined and among customers who had less equity left.

Broker's Commissions: Riding the Double Bubble

by Calculated Risk on 5/28/2008 10:47:00 AM

First, the NY Times reports on the Realtors antitrust settlement: Realtors Agree to Stop Blocking Web Listings

The Justice Department and the National Association of Realtors reached a major antitrust settlement Tuesday that government officials said should spur competition among brokers and ultimately bring down hefty sales commissions.Innovation will probably put pressure on commissions. This gives us an excuse to look at a long term graph of Broker's Commissions:

The deal frees Internet brokers and other real-estate agents offering heavily discounted commissions to operate on a level playing field with traditional brokers by using the multiple listing services that are the lifeblood of the industry, government officials said.

...

Norman Hawker, a business professor at Western Michigan University who ... predicted that the settlement would ultimately mean a drop in sales commissions of 25 percent to 50 percent as a result of increased competition.

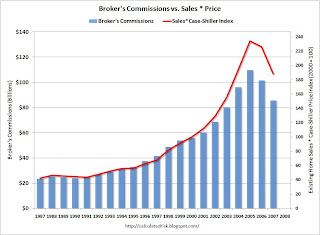

Click on graph for larger image.

Click on graph for larger image. This graph shows broker's commissions as a percent of GDP.

Not surprisingly - giving the housing bubble - broker's commissions soared in recent years, rising from $56 billion in 2000, to $109 billion in 2005 (see 2nd graph for commissions in dollars). Commissions have declined to an annual rate of $72 billion in Q1 2008. (All data from the BEA).

Here is a simple formula: Commissions = transactions X price X commission percent.

Broker's commissions increased because of both soaring prices and soaring activity. A double bubble.

Only the percent commission held down total commissions a little. This might surprise some readers, but at the peak of the bubble, many agents were discounting commissions below 6%. Listings were like printing money, and it was common for agents in California (and probably elsewhere) to offer to list a property for 4 1/2% or 5%, with the selling agents receiving 3%, and the listing agent taking less.

The following graph compares broker's commissions with an index created by multiplying sales transactions times the Case-Shiller National Home Price Index:

UPDATE: Reader 'get sum' notes in the comments that per his discussions with the BEA, their estimate of commissions assumes a 6% rate.

Note that broker's commissions didn't completely keep up with the double bubble. Sales times prices actually rose faster than commissions, suggesting: 1) that the percent commission declined somewhat, or 2) that Case-Shiller overstated the price increase in recent years. Or some combination of both (likely).

Note that broker's commissions didn't completely keep up with the double bubble. Sales times prices actually rose faster than commissions, suggesting: 1) that the percent commission declined somewhat, or 2) that Case-Shiller overstated the price increase in recent years. Or some combination of both (likely).Now, with prices falling, transactions falling, and more competition, it is likely that total commissions will fall further over the next few years. Tough times for many real estate agents.

Appraisal Tightening: No More Mailbox Money For You!

by Tanta on 5/28/2008 08:18:00 AM

As a general rule I do not recommend reading "Realty Times" at 6:00 a.m., but I'm blaming twist.

It's not that people don't want homes, it's that they can't buy them under the stricter lending standards. . . .In 1975, it was not unknown--it was in fact only made illegal that year by the Equal Credit Opportunity Act--to inquire about a married woman's future childbearing plans, her use of contraception, and her religion before deciding whether to "count" any income she might produce for purposes of qualifying for a loan. (If she said "Catholic," forget it.) If you think we are experiencing 1975 mortgage loan underwriting, you were born yesterday.

Lenders are turning the clock back to 1975, requiring larger downpayments and higher credit scores to qualify for low interest rates. That's only prudent, but what they're also doing is tightening appraisals on properties that are being sold or refinanced.

So why is it "prudent" to require larger downpayments and higher credit scores, but another thing entirely to tighten up on appraisals? And how is this nefarious appraisal tightening preventing people from buying homes?

*****************

There must be an anecdote, and we actually get a twofer:

Dallas Realtor Mary O'Keefe was hit with the new lending realities in a double whammy just this week.So the purchase transaction actually did close, although it was--gasp!--"delayed," but this poor lady who wanted to cash out the "equity" in a townhome she was not going to occupy was stymied by some evil bank who--get this--wouldn't use a year-old appraisal. Turn on the disco ball and haul out your lava lamps! It's the seventies!

"I had a closing that was delayed because the lender wanted a second appraisal," says Mary O'Keefe, a Dallas broker. "I told my clients absolutely no way would they pay for a second appraisal."

That deal finally closed, but O'Keefe lost another. A client wanted to take out some equity on her townhome, buy another property to live in, and save the townhome for mailbox money. The client had an 800-plus credit score, was approved by a lender, but went to her personal banker for the HELOC. She had an appraisal from the year before for $467,000 giving her about $155,000 in equity.

Because banks want to use appraisals no less than six months old, the personal banker called for a drive-by appraisal, which came in at $400,000, more than $20,000 below the lowest priced home in the community, and $75,000 below a home that sold a year ago three doors down.

I confess to being somewhat alarmed, by the way, about a Realtor who tells a buyer that "no way" are they going to pay for a second appraisal. You would not, in the current environment, even consider paying another $350-$400 to assure yourself that you are not overpaying for your property by thousands of dollars?

The real problem here is that Realty Times wants to continue to perpetrate the view that establishing reliable appraised values is not in a homebuyer's best interest as well as a lender's. For some reason this reminded me of a story we posted just a year ago, in which the Wall Street Journal waxed outraged about some poor rich doctor who was having trouble getting his loan approved to buy a property for $1.05 million when the lender had gotten a broker price opinion stating that it was only worth $750,000. I did a bit of looking in the county real estate records, and it appears that our man did indeed buy the home on April 17, 2007 for $1.05 million. On April 27, 2007, the county assessed the property for tax purposes at $793,400. Per the WSJ he borrowed $885,000. I wonder if he still feels ripped off by the lender who told him he was overpaying for that home.

Tuesday, May 27, 2008

Rent vs. Buy: NY Times Leonhardt Buys

by Calculated Risk on 5/27/2008 10:44:00 PM

From David Leonhardt at the NY Times: As Home Prices Drop Low Enough, a Committed Renter Decides to Buy

The case for renting has been simple enough. House prices rose so high in the first half of this decade that you could often get more for your money by renting. You could also avoid having a large part of your net worth tied up in a speculative bubble.Leonhardt isn't buying for appreciation, and he realizes the price will probably still decline further. He is buying because prices have fallen enough that the intangibles of homeownership (as he and his wife value them) outweigh the extra costs of owning a home compared to renting.

All this time, I have been a renter myself, ... [but] the housing market has, obviously, changed quite a bit since our last move, in 2005.

...

This month, we found a house that we really liked, and we made an offer. It was accepted.

I’m still not sure how good our timing was. Based on the backlog of houses on the market, I fully expect that our new house will be worth less in six months than it is today. ...

In fact, if you’re now renting — almost anywhere — and do not need to move, I’d probably recommend that you wait to buy. The market is still coming your way.

But it’s O.K. with me if our timing wasn’t perfect.

The article also has an interactive rent vs. buy tool with a number of options.

The Bagholder Battles: Investors vs. Banks

by Calculated Risk on 5/27/2008 08:25:00 PM

From Ruth Simon at the WSJ: Investors Press Lenders on Bad Loans

Unhappy buyers of subprime mortgages, home-equity loans and other real-estate loans are trying to force banks and mortgage companies to repurchase a growing pile of troubled loans. The pressure is the result of provisions in many loan sales that require lenders to take back loans that default unusually fast or contained mistakes or fraud.Tanta and I were discussing who the eventual bagholders would be way back in 2005 - while the bubble was still inflating - and although the picture is much clearer today, some bagholders still don't want to be, uh, bagholders! And who could blame them?

...

The potential liability from the growing number of disputed loans could reach billions of dollars ...

NPR on Mortgage Quality Control

by Tanta on 5/27/2008 04:49:00 PM

This is a sobering, if rather overstated, segment on mortgage loan sale due diligence and the pressures to accept even the most dubious of loans.

Tracy Warren is not surprised by the foreclosure crisis. She saw the roots of it firsthand every day. She worked for a quality control contractor that reviewed subprime loans for investment banks before they were sold off on Wall Street. . . .I have no particular reason to question Ms. Warren's abilities or her take on the situation; I have no doubt that for any number of reasons marginal loans were pushed back into pools over the objections of perfectly competent auditors. I have also had experience with staff whose supervisors stopped telling them when they had been overruled, because . . . life is too short. I suspect I am not the only one who has had this experience. Whatever the merits of this story may be, this I think is an overstatement:

Warren thinks her supervisors didn't want her to do her job. She says that when she would reject, or kick out, a loan, they usually would overrule her and approve it.

"The QC reviewer who reviewed our kicks would say, 'Well, I thought it had merit.' And it was like 'What?' Their credit score was below 580. And if it was an income verification, a lot of times they weren't making the income. And it was like, 'What kind of merit could you have determined?' And they were like, 'Oh, it's fine. Don't worry about it.' "

After a while, Warren says, her supervisors stopped telling her when she had been overruled.

"This is a smoking gun," says Christopher Peterson, a law professor at the University of Utah who has been studying the subprime mess and meeting with regulators. "It suggests that auditors working for Wall Street investment bankers knew how preposterous these loans were, and that could mean Wall Street liability for aiding and abetting fraud."Forgive me for being a shill for Wall Street, but this strikes me as silly. The investment banks, including Bear Stearns, published loan underwriting guidelines detailing what they would accept in mortgage pools, and everybody in the industry had a copy at the time. The things came right out and said that things like stated income for a wage earner were acceptable. Was Mr. Peterson calling that "preposterous" at the time? I was. And I never had to look at a single loan file.

What I suspect Ms. Warren is overlooking is, precisely, that the due diligence on those Bear Stearns pools--like every other pool for every other investor--was based on evaluating the individual loans' compliance with the specific guidelines agreed to for the pool. If the guidelines allowed utter stupidity, it isn't likely that the project supervisors would kick out a loan for displaying that particular kind of stupid. If there's something preposterous here, it was in plain sight in the prospectuses to every one of these loan deals. I am having a hard time with the idea that "the smoking gun" didn't show up until this week.

And then there is this part, which has made it all over the web today:

A bankruptcy examiner in the case of the collapsed subprime lender New Century recently released a 500-page report, and buried inside it is a pretty interesting detail. According to the report, some investment banks agreed to reject only 2.5 percent of the loans that New Century sent them to package up and sell to investors.Now, I actually plowed my way through that New Century report, and I have to say that there's a reason this claim was, um, "buried" therein. From page 135 of the report (Warning! Big Honkin' pdf that will take forever to download!):

If that's true, it would be like saying no matter how many bad apples are in the barrel, only a tiny fraction of them will be rejected.

"It's amazing if any investment bank agreed to a maximum number of loans they would kick back for defects. That means that they were willing to accept junk. There's no other way to put it," says Kurt Eggert, a law professor at Chapman University.

[K]ickout data may not be a true indication of loan quality trends because New Century was able, particularly when the subprime market was strong and housing prices were rising, to negotiate understandings with certain loan purchasers to limit kickouts to a maximum rate, such as 2.5%. Flanagan [NEW's former head of loan sales] was explicit in stating to the Examiner that such understandings were reached. The Examiner was unable to establish corroboration for this statement. Nevertheless, such understandings may have limited kickouts, masking loan quality problems that existed but were not reported.The report goes on to document that NEW's typical kickout rate was north of 5.00% and in many months much higher than that; except in securitization (not whole loan) deals where NEW retained residual credit risk, the kickout rate of 2.5% was, to quote the report, "probably more aspirational than real." The fact that no one could produce a contract or set of deal stips or e-mail or sticky note "corroborating" this claim suggests to me that it may have existed only in Mr. Flanagan's mind.

There are, of course, situations in the whole loan sale world in which people have perfectly respectable reasons to agree to limit "kickouts" up front. Occasionally pools are offered for bid with the stipulation of no kickouts: these are "as is" pools and it is expected that the price offered will reflect that. I have myself both offered and bid on no-exclusion loan pools. This is mostly an issue in the "scratch and dent" loan market, where one might have a mixed pool of pretty good and pretty botched up loans to sell. Allowing a buyer to "cherry pick" the deal just leaves you with all the botched up loans to sell separately, which is never anyone's preferred approach. Of course any buyer of loans can decline to bid on a no- or limited-kickout basis. Those who do bid on these deals tend to lower the bid price accordingly. The NEW report also documents the steady deterioration in NEW's profit margin on its whole-loan sales, and trying to get investors to take packages of loans with limited or no kickouts might explain some of that. My guess, from reading the report, is that while NEW might have thought it wanted a 2.5% kickout rate, it ended up accepting a much higher one because the price discount was more than it could face.

I am not trying to suggest that anyone is particularly innocent here. This all just has a sort of Captain Renault quality to it: we are shocked, shocked! that gambling went on in these casinos. The published underwriting guidelines that were available to everyone involved made explicit what was going on with these loans, and those guidelines were published with the deal prospectuses. Now we have a bunch of investors--including institutional ones with absolutely no excuse--wanting to grab hold of stories like Ms. Warren's about cruddy individual loans, as if the pool guidelines weren't themselves a big flaming hint that the loans were absurd.

New Home Sales: No Spring in 2008

by Calculated Risk on 5/27/2008 03:59:00 PM

There was no spring this year. Click on graph for larger image.

Click on graph for larger image.

This graph shows the Not Seasonally Adjusted (NSA) new home sales for the last 45 years.

Usually sales increase in the spring - but not this year. The pervious worst spring on record was 1982 - in the midst of a severe recession, with 30 year fixed mortgage rates at 17%, and close to double digit unemployment.

In 1982, sales picked up late in the year as interest rates declined sharply (30 year fixed rates fell from 17% to about 13% at the end of the year). The second graph shows monthly new home sales NSA for the last few years (repeated from this morning).

The second graph shows monthly new home sales NSA for the last few years (repeated from this morning).

The Red columns are for 2008. This is the lowest sales for April since the recession of '91.

Once again, the 2008 spring selling season has never really started.

Case-Shiller: Real Prices off 21% from Peak

by Calculated Risk on 5/27/2008 12:34:00 PM

Here are three key graphs ...

The first graph compares real and nominal Case-Shiller Home Prices (real is current index adjusted using CPI less Shelter). Click on graph for larger image.

Click on graph for larger image.

In real terms, the Case-Shiller National Home price index is off 21% from the peak. Real prices are now back to the Q3 2003 level (nominal prices are back to Q3 2004).

With existing home inventory at record levels, prices will probably continue to decline over the next few years - perhaps another 20% in real terms on a national basis.

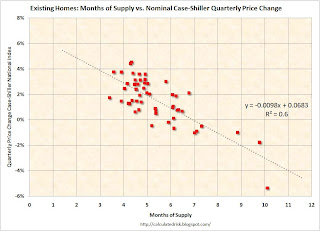

Here is an update to the scatter graph comparing existing homes Months of Supply and the quarterly change in the Case-Shiller National index (hat tip Langley Financial Planning blog for the idea):

Note: this graphs uses data since Q1 1994. In prior periods, Months of Supply appeared to be higher with less negative impact on prices, see 2nd graph of Existing Homes: Months of Supply vs. Real Prices This graph compares the Months of Supply and the quarterly change in the nominal Case-Shiller National Home Price index. The best linear fit has been added to the graph (plus the formula with an R2 of 0.665).

This graph compares the Months of Supply and the quarterly change in the nominal Case-Shiller National Home Price index. The best linear fit has been added to the graph (plus the formula with an R2 of 0.665).

This is a limited amount of data (since Q1 1994), but this does suggest a relationship between price changes and Months of Supply (something we would normally expect). This suggests when there are more than 7 months of supply, nominal prices will decline (with some variability).

In April, the existing homes Months of Supply hit 11.2 months, and will probably be over 12 months this summer. This suggests nominal price declines of around 5% in Q2. The third graph shows the price changes for several selected cities. Prices are falling faster in the 'bubble' cities, like San Diego, Miami, and Las Vegas.

The third graph shows the price changes for several selected cities. Prices are falling faster in the 'bubble' cities, like San Diego, Miami, and Las Vegas.

Year over year prices are also falling in areas that saw less price appreciation, like Denver and Cleveland. It's important to note that different areas - even different parts of the same city - are seeing different price changes. See: House Price Mosaic for some analysis.

Eighteen of the twenty cities in the Case-Shiller composite saw declining prices in February (prices in Dallas were up 1% and Charlotte prices were flat), led by a 4.5% one month decline in Miami, 4.4% in Las Vegas, and over 3% in Los Angeles, San Francisco, Phoenix and Tampa.

Military Foreclosures

by Tanta on 5/27/2008 11:09:00 AM

Bloomberg reports:

Foreclosure filings in 10 towns and cities within 10 miles of military facilities, including Norfolk, Virginia, home of the Navy's largest base, rose by an average 217 percent from January through April from a year earlier. Nationally, the rate was 59 percent in the same period, according to RealtyTrac, which tallies bank seizures, auctions and default notices.Military families were of course favored targets of the subprime industry.

The biggest surge was in Columbia, South Carolina, home to Fort Jackson, where the Army trains recruits for combat in Afghanistan and Iraq. Properties in some stage of foreclosure rose 492 percent from a year earlier, RealtyTrac said. The second-biggest increase was 414 percent in Woodbridge, Virginia, next to the Marine Corps Base Quantico.

Foreclosure filings tripled in the cities surrounding Norfolk Naval Base and the Camp Pendleton Marine Corps Base near Oceanside, California, RealtyTrac said. Havelock, North Carolina, site of Marine Corps Air Station Cherry Point, saw foreclosures more than double.

April New Home Sales

by Calculated Risk on 5/27/2008 10:00:00 AM

According to the Census Bureau report, New Home Sales in April were at a seasonally adjusted annual rate of 526 thousand. Sales for March were revised down to 509 thousand.  Click on graph for larger image.

Click on graph for larger image.

Sales of new one-family houses in April 2008 were at a seasonally adjusted annual rate of 526,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 3.3 percent above the revised March rate of 509,000, but is 42.0 percent below the April 2007 estimate of 907,000.This graph shows New Home Sales vs. recessions for the last 45 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001.

New home sales in April were the lowest April since 1991. This is what we call Cliff Diving!

The second graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

The second graph shows monthly new home sales (NSA - Not Seasonally Adjusted).Notice the Red columns for 2008. This is the lowest sales for April since the recession of '91.

As the graph indicates, the spring selling season has never really started.

And one more long term graph - this one for New Home Months of Supply.

"Months of supply" is at 10.6 months; the highest level since 1981. Note that this doesn't include cancellations, but that was true for the earlier periods too.

"Months of supply" is at 10.6 months; the highest level since 1981. Note that this doesn't include cancellations, but that was true for the earlier periods too.The all time high for Months of Supply was 11.6 months in April 1980.

Once again, the current recession is "probable" and hasn't been declared by NBER.

And on inventory:

The seasonally adjusted estimate of new houses for sale at the end of April was 456,000. This represents a supply of 10.6 months at the current sales rate.Inventory numbers from the Census Bureau do not include cancellations - and cancellations are near record levels. Actual New Home inventories are probably much higher than reported - my estimate is just under 100K higher.

Still, the 456,000 units of inventory is below the levels of the last year, and it appears that even including cancellations, inventory is now falling.

This is another very weak report for New Home sales.

S&P Case-Shiller National Index off 6.7% in Q1

by Calculated Risk on 5/27/2008 09:05:00 AM

S&P Case-Shiller reported that house prices fell sharply in Q1 2008. Click on graph for larger image.

Click on graph for larger image.

The first graph shows the Case-Shiller index since 1987. The index fell to 159.18 in Q1 2008, from 170.62 in Q4. A decline of 6.7%, or almost 30% at an annual rate.

This is the lowest level for the index since Q3 2004.  The second graph shows the year-over-year change in the Case-Shiller index.

The second graph shows the year-over-year change in the Case-Shiller index.

Prices fell 14.1% over the last four quarters according to Case-Shiller.

The index is off 16.2% from the peak.

Monday, May 26, 2008

HELOCs and Auto Sales

by Calculated Risk on 5/26/2008 09:57:00 PM

From Eric Dash at the NY Times: As Credit Tightens, the Auto Industry Feels the Pain

Home equity loans, which had been used in at least one of every nine deals, when lenders were more generous, are no longer a source of easy money for many prospective buyers.According to the NY Times graphic "Mortgaging the House to Buy a Car" (see article), about 1.9 million new cars were purchased using HELOCs in 2007, or 11.8% of the 16.2 million total new cars sold in 2007.

...

As home values have declined, millions of consumers have maxed out on home equity debt. In hot markets like California, nearly 30 percent of all consumers tapped into the value of their homes to help finance their new cars, according to CNW Marketing Research. In Florida, about 20 percent used home equity loans. New car sales in both states are down about 7 percent.

Although HELOCs were used for a variety of household expenditures, probably the two most common uses were for new cars and home improvements. It's not surprising that these two areas are being severely impacted as lenders sharply restrict HELOC borrowing.

Scatter Graphs: Months of Supply vs. House Prices

by Calculated Risk on 5/26/2008 05:12:00 PM

The following two scatter plots compare existing home Months of Supply vs. the quarterly change (both nominal and real) in the Case-Shiller National Home Price index. (hat tip Langley Financial Planning blog for the idea)

Note: these graphs use data since Q1 1994. In prior periods, Months of Supply appeared to be higher with less negative impact on prices, see 2nd graph of Existing Homes: Months of Supply vs. Real Prices Click on graph for larger image.

Click on graph for larger image.

The first graph compares the Months of Supply and the quarterly change in the nominal Case-Shiller National Home Price index. The best linear fit has been added to the graph (plus the formula with an R2 of 0.6).

This is a limited amount of data (since Q1 1994), but this does suggest a relationship between price changes and Months of Supply (something we would normally expect). This suggests when there are more than 7 months of supply, nominal prices will decline (with some variability).

The average Months of Supply in Q1 2008 was just over 9.9 months, suggesting a nominal price decline of about 3.1% for Q1 (+/-2% or so). The Case-Shiller price index will be released on Tuesday. The second graph compares the Months of Supply and the quarterly change in the real (adjusted for inflation using CPI less shelter) Case-Shiller National Home Price index. The linear best fit is also added, and R2 is 0.54.

The second graph compares the Months of Supply and the quarterly change in the real (adjusted for inflation using CPI less shelter) Case-Shiller National Home Price index. The linear best fit is also added, and R2 is 0.54.

In real terms, prices start to decline when Months of Supply are greater than 6.3 months. This suggests the Case-Shiller index will decline about 3.4% in real terms in Q1 2008.

In April, the existing homes Months of Supply hit 11.2 months, and will probably be over 12 months this summer. This suggests nominal price declines of over 5% in Q2.

UBS: More Mortgage Losses Possible

by Calculated Risk on 5/26/2008 03:24:00 PM

From Bloomberg: UBS Falls After Saying More Mortgage Losses Possible

UBS, in the prospectus for its 16 billion-franc rights offer, said the bank's losses on non-U.S. residential and commercial real-estate securities ``could increase in the future.''The confessional is still open.

...

``UBS will have to fight against negative news flow for at least several more quarters,'' said Rolf Biland, who helps manage about $3.1 billion, including UBS shares, as chief investment officer at VZ Vermoegenszentrum in Zurich. ``The U.K. housing market is almost as overheated as in the U.S., and could lead to losses for banks.''

U.K. home values fell for an eighth month in May ...

The Oil Speculation Debate

by Calculated Risk on 5/26/2008 12:39:00 PM

Real Time Economics at the WSJ has a nice summary today: Oil Bubble? The Debate Rages

For reference, here is Justin Lahart's article today: Commodity Prices Soar, But Are They in a Bubble?, and Professor Hamilton has a new research paper on the subject that covers all the key issues: Understanding crude oil prices

First, what is a bubble? Back when I was arguing there was a bubble in housing, I wrote: Housing: Speculation is the Key

A bubble requires both overvaluation based on fundamentals and speculation. It is natural to focus on an asset’s fundamental value, but the real key for detecting a bubble is speculation ...From Real Time Economics:

It is far from clear that the first part of the bubble definition — prices in excess of their fundamental value — is in place. But the second part — that people are buying in anticipation of selling at a higher price — certainly is.I'm not so sure. Speculation requires storage - something that was obvious in the housing bubble, but isn't so obvious for oil.

From Real Time Economics:

Harvard’s Jeffrey Frankel, has argued for the idea that speculation is behind the run-up in price. He says that such behavior is due to the sharp reduction in interest rates by the U.S. Federal Reserve. Low rates encourage commodity stockpiling, he says, by making it less attractive to sell commodities and put the proceeds into bonds and other debt instruments.Frankel's argument is similar to the one I suggested here (based on research from Professor Krugman!): Petroleum Prices and GCC Spending.

Critics of Mr. Frankel’s theory, including Paul Krugman, say the expected rise in commodity inventories hasn’t shown up.

Mr. Frankel has acknowledged that, but also notes that perhaps oil producers are leaving those inventories in the ground.

[T]here is a possibility that what has looked like peak oil to some observers (something I believe is coming), was actually GCC countries investing by not extracting oil. If oil prices start to fall, and with rising expenditures, the GCC countries might increase production - causing prices to fall further.So is oil a bubble? Is there evidence of speculation and storage? Some people have cited recent comments by Saudi Arabia's King Abdullah as evidence of storage, from Reuters: Saudi King says keeping some oil finds for future

"I keep no secret from you that when there were some new finds, I told them, 'no, leave it in the ground, with grace from god, our children need it'."I'm skeptical of this comment (and similar comments from Saudi officials over the years), because I think it is intended for domestic purposes.

The alternative to speculation is that oil prices being driven by the fundamentals of supply and demand - with strong growth in global demand, even as demand weakens in the U.S. - and suppliers are struggling to keep up.

On supply, from the WSJ: Energy Watchdog Warns Of Oil-Production Crunch

The Paris-based International Energy Agency is in the middle of its first attempt to comprehensively assess the condition of the world's top 400 oil fields. Its findings won't be released until November, but the bottom line is already clear: Future crude supplies could be far tighter than previously thought.Oil prices aren't an obvious bubble like housing or tech stocks. It seems the key question is: Are the oil exporting countries producing as much as possible - or are they investing by cutting oil extraction (and leaving the oil in the ground)? The lack of transparency for the GCC countries, and several other oil producing countries, makes it unclear.

...

For several years, the IEA has predicted that supplies of crude and other liquid fuels will arc gently upward to keep pace with rising demand, topping 116 million barrels a day by 2030, up from around 87 million barrels a day currently. Now, the agency is worried that aging oil fields and diminished investment mean that companies could struggle to surpass 100 million barrels a day over the next two decades.

The decision to rigorously survey supply -- instead of just demand, as in the past -- reflects an increasing fear within the agency and elsewhere that oil-producing regions aren't on track to meet future needs.

Financial Times Interview With Professor Roubini

by Calculated Risk on 5/26/2008 11:12:00 AM

Here is part one of a Financial Times interview with Professor Nouriel Roubini (5 min 42 sec):

For parts 2 & 3, see the Financial Times video site.

Sunday, May 25, 2008

Housing: Why was Kudlow so wrong?

by Calculated Risk on 5/25/2008 05:35:00 PM

Note: It is not my intention to embarrass Mr. Kudlow, rather to simply show why his analysis was wrong (typical of many back in 2005) - and why the "housing bears" were correct.

Back in June 2005, Larry Kudlow wrote: The Housing Bears Are Wrong Again

"If [the housing bears] had put a little elbow grease into their analysis, they would have learned that new-housing starts for private homes and apartments haven’t changed much during the past three and a half decades.*******************

Although year-to-date housing starts have kicked up to 2 million, average new construction since the early 1970s has hovered around 1.5 million to 1.75 million new starts per year. During the same period, the number of American households has increased by 48 million, or 75 percent, according to the U.S. Census Bureau. It is plain to see that the family demand for homes has far outstripped the supply of newly built residences. So it should not be shocking that home prices have tended to rise on a steady basis, averaging 6.5 percent price gains over the last 35 years."

Click on graph for larger image.

Click on graph for larger image.This graph shows housing starts from 1970 to the present. Kudlow's claim that housing starts "haven’t changed much" and "hovered around 1.5 million to 1.75 million per year" was not quite accurate. Housing starts did average 1.59 million per year from 1970 through 2005, but there was a wide variation in starts.

Then Kudlow goes on to state:

"During the same period, the number of American households has increased by 48 million, or 75 percent, according to the U.S. Census Bureau. It is plain to see that the family demand for homes has far outstripped the supply of newly built residences."According to the Census Bureau's Housing and Homeownership data, the number of occupied housing units increased from 63.6 million in 1970 to 108.2 million in 2005, or about 44.6 million.

Looking at the same Census data, we can see that total housing units increased from 69.8 million in 1970, to 123.9 million in 2005, or about 54.1 million during that same period. We can obtain a similar number by adding the total starts from 1970 through 2005, about 57 million starts.

Some of these housing units are second homes, but why is it "plain to see" that demand for homes had "outstripped" supply? There were significantly more housing units built (57 million starts) during this period than new households formed (44.6 million) in the U.S.!

Perhaps Kudlow, when looking at those peaks of housing starts in the '70s and early '80s, was fooled into thinking that the recent peak in activity wasn't extraordinary, especially since the U.S. population is growing. This was an inaccurate view.

The second graph shows the trend of people per household (and people per total housing units) in the United States since 1950. Before the period shown on this graph there was a long steady down trend in the number of people per household.

The second graph shows the trend of people per household (and people per total housing units) in the United States since 1950. Before the period shown on this graph there was a long steady down trend in the number of people per household.Note: the dashed lines indicates estimates based on the decennial Census for 1950 and 1960.

Starting in the late '60s there was a rapid decrease in the number of persons per household until about the late '80. This was primarily due to the "baby boom" generation forming new households en masse.

It was during this period - of rapid decline in persons per household - that the peaks in housing starts occurred. Many of those starts, especially in the '70s, were for apartments. Even if there had been no increase in the U.S. population, the U.S. would have needed approximately 27% more housing units at the end of this period just to accommodate the change in demographics (persons per household).

Now look at the period since 1988, the persons per household has remained flat. The increase in 2002 was due to revisions, and isn't an actual shift in demographics.

Here is a simple formula for housing starts (assuming no excess inventory):

Housing Starts = f(population growth) + f(change in household size) + demolitions.

f(change in household size) was an important component of housing demand in the '70s and early '80s. In recent years, f(change in household size) = zero.

So, unless Kudlow is arguing for a significant further reduction in housing size, he shouldn't have been comparing starts in recent years to starts in the '70s and '80s.

And finally, Kudlow should have been looking at the rampant speculation in 2005, both with flippers and homebuyers using excessive leverage. That is what defines a bubble, and that is what I focused on in April 2005: Housing: Speculation is the Key.

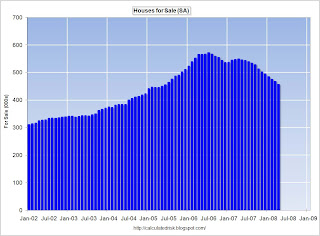

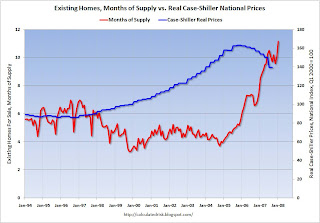

Existing Homes: Months of Supply vs. Real Prices

by Calculated Risk on 5/25/2008 11:41:00 AM

Here is a graph of existing home Months of Supply vs. quarterly Real Case-Shiller National house prices since Jan 1994. Click on graph for larger image.

Click on graph for larger image.

A couple of notes: The Case-Shiller data is the National Index adjusted for inflation using CPI less shelter. The graph is monthly, but the Case-Shiller national data is quarterly (so the price data is stair-stepped). I only have monthly inventory and sales data back to Oct '93. Also, I'm missing some 2000 inventory data, and I extrapolated for a few months in 2000.

From this graph, it appears real prices are flat with about 6 months of inventory - prices rising with less than 6 months - and prices falling with more than 6 months. So perhaps we could argue house prices will fall until Months of Supply declines to close to 6 months.

However this relationship between price and Months of Supply doesn't seem to fit with earlier data. I have year end inventory and sales data back to 1982, and the following graph shows year end months of supply since 1982 (and April 2008). Year end inventory data is usually the low point for the year (as homeowners take their houses off the market for the holidays). So the months of supply was probably higher during the spring and summer selling months.

Year end inventory data is usually the low point for the year (as homeowners take their houses off the market for the holidays). So the months of supply was probably higher during the spring and summer selling months.

From Q1 1987 through Q3 1989, real national prices rose almost 10% according to the Case-Shiller National Index, even though year end Months of Supply was close to 7 months (and likely higher during the summer).

So maybe prices will flatten out when Months of Supply declines to 8 months or so.

With inventory levels approaching 12 months (11.2 months in the most recent report), prices will probably continue to fall for some time.