by Calculated Risk on 5/26/2008 12:39:00 PM

Monday, May 26, 2008

The Oil Speculation Debate

Real Time Economics at the WSJ has a nice summary today: Oil Bubble? The Debate Rages

For reference, here is Justin Lahart's article today: Commodity Prices Soar, But Are They in a Bubble?, and Professor Hamilton has a new research paper on the subject that covers all the key issues: Understanding crude oil prices

First, what is a bubble? Back when I was arguing there was a bubble in housing, I wrote: Housing: Speculation is the Key

A bubble requires both overvaluation based on fundamentals and speculation. It is natural to focus on an asset’s fundamental value, but the real key for detecting a bubble is speculation ...From Real Time Economics:

It is far from clear that the first part of the bubble definition — prices in excess of their fundamental value — is in place. But the second part — that people are buying in anticipation of selling at a higher price — certainly is.I'm not so sure. Speculation requires storage - something that was obvious in the housing bubble, but isn't so obvious for oil.

From Real Time Economics:

Harvard’s Jeffrey Frankel, has argued for the idea that speculation is behind the run-up in price. He says that such behavior is due to the sharp reduction in interest rates by the U.S. Federal Reserve. Low rates encourage commodity stockpiling, he says, by making it less attractive to sell commodities and put the proceeds into bonds and other debt instruments.Frankel's argument is similar to the one I suggested here (based on research from Professor Krugman!): Petroleum Prices and GCC Spending.

Critics of Mr. Frankel’s theory, including Paul Krugman, say the expected rise in commodity inventories hasn’t shown up.

Mr. Frankel has acknowledged that, but also notes that perhaps oil producers are leaving those inventories in the ground.

[T]here is a possibility that what has looked like peak oil to some observers (something I believe is coming), was actually GCC countries investing by not extracting oil. If oil prices start to fall, and with rising expenditures, the GCC countries might increase production - causing prices to fall further.So is oil a bubble? Is there evidence of speculation and storage? Some people have cited recent comments by Saudi Arabia's King Abdullah as evidence of storage, from Reuters: Saudi King says keeping some oil finds for future

"I keep no secret from you that when there were some new finds, I told them, 'no, leave it in the ground, with grace from god, our children need it'."I'm skeptical of this comment (and similar comments from Saudi officials over the years), because I think it is intended for domestic purposes.

The alternative to speculation is that oil prices being driven by the fundamentals of supply and demand - with strong growth in global demand, even as demand weakens in the U.S. - and suppliers are struggling to keep up.

On supply, from the WSJ: Energy Watchdog Warns Of Oil-Production Crunch

The Paris-based International Energy Agency is in the middle of its first attempt to comprehensively assess the condition of the world's top 400 oil fields. Its findings won't be released until November, but the bottom line is already clear: Future crude supplies could be far tighter than previously thought.Oil prices aren't an obvious bubble like housing or tech stocks. It seems the key question is: Are the oil exporting countries producing as much as possible - or are they investing by cutting oil extraction (and leaving the oil in the ground)? The lack of transparency for the GCC countries, and several other oil producing countries, makes it unclear.

...

For several years, the IEA has predicted that supplies of crude and other liquid fuels will arc gently upward to keep pace with rising demand, topping 116 million barrels a day by 2030, up from around 87 million barrels a day currently. Now, the agency is worried that aging oil fields and diminished investment mean that companies could struggle to surpass 100 million barrels a day over the next two decades.

The decision to rigorously survey supply -- instead of just demand, as in the past -- reflects an increasing fear within the agency and elsewhere that oil-producing regions aren't on track to meet future needs.

Financial Times Interview With Professor Roubini

by Calculated Risk on 5/26/2008 11:12:00 AM

Here is part one of a Financial Times interview with Professor Nouriel Roubini (5 min 42 sec):

For parts 2 & 3, see the Financial Times video site.

Sunday, May 25, 2008

Housing: Why was Kudlow so wrong?

by Calculated Risk on 5/25/2008 05:35:00 PM

Note: It is not my intention to embarrass Mr. Kudlow, rather to simply show why his analysis was wrong (typical of many back in 2005) - and why the "housing bears" were correct.

Back in June 2005, Larry Kudlow wrote: The Housing Bears Are Wrong Again

"If [the housing bears] had put a little elbow grease into their analysis, they would have learned that new-housing starts for private homes and apartments haven’t changed much during the past three and a half decades.*******************

Although year-to-date housing starts have kicked up to 2 million, average new construction since the early 1970s has hovered around 1.5 million to 1.75 million new starts per year. During the same period, the number of American households has increased by 48 million, or 75 percent, according to the U.S. Census Bureau. It is plain to see that the family demand for homes has far outstripped the supply of newly built residences. So it should not be shocking that home prices have tended to rise on a steady basis, averaging 6.5 percent price gains over the last 35 years."

Click on graph for larger image.

Click on graph for larger image.This graph shows housing starts from 1970 to the present. Kudlow's claim that housing starts "haven’t changed much" and "hovered around 1.5 million to 1.75 million per year" was not quite accurate. Housing starts did average 1.59 million per year from 1970 through 2005, but there was a wide variation in starts.

Then Kudlow goes on to state:

"During the same period, the number of American households has increased by 48 million, or 75 percent, according to the U.S. Census Bureau. It is plain to see that the family demand for homes has far outstripped the supply of newly built residences."According to the Census Bureau's Housing and Homeownership data, the number of occupied housing units increased from 63.6 million in 1970 to 108.2 million in 2005, or about 44.6 million.

Looking at the same Census data, we can see that total housing units increased from 69.8 million in 1970, to 123.9 million in 2005, or about 54.1 million during that same period. We can obtain a similar number by adding the total starts from 1970 through 2005, about 57 million starts.

Some of these housing units are second homes, but why is it "plain to see" that demand for homes had "outstripped" supply? There were significantly more housing units built (57 million starts) during this period than new households formed (44.6 million) in the U.S.!

Perhaps Kudlow, when looking at those peaks of housing starts in the '70s and early '80s, was fooled into thinking that the recent peak in activity wasn't extraordinary, especially since the U.S. population is growing. This was an inaccurate view.

The second graph shows the trend of people per household (and people per total housing units) in the United States since 1950. Before the period shown on this graph there was a long steady down trend in the number of people per household.

The second graph shows the trend of people per household (and people per total housing units) in the United States since 1950. Before the period shown on this graph there was a long steady down trend in the number of people per household.Note: the dashed lines indicates estimates based on the decennial Census for 1950 and 1960.

Starting in the late '60s there was a rapid decrease in the number of persons per household until about the late '80. This was primarily due to the "baby boom" generation forming new households en masse.

It was during this period - of rapid decline in persons per household - that the peaks in housing starts occurred. Many of those starts, especially in the '70s, were for apartments. Even if there had been no increase in the U.S. population, the U.S. would have needed approximately 27% more housing units at the end of this period just to accommodate the change in demographics (persons per household).

Now look at the period since 1988, the persons per household has remained flat. The increase in 2002 was due to revisions, and isn't an actual shift in demographics.

Here is a simple formula for housing starts (assuming no excess inventory):

Housing Starts = f(population growth) + f(change in household size) + demolitions.

f(change in household size) was an important component of housing demand in the '70s and early '80s. In recent years, f(change in household size) = zero.

So, unless Kudlow is arguing for a significant further reduction in housing size, he shouldn't have been comparing starts in recent years to starts in the '70s and '80s.

And finally, Kudlow should have been looking at the rampant speculation in 2005, both with flippers and homebuyers using excessive leverage. That is what defines a bubble, and that is what I focused on in April 2005: Housing: Speculation is the Key.

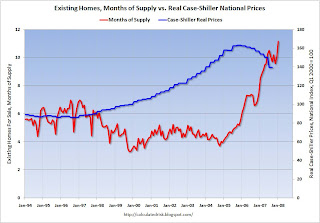

Existing Homes: Months of Supply vs. Real Prices

by Calculated Risk on 5/25/2008 11:41:00 AM

Here is a graph of existing home Months of Supply vs. quarterly Real Case-Shiller National house prices since Jan 1994. Click on graph for larger image.

Click on graph for larger image.

A couple of notes: The Case-Shiller data is the National Index adjusted for inflation using CPI less shelter. The graph is monthly, but the Case-Shiller national data is quarterly (so the price data is stair-stepped). I only have monthly inventory and sales data back to Oct '93. Also, I'm missing some 2000 inventory data, and I extrapolated for a few months in 2000.

From this graph, it appears real prices are flat with about 6 months of inventory - prices rising with less than 6 months - and prices falling with more than 6 months. So perhaps we could argue house prices will fall until Months of Supply declines to close to 6 months.

However this relationship between price and Months of Supply doesn't seem to fit with earlier data. I have year end inventory and sales data back to 1982, and the following graph shows year end months of supply since 1982 (and April 2008). Year end inventory data is usually the low point for the year (as homeowners take their houses off the market for the holidays). So the months of supply was probably higher during the spring and summer selling months.

Year end inventory data is usually the low point for the year (as homeowners take their houses off the market for the holidays). So the months of supply was probably higher during the spring and summer selling months.

From Q1 1987 through Q3 1989, real national prices rose almost 10% according to the Case-Shiller National Index, even though year end Months of Supply was close to 7 months (and likely higher during the summer).

So maybe prices will flatten out when Months of Supply declines to 8 months or so.

With inventory levels approaching 12 months (11.2 months in the most recent report), prices will probably continue to fall for some time.

Saturday, May 24, 2008

U.S. Vehicle Miles vs. Real Gasoline Price

by Calculated Risk on 5/24/2008 10:31:00 PM

Yesterday the Department of Transportation reported that Americans drove 11 billion fewer miles in March '08 than in March '07. I presented a graph of the moving 12 month total miles driven here.

The following graph compares the year-over-year change in the moving 12 month total vs. the real price of gasoline (source for real prices: EIA). Note: graph uses annual data for real prices prior to 1980. Click on graph for larger image.

Click on graph for larger image.

This is only the third time since 1970 that the YoY change in total U.S. miles driven has declined. The previous two times were following the oil shocks of 1973 and 1979 - and led to the two most severe U.S. recessions since WWII.

Note that the most recent data from the DOT is for March. According to the EIA, gasoline prices have risen 13% since then! So I'd expect U.S. miles driven to have declined further in April and May.

Buffett: "longer, deeper" U.S. recession than most expect

by Calculated Risk on 5/24/2008 04:11:00 PM

From Spiegel Online: Investor-Legende Buffett attackiert gierige Banker (attacks greedy bankers)

Die Rezession werde "tiefer gehen und länger dauern, als viele denken".The recession will be deeper and last longer than most people think.

And on the bankers:

"Sie brauten ein Giftgetränk und mussten es am Ende selbst trinken", sagte Buffett. "So etwas machen die Banker normalerweise ungern, sie verkaufen es lieber an andere", fügte er sarkastisch hinzu.Loosely translated: The bankers brewed a poisoned drink, and then had to drink it themselves. Usually they prefer to sell the poison to others (said sarcastically).

Meanwhile, on Friday, Goldman Sachs forecast a "double dip" recession, with a mild pick up in the economy mid-year from the stimulus checks, followed by another slump in the economy later this year.

Update: changed headline to more accurate reflect Buffet's comments.

UPDATED: A Congressional Speculator?

by Tanta on 5/24/2008 06:37:00 AM

This is an update to post below on Rep. Laura Richardson's foreclosure woes.

Gene Maddaus of the Daily Breeze kindly forwarded today's additions to the saga. There are not two, but three homes owned by Richardson in foreclosure. And yes, she appears to have cashed out her primary residence back in 2006 to fund her campaign for State Assembly. So it looks like a pattern.

* * * * * *

I have been watching the story of Representative Linda Laura [Oops! --Ed.] Richardson and her foreclosure woes for a while now, while heretofore hesitating to post on it. For one thing, the original story--a member of Congress losing her expensive second home to foreclosure--had that kind of celebrity car-crash quality to it that I'm not especially interested in for the purposes of this blog. For another thing, posting about anything even tangentially related to politics invites the kind of comments that personally bore me to tears.

All that is still true, but the story has taken such an unfortunate turn that I feel obligated to weigh in on it. Specifically, Rep. Richardson is threatening us:

Rather than shy away from voting on mortgage-related bills, Richardson said her experiences could help her craft legislation to make sure others don't experience what she did. For example, she sees a need to add steps to inform property owners before their property can be sold.If Rep. Richardson is going to base legislative proposals on her own experience, then it matters to the rest of us what that experience was. So click the link below if you can stand to hear about it.

"We have to ensure that lenders and lendees have the tools with proper timing to resolve this," she said.

* * * * * * * * * *

The story was originally reported in the Sacramento Capitol Weekly, and picked up by the Wall Street Journal, and thence covered by a number of blogs, with the storyline being that Rep. Richardson "walked away" from her home, a second home she purchased in Sacramento after being elected to the State Assembly. The "walk away" part came from a remark made by the real estate investor who purchased the home at the foreclosure auction, not Rep. Richardson or anyone who could be expected to understand her financial situation, but that didn't stop the phrase "walk away" from headlining blog posts.

Rep. Richardson has variously claimed at different times that the house was not in foreclosure, that she had worked out a modification with the lender, and that the lender improperly foreclosed after having agreed to accept her payments. Frankly, unless and until Rep. Richardson gives her lender, Washington Mutual, permission to tell its side of the story--I'm not holding my breath on that--we're unlikely to be able to sort out this mess of claims to my satisfaction, at least. It's possible that WaMu screwed this up--that it accepted payments on a workout plan with the understanding that foreclosure was "on hold" and then sold the property at auction the next week anyway. It's possible that Richardson's version of what went on is muddled, too. Without some more hard information I'm not inclined to assume the servicer did most of the screwing up, if for no other reason that we didn't find out until late yesterday, courtesy of the L.A. Land and Foreclosure Truth blogs, that Richardson's other home--her primary residence--was also in foreclosure proceedings as recently as March of this year, a detail that as far as I can tell Richardson never disclosed in all the previous discussion of the facts surrounding the foreclosure of her second home.

What part of this I am most interested in, right now, is the question of what in the hell exactly Richardson was thinking when she bought the Sacramento home in the first place. Since the story is quite complex, let's get straight on a few details. Richardson was a Long Beach City Council member who was elected to the state legislature in November of 2006. In January of 2007 she purchased a second home in Sacramento, presumably to live in during the Assembly session. In April 2007, the U.S. Congressional Representative from Richardson's district died, and Richardson entered an expensive race for that seat, winning in a special election in August of 2007. By December 2007 the Sacramento home was in default, and it was foreclosed in early May of 2008. The consensus in the published reports seems to be that Richardson spent what money she had on her campaign, not her bills. According to the AP:

Richardson, 46, makes nearly $170,000 as a member of Congress and was paid $113,000 during the eight months she served in the state Assembly in 2007 before her election to Congress. She also received a per diem total of $20,000 from California, according to a financial disclosure form she filed with the House of Representatives clerk.It seems to me that all this focus on what happened after she bought the Sacramento home--running for the suddenly-available Congressional seat, changing jobs, etc.--is obscuring the issue of the original transaction.

In November of 2006, Richardson already owned a home in Long Beach. As a newly-elected state representative, she would have been required to maintain her principal residence in her district, but she would also have had to make some arrangements for staying in Sacramento during Assembly sessions, given the length of the commute from L.A. County to the state capitol. She seems to have told the AP reporter that "Lawmakers are required to maintain two residences while other people don't have to," which is not exactly the way I'd have put it. Lawmakers are required to maintain one primary residence (which need not be owned) in their district. They are not required to buy a home at the capitol (of California or the U.S.); many legislators do rent. Richardson is a single woman with no children, yet she felt "required" to purchase a 3-bedroom, 1 1/2 bathroom home in what sounds like one of Sacramento's pricier neighborhoods for $535,500, with no downpayment and with $15,000 in closing cost contributions from the property seller. (The NAR median price in Sacramento in the first quarter of 2007 was $365,300.)

I have no idea what loan terms Richardson got for a 100% LTV second home purchase in January 2007, but I'm going to guess that if she got something like a 7.00% interest only loan (without additional mortgage insurance), she got a pretty darn good deal. If she got that good a deal, her monthly interest payment would have been $3123.75. Assuming taxes and insurance of 1.50% of the property value, her total payment would have been $3793.13.

The AP reports that Richardson's salary as a state representative was $113,000 in 2007, and she received $20,000 in per diem payments (which are, of course, intended to offset the additional expense of traveling to and staying in the Capitol during sessions). I assume the per diem is non-taxable, so I'll gross it up to $25,000. That gives me an annual income of $138,000 or a gross monthly income of $11,500.

The total payment on the second home, then, with my sunny assumptions about loan terms, comes to 33% of Richardson's gross income. I have no idea what the payment is for her principal residence in Long Beach. I have no idea what other debt she might have. I am ignoring her congressional race and job changes and all that because at the point she took out this mortgage, that was all in the future and Richardson didn't know that the incumbent would die suddenly and all that. I'm just trying to figure out what went through this woman's mind when she decided it was a wise financial move to spend one-third of her pre-tax income on a second home. (There's no point trying to figure out what went through the lender's mind at the time. There just isn't.)

Now, Richardson has this to say about herself:

"I'm Laura Richardson. I'm an American, I'm a single woman who had four employment changes in less than four months," Richardson told the AP. "I had to figure out just like every other American how I could restructure the obligations that I had with the income I had."Yeah, well, I'm Tanta, I'm an American, I'm a single woman, and I say you're full of it. You need to show us what your plan for affording this home was before the job changes, girlfriend. You might also tell me why you felt you needed such an expensive second home when you had no money to put down on it or even to pay your own closing costs. As it happens, the Mercury News/AP reported that by June of 2007--five months after purchase--you had a lien filed for unpaid utility bills. You didn't budget for the lights?

But what are we going to get? We're going to get Richardson all fired up in Congress about tinkering with foreclosure notice timing, which is last I knew a question of state, not federal, law, and which has as far as I can see squat to do with why this loan failed.

Quite honestly, if WaMu did give Richardson some loan modification deal, I'd really like to know what went through the Loss Mit Department's collective and individual minds when they signed off on that. Sure, Richardson's salary went up to $170,000 when she became a member of the U.S. Congress, but what does she need a home in Sacramento for after that? Where's she going to live in Washington, DC? And, well, her principal residence was also in the process of foreclosure at the same time. I suppose I might have offered a short sale or deed-in-lieu here, but a modification? Why would anybody do that? Because she's a Congresswoman?

I'm quite sure Richardson wants to be treated like just a plain old American and not get special treatment. Well, I was kind of hard on a plain old American the other day who wrote a "hardship letter" that didn't pass muster with me. I feel obligated to tell Richardson that she sounds like a real estate speculator who bought a home she obviously couldn't afford, defaulted on it, and now wants WaMu to basically subsidize her Congressional campaign by lowering her mortgage payment or forgiving debt. And that's . . . disgusting. At the risk of sounding like Angelo.

I know some of you are thinking that maybe poor Ms. Richardson got taken advantage of by some fast-talking REALTOR who encouraged her to buy more house than she could afford. According to Pete Viles at L.A. Land,

She likes the Realtors, and they like her. She filed financial disclosure forms with the House Ethics Committee reporting the National Assn. of Realtors flew her to Las Vegas in November to help swear in the new president of the association, Realtor Dick Gaylord of Long Beach.No wonder she's blaming the lender.

In suggested remarks* at the NAR gathering, also filed with the House, Richardson's script read: "I might be one of the newest members of Congress but I am not a new member of the REALTOR Party. When I needed help to win a tough primary, REALTORS stood up and backed me even though I was the underdog."

--Real estate industry professionals have given her $39,500 in campaign contributions in the current election cycle, according to Open Secrets.

Friday, May 23, 2008

MarketWatch: Bank failures to surge in coming years

by Calculated Risk on 5/23/2008 08:08:00 PM

Alistair Barr at MarketWatch provides an analysis of the coming surge in bank failures.

Only three banks have failed so far in 2008. But that number is set to surge as the credit crunch slows economic growth and hammers some lenders that grew too fast during the recent real-estate boom, experts say.And on C&D loans:

The roots of today's banking crisis grew out of the boom and bust in the real estate market. Lenders originated more and more mortgages, while other banks, particularly smaller and medium-sized institutions, ploughed money into construction and development loans.

...

At this point in the crisis, you can't stop bank failures," said Joseph Mason, associate professor of finance at Drexel University's LeBow College of Business, who has studied past financial crises.

Small and medium-sized banks found it difficult to compete with large lenders in the national markets for mortgages and other consumer loans. So many focused on C&D loans because this type of financing relies more on local, personal connections, said Zach Gast, financial sector analyst at RiskMetrics.Barr names several banks that might fail, including IndyMac and Corus. The bank failures are coming.

As the real estate market boomed, C&D loans did too. A decade ago, bank holding companies had $60 billion of these loans. That number is now $480 billion, according to Gast, who also notes that C&D loans are almost never securitized, so they're held on banks' balance sheets.

Such rapid loan growth usually creates trouble later. Indeed, delinquencies represented 7.1% of total C&D loans at the end of the first quarter, up from 0.9% at the end of 2005, Gast said.

DOT: Vehicle Miles Fell 4.3% in March

by Calculated Risk on 5/23/2008 04:31:00 PM

Graph of 12 month rolling total U.S. vehicle miles added: Click on graph for larger image.

Click on graph for larger image.

From the Department of Transportation: Eleven Billion Fewer Vehicle Miles Traveled in March 2008 Over Previous March

Americans drove less in March 2008, continuing a trend that began last November, according to estimates released today from the Federal Highway Administration.It appears that prices are finally impacting demand in the U.S.

...

The FHWA’s “Traffic Volume Trends” report, produced monthly since 1942, shows that estimated vehicle miles traveled (VMT) on all U.S. public roads for March 2008 fell 4.3 percent as compared with March 2007 travel. This is the first time estimated March travel on public roads fell since 1979. At 11 billion miles less in March 2008 than in the previous March, this is the sharpest yearly drop for any month in FHWA history.

Vallejo files for bankruptcy

by Calculated Risk on 5/23/2008 02:21:00 PM

From the AP: Vallejo files for bankruptcy to deal with budget shortfall

This was expected. The question is: Is Vallejo unique, or will a number of other cities file bankruptcy?