by Calculated Risk on 9/21/2007 03:41:00 PM

Friday, September 21, 2007

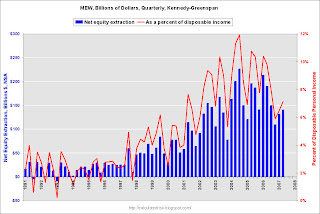

Q2 Mortgage Equity Withdrawal: $140.3 Billion

Here are the Kennedy-Greenspan estimates of home equity extraction for Q2 2007, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41. Click on graph for larger image.

Click on graph for larger image.

For Q2 2007, Dr. Kennedy has calculated Net Equity Extraction as $140.3 Billion, or 7.1% of Disposable Personal Income (DPI). Note that equity extraction for Q1 2007 has been revised upwards to $131.3 Billion.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

It is very likely that MEW will collapse in Q3 2007, based on the tighter lending standards and falling home prices, leading, most likely, to less consumer spending.

HSBC to Close U.S. Mortgage Unit

by Calculated Risk on 9/21/2007 12:57:00 PM

From the WSJ: HSBC to Close U.S. Mortgage Unit

HSBC PLC will close its standalone U.S. subprime-mortgage business and take $945 million in related charges ...The beat goes on.

The London banking giant will close Decision One Mortgage, which originates nonprime mortgages through brokers. Instead, the company will focus on loan origination and servicing through its HFC and Beneficial bank branches.

...

Approximately 750 people will lose their jobs ...

Fed's Kohn on Causes of Housing Bubble

by Calculated Risk on 9/21/2007 11:48:00 AM

From Fed Vice Chairman Donald L. Kohn: Success and Failure of Monetary Policy since the 1950s. An excerpt on the causes of the housing bubble:

"... it is far too soon to pass judgment on what went wrong in the U.S. housing market and why. I suspect that, when studies are done with cooler reflection, the causes of the swing in house prices will be seen as less a consequence of monetary policy and more a result of the emotions of excessive optimism followed by fear experienced every so often in the marketplace through the ages. To some extent, too, the amplitude of the housing cycle was heightened by the newness of the subprime market, the fragmentation of regulatory oversight responsibility for that market, and the complexity and opacity of the newer instruments for transforming and distributing risk. Low policy interest rates early in this decade helped feed the initial rise in house prices. However, the worst excesses in the market probably occurred when short-term rates were already well on their way to more normal levels, but longer-term rates were held down by a variety of forces. And similar, sometimes even sharper, trajectories of house prices have been witnessed in some economies in which the central banks said they were paying more attention to asset prices."Many very lengthy papers will be written on the causes of the bubble. Agree or disagree, Kohn touches on a few key points: monetary policy definitely contributed to the initial surge in prices, lax oversight - Kohn says because of "fragmentation of regulatory oversight responsibility" - allowed the bubble to expand, and speculation played a key role. I'll post on what I consider the key causes this weekend.

Report: Harman LBO Deal in Trouble

by Calculated Risk on 9/21/2007 02:19:00 AM

Another private equity LBO is in trouble.

From the WSJ: Harman's Suitors Sour on Buyout

The private-equity buyers of Harman International Industries Inc. are balking at completing the $8 billion purchase of the audio-equipment maker, people familiar with the matter said, as yet another leveraged buyout falls into a hostile tête-à-tête between buyer and seller.Based on previous reports, the average loss on recent LBOs has been about 4% of the

...

Should KKR and Goldman choose to break the deal, they would have to pay a $225 million termination fee, according to corporate filings. That fee is about 2.86% of the deal's value, which is somewhat lower than other transactions of a similar size, according to an analysis by MergerMetrics.com.

As an aside, the Harman business has recently underperformed expectations, probably as a direct result of the housing bust.

Thursday, September 20, 2007

Emily Litella as a Central Banker: "Never mind"

by Calculated Risk on 9/20/2007 09:55:00 PM

Floyd Norris writes at the NY Times: Inside the Mind of the Fed

Six weeks ago, the Federal Reserve thought the American economy would easily weather problems in the credit market. One week ago, the Bank of England warned against the risks of bailing out those who had made risky loans.Norris notes that the Fed and the BoE changed course, but ...

This was a week to say “never mind.”

By yesterday ... the markets were moving in ways that cannot have made the Fed happy. The dollar fell — an expected result from cutting short-term interest rates — but long-term rates rose, and so did mortgage rates.This was my concern when I outlined a possible vicious cycle that could occur as the Fed cut rates: Watch Long Rates.

“Alan Greenspan’s conundrum is becoming Ben Bernanke’s calamity,” said Robert Barbera, the chief economist of ITG, recalling that when the Fed raised short-term rates under Mr. Greenspan, long-term rates did not follow. Now the opposite is happening, a fact that will make it that much harder to stimulate the economy.

Norris goes on to highlight two recent Fed papers that we've discussed before:

Those wanting to understand the Fed’s reversal can profit from reading two papers by Fed officials, released this summer as the credit squeeze was worsening.emphasis added

In total, they constitute an admission that the Fed was surprised by the housing and borrowing boom on the upside, and now fears it will be surprised on the downside.

The Dollar and the Trade Deficit

by Calculated Risk on 9/20/2007 03:07:00 PM

The following graph shows the U.S. trade deficit as a percent of GDP compared to the Fed Nominal Major Currencies Dollar Index.

NOTE: The trade deficit as a percent of GDP is presented as a positive number (for easier comparison to the dollar index). The 2007 trade deficit is estimated at 5.1% of GDP. The 2007 currency index is set to the Sept value. Click on graph for larger image.

Click on graph for larger image.

The common pattern is a currency strengthens and the trade deficit increases. Some time after the currency peaks, the trade deficit peaks. And that is followed by a bottom in the currency. There are other factors, but that is the common pattern.

The recent increase, and extraordinary size of the U.S. trade deficit, was probably related to the housing bubble and mortgage equity withdrawal (MEW). Now that MEW is generally declining, and the U.S. economy weakening, the U.S. trade deficit will probably continue to decline.

If the trade deficit has peaked, the dollar is probably much closer to the bottom than the top. I know this may seem like heresy, especially given recent events.

The biggest short term concern is that MEW will collapse, and the trade imbalance will unwind faster than expected. A "Wile E. Coyote moment"! (see Krugman: Will There be a Dollar Crisis? )

Also, from the WSJ: World Economy in Flux As America Downshifts

"We're definitely poised to have some significant rebalancing" of trade, says Harvard University economist Kenneth Rogoff, a former chief economist for the International Monetary Fund. He had been expecting the account deficit to shrink "by maybe half a percentage point of GDP over the next twelve months. Now it seems likely it will go down by 1.5 percentage points." And, he adds, "We could see something more rapid."

Something "more rapid" could be painful. Since Americans have financed their prosperity with borrowed money, reversing that habit means a period of living less opulently.

If foreign money turns scarce and the trade deficit narrows suddenly, Americans could face a tumbling dollar, soaring interest rates and an economic downturn. That could send shock waves back through Europe and Asia if their own consumers don't make up for lost demand from the U.S., the world's largest national economy.

If it happens more gradually, the recent run of American prosperity may continue, in a more subdued way.

Bernanke: Subprime mortgage lending and mitigating foreclosures

by Calculated Risk on 9/20/2007 11:19:00 AM

Fed Chairman Ben Bernanke testified before the House Committee on Financial Services this morning: Subprime mortgage lending and mitigating foreclosures. A few excerpts:

During the past two years, serious delinquencies among subprime adjustable-rate mortgages (ARMs) have increased dramatically. (Subprime mortgages with fixed rates, on the other hand, have had a more stable performance.) The fraction of subprime ARMs past due ninety days or more or in foreclosure reached nearly 15 percent in July, roughly triple the low seen in mid-2005.1 For so-called near-prime loans in alt-A securitized pools (those made to borrowers who typically have higher credit scores than subprime borrowers but still pose more risk than prime borrowers), the serious delinquency rate has also risen, to 3 percent from 1 percent only a year ago. These patterns contrast sharply with those in the prime-mortgage sector, in which less than 1 percent of loans are seriously delinquent.In July Bernanke argued that what started in subprime would stay in subprime. He was wrong. Now he is arguing that the problems will be contained to subprime and "near prime" loans. More likely delinquency rates will increase in all categories as house prices fall.

The Federal Reserve takes responsible lending and consumer protection very seriously. Along with other federal and state agencies, we are responding to the subprime problems on a number of fronts. We are committed to preventing problems from recurring, while still preserving responsible subprime lending.The Fed's job was to prevent these problems from "occurring". Preventing them from "recurring" is a tacit acknowledgment of the Fed's earlier failures.

On raising the GSE conforming limit:

Some have suggested that the GSEs could help restore functioning in the secondary markets for non-conforming mortgages (specifically jumbo mortgages, those with principal value greater than $417,000) if the conforming-loan limits were raised. However, in my view, the reason that GSE securitizations are well-accepted in the secondary market is because they come with GSE-provided guarantees of financial performance, which market participants appear to treat as backed by the full faith and credit of the U.S. government, even though this federal guarantee does not exist. Evidently, market participants believe that, in the event of the failure of a GSE, the government would have no alternative but to come to the rescue. The perception, however inaccurate, that the GSEs are fully government-backed implies that investors have few incentives in their role as counterparties or creditors to act to constrain GSE risk-taking. Raising the conforming-loan limit would expand this implied guarantee to another portion of the mortgage market, reducing market discipline further.In general I agree with Bernanke's comments on the GSEs and conforming limits. It might be reasonable to have different limits for different areas, based on the median income for each area.

There is much more in the speech.

Late Mortgage Payments Continue to Climb

by Calculated Risk on 9/20/2007 10:36:00 AM

From the WSJ: Late Mortgage Payments Continue to Climb

Mortgage delinquencies jumped again in August, according to new data from Equifax and Moody's Economy.com. ...As a reminder, here is a chart from BofA analyst Robert Lacoursiere via Mathew Padilla at the O.C. Register. Please see Mathew's discussion from June 29th: (updated URL) BofA Analyst: Mortgage correction just 'tip of the iceberg'.

Nationwide, 3.56% of mortgages were at least 30 days past due last month, up 0.31 percentage points from July. The delinquency rate has increased about 1.5 points since bottoming out at the end of 2005, with fully half of that increase coming in the last three months.

... The rise in bad loans is "broad based," says Mark Zandi, chief economist at Moody's Economy.com. "That signals that foreclosure problems are going to be widespread."

ARM resets are just one cause of rising delinquencies, and most of the problems from resets are still ahead of us.

GSE Portfolio Caps

by Tanta on 9/20/2007 08:46:00 AM

OFHEO has issued authorization for Fannie Mae and Freddie Mac to increase their portfolio holdings, as most of us expected. The terms of the announcement have a number of people concerned, judging from my email traffic: are they up to some nefarious accounting here? My opinion, if you care about it, is it doesn't look like that to me.

The basic part:

With the ongoing concerns about the subprime mortgage market, both Fannie Mae and Freddie Mac have announced commitments to purchase tens of billions of dollars of subprime mortgages over the next several years. The portfolio cap flexibility plus their ongoing ability to securitize mortgages, sell assets, and replace maturing assets, will enhance each Enterprise’s ability to purchase or securitize, over the next six months up to $20 billion or more of subprime mortgages, refinanced mortgages for borrowers with lower credit scores, and affordable multi-family housing mortgages. These efforts should assist lenders in helping some subprime borrowers avoid foreclosure.$40 billion in the next six months for Fannie and Freddie combined is not, in my view, such a huge number: it's probably less than some parties wanted and more than some parties wanted.

The part that concerns folks is this:

The specific flexibilities are as follows:This does not mean that the GSEs will be allowed to use non-GAAP accounting on the actual balance sheets, whenever we end up seeing those. That's, actually, the issue: given how far behind Freddie and particularly Fannie are with getting financial statements up to date, to require the use of GAAP measures for monitoring these portfolio caps would be to force more resources off that project, if you wanted month-by-month current monitoring of the portfolio growth, which of course we do, or to end up with a several month lag between portfolio acquisition and the reporting thereon. That we don't want.

1. Change the portfolio measure from a GAAP number as reported on the balance sheet to Unpaid Principal Balance (UPB), which the Enterprises use in their publicly released monthly summaries. Under present market conditions, the GAAP value can fluctuate widely and we have concluded this adds unnecessary complexity for the Enterprises in managing to the portfolio cap. UPB, which reflects the original principal balance of mortgages and securities less repayments, is not subject to daily market fluctuations.

2. Set the new UPB portfolio cap at $735 billion on July 1, 2007 and apply it to the third quarter. On that date, the GAAP measured cap was $728.1 billion for Freddie Mac and $727.7 billion for Fannie Mae. (UPB often exceeds the GAAP value for the Enterprises. Due to market fluctuations over the first seven months of 2007, this difference has ranged from $0.1 billion to $9.4 billion.)

So OFHEO is simply changing the measurement used in the cap agreement from GAAP to UPB. We will still see the GAAP measurement on the financials, someday. In the meantime we will see monthly reporting on portfolio limits that uses a "raw" number that is almost always going to be larger than a GAAP number. (GAAP adjusts UPB for things like valuation allowances, discounts and premiums, and contingent liabilities. UPB is just what the borrower owes you since application of the most recent payment.)

As long as the new cap level is also expressed in UPB, not GAAP, then calculating additions to the portfolios in UPB doesn't constitute "cheating." On the contrary, it seems to me that OFHEO is being quite prudent here: by using simpler numbers, the cap monitoring is closer to real time. It will also mean that the numbers in play are closer to what we laypeople think of as "loan amounts," so if you're looking at them to get some sort of sense of how many loans to how many homebuyers are in question here, UPB is a better approximation than GAAP.

Personally, I am looking forward to seeing those monthly reports, to get a handle on how these acquisitions are changing the average characteristics of the GSEs' portfolios. I can live with UPB rather than GAAP if it means I can see those reports every month.

Sallie Mae Deal in Jeopardy

by Calculated Risk on 9/20/2007 12:47:00 AM

From the NY Times: Deal to Buy Sallie Mae in Jeopardy

The consortium that had agreed to buy Sallie Mae for $25 billion plans to return to the negotiating table and seek a lower price ...The $900 million breakup fee is a little higher than the reported percentage writedowns at Lehman and Morgan Stanley. If unsuccessful, this would be the largest deal to fall apart so far in this cycle.

The buyers — the private equity firms J. C. Flowers & Company and Friedman Fleischer & Lowe, as well as two banks, JPMorgan Chase and Bank of America — met Tuesday to discuss the best way to pressure Sallie Mae into accepting a lower price, these people said.

While the group is hoping to renegotiate the price of Sallie Mae, these people said, it may also be willing to walk away and pay the $900 million breakup fee.