by Calculated Risk on 9/19/2007 06:19:00 PM

Wednesday, September 19, 2007

Saudi Arabia Refuses to Cut Rates

From The Telegraph: Fears of dollar collapse as Saudis take fright

Saudi Arabia has refused to cut interest rates in lockstep with the US Federal Reserve for the first time, signalling that the oil-rich Gulf kingdom is preparing to break the dollar currency peg in a move that risks setting off a stampede out of the dollar across the Middle East.This ties back to my post yesterday on a possible vicious cycle. To attract sufficient foreign capital flows to cover the U.S. current account deficit, interest rates in the U.S. may need to rise significantly.

"This is a very dangerous situation for the dollar," said Hans Redeker, currency chief at BNP Paribas.

Saudi Arabia has $800bn (£400bn) in their future generation fund, and the entire region has $3,500bn under management. They face an inflationary threat and do not want to import an interest rate policy set for the recessionary conditions in the United States," he said.

The Saudi central bank said today that it would take "appropriate measures" to halt huge capital inflows into the country, but analysts say this policy is unsustainable and will inevitably lead to the collapse of the dollar peg.

The Greenspan conundrum was that long rates didn't rise at the Fed Funds rate was increased. Bernanke's conundrum may be that long rates don't fall (or maybe even increase) as he lowers the Fed Funds rate!

Moody's Forecasts House Prices to Fall 7.7% Nationwide

by Calculated Risk on 9/19/2007 04:38:00 PM

From CNN Money: Double-digit home price drops coming

According to an analysis conducted by Moody's Economy.com, declines will exceed 10 percent in 86 of the 379 largest housing markets. And 290 of the cities will experience price drops of 1 percent or more.See story for Moody's price forecast for top 100 cities.

The survey attempted to identify the high and low points of housing prices in each of the markets, some of which started declining from their peak in the third quarter of 2005. All are median prices for single-family houses.

Nationally, Moody's is projecting an average price decline of 7.7 percent. That's a jump from the 6.6 percent total price drop that the company was forecasting in June and more than twice that of last October's forecast of a 3.6 percent price decrease.

Here are the top ten by forecasted price declines:

| Rank | Area | State | Peak | Bottom | Peak to bottom home price decline |

| 1 | Stockton | CA | 06Q1 | 08Q4 | -25.0 |

| 2 | Palm Bay-Melbourne-Titusville | FL | 06Q1 | 08Q4 | -24.9 |

| 3 | Sarasota-Bradenton-Venice | FL | 06Q1 | 08Q3 | -24.8 |

| 4 | Reno-Sparks | NV | 06Q1 | 09Q1 | -22.4 |

| 5 | Modesto | CA | 06Q2 | 08Q3 | -22.3 |

| 6 | Detroit-Livonia-Dearborn | MI | 05Q3 | 09Q1 | -21.3 |

| 7 | Fresno | CA | 06Q2 | 09Q1 | -20.0 |

| 8 | Oxnard-Thousand Oaks-Ventura | CA | 06Q2 | 08Q3 | -19.2 |

| 9 | Sacramento--Arden-Arcade--Roseville | CA | 06Q1 | 08Q4 | -19.1 |

| 10 | Las Vegas-Paradise | NV | 06Q2 | 08Q4 | -18.7 |

Look at the price bottoms; Moody's is mostly forecasting the price bottoms to happen in late 2008. That would make this one of the shortest duration housing busts with similar price declines in history. Historically declines of this magnitude have taken 5 to 7 years because house prices are sticky.

My guess is prices will decline further than Moody's is expecting, and the duration of the bust will be longer.

Banks Balk, PHH Deal in Jeopardy

by Calculated Risk on 9/19/2007 02:16:00 PM

From Bloomberg: PHH Sale to GE, Blackstone May Collapse as Banks Balk

PHH Corp., the New Jersey-based mortgage lender that agreed to be bought by General Electric Co. and Blackstone Group LP, said the $1.8 billion sale may unravel as lenders back away from some leveraged buyouts.Other deals in trouble include Genesco and Reddy Ice.. The banks are balking as they report write downs from the LBO loans - and try to avoid more pier loans on their balance sheets. See the WSJ: Fuzzy LBO Math

JPMorgan Chase & Co. and Lehman Brothers Holdings Inc. told Blackstone they may fall $750 million short in funding its part of the deal ...

``There will be some deals that won't get done, but it won't be the big names,'' billionaire financier Wilbur Ross, whose New York-based WL Ross & Co. invests in distressed companies, said today in an interview. ``Some of the smaller deals have better escape hatches.''

The [Morgan Stanley]’s finance chief, David Sidwell, told Bloomberg in an interview that net of fees, Morgan Stanley had $726 million of markdowns on $31 billion of leveraged-loan commitments.

Lehman Brothers Holdings said Tuesday on a conference call that it had “more than” $1 billion of paper losses on $27 billion of such commitments.

Fed: Household Debt Service and Financial Obligations Ratios

by Calculated Risk on 9/19/2007 01:07:00 PM

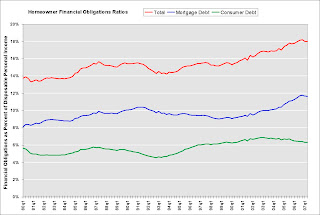

The Federal Reserve released the Q2 Household Debt Service and Financial Obligations Ratios today.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households. This data has limited value in terms of absolute numbers, but might be useful in looking at trends. Here is the discussion from the Fed:

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only a rough approximation of the current debt service ratio faced by households. Nonetheless, this rough approximation may be useful if, by using the same method and data series over time, it generates a time series that captures the important changes in household debt service payments.

Click on graph for larger image.

Click on graph for larger image.After several years of the homeowners financial obligations ratio (FOR) increasing rapidly - due almost entirely to increases in mortgage obligations - it appears the FOR might have peaked at the end of 2006.

The recent rapid increase in the FOR was especially stunning considering interest rates were falling (if the debt to income ratio had stayed stable, the FOR would have declined along with rates).

Even with the small declines over the first half of 2007, the homeowner FOR (and mortgage FOR) are still near record levels. For the FOR to decline to more normal levels requires some mix of an increase in disposable personal income, a decrease in debt, or a decrease in interest rates. This correction process will probably take several years, as U.S. households work to reduce their financial obligations as a percent of DPI.

MMBS: Mountain-Molehill Befuddlement Syndrome

by Tanta on 9/19/2007 11:30:00 AM

To supplement our regular reporting on MMI (Muddled Metaphor Index), we present our inaugural post on Mountain-Molehill Befuddlement Syndrome. MMBS is characterized by an inability to resist making a front-page story out of anything with 1) "mortgage-backed security" in it plus 2) one quote from some hedge fund guy (whose position is disclosed only in dollars, not in, like, who's getting shorted in the swap market). It's probably incurable, but we fight the good fight here anyway. Call us Quixotic.

Karen Johnson of the Wall Street Journal has a bad case of MMBS:

When fruit-spread purveyor J.M. Smucker Co. started buying mortgage-backed securities in 2004, they seemed like a safe way to diversify some of its investments.Oh, man, this is just not sounding good. Jelly makers hiding the sticky details of MBS holdings. According to some guy who runs a little bitty hedge fund in "Short Hills."

Now, however, that asset class is in a bit of a jam.

Shares of banks and brokerages have fallen sharply since the markets cooled for commercial paper and other securitized debt that might hold mortgage-backed loans. But they aren't the only players with home-loan-related holdings.

In recent years, Smucker joined the ranks of other nonfinancial companies such as Garmin Ltd., Microsoft Corp., Netflix Inc. and Sun Microsystems Inc. by investing in what had been viewed as relatively safe investments that produced slightly better returns than cash and government bonds -- and could be sold quickly if needed. Many of these companies are cash-rich, looking for a secure place to park their millions. And none are expected to cash out any time soon.

The issue for investors is how these companies determine the "fair" value of their mortgage-backed securities in the current environment, and whether they are telling the whole story about how easily these assets can be liquidated -- and for how much.

"It concerns me from the standpoint of transparency, whether the cash stated on the balance sheet is a true representation of the cash available to the company," said Jeffrey Diecidue, a hedge-fund manager at UCA LLC in Short Hills, N.J., who has less than $100 million in assets.

You might as well get off the edge of your seats here, folks.

The amount of mortgage-backed securities owned by nonfinancial companies as a proportion of their total assets is low, and some, like Smucker, say they invest in only highly rated loans. But in the current environment, just saying investments have high credit ratings gives investors little comfort. As the traditionally staid commercial-paper market has shown recently, even triple-A-rated debt can be backed by subprime loans, causing investors to balk, prices to fall and trading to seize up.Hoooo-eee. $41.5 million. 1.2% of assets. You get bonus points here if you know that "noncurrent" in this context has nothing to do with performance. And double-extra bonus points if you have any idea why the metric of percent of noncurrent marketable securities means anything important, useful, or sinister. If you enjoyed the slide from "investors in Smuckers, Inc." to "investors in MBS," vis-a-vis who is balking about what, you win the whole PBJ.

At the end of July, Smucker had $41.5 million in mortgage-backed debt classified as noncurrent marketable securities available for sale, which are assets the company intends to sell for cash if it is needed for future operations. While that debt is just 1.2% of Smucker's total assets, it makes up 22% of the company's total marketable securities and 100% of its noncurrent marketable securities.

Other companies with mortgage-backed securities, including Biomet Inc., Microsoft, Novell Inc., Netflix and Sun Microsystems, declined to comment. Semiconductor maker LSI Corp. didn't respond to requests for comment.So, the CFO guy says, we aren't holding the complicated ones and we aren't holding derivatives of the complicated ones. Therefore the very next paragraph says . . . "still."

John Olson, chief financial officer of memory-chip maker Xilinx Inc., said the company buys only diverse high-grade securities and no collateralized debt obligations, or CDOs, which are debt pools that can carry triple-A ratings while still being backed entirely by subprime debt. "Fortunately, our treasurer was smart enough to know that CDOs aren't always what they say they are," he said. Mortgage-backed securities make up $24.3 million, or 2.5%, of Xilinx's $963.8 million in short-term investments.

Still, complicated investments have hurt other companies in the past. In 1994, for instance, Procter & Gamble Co. sustained heavy losses from derivatives on its balance sheet and sued its financial adviser, Bankers Trust, for selling these complex contracts to the consumer-products company.

For the moment, investors will pretty much have to take companies at their word when they say such mortgage-backed financial instruments are liquid and their stated fair-value estimates are based on market prices. Most nonfinancial companies classify their mortgage-backed securities investments as available for sale, meaning they aren't required to record changes in fair value on the income statement, which is followed closely by investors and analysts.Well, you know, if you're worried about it, you could get out the back of the envelope and write down 100% of Smuckers' MBS holdings, which would reduce assets by 1.2%. Then you could go back to worrying about somebody who has substantial enough MBS holdings to get your knickers in a twist over.

Instead, changes in fair value of such securities are recorded on the balance sheet in "other comprehensive income," which affects shareholders' equity but is less of a focus for Wall Street. Those disclosures will begin to change next year, when a new accounting rule kicks in for U.S. companies. This rule, which will first be required of companies with financial years beginning after Nov. 15, calls for companies to provide more information about financial instruments for which they apply fair, or market, values.

For investors like Mr. Diecidue, the rule can't come soon enough.

"The current market volatility in connection with these asset-backed securities presents a conundrum to the investors, because it's harder to know the true book value of a company," he says, referring to the measure of a company's assets minus its liabilities.

Or maybe you could ferret out some "news" about corporate balance sheets that is somewhat less mortgage-obsessed? Nah . . .

NY Times: TimesSelect is now Free

by Calculated Risk on 9/19/2007 09:54:00 AM

The NY Times is no longer charging for TimesSelect, and their archives are available free back to 1987.

We have ended TimesSelect. All of our Op-Ed and news columns are now available free of charge. Additionally, The New York Times Archive is available free back to 1987.The NY Times archive is a great resource.

Also, economist Paul Krugman has started his own blog: The Conscience of a Liberal.

Housing Starts and Completions for August

by Calculated Risk on 9/19/2007 09:21:00 AM

The Census Bureau reports on housing Permits, Starts and Completions.

Seasonally adjusted permits fell sharply:

Privately-owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 1,307,000. This is 5.9 percent below the revised July rate of 1,389,000 and is 24.5 percent below the revised August 2006 estimate of 1,731,000.Starts declined:

Privately-owned housing starts in August were at a seasonally adjusted annual rate of 1,331,000. This is 2.6 percent below the revised July estimate of 1,367,000 and is 19.1 percent below the revised August 2006 rate of 1,646,000.And Completions declined slightly:

Privately-owned housing completions in August were at a seasonally adjusted annual rate of 1,523,000. This is 0.2 percent below the revised July estimate of 1,526,000 and is 19.0 percent below the revised August 2006 rate of 1,881,000.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of starts and completions. Completions follow starts by about 6 to 7 months.

My forecast is for starts to fall to around the 1.1 million units per year level; a substantial decline from the current level. Goldman Sachs' forecast is for 1.1 million units, and UCLA is for 1.0 million units.

Even with the declines in permits and starts, this report shows builders are still starting too many projects. Starts will probably fall much further incoming months.

Tuesday, September 18, 2007

Gross, Rosenberg on the Fed and Rates

by Calculated Risk on 9/18/2007 08:29:00 PM

Update: From the Financial Times: Bank acts boldly to avert recession risk (hat tip Steve)

David Rosenberg, chief economist at Merrill Lynch, said it was hard to combat a deflating credit and asset bubble. He said that while markets soared when the Fed cut rates by 50 basis points in January 2001, they soon fell back.The S&P 500 closed at 1,276.05 on January 2nd, 2001. The Fed cut rates 50bps on Jan 3rd. The S&P 500 closed at 1,347.56, up 5.6% for the day. Then the market started to sell off, falling almost 20% by March. Rosenberg is correct (doesn't mean history will repeat).

Bloomberg video has several interviews concerning the Fed rate cuts. Here is PIMCO's Bill Gross:

| Gross of Pimco Sees 3.75% as `Destination' for Fed Rate September 18 (Bloomberg) -- Bill Gross, manager of the world's biggest bond fund at Pacific Investment Management Co., talks with Bloomberg's Michael McKee from Newport Beach, California, about today's decision by the Federal Reserve to lower its benchmark interest rate by a half point to 4.75 percent, the first cut by the central bank in four years. (Source: Bloomberg) |

Rate Cut Reactions

by Calculated Risk on 9/18/2007 04:26:00 PM

The reactions to the Fed funds rate cut are extremely varied - from relief to outrage. Here are a couple excerpts from the WSJ: Economists React: ‘One and Done’?

The FOMC makes it sound like “one and done” as it cuts both the Fed funds and discount rate by 50 basis points but continues to note inflation risks… As of this writing, we no longer look for the Fed to cut rates in October but that position, like the Fed’s, remains data dependent. –Drew Matus, Lehman BrothersAnd outrage:

Today’s irresponsible 50 basis point reduction is really just the hair of the dog that bit us and is a tacit admission that our economy is addicted to cheap money… A Fed bailout in the form of rate cuts will neither prevent the recession nor keep house prices from collapsing. It may slow the process down a few quarters, but it will cost us dearly. –Peter Schiff, Euro Pacific Capital

Fed Funds Rate Cut: Watch Long Rates

by Calculated Risk on 9/18/2007 02:49:00 PM

Virtuous cycle and vicious cycle:

In many parts of economics there is an assumption that a complex system of determinants will tend to lead to a state of equilibrium. When this tendency is absent terms like virtuous circle and vicious circle (or virtuous cycle and vicious cycle) to describe these unstable pattern of events are used. Both circles are complexes of events with no tendency towards equilibrium (at least in the short run). Both systems of events have feedback loops in which each iteration of the cycle reinforces the first (positive feedback). The difference between the two is that a virtuous cycle has favorable results and a vicious cycle has deleterious results. These cycles will continue in the direction of their momentum until an exogenous factor intervenes and stops the cycle.Perhaps, during the housing boom, a Virtuous Cycle was present as depicted in the following diagram:

Click on diagram for larger image.

Click on diagram for larger image.Starting from the top (during the housing boom): Lower interest rates led to an increase in housing prices. And those higher housing prices led to ever increasing mortgage equity withdrawal (MEW) by homeowners.

A large percentage of this equity withdrawal flowed to consumption, increasing both GDP and imports during the boom years. There is a strong correlation between the trade deficit and mortgage equity withdrawal, and although correlation doesn't imply causation, it appears mortgage equity withdrawal was a meaningful contributor to the widening trade and current account deficits during the housing boom.

To finance the current account deficit, foreign Central Banks (CBs) invested heavily in dollar denominated securities. Some analysts have suggested that these investments lowered interest rates by between 40 bps and 200 bps (Roubini and Setser: "Will the Bretton Woods 2 Regime Unravel Soon? The Risk of a Hard Landing in 2005-2006")

If these analysts are correct, and foreign CB intervention lowered treasury yields, then this also lowered mortgage interest rates ... and the cycle repeated. The result: a Virtuous Cycle with higher housing prices, more consumption and lower interest rates.

Now that the housing cycle has broken, what happens next?

The Vicious Cycle

The following diagram depicts the possible unwinding of the virtuous cycle.

As housing cools down (prices do not need to collapse), mortgage equity withdrawal declines. Then less MEW leads to a slow down in GDP growth and lower imports.

Lower imports might lead to a lower trade deficit, depending on the strength of exports. This could lead to less foreign CB investment in dollar denominated assets. And this could lead to higher interest rates followed by even lower housing prices and the cycle repeats.

The result: a Vicious Cycle with lower housing prices, less consumption leading to higher interest rates.

House prices are now falling. MEW is now falling. And the trade deficit is falling. And the LIBOR rate has increased.

An increase in long rates would be normal if the market expectations for the economy improve. What would be concerning is if long rates increased by more than normal because of the unwinding of investments by foreign CBs. This could lead - for the short term - to a vicious cycle as depicted in the second diagram.