by Calculated Risk on 7/08/2019 06:39:00 PM

Monday, July 08, 2019

Seattle Real Estate in June: Sales down 3.5% YoY, Inventory up 69% YoY from Low Levels

The Northwest Multiple Listing Service reported Buyers Getting "Some Relief" as Key Indicators Point to Strong Summer for Housing Market

Inventory, pending sales and prices all increased during June compared to a year ago, according to the latest report from Northwest Multiple Listing Service. The same report, which covers 23 counties in Washington state, shows year-over-year drops area-wide in both the volume of new listings and closed sales.The press release is for the Northwest. In King County, sales were down 4.1% year-over-year, and active inventory was up 32% year-over-year.

...

House hunters had a broader selection to consider as inventory at month end totaled 16,800 active listings, about 9.5 percent larger than at the same time a year ago. Brokers added 11,977 new listings during the month, a drop from both a year ago when they added, 13,153 new listings, and from May, when they added 14,689 new listings.

About half the counties reported gains in inventory, led by King County where the selection grew nearly 32 percent from a year ago.

...

The Northwest MLS report indicates there is 1.76 months of inventory area-wide (matching May), with eight counties having less than two months of supply.

emphasis added

In Seattle, sales were down 3.5% year-over-year, and inventory was up 69% year-over-year from very low levels. This is another market with inventory increasing sharply year-over-year (but at a much slower rate than the previous months), but months-of-supply in Seattle is still on the low side at 2.1 months.

House Prices to National Average Wage Index

by Calculated Risk on 7/08/2019 04:17:00 PM

One of the metrics we'd like to follow is a ratio of house prices to incomes. Unfortunately most income data is released with a significantly lag, and there are always questions about which income data to use (the average total income is skewed by the income of a few people).

And for key measures of house prices - like Case-Shiller - we have indexes, not actually prices.

But we can construct a ratio of the house price indexes to some measure of income.

For this graph I decided to look at house prices and the National Average Wage Index from Social Security.

Note: For a different look at house prices and income, see this post (using median income).

This graph shows the ratio of house price indexes divided by the National Average Wage Index (the Wage index is first divided by 1000).

This uses the annual average National Case-Shiller index since 1976.

As of 2018, house prices were somewhat above the median historical ratio - but far below the bubble peak.

Prices have increased a little more in 2019, but house prices relative to incomes are still way below the 2006 peak (but slightly above the 1989 peak).

Going forward, I think it would be a positive if wages outpaced, or at least kept pace with house prices increases for a few years.

Note: The national wage index for 2018 and 2019 is estimated as increasing at the same rate as in 2017. House prices in 2019 are estimated to increase the same as the Year-over-year change in April (3.5%)

U.S. Heavy Truck Sales up 12% Year-over-year in June, Near All Time High

by Calculated Risk on 7/08/2019 10:51:00 AM

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the June 2019 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand in May 2009, on a seasonally adjusted annual rate basis (SAAR). Then sales increased more than 2 1/2 times, and hit 479 thousand SAAR in June 2015.

Heavy truck sales declined again - mostly due to the weakness in the oil sector - and bottomed at 366 thousand SAAR in October 2016.

Click on graph for larger image.

Since 2016, heavy truck sales have increased to near the all time high (the high was 561 in April 2006).

Heavy truck sales were at 544 thousand SAAR in June, up from 537 thousand SAAR in May, and up from 485 thousand SAAR in June 2018.

Merrill: "Data cools call for July cuts"

by Calculated Risk on 7/08/2019 09:25:00 AM

A few excerpts from a Merrill Lynch research note:

The June employment report was strong with job growth of 224K ... leaving us comfortable with our view that the Fed will not cut in July and wait until September to deliver the first rate reduction. … last week's data were extremely important in dictating Fed action. So what did we learn? No fireworks from the G20 meeting, the ISM manufacturing index held in expansion territory at 51.7 and job creation was robust. The combination does not point to an immediate cut. At a minimum, this takes a 50bp cut off the table but should also prompt the Fed to argue for waiting for more data.

This puts the spotlight on Fed Chair Powell at the Semi-Annual Monetary Policy testimony on Wednesday. … We would argue that since the June meeting, the evidence suggests more positive news ... Indeed, even on the inflation front, the data have been better with an upward revision to 1Q core PCE inflation to 1.2% q/q saar from 1.0%, and the University of Michigan long-run inflation expectations revised up to 2.3% from 2.2%. … Powell ... can make the case that the data have been better than expected [and] note that the Fed remains vigilant and stands ready to act to prevent below-trend growth.

Sunday, July 07, 2019

Sunday Night Futures

by Calculated Risk on 7/07/2019 06:38:00 PM

Weekend:

• Schedule for Week of July 7, 2019

Monday:

• At 3:00 PM, Consumer Credit from the Federal Reserve.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $57.63 per barrel and Brent at $64.36 barrel. A year ago, WTI was at $74, and Brent was at $77 - so oil prices are down about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.75 per gallon. A year ago prices were at $2.85 per gallon, so gasoline prices are down about 4% year-over-year.

Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 7/07/2019 11:18:00 AM

By request, here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

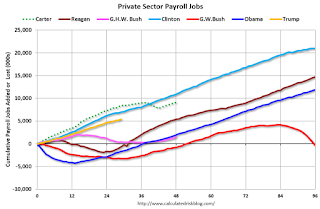

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (29 months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 821,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 382,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 20,979,000 under President Clinton (light blue), by 14,714,000 under President Reagan (dark red), 9,039,000 under President Carter (dashed green), 1,511,000 under President G.H.W. Bush (light purple), and 11,890,000 under President Obama (dark blue).

During the first 29 months of Mr. Trump's term, the economy has added 5,370,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 269,000 jobs).

During the first 29 months of Mr. Trump's term, the economy has added 243,000 public sector jobs.

After 29 months of Mr. Trump's presidency, the economy has added 5,613,000 jobs, about 429,000 behind the projection.