by Calculated Risk on 2/16/2007 02:48:00 PM

Friday, February 16, 2007

Wells Fargo and Subprime Loans

From Credit Suisse Financial Services Forum, "[Banks are] Bracing for a challenging year of EPS growth due to tepid net interest income growth and rising credit losses..." and Wells Fargo President and Chief Operating Officer John Stumpf amde it clear that "roughly 72% of the mortgage originations attributed to Wells Fargo Financial in the league tables for the 1H06 were co-issue originations."

Housing Starts and Completions

by Calculated Risk on 2/16/2007 09:11:00 AM

The Census Bureau reports on housing Permits, Starts and Completions. Seasonally adjusted permits declined:

Privately-owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 1,568,000. This is 2.8 percent below the revised December rate of 1,613,000 and is 28.6 percent below the January 2006 estimate of 2,195,000.Starts declined significantly:

Privately-owned housing starts in January were at a seasonally adjusted annual rate of 1,408,000. This is 14.3 percent below the revised December estimate of 1,643,000 and is 37.8 percent below the January 2006 rate of 2,265,000.And Completions declined slightly and are just 8% below the level of last January:

Privately-owned housing completions in January were at a seasonally adjusted annual rate of 1,880,000. This is 1.2 percentbelow the revised December estimate of 1,902,000 and is 8.0 percent below the January 2006 rate of 2,044,000.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Starts vs. Completions.

Starts are now at the lowest level since Aug 1997. Completions are still just 8% below one year ago, and are at about the same level as early 2005.

This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment are highly correlated, and Completions lag Starts by about 6 months.

Based on historical correlations, it is reasonable to expect Completions and residential construction employment to follow Starts "off the cliff". This would indicate the loss of 400K to 600K residential construction employment jobs by this Summer.

Thursday, February 15, 2007

CNNMoney: Record home price slump

by Calculated Risk on 2/15/2007 07:12:00 PM

From CNNMoney: Record home price slump

The slump in home prices was both deeper and more widespread than ever in the fourth quarter, according to a trade group report Thursday.Here is the NAR report: Fourth Quarter Metro Home Prices & State Sales Likely Have Hit Bottom

Prices slumped 2.7 percent in the fourth quarter compared to the fourth quarter a year earlier, according to the report from the National Association of Realtors (NAR). That's the biggest year-over-year drop on record and follows a 1.0 percent year-over-year decline in the third quarter.

I mostly use the OFHEO House Price Index, not the NAR data. OFHEO will release Q4 data on March 1st.

DataQuick: Bay Area Prices Fall, Slowest Sales Since 1996

by Calculated Risk on 2/15/2007 05:49:00 PM

DataQuick reports: Bay Area home prices edge down, slowest sales in eleven years

Home sales in the Bay Area fell for the 24th month in a row in January as prices slipped to their lowest level in a year and a half, a real estate information service reported.

A total of 6,168 new and resale houses and condos sold in the nine- county Bay Area last month. That was down 26.3 percent from a revised 8,372 in December, and down 4.1 percent from a revised 6,434 for January last year, according to DataQuick Information Systems.

A decline from December to January is normal for the season. Sales last month were the lowest for any January since 1996 when 5,504 homes were sold. The average January since 1988 has had 6,455 sales. Last month's year-over-year decline was the most moderate since March 2005 when sales fell 2.7 percent. Year-over-year sales declines peaked last July at 32.4 percent.

...

The median price paid for a Bay area home was a revised $601,000 last month, down 2.8 percent from a revised $618,000 for December, and down 1.5 percent from a revised $610,000 for January last year. Year-over-year price changes have been negative three of the last four months, ending a 57-month rise that started in December 2001. Last month's median was the lowest since $597,000 in May 2005.

S&P to Warn Earlier

by Calculated Risk on 2/15/2007 04:05:00 PM

From Bloomberg: Subprime Mortgage Bondholders to Get Earlier Warnings From S&P

Standard & Poor's said it will no longer wait for homes to be foreclosed and sold for losses before alerting investors in mortgage-backed securities that it expects to lower ratings on their bonds.And it's not just subprime:

The ratings company will now consider issuing downgrade warnings based on the amount of loans that are delinquent, in foreclosure proceedings or already backed by seized property, Robert B. Pollsen, an analyst at the firm, said on a conference

call today.

...

``It is a watershed event'' because it means S&P is now actively considering downgrading bonds within their first year and has a new program to address high levels of early delinquencies, said Daniel Nigro, an asset-backed securities portfolio manager in New York at Dynamic Credit Partners ...

One of the bonds S&P warned about yesterday was backed by Alt A -- often called ``near prime'' -- mortgages, the firm's first warning about that type of security sold last year.S&P also expressed concerns about home equity loans.

...

``In terms of performance, I'd say there are equal concerns'' about Alt A loans and subprime loans at S&P based on early delinquencies, [Ernestine Warner, an S&P analyst] said. The Alt A bond that S&P warned about was issued by Calabassas, California-based Countrywide Financial Corp., the country's top mortgage lender.

Builder Confidence Improves in February

by Calculated Risk on 2/15/2007 02:27:00 PM

Click on graph for larger image.

Click on graph for larger image.

The National Association of Home Builders/Wells Fargo Housing Market Index (HMI)increased from 35 in January to 40 in February, its highest level since June of 2006.

Here is the NAHB press release.

WSJ: Mortgage Hot Potatoes

by Calculated Risk on 2/15/2007 11:12:00 AM

From the WSJ: Mortgage Hot Potatoes. Excerpts:

Efforts by major banks and Wall Street firms to unload bad U.S. housing loans are speeding up a shakeout in the subprime mortgage industry.

As more Americans fall behind on mortgage payments, Merrill Lynch & Co., J.P. Morgan Chase & Co., HSBC Holdings PLC and others are trying to force mortgage originators to buy back the same high-risk, high-return loans that the big banks eagerly bought in 2005 and 2006.

Wednesday, February 14, 2007

Q4 GDP to be Revised Down

by Calculated Risk on 2/14/2007 08:09:00 PM

Rex Nutting at MarketWatch reports: Big downward revision to GDP coming

The U.S. economy was growing much slower in the fourth quarter of 2006 than the government's first estimate of 3.4%, economists say.This has been discussed at MacroBlog, The Big Picture and by Nouriel Roubini.

Instead of fairly robust 3.4% annualized growth, the government's next estimate will probably be closer to 2.2%, according to median forecast of economists surveyed by MarketWatch. Instead of bouncing back, the economy would have turned in its third quarter in a row of below-trend growth.

The first quarter also looks fairly tepid, with weak retail sales, falling homebuilding and growing signs that business investment isn't picking up the slack.

2007 Update

by Calculated Risk on 2/14/2007 05:03:00 PM

For some time I've felt the first half of 2007 was when we would start to see significant spillover effects from the housing bust into the general economy. I suggested we would see:

1) Several hundred thousand residential construction jobs lost.

Rex Nutting at MarketWatch wrote: Many layoffs coming in housing, economists say

The home-building industry collapsed in 2006, but surprisingly few workers lost their jobs, revised government data show. That could change this year, economists said.

Between December 2005 and December 2006, the number of building permits for new homes plunged 23.5%, while spending on residential construction projects fell by 12.4%. But over that time, employment in residential construction fell by just 1.4% from 3.38 million to 3.34 million. ...

Click on graph for larger image.

Click on graph for larger image.This graph shows residential construction employment vs. completions and starts (Starts are shifted 6 months into the future). Part of my Housing 2007 forecast concerned the loss of 400K to 600K residential construction jobs over the first 6 months of 2007.

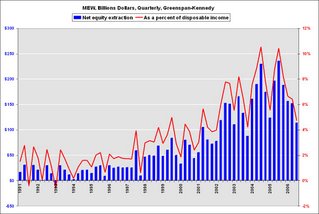

2) A significant decline in Mortgage Equity Withdrawal (MEW), and a negative impact on consumer spending.

From the WSJ: Homeowners Borrow Less Against Equity in Their Homes, Data Show

From the WSJ: Homeowners Borrow Less Against Equity in Their Homes, Data Show "Homeowners extracted $113.5 billion ... via mortgage refinancing and other means in the third quarter, the lowest since the fourth quarter of 2003, according to new estimates by a Federal Reserve staffer and former chairman Alan Greenspan3) Rising defaults with an impact on lenders.

That amount ... was down from $151.8 billion in the second quarter, and the high of $235.9 billion recorded in the third quarter of last year. The latest figure equals 4.7% of households' after-tax income, compared to 10.4% in the third quarter of 2005."

"We're in the midst of an adjusting market right now, and we won't know until spring or summer if this [foreclosure activity] is ominous or not,"

Marshall Prentice, DataQuick president, Jan 24, 2007

Click on graph for larger image.

Click on graph for larger image.This graph shows Notices of Default (NOD) by year in California since 1992.

2006 had the highest number of NODs since 1998. And it now appears 2007 will see record or near record NODs.

It is now six weeks into 2007, and I think we can agree that there has already been a significant impact on mortgage lenders. We are still waiting for the other two shoes to drop ...

Accredited Home stops making riskier loans

by Calculated Risk on 2/14/2007 03:18:00 PM

From MarketWatch (hat tip: REBear): Accredited Home stops making riskier loans

Accredited Home Lenders said on Wednesday that it has stopped making some riskier types of loans as the market for low-end mortgages showed signs of a mini credit crunch.Hey, there it is ... "mini credit crunch". I was wondering when that phrase would appear in a story.

"In response to what we were hearing from the whole loan buyers, we began making adjustments to products with high combined loan-to-value ratios, products with low credit scores and products with less than full income documentation," Joseph Lydon, chief operating officer of Accredited, said during a conference call with analysts on Wednesday.

Accredited eliminated stated income loans with higher combined loan-to-value ratios (CLTVs) to borrowers with FICO credit scores of less than 640, Lydon explained. ...

The company also curtailed first-time homebuyer programs and dramatically reduced combo loan products, helping to significantly cut back second mortgage loans, he added.