by Calculated Risk on 8/04/2005 09:00:00 PM

Thursday, August 04, 2005

California Realtors: Income Gap Increases

The California Association of Realtors (C.A.R.) released survey results this week showing: "California Households Fall $70,480 Short in Income Needed to Purchase Home; Income Gap in San Francisco Bay Area at $102,230"

California households, with a median household income of $53,840, are $70,480 short of the $124,320 qualifying income needed to purchase a median-priced home at $530,430 in California, according to the California Association of REALTORS(R) (C.A.R.) Homebuyer Income Gap Index(TM) (HIGI) report for the second quarter of 2005, released today.

Click on graph for larger image.

Click on graph for larger image.The Homebuyer Income Gap Index(TM) for California increased 28.3 percent during the second quarter of 2005 compared to the second quarter of 2004, when the gap stood at $54,920, the median household income was $52,630, and qualifying income needed to purchase a median-priced home at $461,280 was $107,550.Although I think there are some inherent problems comparing medium income to medium house prices, the year over year comparison seems appropriate.

Bank of England Cuts Repo Rate

by Calculated Risk on 8/04/2005 01:28:00 PM

As expected, the BoE cut the Repo rate by 25 bps. The BoE believes that slackening demand will keep inflation in check.

...the Committee judged that a decrease of 0.25 percentage points in the repo rate to 4.5% was necessary to keep CPI inflation on track to meet the 2% target in the medium term.The minutes will be released on Aug 17th and it might be interesting to see the vote on the rate cut. Last month was 5 to 4 against a cut. The Financial Times reports:

The first rate cut by the Bank of England in two years was widely expected and had little immediate effect on financial markets. But it was an important symbolic moment, especially given the contrast with the US Federal Reserve which is still committed to raising rates.

...a lot clearly depends on the UK's consumers. The housing market has stabilised, rather than collapsed, but that still seems to have weighed on spending patterns. Some, however, would argue that the UK is still seeing the effect of last year's rate tightening. As that fades, spending should pick up in the second half of the year. If the optimists are right, this rate-cutting cycle may turn out to be short.

Investors buying up the Texas Badlands

by Calculated Risk on 8/04/2005 02:30:00 AM

David Streitfeld writes in the LA Times: Bad Lands Now Hot Property

Undeveloped -- even bleak -- parcels in a Texas county lure out-of-state buyers looking to jump into the real estate market.The mania is spreading. Here is a good description of the land:

The soil is lousy for crops, ... unemployment is high and wildlife scarce, except for the snakes. Until a few years ago, one of the biggest businesses in the county was importing New York's sewage, which was dried on a ranch next to the county seat of Sierra Blanca. On windy days, the sewage would blow into town.The local Judge expresses amazement:

"I don't know what these folks expect for their money," said Jeff Davis County Judge George Grubb.I know. They expect to sell to the greater fool.

Wednesday, August 03, 2005

California Investor: "Your Market was Undervalued"

by Calculated Risk on 8/03/2005 11:34:00 PM

Catherine Wilkinson writes for BKCI 2 in Boise, Idaho: Real Estate Sales Surge

If you build it, they will come. And as fast as homes are being built in the Treasure Valley, the faster out of state investors primarily from California and Nevada are buying them up. I've never seen anything like it in my entire life." said Tony Drost with the National Association of Retail Property Managers. He also adds he's having a hard time keeping up with the demand. "I personally field about 7 phone calls a day."Emphasis by Ms. Wilkinson.

Experts say the market is so hot single family home sales and prices have set record numbers in the first half of 2005.

An average price of a home in Meridian was about $177,000, in just six months that number increased 14%.

But Meridian was not the only city experiencing dramatic changes..

Nampa and Eagle saw their home prices increase by 11%, and in Boise prices jumped a whopping 23%. "It's all numbers you can see the appreciation happening and it actually escalates as more invest and it's just going to continue going up," said Drost.

California investor Bob Koop says it was a deal he couldn't pass up. "It seemed like your market as a whole was undervalued."

But this hot housing market bubble could pop as more rental property become available. Rental prices are going down, something Drost warns his investors about before they buy, "There's 200 single family homes for rent in Meridian. In March when I did my search there was roughly 36 homes which at the time I thought was kind of high and now when I look at 200 I don't even know what to think."

But Koop says Boise's a bargain, and is in fact coming back to buy more, "I'll be up there in two weeks."

I have nothing to add.

Housing: More Inventory

by Calculated Risk on 8/03/2005 12:59:00 PM

Realty Times reports: San Francisco, California Real Estate Cools Slightly:

"Wow. Inventory is rising and sitting!," says Realtor James Kastner. "I saw several properties on broker's tour that have been on the market a few weeks -- even a few price reductions. Inventory tends to surge after a holiday weekend -- and drop before. Remember that we have Labor Day coming."So the increase might just be seasonal. And this from Realtor Jeffrey Tong:

"Prices are still increasing, however there are no longer 20 offers on each house -- more like two. Although I don't believe the amount of buyer interest has waned, it appears many are just pausing to see what happens to the market."Occasionally I like to check in on the Downtown San Diego condo market (see graphic). The trend of increasing inventories appears to be continuing.

Tuesday, August 02, 2005

Zero Savings and Housing

by Calculated Risk on 8/02/2005 07:18:00 PM

General Glut notes today that savers have reached the Rubicon of zero savings. But will they cross it? Dr. Hamilton had a recent discussion on savings and showed that the rate has been declining for 20+ years.

CNN has an article, The zero-savings problem, tying the recent lack of savings to the housing boom:

Even as a government report Tuesday showed the national savings rate at zero -- that's right nada -- the rise in the value of homes has given the average U.S. household a net worth of greater than $400,000, according to a separate report from the Federal Reserve.And that could mean problems ahead:

Household real estate assets have risen by just over two-thirds since 1999, and the run up has enabled consumers to spend more money than they are bringing home in their paychecks. They're viewing their homes almost like ATM machines, using home equity loans and refinancings to pull out cash and support a higher level of spending.

"[Rising home values] are making people feel they don't need to save," said Lakshman Achuthan, managing director of the Economic Cycle Research Institute.

That means they are spending more of their paychecks than they would otherwise. That's good news for the current economy but it could cause trouble longer term, according to some economists.

The low savings rate has kept consumers spending, which in turn has kept the economy growing.

"We've backed ourselves into a very dangerous situation," said Dean Baker, co-director of the Center for Economic and Policy Research. "The economy is dependent on everyone consuming like crazy. If everyone heard my diatribe and said, 'Yeah, we better start saving,' the economy would go into a recession."

And while it's not going to be the warnings of economists that start people saving, the slowing of housing price growth or actual declines will put brakes on the spending as people will run out of equity they can tap.

The savings rate will also have more downward pressure as Baby Boomers start retiring and drawing down on retirement savings. While Social Security benefits count as income, withdrawals from 401(k) and other retirement accounts do not.

So if there is no change in the spending habits, the aging of the U.S. workforce could soon make zero or negative savings rates the norm.

"I find it just odd for all these economists and policy makers to be cheering for all this consumer spending when we're just digging ourselves into a hole," said Brusca. "With all the obligations we have ahead, to retirees and to ourselves, we have all the reasons in the world for people to be saving more and be controlling their spending."

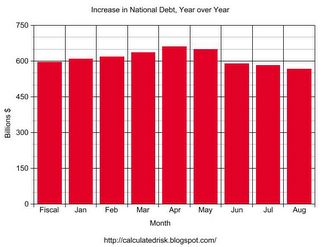

National Debt Increase: $566 Billion YoY

by Calculated Risk on 8/02/2005 05:53:00 PM

As of Aug 1, 2005 our National Debt is:

$7,869,521,621,947.05 (Over $7.8 Trillion)

As of Aug 1, 2004, our National Debt was:

$7,303,319,122,668.55

SOURCE: US Treasury.

Click on graph for larger image.

For comparison:

For Fiscal 2004 (End Sept 30, 2004): $596 Billion

For Jan 1, 2004 to Jan 1, 2005: $609.8 Billion

For Feb 1, 2004 to Feb 1, 2005: $618.6 Billion

For Mar 1, 2004 to Mar 1, 2005: $635.9 Billion

For Apr 1, 2004 to Apr 1, 2005: $660.9 Billion

For May 1, 2004 to May 1, 2005: $648.8 Billion

For Jun 1, 2004 to Jun 1, 2005: $588.0 Billion

For Jul 1, 2004 to Jul 1, 2005: $581.2 Billion

For Aug 1, 2004 to Aug 1, 2005: $566.2 Billion

It now appears that the debt increase for fiscal '05 will be slightly less than the record set in fiscal '04. The current record annual increase in the National Debt is $596 Billion for fiscal '04.

Housing: Mortgage Rates

by Calculated Risk on 8/02/2005 11:36:00 AM

UPDATE: See graph at bottom.

Mortgage rates bottomed in May 2003.

Click on graph for larger image.

Since May 2003 the 30 year fixed rate has been steady and the 1 Year ARM starter rate has risen almost 100 bps.

A couple of points: We haven't seen a substantial increase in rates yet.

Second, in the less than two years since rates bottomed, house prices have continued to rise.

Percent Increase since Q2 2003 (through Q1 2005 according to OFHEO):

California 37%

Florida 29%

Nationwide 18%

This raises some questions:

1) Why have house prices continued to rise?

2) Have homebuyers migrated from fixed instruments to ARMs to afford homes?

3) Did transaction volumes fall when the 30 year fixed moved above 6% in late summer '03 and mid-summer '04?

To try to address the third question, here is a graph of New Home Sales, Seasonally adjusted since Jan 2002. When the 30 year fixed rate was above 6% is shaded in gray.

During the last two years, it appears that when fixed rates rose above ~6%, New Home Sales faltered. Many buyers just switched to ARMs, but there are probably some buyers that insisted on the insurance of a fixed rate loan. This might be of interest since the 30 year rate is closing in on 6% again.

Monday, August 01, 2005

Housing, Layoffs, the UK and more

by Calculated Risk on 8/01/2005 02:12:00 AM

A potpourri of stories ...

My most recent post is up on Angry Bear: A Regulatory Substitute to Burst Housing Bubble? Fed Chairman Alan Greenspan, July 11, 2005:

"Bank Regulatory policies are neither designed nor used to influence asset prices in particular sectors of the economy. Rather, there purpose is to ensure adequate bank risk management ..."

Bloomberg: Greenspan Housing View Seen Hazardous by Wall Street Economists

Worry, say Wall Street economists including David Rosenberg of Merrill Lynch & Co. and Stephen Roach of Morgan Stanley.Danielle DiMartino: Job losses might herald bigger woes

The economists say the Fed must act, for a simple reason: The U.S. has become so dependent on real estate and construction to fuel growth and jobs that an eventual, wrenching correction has the potential to sink the entire economy.

"Act now and cut off the pinky, or wait till later and risk slicing off the entire hand," Rosenberg said in an interview last week. "Either way it hurts, but you can still type with nine fingers."

...

"The Fed is in some sense caught in a box," said Rosenberg, who estimates 60 percent of the U.S. is experiencing a housing-price bubble. "Housing has been this giant locomotive driving just about everything."

...

"There's enough of a risk that the Fed should be preemptive," Maury Harris, chief economist at UBS Securities LLC in Stamford, Connecticut, said in an interview. He recommends the Fed keep pushing up its short-term rate, now at 3.25 percent, until market forces raise mortgage rates as much as 0.75 percentage points. Mortgages are linked to long-term bond yields.

...

"The Fed behaved irresponsibly" by "over-stimulating housing," Edward Leamer, director of the Anderson Forecast Center at the University of California, Los Angeles, said in an interview.

...

"The Fed is probably going to raise interest rates somewhat faster because of the housing price bubble," said Gramley, who is now a senior economic adviser at Stanford Washington Research Group in Washington. "If they can engineer a monetary policy now that brings a nice smooth end to this run-up in home prices, they're less likely to have economic instability down the road,"

"Summer is typically a time when we see a dropoff in job cuts, but this year that slowdown has not materialized," said John Challenger, chief executive of outplacement firm Challenger, Gray & Christmas. "In fact, five out of the six largest job cuts announced so far this year have occurred since May."Stephen King: America and Britain: united by debt but divided by economic performance - so far

With that in mind, while most others waited out last week on tenterhooks until Friday's July labor report, my vigil will end Wednesday with the release of Challenger's July layoff report.

After all, the government's report looks to the past, while Challenger's looks to the future, as the announced job cuts turn into real job cuts.

Announced job cuts in May and June alone were nearly 200,000. This summer's cuts could easily surpass the total for the first four months of the year, when it is much more typical to see heavy downsizing.

The number of job cuts announced between May and August is typically 20 percent lower than in the first four months of the year, according to Challenger.

This break with the typical pattern has John Challenger, whose Chicago firm has been tracking layoff announcements since 1989, looking for a deeper meaning in the numbers.

"We haven't seen mega-layoffs like this in years," Challenger said. "If the summer surge proves to be the first sign of an eventual economic slowdown, this would be the weakest expansion in recent times."

... the biggest difference, at least from a cyclical point of view, probably lies with housing and the consumer. From the Bank of England's point of view, the UK economy has delivered three major surprises over the past 18 months. The first surprise has been the slowdown in housing activity given that short-term interest rates rose only to 4.75 per cent last year, hardly a threatening level by previous standards.Bloomberg: ECB Rate Cut May Hurt More Than Help, Economists Say

Surprise No 2 has been the consumer's response: house prices are now roughly flat year-on-year, yet consumers have retrenched more rapidly than the Bank had expected. And the third surprise has been that, on the back of all these housing and consumer shenanigans, interest rates are on the verge of falling once again, suggesting that the neutral, or structural, level of interest rates is a lot lower than the Bank of England ever seriously contemplated.

"If consumers are hiding in their bolt holes, it's because of the fear of higher unemployment and unsettling European policies," said David Brown, chief European economist at Bear Stearns in London. While the ECB may lower rates as a last resort, "a quarter-point rate cut is going to make very little difference to consumer or business confidence. It's a drop in the ocean."Sorry for all the Doom and Gloom to start the week.