by Calculated Risk on 1/12/2007 01:37:00 PM

Friday, January 12, 2007

NRF: "Subdued" Retail Gains

From the National Retail Federation (NRF): Warmer Weather and Soft Housing Market Lead to Subdued Holiday Gains

... retail industry sales for December (which exclude automobiles, gas stations, and restaurants) rose 3.9 percent unadjusted over last year and increased 0.4 percent seasonally adjusted from November. November industry sales were revised down from 6.3 percent unadjusted to 5.1 percent unadjusted.After the Government report, this is a little surprising.

December retail sales released today by the U.S. Commerce Department show that total retail sales (which include non-general merchandise categories such as autos, gasoline stations and restaurants) rose 0.9 percent seasonally adjusted from November and increased 3.6 percent unadjusted year-over-year.

“Unseasonably warmer weather and the slower housing market had a clear impact on consumer spending,” said NRF Chief Economist Rosalind Wells. “NRF expects these subdued gains to continue into the first half of 2007.”

December Retail Sales

by Calculated Risk on 1/12/2007 09:21:00 AM

The Census Bureau reports:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for December, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $369.9 billion, an increase of 0.9 percent from the previous month and up 5.4 percent from December 2005.After a weak start in Q4, it looks like retail sales finished reasonably strong.

Thursday, January 11, 2007

The Long and Short Views

by Calculated Risk on 1/11/2007 12:18:00 PM

In the comments, and occasionally via email, people have expressed surprise at my positive long term outlook. This reaction is probably understandable since most of my posts have a bearish economic tone.

In my view, both history and logic suggest that the economic future will be brighter. Economic growth has been the norm, and in the long term, the markets almost always reward the bullish investor.

It's human nature to be concerned about specific events, but historically the economy has recovered quickly from trauma. Concerned about the bird flu? Look at the 1918 flu pandemic that was followed by the Roaring '20s. Concerned about an economic Depression? The Great Depression was the worst economic event in recent times, and the economy was fine after WWII.

These are serious, but relatively short term events for the general economy.

Logically this makes sense. Economic growth is dependent on innovation and population growth. And innovation will almost certainly continue. In fact, the only real threats to the long term economy are massively destructive events (like a major meteor strike) and impediments to innovation.

It's not worth worrying about very low probability events like super volcanoes or meteor strikes. However higher probability events, like the potential impact from global warming, is probably a concern. But once again, even with global warming, innovation will most likely (hopefully) save the day.

I'll discuss possible impediments to innovation in a future post.

So why are my posts generally bearish? Simple - because I am writing about the short term. And in the short term I'm concerned about the impact of the housing bust on the general economy. And a short term aberration (a recession) to the long term trend is interesting and worth discussing. Clearly I'm bearish in the short term, and I feel the "odds of a recession" in 2007 "are at least a coin flip".

But we have to guard against always being short term bearish and long term bullish. That doesn't work from an investment perspective, since we will always be cautious in each successive short term - and the sum of many short terms is the long term. Intelligent people can always make a strong short term bearish argument, so a pattern of always being short term bearish is a serious risk - just something to consider.

Luckily, as I've been noting for some time, we will probably know by mid-2007 if the housing bust is going to significantly impact the general economy. I believe it will, so the next few months should be interesting.

Best to all.

Fed's Bies on Mortgage Lending

by Calculated Risk on 1/11/2007 11:24:00 AM

Fed Governor Susan Schmidt Bies spoke today on Enterprise Risk Management and Mortgage Lending. On mortgage lending risks:

Effectively managing the risk associated with mortgage lending involves much more than prudent underwriting. Experienced risk managers understand the need to carefully consider the risks should the housing market slow, interest rates change, or unemployment rise. These include the risks that borrowers will not have sufficient income in the future to manage substantial payment increases and that continued home price appreciation may not provide a sufficient equity cushion to minimize losses in foreclosure. In addition, an accumulation of portfolio concentrations could leave an institution exposed in a downturn. Lenders specializing in subprime loans, for example, have endured a string of bad news recently, including increasing loan delinquency and foreclosure rates and the shutdown of some lenders that could not operate profitably in a slower origination environment.Then Bies reviewed the nontraditional mortgage guidance (see speech), and commented on subprime mortgage lending:

The agencies' guidance on nontraditional mortgage products did not specifically address mortgage lending to subprime borrowers--although, as noted, nontraditional mortgage products are sometimes offered to subprime borrowers. ...And from the Financial Times: High-risk loans revealing shaky foundations

While overall mortgage delinquency rates remain low by historical standards, they have been increasing in recent months, especially in the subprime sector. Performance deterioration is most notable in the more recent vintages. Many industry observers believe the poor performance of more recently originated subprime loans is due primarily to looser underwriting standards, including limited or no verification of borrower income and high loan-to-value transactions. ...

Subprime mortgages typically carry higher interest rates than prime loans. It is not uncommon to find margins of 600 basis points or more on adjustable rate subprime loans after the expiration of a teaser rate. Not surprisingly, some borrowers are unable to keep up with their mortgage payments once these payments fully adjust. In some cases, if alternative financing cannot be found, borrowers may be forced to sell their home or enter foreclosure. And given prepayment penalties, home price appreciation slowing significantly and capital market investors becoming more conservative, some borrowers may be having more difficultly in refinancing to avoid foreclosure.

In the closing days of last year, something came un-stuck in a small but important corner of the US mortgage market, causing pain for investors and resulting in several mortgage lenders shutting their doors.

...

In the last few weeks of 2006, the poor credit quality of the 2006 vintage subprime mortgage origination came home to roost.

Delinquencies and foreclosures among high-risk borrowers increased at a dramatic rate, weakening the performance of the mortgage pools.

In one security backed by subprime mortgages issued last March, foreclosure rates were already 6.09 per cent by December, while 5.52 per cent of borrowers were late on their payments by more than 30 days.

Lenders also began shutting their doors, sending shock waves through the high-risk mortgage markets.

Homebuilder: Housing to "remain challenging throughout 2007"

by Calculated Risk on 1/11/2007 11:15:00 AM

From MarketWatch: M/I Homes quarterly contracts plunge 61%

[M/I Homes] said its cancellation rate rose to 63% in the fourth quarter from 27% in the year-ago period, and from 42% in the third quarter.And 2007 doesn't look any better:

"... housing conditions are likely to remain challenging throughout 2007 and we see no reason to deviate from that belief."

[said Chief Executive Robert Schottenstein]

Wednesday, January 10, 2007

November Trade Deficit: $58.2 billion

by Calculated Risk on 1/10/2007 09:47:00 AM

The trade deficit decreased in November to $58.2 Billion. Looking at the trade balance, excluding petroleum products, the deficit has been fairly stable since the second half of 2005. Click on graph for larger image.

Click on graph for larger image.

The red line is the trade deficit excluding petroleum products. (Blue is the total deficit, and black is the petroleum deficit).

It appears the trade deficit, ex-oil, has stabilized or even started to decline.

MBA: Mortgage Applications Increase

by Calculated Risk on 1/10/2007 09:36:00 AM

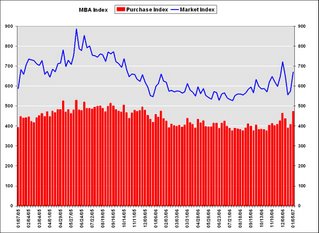

The Mortgage Bankers Association (MBA) reports: Mortgage Applications Increase Click on graph for larger image.

Click on graph for larger image.

This week’s results include an adjustment to account for the New Year’s Day holiday. The Market Composite Index, a measure of mortgage loan application volume, was 671.1, an increase of 16.6 percent on a seasonally adjusted basis from 575.6 one week earlier. On an unadjusted basis, the Index increased 33.2 percent compared with the previous week and was up 12 percent compared with the same week one year earlier.Mortgage rates decreased:

The Refinance Index increased by 17.3 percent to 1923.8 from 1640.4 the previous week and the seasonally adjusted Purchase Index increased by 16.2 percent to 472.8 from 406.9 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.13 from 6.22 percent ...

The average contract interest rate for one-year ARMs decreased to 5.79 percent from 5.84 ...

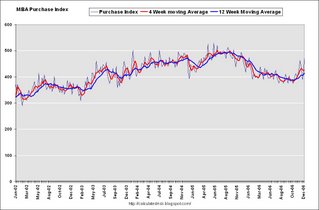

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average is up 0.5 percent to 426.6 from 424.4 for the Purchase Index.

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average is up 0.5 percent to 426.6 from 424.4 for the Purchase Index.The refinance share of mortgage activity increased to 48.4 percent of total applications from 48.1 percent the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 20.1 from 20.4 percent of total applications from the previous week. The ARM share is at its lowest level since July 2003.

Tuesday, January 09, 2007

Increasing Foreclosures

by Calculated Risk on 1/09/2007 02:14:00 PM

From LA Bizjournals: Foreclosures increase 51 percent nationwide

Foreclosures increased 94 percent last year to 157,417 homes in California, as homeowners struggle with fast-rising home payments and a slow-selling market, according to ... ForeclosureS.com.

Nationwide, almost 971,000 foreclosure filings were reported last year, 51 percent more than the 641,000 in 2005, according to the annual report.

Monday, January 08, 2007

Fed's Kohn on Housing

by Calculated Risk on 1/08/2007 03:46:00 PM

From Federal Reserve Vice Chairman Donald L. Kohn: The Economic Outlook. Excerpts on housing:

Uncertainty about where we stand in the housing cycle remains considerable. In part, that is because this housing downturn has differed from some of those in the past in important ways. It was not triggered by a restrictive monetary policy and high interest rates; indeed, relatively low intermediate and long-term interest rates are helping to support the stabilization of this sector. But the current contraction in housing did follow an unusually large run-up in sales and construction and, even more so, in prices relative to the returns on other financial and real assets. Our uncertainty about what pushed home prices and sales to those elevated levels raises questions about how the market will adjust now that expectations of the rate of house price appreciation are being trimmed. And changes in the organization of the construction industry, with activity more concentrated in the hands of large, publicly traded corporations, may also affect the dynamics of prices and activity in response to the inventory overhang.

In my own judgment, housing starts may be not very far from their trough, but the risks around this outlook still are largely to the downside. Although house prices nationally have decelerated noticeably and appear to have fallen in some markets, they are still high relative to rents and interest rates. Building permits decreased substantially again in November, and inventories of unsold homes have only started to edge lower. We also do not know whether the possible stabilization that seems to be taking hold would be immune to a rise in longer-term interest rates should term premiums increase or the federal funds rate fail to follow the downward path currently built into market expectations. Even if starts stabilize at close to current levels, those levels are sufficiently low that overall construction activity would remain a negative for the growth of economic activity in the first half of this year.

Baum: "a False Sense of Complacency"

by Calculated Risk on 1/08/2007 01:27:00 PM

Caroline Baum writes for Bloomberg: Housing Data Yield a False Sense of Complacency. Some excerpts on non-residential construction:

The increase in non-residential construction has helped to offset the decline in housing... Typically commercial activity lags residential -- and the economic cycle. And it makes intuitive sense.

``Once a new subdivision is built and people move in, they look for places to work, shop, eat and have their dry-cleaning done,'' said Ian Shepherdson, chief U.S. economist at High Frequency Economics in Valhalla, New York. ``That's when the new strip malls, schools, churches and office parks start to appear.''

The lag between turning points in residential and non- residential construction is variable, Shepherdson said, but one follows the other as night follows day.

``The plunge in housing construction promises tough times ahead, sooner or later, for the non-residential construction business,'' he said.