by Calculated Risk on 4/29/2005 06:35:00 PM

Friday, April 29, 2005

Q1 GDP and Trade

Reviewing the first quarter 2005 (advance) GDP report, the first unusual item was inventories. Kash covered inventories in "Changes in Inventories".

Trade

UPDATE: All numbers are seasonally adjusted from the advance GDP report and the Trade report. So these numbers are correct. However, my calculation of $4.5 Billion in additional oil imports is not seasonally adjusted (I noted this in my previous post) so this might be a little less after adjustment.

But another area for concern is the balance of trade. The following table includes the reported trade balance, export and imports, for January and February and the projected numbers for March according to the GDP report.

| Trade | Exports | Imports | ||

| Balance | ||||

| January | -$58.5 | $100.4 | $158.9 | |

| February | -$61.0 | $100.5 | $161.5 | |

| March (est. from GDP) | -$59.9 | $110.3 | $170.1 | |

| Q1 TOTAL | -$179.4 | $311.2 | $490.6 |

We already know the dollar value of oil imports surged in March, probably adding another $4.5 Billion to imports. Therefore imports of $170 Billion is very possible. But why does the BEA expect exports to surge? The global slowdown is impacting other countries more than the US, so we might expect exports to be flat.

I expect the March trade deficit (due May 11) to be worse than the BEA estimate and to negatively impact GDP (preliminary) due on May 26th. Other factors may lead to a positive GDP revision.

Thursday, April 28, 2005

Macroblog to Roach: J'Défends!

by Calculated Risk on 4/28/2005 01:29:00 AM

In a four post series (1, 2, 3, 4) , Dr. Altig defends the Federal Reserve against Stephen Roach's most recent Fed bashing piece: "Original Sin".

Stripping aside Roach's hyperbole, I believe Roach makes three arguments:

1) that recent growth in the US economy has resulted from borrowing against inflated assets leading to "imbalances and distortions";

2) the FED should consider asset prices when setting interest rates and

3) that FED officials have made some irresponsible comments in recent years.

On the first point, I mostly agree with Roach. In my mind there is no question that the US has been buying growth with debt, both public (general fund deficit) and private (mortgage equity withdrawal).

On the second point, I believe the FED should not consider asset prices when setting interest rates, so I disagree with Roach. Much of Roach's scathing commentary is based on his belief that the FED should target asset prices.

And on the third point, I generally agree with macroblog that FED officials have, with the exception of Mr. Greenspan, been responsible in their comments, especially in recent months. I believe Chairman Greenspan has made several irresponsible and inaccurate comments when speaking for himself.

Perhaps the FED could have spoken out sooner on certain issues, like the general fund deficit and the housing bubble. As Dr. Thoma wrote in the macroblog comments concerning the 'behavior of congress over the deficit/trust fund':

"... watching out for the public interest is an important role of the Fed, but that's not something the Fed had direct control over and other than publicly denouncing such policy, they have little choice but to do their best in spite of poor policy elsewhere in government."In my view Roach's anger is misdirected. Although I agree with Roach's general economic assessment, I believe the problems are primarily due to poor fiscal and public policy.

Wednesday, April 27, 2005

More Signs of a Global Slowdown

by Calculated Risk on 4/27/2005 12:45:00 AM

UPDATE: The Economist (on Germany): If not now, when?

Germany:

NYTimes: Fears Mount That Germany Faces Recession

Financial Times: German business data add to eurozone gloom

Japan:

Bloomberg: Japan's Household Spending Falls; Economy Sheds Jobs

Financial Times: Japanese economy stuck in deflation

And the really dark side ...

$100 (US) oil, major recession seen as likely

Conference told of imminent price shocks as world demand rises while reserves fall

Tuesday, April 26, 2005

New Home Sales, Monthly Unadjusted

by Calculated Risk on 4/26/2005 08:21:00 PM

Here is a graph of actual monthly New Home Sales for the last 3 years.

Click on graph for larger image.

March is usually one of the strongest months of the year, and for March 2005, sales were a monthly record of 144 thousand units.

Interestingly the median sales price dropped significantly in March. The reason probably is due to the surge in sales in the South. Over half the sales in March (73 thousand) occured in the South (the Census bureau segments the data into four regions). The previous record for the South was 59 thousand last March.

So sales in the South increased 23% from last March, but only 10% over the other three regions.

Record New Home Sales

by Calculated Risk on 4/26/2005 12:54:00 AM

According to a Census Bureau report, New Home Sales set a record in March to a seasonally adjusted annual rate of 1.431 million vs. market expectations of 1.19 million.

Click on Graph for larger image.

NOTE: The graph starts at 700 thousand units per month to better show monthly variation.

Sales of new one-family houses in March 2005 were at a seasonally adjusted annual rate of 1,431,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 12.2 percent above the revised February rate of 1,275,000 and is 12.7 percent above the March 2004 estimate of 1,270,000.

The median sales price of new houses sold in March 2005 was $212,300; the average sales price was $281,300. The seasonally adjusted estimate of new houses for sale at the end of March was 433,000. This represents a supply of 3.6 months at the current sales rate.

There is a seasonal pattern to supply and 3.6 months is below the normal level of supply as compared to 2003 and 2004. Months of supply is based on sales, and the record sales in March makes the months of supply number smaller.

Monday, April 25, 2005

Lau and Stiglitz: China's Alternative to Revaluation

by Calculated Risk on 4/25/2005 07:40:00 PM

In a Financial Times commentary, Lawrence Lau and Joseph Stiglitz argue that an export tax would be a better choice for China.

"If China were to contemplate a revaluation, it should consider as an alternative the imposition of a tax on its exports. Export taxes are generally permitted under WTO rules. Indeed, China has already moved in a limited way in this direction on textiles. There are several reasons voluntary imposition of a tax on its exports may be preferable to a renminbi revaluation. Both would have similar effects on Chinese exports - they would make them appear more expensive to the rest of the world. Because of this similarity, an export tax would provide an empirical answer to the question of whether a revaluation would work. But it would do this without some of the significant costs attendant on revaluation.It seems a 5% export tax would just increase the US trade deficit with China and might lead to more inflation in the US. I'll be interested in Setser and Roubini's views on this proposal!

One of the advantages of an export tax is that, unlike a revaluation, it would not lead to financial losses for Chinese holders of dollar-denominated assets, such as the People's Bank of China or commercial banks and enterprises. China's central bank currently holds about $640bn (£334bn) in foreign exchange reserves. Assume that only 75 per cent is held in dollar-denominated assets. A renminbi revaluation of 10 per cent would result in a loss of $48bn or about 400bn yuan for the central bank.

Another cost of revaluation would be possible further deterioration in the distribution of income, including increasing the already large rural-urban wage gap. Revaluation would put downward pressure on domestic Chinese agricultural prices; an export tax would not. An export tax, by contrast, would have a beneficial side effect: it could generate substantial government revenue for China. Given the high import content of Chinese exports to the US, a 5 per cent export duty would be equivalent to a currency revaluation of some 15-25 per cent, generating about $30bn-$42bn a year.

Finally, an export tax would not reward currency speculators. It may even discourage the speculation that has complicated macro-economic management of China's economy. If potential speculators can be convinced that China would rather impose an export tax than revalue, less "hot money" will flow into China. By contrast, nothing encourages speculators more than a "victory", especially where, as here, it is likely to do little to correct the underlying problems."

Q1 2005: Housing Vacancies and Homeownership

by Calculated Risk on 4/25/2005 11:29:00 AM

The Census Bureau released their Housing Vacancies and Homeownership report for Q1 2005 this morning.

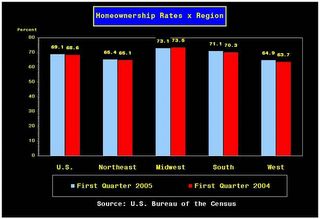

National vacancy rates in the first quarter 2005 were 10.1 percent in rental housing and 1.8 percent in homeowner housing, the Department of Commerce and Census Bureau announced today. The Census Bureau said the rental vacancy rate was not different from the first quarter rate last year (10.4 percent) or the rate last quarter (10.0 percent). For homeowner vacancies, the current rate (1.8 percent) was also not different from the rate a year ago (1.7 percent), or the rate last quarter (1.8 percent). The homeownership rate (69.1 percent) for the current quarter was higher than the first quarter 2004 rate (68.6 percent) but not different from the rate last quarter (69.2 percent).

Click on graph for larger image.

Rental vacancies are still over 10% and homeownership rates are still climbing when compared to Q1 2004.

More on Housing

by Calculated Risk on 4/25/2005 01:55:00 AM

My most recent post, "After the Housing Boom: Impact on the Economy", is up on Angry Bear.

On Tuesday, New Home Sales will be released. I believe New Home Sales is a better leading indicator than Existing Home Sales (to be released on Monday). It appears that Sales for March were still strong, so I'm not expecting a significant drop-off in sales volumes reported this month.

Also the Census Bureau will release their quarterly Housing Vacancies and Homeownership report tomorrow.

A busy week for housing stats.

Best to all!

Friday, April 22, 2005

Fed's Kohn: Imbalances, Risks

by Calculated Risk on 4/22/2005 05:08:00 PM

Fed Governor Donald L. Kohn spoke today at the Hyman P. Minsky Conference in New York. Kohn made several cautionary comments on global imbalances. A few excerpts:

... beneath this placid surface are what appear to be a number of spending imbalances and unusual asset-price configurations. At the most aggregated level, the important imbalance is the large and growing discrepancy between what the United States spends and what it produces. This imbalance, measured by the current account deficit, has risen to a record level, both in absolute terms and as a ratio to GDP.

...

The sustainability of these large and growing imbalances has become especially suspect because it would require behavior that appears to be inconsistent with reasonable assumptions about how people spend and invest.

...

The current imbalances will ultimately give way to more sustainable configurations of income and spending. But that leaves open the question of the nature of that adjustment. Ideally, the transition would be made without disturbing the relatively tranquil macroeconomic environment that we now enjoy. But the size and persistence of the current imbalances pose a risk that the transition may prove more disruptive.

And on Real Estate:

A couple of years ago I was fairly confident that the rise in real estate prices primarily reflected low interest rates, good growth in disposable income, and favorable demographics. Prices have gone up far enough since then relative to interest rates, rents, and incomes to raise questions; recent reports from professionals in the housing market suggest an increasing volume of transactions by investors, who (along with homeowners more generally) may be expecting the recent trend of price increases to continue.In other words, a BUBBLE!

I take some comfort from the continuing disagreement among close students of the market about whether houses are overvalued, and, given the widespread press coverage of this issue, from my expectation that people should now be aware of the risks in the real estate market.

A very interesting speech and an extension of recent hard landing discussion. (see macroblog for a summary here, here and here)

Oil Prices Hurting less Developed Countries

by Calculated Risk on 4/22/2005 11:26:00 AM

It appears that oil prices have started to slow the US economy. But less developed countries are really feeling the pinch. Speaking at the Asia-Africa summit in Jakarta, Indonesia, Philippine President Gloria Macapagal-Arroyo warned that oil prices could lead to a "global recession".

Arroyo told the meeting in Jakarta, featuring some of the world’s leading oil consumers, that unsustainable prices were driving many countries to the brink of financial instability.

“There’s no question that the rising price of oil has the potential to put the brakes on economic expansion,” Arroyo said, urging delegates to work together to “prevent such a crisis”.

The rising trend of oil prices could worsen to levels that could halt economic growth or even prompt global economic recession, Arroyo said.

“It is stripping oil-importing Asia and Africa of our ability to manage for global competitiveness. It is preventing us from pursuing our economic development programmes with vigor. It is requiring us to face the spectre of economic decline,” she said.

Philippine Foreign Affairs Secretary Alberto Romulo made similar comments at the ministerial meeting of the conference.

"The current trend in oil prices points toward a situation that could halt global economic growth and further widen the gap between the rich and poor countries," Romulo said.

Spot oil prices reached $55 per barrel earlier today.