by Calculated Risk on 1/31/2008 07:18:00 PM

Thursday, January 31, 2008

Chase: Max HELOC LTV 70% in Certain Areas

From Kathy Kristof and Scott Reckard at the LA Times: Trying to tap into home equity? We'll see

Countrywide Financial Corp. sent letters to 122,000 customers last week telling them they could no longer borrow against their credit lines because the total debt on the home exceeded the market value of the property. ... The move by Countrywide ... is part of a pullback by lenders nationwide on home equity loans ... with new evidence of sinking home values, many lenders are requiring that homeowners maintain a much larger percentage of equity in their homes as a cushion against financial problems.This is an excellent followup to my posts this morning: Advance Q4 MEW Estimate and Lenders Suspending HELOCs

... Chase Home Lending ... will start imposing new guidelines Monday that further restrict who will be granted a home equity line ... This week, California homeowners can tap as much as 90% of the equity in their homes. Starting Monday, however, Chase won't let homeowners in certain parts of the state -- including Los Angeles, Orange and Imperial counties -- borrow more than 70% of the value of their homes.

CR4RE Newsletter: Sign Up Now to Receive February Issue

by Calculated Risk on 1/31/2008 04:35:00 PM

A repeat ...

Tanta and I are starting to write the February CR4RE "Calculated Risk 4 Real Estate". The newsletter should be sent out in a few days.

If you'd like to subscribe, here is the sign up page ($60 for 12 monthly issues).

The January 2008 Newsletter is available free as a sample (858kb PDF file).

We've received some excellent feedback - thanks! - and a number of subscribers commented that we priced the newsletter too low compared to other newsletters. Hey, take advantage of us!

Best Wishes to All.

CRE: Macklowe Cedes Control to Lender

by Calculated Risk on 1/31/2008 04:32:00 PM

Remember this story? Macklowes On a Wire

Mr. Macklowe and his son Billy paid $6.8 billion to buy seven New York buildings from Equity Office Properties Trust. ... Macklowe Properties put in only $50 million of equity and borrowed $7.6 billion, according to the documents. (Mr. Macklowe borrowed more than the purchase price to cover closing costs and other fees.) The deal also had "negative debt service," meaning that the rents from the buildings weren't expected to cover the debt payments for five years ...Macklowe Properties financed nearly $5.1 billion in debt that must be paid back by February...Well, the debt apparently isn't being paid off. Instead, from the WSJ: Macklowe in Deal to Cede Control Of Seven Manhattan Properties

Troubled New York real estate titan Harry Macklowe has reached a tentative agreement with his lender to turn over effective control of seven Manhattan office buildings he triumphantly acquired less than a year ago for $7.2 billion ...Talk about walking away.

S&P Cuts FGIC To AA; MBIA, XLCA On Watch Neg

by Calculated Risk on 1/31/2008 04:14:00 PM

From S&P (no link):

Standard & Poor's Ratings Services today lowered its financial strength, financial enhancement, and issuer credit ratings on Financial Guaranty Insurance Co. to 'AA' from 'AAA' and its senior unsecured and issuer credit ratings on FGIC Corp. to 'A' from 'AA.' Standard & Poor's also placed all the above ratings on CreditWatch with developing implications.Update: And from the WSJ a long time ago (this morning): AAA Rating Will Stand, MBIA Says.

At the same time, Standard & Poor's placed various ratings on MBIA Insurance Corp., XL Capital Assurance Inc., XL Financial Assurance Ltd., and their related entities on CreditWatch with negative implications. The ratings on various related contingent capital facilities were also affected.

Chief Executive Officer Gary Dunton mounted a spirited defense on a conference call, following MBIA's quarterly earnings report, against "fear mongering" and "distortions' that he said have contributed to last year's dramatic stock-price decline. He also said that MBIA's capital plan currently exceeds all stated rating agency requirements.MBIA hasn't been downgraded so far; this is just a move to CreditWatch with negative implications. BTW, I don't think a CEO should ever comment on his company's stock price, only on the performance of the company:

Despite the significant losses posted by the company, Mr. Dunton said, "there is nothing that we can identify that justifies the 80% drop in our stock price since last year."

Comptroller Dugan Expresses Concern About CRE Concentrations

by Calculated Risk on 1/31/2008 02:15:00 PM

From the Comptroller of the Currency John C. Dugan: Comptroller Dugan Expresses Concern About Commercial Real Estate Concentrations

Comptroller of the Currency John C. Dugan told a bank conference today that the OCC is focusing increased attention on problems arising from high community bank concentrations in commercial real estate (CRE) at a time of significant market disruptions and declining house and condominium sales and values.As I noted last week, with the failure of Douglass National Bank in Kansas City, the housing bust hasn't hurt most small banks and institutions because the banks didn't hold many of the residential mortgages they originated. Instead the small to mid-sized institutions focused on commercial real estate (CRE) and construction and development (C&D) loans, so rising CRE and C&D defaults will impact community banks much more than rising residential mortgage defaults.

“The combination of these conditions is putting considerable stress on one particular category of commercial real estate lending: residential construction and development – and other categories of CRE loans will feel similar stress if general economic activity slows materially,” Mr. Dugan said in a speech before a meeting of the Florida Bankers Association.

In the area of construction and development (C&D) loans, nonperforming loans in community national banks amounted to 1.96 percent of the total at the end of the third quarter, double the rate of the year before.

“Although starting from an admittedly very low baseline, an increase like this – over 100 percent in a single year – is clearly a trend that we need to monitor closely,” Mr. Dugan said.

...

In recent years, the Comptroller said, banks had become too complacent regarding the potential for significant stresses in these markets, and CRE concentrations rose significantly in many banks. The ratio of commercial real estate loans to capital has nearly doubled in the past six years, he said.

“Even more significant than this overall industry statistic is the number of individual banks that have especially large concentrations,” Mr. Dugan added. “Over a third of the nation’s community banks have commercial real estate concentrations exceeding 300 percent of their capital, and almost 30 percent have construction and development loans exceeding 100 percent of capital.”

...

“In terms of asset quality, our horizontal reviews have indeed confirmed a significant increase in the number of problem residential construction and development loans in community banks across the country,” the Comptroller added.

Note: Dugan was one of the first regulators to express concern about non-traditional mortgages, especially Option ARMs.

Clockwork Mortgages, Again

by Tanta on 1/31/2008 12:26:00 PM

So far at least a dozen people have emailed me the link to Jonathan Weil's latest egregiousness in Bloomberg. I have no idea how many times it has come up in the comments. My response?

What P.J. said.

Weil's whole argument rests on the original assumption that pools of mortgage loans can be "wind-up toys" or "brain dead" from a servicing perspective. The reality is that they cannot, they are not, and anyone who pretended otherwise was an idiot (I'm lookin' at you, Wall Street). The prohibition on actively managed pools is there to prevent the issuer or servicer from buying and selling loans in and out of the trust and passing through gain-on-sale to investors while calling it "interest income," or securitizing loans with "putback" provisions that mean the issuer can repurchase loans out of the pools whenever it wants to at a price that is below market in order to take advantage of the bondholders. It was never and is not a prohibition on servicing mortgage loans. That is, in fact, what the SEC just said.

There is and has always been the recognition that mortgage loans, unlike, say, Treasury notes, need to be "serviced." There are therefore long and involved servicing agreements and absolutely not trivial servicing fees specified in all these deals. A couple minutes' worth of reflection would lead you to this: perhaps there is a debate about where you cross the line between servicing a pool and managing it. That would be a debate about when "loss mitigation" (working out a loan in order to minimize loss when loss is inevitable) becomes "loss creation" (a servicer creating a loss to the investor in order to increase servicing income or something like that). But to have that debate you'd have to accept that real loss mitigation is acceptable, and you'd have to look at more facts than just the presence of workouts as such. Such a debate doesn't have jack to do with the SEC handing out "accounting favors" to anyone.

I simply hope that someday Weil wants to drop escrows or make a curtailment and get a payment recast or deed off an easement or something on his home mortgage and he calls his servicer and the servicer says, "Sorry, dood. You're brain dead to us. All we do is collect your payment. Have a nice day. Click."

Maybe that has already happened to him, and it's making him bitter. Beats me. All I know is that a bunch of geniuses on Wall Street did, actually, fall for the idea that residential home mortgages were "wind-up toys," just "asset classes" instead of messy complicated things that involve real people (good, bad, and indifferent, lucky and unlucky, high-maintenance and low-maintenance) on the other side of the cash flow, who don't always behave the way your models said they would. And here we are. Demanding that we continue the delusion in order to make the accounting work out is mind-boggling. Demanding that issuers take it all back onto their balance sheets as punishment for trying to mitigate losses to bondholders is beyond perverse.

Bristol-Myers: $275 Million in Mortgage Related Write-Downs

by Calculated Risk on 1/31/2008 11:52:00 AM

From Bloomberg: Bristol-Myers Posts Quarterly Loss on Investments (Hat tip NK)

The company wrote off $275 million in investments in the quarter, which could rise to as much as $417 million, said Rebecca Goldsmith, a spokeswoman for the New York-based drugmaker ...More containment.

``Some of the underlying collateral for the auction rate securities held by the company consists of sub-prime mortgages,'' the company said today in a statement. If credit and capital markets continue to deteriorate, Bristol-Myers said, it ``may incur additional impairments to its investment portfolio, which could negatively affect the company's financial condition, cash flow and reported earnings.''

Lenders Suspending HELOCs

by Calculated Risk on 1/31/2008 10:49:00 AM

In the previous post, I noted that mortgage equity withdrawal (MEW) was apparently still strong in Q4. Unlike previous years, this appears to be the result of homeowners drawing down HELOCs as opposed to cash out refis.

The lenders are starting to be concerned about the risk of homeowners drawing down HELOCs, while at the same time their property value is declining, leaving little or no equity in the home.

The Implode-O-Meter has posted a letter today from Countrywide suspending certain HELOCs.

A portion of HELOC customers have already or will soon be notified by CFC Loan Administration that their HELOC draws have been suspended indefinitely. These HELOCs were identified as candidates for suspensions for various reasons including:Significant decrease in supporting property value – If the customer's current untapped equity (home value minus all mortgage liens) drops by 50% or more from their HELOC opening date, his/her line will be suspended.This is not a one-time event, but an on-going strategy as we continue to manage our lending risk.

HELOC payment delinquency – If the customer's payment is made two or more days after the grace period ends, his/her line will be suspended.

Product Terms/Conditions Violation – In cases where the customer violated terms or conditions of the HELOC Agreement, his/her line will be suspended.

Examples include, but are not limited to: HELOC on property originated as owner occupied, but now believed to be non-owner occupied or unpaid taxes or insurance on the subject property.

Be aware that there may be other actions that could trigger draw suspensions.

Advance Q4 MEW Estimate

by Calculated Risk on 1/31/2008 10:18:00 AM

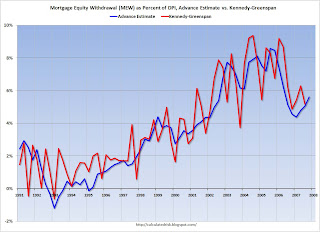

Based on the Q4 GDP data from the BEA, my advance estimate for Mortgage Equity Withdrawal (MEW) is approximately $145 Billion for Q4 (just under $600 billion on a SAAR) or 5.6% of Disposable Personal Income (DPI). This would be slightly higher than the Q3 estimates, from the Fed's Dr. Kennedy, of $133.0 Billion, or 5.2% of Disposable Personal Income (DPI).

The actual Q3 data for MEW will be released after the Flow of Funds report is available from the Fed (scheduled for March 6, 2008 for Q4).  Click on graph for larger image.

Click on graph for larger image.

This graph compares my advance MEW estimate (as a percent of DPI) with the MEW estimate from Dr. James Kennedy at the Federal Reserve. The correlation is pretty high, but there are differences quarter to quarter. This analysis does suggest that MEW was at about the same level in Q4 2007, as in Q3. We will have to wait until March to know for sure.

MEW had been expected to decline precipitously since mid-summer 2007, with a combination of tighter lending standards and falling house prices. However, in Q3, MEW was supported by homeowners drawing down pre-existing home equity lines of credit (HELOC). The sizable MEW in Q4 was probably related to home equity lines too (as opposed to cash out refis of a couple of years ago).

The impact of less equity extraction on consumer spending is still being debated, but as HELOCs dry up, I believe a slowdown in consumption expenditures is likely.

Another "Significant Discount"

by Tanta on 1/31/2008 08:34:00 AM

HOUSTON, Jan 31, 2008 (BUSINESS WIRE) -- Oxford Funding Corporation has won the bid and secured financing for the purchase of a portfolio of mortgage loans offered by a national lender which is finalizing its bankruptcy proceedings. The pool of loans carries principal balances of $2.6 million, and consists of a mix of performing, sub-performing and non-performing loans; Oxford is purchasing these assets at a significant discount.90% ROI? Jeepers.

"We have evaluated the real estate securing these loans, and based on current valuations our cost of the portfolio will equate to approximately 30% of the collateral value," said Robert Dunn, President of Oxford. "We think this is another excellent opportunity for a safe and significant return on our investment."

Earlier this week, Oxford announced that its portfolio reflected an annualized return on investment exceeding 90% during 2007.

If the price was 30 cents on the collateral dollar, I'd like to know what it was on the loan balances.