by Calculated Risk on 2/04/2005 08:48:00 PM

Friday, February 04, 2005

FT: BoJ's bill auction fails first time in two years

In yesterday's FT was this interesting article.

Excerpt:

"The Bank of Japan on Wednesday failed to attract enough offers in a bill-buying operation for the first time in nearly two and a half years, raising speculation that the central bank may struggle to meet its ultra-loose liquidity targets.

The BoJ conducts money market operations aimed at keeping the balance of current accounts deposited at the central bank between Y30,000bn and Y35,000bn. Because interest rates have long been at zero, the bank has flooded the markets with liquidity in an effort to head off systemic risk and rid the economy of deflation, which has dogged the economy since the mid-1990s.

On Wednesday, the BoJ sought to buy Y1,000bn of discount bills, but offers from financial institutions - already flush with cash - fell below Y700bn. The shortfall was even more shocking given that the BoJ was conducting a powerful "all offices" transaction in which its regional branches also participated."

Since the US has received most of the financing of its current account deficit from foreign central banks, if the BoJ struggles with its liquidity operations in Japan, would they have difficulty increasing their dollar reserves?

Brad Setser and Nouriel Roubini have been writing some excellent articles on the current account deficit and foreign dollar reserves.

Dan Froomkin on Social Security

by Calculated Risk on 2/04/2005 06:30:00 PM

Froomkin's WaPo article, "Avoiding the Tough Questions" is excellent.

An excerpt:

"... there are some serious and legitimate concerns that need to be addressed about Bush's Social Security proposals and how they are being characterized.

One overarching issue is that the White House is talking about Social Security as if it were one big underperforming 401(k) program. In other words, they're implying that workers right now get back what they put in plus interest -- and that the interest rate they're getting is not so hot.

But it's not that way, not by a long shot. Social Security is a complex social insurance program that uses payroll taxes from current workers to pay benefits to the elderly, the disabled and their families in a progressive manner that guarantees an income floor below which the least fortunate are not allowed to sink."

Ahhh ... a Safety Net?

An excellent analysis worth reading.

Tuesday, February 01, 2005

Advertising

by Calculated Risk on 2/01/2005 11:32:00 PM

Advertisements: Thank you for your interest!

Advertising space is limited and available on a fixed price per month basis.

A maximum of three banner ads will run at any one time in the upper portion of the right side bar.

A banner is 190 X 120 pixels.

If the advertiser hosts the graphic (recommended), they are welcome to change the image as often as they like.

If you'd like to place a banner ad on Calculated Risk, please contact me for pricing.

About Me and Media Requests

by Calculated Risk on 2/01/2005 11:11:00 PM

Calculated Risk: a senior executive, retired from a public company, with a background in investing, finance and economics.

Tanta: Tanta passed away in December 2008. Please see: Tanta: In Memoriam for more.

For media requests: Please feel free to quote from the blog (with a reference). I'm not looking for any personal publicity, but I'm happy to discuss economic and housing issues for background (emails or phone calls). Please feel free to email me. Please see Tanta's piece: Media Inquiries Policy.

Thank You

by Calculated Risk on 2/01/2005 10:43:00 PM

Thank you for the tip!

Your transaction has been completed, and a receipt has been emailed to you by PayPal.

Best Wishes.

Click here to return to the main page.

GAO: Long Term Fiscal Challenge

by Calculated Risk on 2/01/2005 09:53:00 PM

The GAO released a report on their recent forum addressing long term fiscal challenges. Three key points:

1) Today's fiscal policy is unsustainable.

2) Health Care Is the Largest and Perhaps Most Difficult Part of the Long-Term Fiscal Challenge.

"Health care is a bigger problem than Social Security. Participants acknowledged the need for Social Security reform but emphasized that Social Security is a relatively small part of the long-term fiscal challenge when compared to spending on health care. One participant noted that the estimated Social Security shortfall is about one-third the estimated cost of recent tax cuts if made permanent. Several participants observed that few members of the public are aware of this. Rather, the general public impression is that solving Social Security would solve most of the longterm fiscal challenge, and this is not correct. Indeed, one forum participant stated that it was only by attending this forum that he had learned that health care spending was a much more important, and potentially far more difficult, component of the long-term fiscal challenge than Social Security.

Participants expressed the view that in characterizing the long-term fiscal outlook, several key distinctions needed to be made between Social Security and the largest federal health programs, Medicare and Medicaid. Participants observed that the public was largely unaware that health spending accounted for a much larger share of the long-term fiscal problem than did Social Security."

3) We need to elevate the public discourse to address the problem. There is a serious lack of leadership, especially in the White House.

"Participants agreed that a key moral context is the impact federal budget deficits will have on future generations. Another key moral context is integrity. Some participants called for greater integrity, e.g., transparency, in the federal budget process."

And a table of fiscal exposures (billions of dollars, End of 2003):

See page 50, GAO-05-282SP CG Forum

Selected Fiscal Exposures: Sources and Examples

Explicit Liabilities

Publicly held debt ($3,913)

Military and civilian pension and post-retirement health ($2,857)

Veterans benefits payable ($955)

Environmental and disposal liabilities ($250)

Loan guarantees ($35)

Explicit Financial commitments

Undelivered orders ($596)

Long-term leases ($47)

Financial contingencies

Unadjudicated claims ($9)

Pension Benefit Guaranty Corporation ($86)

Other national insurance programs ($7)

Government corporations e.g., Ginnie Mae

Exposures implied by current policies or the public's expectations about the role of government

Debt held by government accounts ($2,859)b

Future Social Security benefit payments ($3,699)c

Future Medicare Part A benefit payments ($8,236)c

Future Medicare Part B benefit payments ($11,416)c

Future Medicare Part D benefit payments ($8,119) c

Life cycle cost including deferred and future maintenance and operating costs (amount unknown)

Government Sponsored Enterprises e.g., Fannie Mae and Freddie Mac

Monday, January 31, 2005

Misestimates in CBO's Projections

by Calculated Risk on 1/31/2005 10:41:00 PM

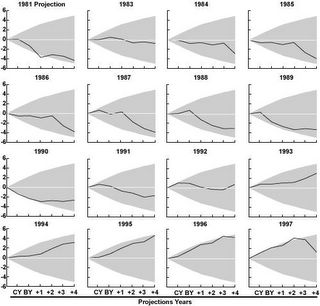

The following chart shows the accuracy of the CBO's projections from 1981 to 1997.

Misestimates in CBO's Projections Made from 1981 to 1997

Source: Congressional Budget Office. Notes: CY = current year; BY = budget year.

When the CBO makes an error (see '80s or 90's) they continue to make the same error for several years running. We are seeing the same phenomenon now. The CBO is consistently underestimating the tax revenues, specifically Corporate and Individual Income taxes. Social Security taxes (now 38% of all Federal revenue) have been reliable.

As an example, in Jan 2002 CBO projected a unified deficit of 21 Billion for fiscal 2002 (ends in Sept). The actual unified deficit was $158 Billion. The primary causes for this miss were Individual Income Taxes (short $89 Billion) and Corporate Income Taxes (short $31 Billion). This pattern is repeated for 2003 and 2004.

Just a reminder: On January 29, 2002, George W. Bush said in his State of the Union Address: "... our budget will run a deficit that will be small and short-term". He was sure wrong.

Mort Zuckerman on Social Security

by Calculated Risk on 1/31/2005 08:57:00 PM

Mort Zuckerman (US News & Report) writes: "A 'cure' worse than the cold"

Excerpt:

"[T]here is value in savings and self-reliance, in making private investment decisions, planning ahead, and increasing distance from the government. But there are other values in the very title of the program--Social Security. "Social" surely implies a contract to help manage poverty among the old and to know that our society provides a minimum income for all of our fellow citizens in their retirement years. And "security" means buffering the harshness and cruelty of the markets so that the well-being of the elderly is not dependent on shrewd stock picks and hot mutual funds that enrich some but fail the very people who need Social Security benefits the most.

Privatization thus gets things upside down. Social Security was not meant to re-create the free market; it was intended to insure against the vagaries and cruelties of the market and to permit Americans to count on the promise that the next generation will take care of them in their old age."

New Home Sales off in December

by Calculated Risk on 1/31/2005 10:44:00 AM

The Census Bureau's report today:

Sales of new one-family houses in December 2004 were at a seasonally adjusted annual rate of 1,098,000, according to estimates released jointly today by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development. This is 0.1 percent (±9.4%) above the revised November rate of 1,097,000, but is 2.0 percent (±10.6%) below the December 2003 estimate of 1,120,000.

The median sales price of new houses sold in December 2004 was $222,000; the average sales price was $276,600. The seasonally adjusted estimate of new houses for sale at the end of December was 432,000. This represents a supply of 4.8 months at the current sales rate.

In 2004, there were 1,183,000 houses sold compared with 1,086,000 houses sold during 2003, establishing a new record. This is an increase of 8.9 percent (±3.0%).

Thursday, January 27, 2005

4th Quarter Housing Vacancies and Homeownership

by Calculated Risk on 1/27/2005 04:01:00 PM

The 4th quarter report of Housing Vacancies and Homeownership is now available.

The housing inventory increased 1.325 million units in 2004. Interestingly, 1.763 million more units were occupied by owner; more units than the overall inventory increased.

The number of occupied rental units decreased slightly for the year and increased in the 4th quarter. This is the 2nd consecutive quarter of an increase in occupied rental units - a trend change from the last few years.

The Home Ownership rate is at a record 69.2%.