by Calculated Risk on 1/31/2008 10:18:00 AM

Thursday, January 31, 2008

Advance Q4 MEW Estimate

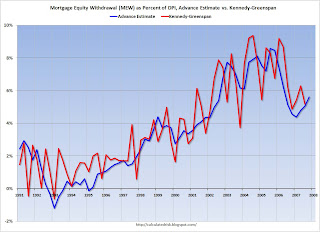

Based on the Q4 GDP data from the BEA, my advance estimate for Mortgage Equity Withdrawal (MEW) is approximately $145 Billion for Q4 (just under $600 billion on a SAAR) or 5.6% of Disposable Personal Income (DPI). This would be slightly higher than the Q3 estimates, from the Fed's Dr. Kennedy, of $133.0 Billion, or 5.2% of Disposable Personal Income (DPI).

The actual Q3 data for MEW will be released after the Flow of Funds report is available from the Fed (scheduled for March 6, 2008 for Q4).  Click on graph for larger image.

Click on graph for larger image.

This graph compares my advance MEW estimate (as a percent of DPI) with the MEW estimate from Dr. James Kennedy at the Federal Reserve. The correlation is pretty high, but there are differences quarter to quarter. This analysis does suggest that MEW was at about the same level in Q4 2007, as in Q3. We will have to wait until March to know for sure.

MEW had been expected to decline precipitously since mid-summer 2007, with a combination of tighter lending standards and falling house prices. However, in Q3, MEW was supported by homeowners drawing down pre-existing home equity lines of credit (HELOC). The sizable MEW in Q4 was probably related to home equity lines too (as opposed to cash out refis of a couple of years ago).

The impact of less equity extraction on consumer spending is still being debated, but as HELOCs dry up, I believe a slowdown in consumption expenditures is likely.