by Calculated Risk on 6/10/2005 02:23:00 AM

Friday, June 10, 2005

US Trade Deficit: $57 Billion for April

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis released the monthly trade balance report today for April:

"... total April exports of $106.4 billion and imports of $163.4 billion resulted in a goods and services deficit of $57.0 billion, $3.4 billion more than the $53.6 billion in March, revised.Note: all numbers are seasonally adjusted.

April exports were $3.1 billion more than March exports of $103.4 billion.

April imports were $6.5 billion more than March imports of $156.9 billion."

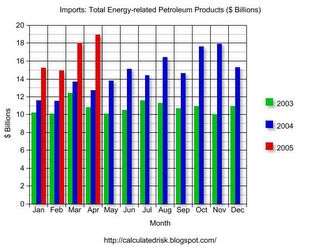

Click on graph for larger image.

This graph shows the monthly trade balances for 2003, 2004 and 2005 and depicts the worsening year over year trade imbalance. The April trade deficit worsened as exports increased $3.1 Billion and imports increased $6.5 Billion.

The recent increase in oil prices had an impact on the April trade deficit. The average contract price for oil jumped from $41.14 in March to $44.76 in April. This is a new record for the import contract price, exceeding the old record of $41.79 set in October.

This graph shows total petroleum imports (NSA) per month for 2003, 2004 and the first four months of 2005. Petroleum imports were about 30% of the trade deficit or about 1.5% of GDP. Even without petroleum imports, the trade deficit would be close to 4% of GDP - a serious problem.

April is the 4th largest trade deficit ever. The trade deficit has been over $50 billion 11 times - the last 11 months in a row.

Thursday, June 09, 2005

America's Debt Binge

by Calculated Risk on 6/09/2005 08:22:00 PM

The Federal Reserve released their quarterly Flow of Funds report today for Q1 2005. The summary: America's debt binge continued.

Borrowing in the first quarter was at an all time high of $2.4 Trillion (annualized) for all sectors. That is double the quarterly borrowing of just 3 years ago.

The leading offenders by percentage debt growth (annualized): State and Local Governments at 16.2%, the Federal Government at 13.8% (2nd worst quarter in almost 20 years), and household home mortgages at 10.6% (down from 2004 levels).

The surprise is the surge in State and Local borrowing. The $271 Billion annualized rate of borrowing is almost double any quarter in the last few years.

With approximately $600 Billion in new debt in Q1 (reported as $2.4 Trillion annualized) and GDP growth of approximately $50B for Q1 (current dollars - see table 3) is the United States just buying growth with debt?

Wednesday, June 08, 2005

Housing Indicators

by Calculated Risk on 6/08/2005 09:12:00 PM

Here are a couple of sites I'm following to check the pulse of the housing market (still tachycardia!):

The Mortgage Banker's Association issues the results of a weekly survey on mortgage applications. The MBAA's seasonally adjusted Purchase Index (PI) is a guide to ongoing purchase loan applications.

Click on graph for larger image.

This is a graph of the PI for the first week of each month since January 2004. Clearly purchase activity has been very stable. The most recent release shows the PI at 479.3, a slight increase from the previous week.

The MBAA also provides a Composite Index (jumps around based on percentage of ReFis), a Refinancing Index and more. They also provide percentages on refinancing and adjusted rate mortgages. Interesting stuff.

The National Association of Home Builders (and Wells Fargo) provide a monthly House Market Index. This is new (UPDATE: tea points out this is not new, here is the historical data) and is based on surveys of home builders. The index currently shows steady interest in new homes.

Tuesday, June 07, 2005

Income Inequality vs. Growth

by Calculated Risk on 6/07/2005 08:55:00 PM

Dr. DeLong directs us to a letter from Greg Mankiw (former chairman of President Bush's Council of Economic Advisers) to the New York Times. In the letter, Mankiw concluded:

Here's the lesson: If policy makers' primary goal is to reduce income inequality, they should put the economy through the wringer. But if they want economic prosperity for all, they should avoid focusing on the politics of envy.Dr. DeLong provides two graphs showing that Dr. Mankiw is wrong. There is extensive research on this subject to support Dr. DeLong's position that the relationship between growth and income inequality is inconclusive. At the extreme, there is no question that income and wealth inequality lead to slower growth (I'll let the reader think about this). But the US is far from that extreme.

So this is primarily a normative question: What kind of society do we want? Do we want a more egalitarian society where two people of equal talent, drive and risk tolerance can achieve similar economic success? Or do we want a more hereditary society? That is the primary question.

Another question is the appropriate public policy with regards to income inequality. At the least we should do nothing. In fact, shouldn't all Americans agree with this statement (from Tax Law Professor Geier)?

"...the government should not be intervening through the tax system to make the gap between the very rich and everyone else actually greater than it otherwise is (in the absence of tax)."But, according to Professor Geier that is exactly what the current tax law does:

"The distribution of the tax burden worsens inequality because there is less income inequality before annual tax bills are paid than after they are paid."To be charitable to Mankiw: Maybe we now know why Mankiw was a champion of Bush's tax policy - he erroneously thought income inequality leads to faster growth.

UPDATE: Via Dr. DeLong: WSJ.com - As Rich-Poor Gap Widens in the U.S., Class Mobility Stalls EXCERPTS:

The promise that a child born in poverty isn't trapped there remains a staple of America's self-portrait....

Although Americans still think of their land as a place of exceptional opportunity... the evidence suggests otherwise....

'The U.S. and Britain appear to stand out as the least mobile societies among the rich countries studied,'

When the Bubble will Burst

by Calculated Risk on 6/07/2005 03:30:00 PM

In March 2003, physicists Didier Sornette (UCLA) and Wei-Xing Zhou (East China University of Science & Technology) correctly predicted that the UK housing bubble would "burst" in mid-2004. At that time they argued the US housing market was not yet a bubble.

This week the physicists released a new paper "Is There a Real-Estate Bubble in the US?". They now conclude that there is a bubble in the US, it is widespread, but that the turning point is still a year away:

"We conclude that the turning point of the bubble will probably occur around mid-2006."Their analysis looks for "positive feedbacks" that result in faster-than-exponential growth in prices. They divide states into three groups: 22 (including DC) existing bubble states (red), 8 new bubble states (purple) and 21 non-bubble states (green). The following map shows these states:

Click on map for larger image.

The paper includes several interesting graphs of price trajectories for bubble and non-bubble states. Maybe Dr. Polley is right about Peoria!

Monday, June 06, 2005

My New Reading List

by Calculated Risk on 6/06/2005 03:37:00 PM

From the Westchester County Business Journal: Real estate book for 'dummies' exceeds expectations

UPDATE: Added to photo, thanks to benwood!

Click on covers for larger image.

Last year Wiley Publishing Inc. in Indianapolis tapped Yoegel to write its "Real Estate License Exams for Dummies" book.And another interesting employment statistic:

So far the book, released in January, has been doing well.

"It's probably tripled our expectation. It's a first," said Diane Steele, vice president and publisher, consumer dummies line at Wiley.

In 2003 there were 14,000 real estate sales agents licensed in Connecticut. This year that number is expected to climb to 18,000, according to the state's Department of Consumer Protection, Real Estate Unit.

That is impressive growth, but in California we have 436,735 real estate agents!

Sunday, June 05, 2005

TIME: Home Sweet Home

by Calculated Risk on 6/05/2005 04:49:00 PM

The housing market gets another cover: Click on cover for larger image.

Click on cover for larger image.

From the story, "Home Sweet Home", first the anecdote:

"I went to look at some homes in Palmdale- Lancaster [an area of Los Angeles County]," [John williams, a disc jockey from long beach, Calif] says, "and the woman showing me and a group of other investors around was a hairdresser who works for Century 21 on the side. We went into Taco Bell for lunch. The girl at the register heard us talking, and she told us she just got her mortgage broker's license."

And from an economist:

To Edward Leamer, economist and director of the ucla Anderson Forecast, the housing market, especially in hot coastal areas, is a bubble just as ripe for popping. "We've had a more than doubling of housing prices in the past three years here in Southern California, for instance, and there's no fundamental driving it," he says. "There isn't some big crush of people coming to California. That's ridiculous."

Instead, say Leamer and other bubbleologists, what's driving the market is low interest rates, herd psychology, speculation and the expectation of unending price increases. (One study found that Los Angeles homeowners expect their home values to grow 22% every year for a decade.) Meanwhile, promiscuous lenders are throwing money at buyers like beads during Mardi Gras. "Anybody who can crawl in off the street can get a loan with 0% down at three or four times their income," Leamer says.

Friday, June 03, 2005

Shiller on NPR

by Calculated Risk on 6/03/2005 09:47:00 PM

Yale University economics professor Robert Shiller appeared on NPR today to discuss - what else? - the real estate bubble. Here are a few quotes:

"But I think the nature of the talk may be subtly changing. I mean people are seem to be much more aware of the possibility that we are in a bubble now. Whether they call it a bubble or something else, lots of people are expressing awareness that something is funny here."On the fundamentals of Real Estate:

"Right now price relative to rent, price relative to construction cost, price relative to income, those are at high or record levels. And, uh, people are starting to become aware of that. And that's the change that will eventually end this bubble."On the myth that housing prices do not decline:

"Although home prices have gone up a lot in the recent years, they are just the same houses, right? There is no change in the services they provide, its just the value we put on them. And so houses' value can just evaporate overnight too. If people suddenly get vary wary of investing houses, because they don't think the prices are going to go up, or if they think they are going to fall that will cause home prices to fall."On the breadth of the bubble:

"Alan Greenspan said we have a lot of local bubbles - that we don't have a national bubble. Well, Ok, maybe he is technically right, but the enthusiasm is infectious and it is starting to spread all over the place."On speculating today:

"I think that one conceivably could buy a house to try to flip it in a year. There is a good chance that prices will be a lot higher in a year, but I wouldn't be too sure. I think it is getting risky."Bubbles last longer than most people expect and end quicker. In June 2006, I expect to be writing about the impact of the housing bust, not when it will bust. But you never know.

Thursday, June 02, 2005

Budget Deficit Improves: Only $588 Billion

by Calculated Risk on 6/02/2005 08:46:00 PM

My congressman Christopher Cox (R-CA) is in the news as Bush's nominee to lead the U.S. Securities and Exchange Commission. So I will quote Mr. Cox on how to look at the budget deficit:

In a 1998 letter, Christorpher Cox wrote:

"... the surplus would disappear if Social Security payroll taxes weren't used to pay for other deficit spending. In 1998, Social Security payroll taxes exceeded Social Security benefit payments by $86 billion. If those extra payroll taxes hadn't been spent on other programs, the federal government would have shown a deficit of $16 billion for 1998."Taking Mr. Cox' lead, here is the current Year over Year deficit number (June 1, 2004 to June 1, 2005). As of June 1, 2005 our National Debt is:

$7,775,553,817,632.01 (Almost $7.8 Trillion)

As of June 1, 2004, our National Debt was:

$7,187,557,826,891.12

The good news is the National Debt has only increased $588.0 Billion over the last 12 months. SOURCE: US Treasury

The bad news is the improvement is due mainly to one time events (mostly the Real Estate bubble). As Dr. Setser has noted:

Tax revenues seem to have outperformed in part because of capital gains on real estate (and also on the equities). In an asset-based economy, it increasingly seems that tax revenues are quite pro-cyclical, rising more than expected in good times and falling a bit more than expected in bad times. The revenues from the amnesty (actually a low tax rate) on the repatriation of profits probably helped too.

Click on graph for larger image.

For comparison:

For Fiscal 2004 (End Sept 30, 2004): $596 Billion

For Jan 1, 2004 to Jan 1, 2005: $609.8 Billion

For Feb 1, 2004 to Feb 1, 2005: $618.6 Billion

For Mar 1, 2004 to Mar 1, 2005: $635.9 Billion

For Apr 1, 2004 to Apr 1, 2005: $660.9 Billion

For May 1, 2004 to May 1, 2005: $648.8 Billion

For Jun 1, 2004 to Jun 1, 2005: $588.0 Billion

A decent improvement.

Free Money: Part II

by Calculated Risk on 6/02/2005 07:08:00 PM

A couple of months ago, I wrote that they were giving away free money in The OC (Orange County, CA). At that time the median home price in OC was $555,000.

According to the OC Register, the mediam home price is now $585,000. That is a gain of $30,000 in just two months.

Prices are well on their way to local RE Broker Gary Watts' prediction of $70,000 in gains this year. Amazing.