by Calculated Risk on 6/18/2011 11:11:00 AM

Saturday, June 18, 2011

Summary for Week Ending June 17th

You know it was a tough week when the “good news” was a smaller than expected decline in retail sales, and also a minor increase in housing starts. Of course the headlines were mostly about the financial crisis in Europe, especially in Greece. The next "bailout" for Greece is expected very soon.

The negative U.S. economic news included both the New York and Philadelphia Fed manufacturing surveys indicating contraction in June. Also Industrial Production in May edged up only slightly and capacity utilization was flat.

At the same time, core inflation picked up a little in May – so we saw slowing growth and a little more inflation – not good news for the economy (although oil and gasoline prices have fallen sharply, so measured inflation will probably moderate in June). Meanwhile consumer sentiment declined in the preliminary June reading.

This continues the recent trend of weak economic news - something that will probably continue next week with the release of existing and new home sales for May. Below is a summary of economic data last week mostly in graphs:

• Retail Sales declined 0.2% in May

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

On a monthly basis, retail sales decreased 0.2% from April to May (seasonally adjusted, after revisions), and sales were up 7.7% from May 2010.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 16.4% from the bottom, and now 2.3% above the pre-recession peak.

• Housing Starts increased in May

This graph shows total and single unit starts since 1968. Total housing starts were at 560 thousand (SAAR) in May, up 3.5% from the revised April rate of 541 thousand.

This graph shows total and single unit starts since 1968. Total housing starts were at 560 thousand (SAAR) in May, up 3.5% from the revised April rate of 541 thousand.

Single-family starts increased 3.7% to 419 thousand in May.

This was above expectations of 547 thousand starts in May. Multi-family starts are beginning to pickup - although from a very low level - but single family starts are still moving sideways.

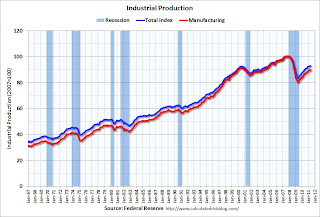

• Industrial Production edged up in May, Capacity Utilization unchanged

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.

Industrial production edged up slightly in May to 93.0. Capacity utilization for total industry was flat at 76.7 percent.

Both industrial production and capacity utilization have stalled recently. The was below the consensus of a 0.2% increase in Industrial Production in May, and an increase to 77.0% for Capacity Utilization.

• Core Measures of Inflation increased in May

"According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.1% annualized rate) in May. The 16% trimmed-mean Consumer Price Index increased 0.2% (2.8% annualized rate) during the month."

"According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.1% annualized rate) in May. The 16% trimmed-mean Consumer Price Index increased 0.2% (2.8% annualized rate) during the month."

Over the last 12 months, core CPI has increased 1.5%, median CPI has increased 1.5%, and trimmed-mean CPI increased 1.9%.

This graph shows these three measure of inflation on a year-over-year basis.

These measures all show that year-over-year inflation is still low, but increasing. Although the year-over-year increases are below the Fed's inflation target, the annualized rates were above the target in May.

• Philly Fed and NY Fed Manufacturing Surveys showed contraction in June

From the Philly Fed: June 2011 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from 3.9 in May to -7.7, its first negative reading since last September.From the NY Fed: Empire State Survey indicates contraction

The general business conditions index slipped below zero for the first time since November of 2010, falling twenty points to -7.8.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through June. The ISM and total Fed surveys are through May.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through June. The ISM and total Fed surveys are through May.This early reading suggests the ISM index could be below 50 in June - if so, this would be the lowest reading since mid-2009.

• NFIB: Small Business Optimism Index decreased in May

From National Federation of Independent Business (NFIB): Consumer Spending Remains Weak: Small Business Optimism Dips Lower in May

From National Federation of Independent Business (NFIB): Consumer Spending Remains Weak: Small Business Optimism Dips Lower in May This graph shows the small business optimism index since 1986. The index decreased to 90.9 in May from 91.2 in April.

This has been trending up, although optimism has declined for three consecutive months now.

• Consumer Sentiment declines in June

The preliminary June Reuters / University of Michigan consumer sentiment index declined to 71.8 from 74.3 in May.

The preliminary June Reuters / University of Michigan consumer sentiment index declined to 71.8 from 74.3 in May.In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. However, even with gasoline prices falling, consumer sentiment is mostly moving sideways at a low level.

This was below the consensus forecast of 74.0.

• Other Economic Stories ...

• Residential Remodeling Index increased in April

• Hotels: Occupancy Rate increased 3.0 percent compared to same week in 2010

• Lawler: CAR vs. “Reality,” and the NAR Benchmarking

• State Unemployment Rates "little changed" in May

• Lawler: Early Read on Existing Home Sales in May

• NAHB Builder Confidence index declined in June

Best wishes to all!

Unofficial Problem Bank list at 996 Institutions

by Calculated Risk on 6/18/2011 08:30:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 17, 2011.

Changes and comments from surferdude808:

This week a little bit of almost everything happened to the Unofficial Problem Bank List. There were three additions, two removals from failure, five removals from action termination, and two removals from unassisted mergers. The net of these changes leave the list with 996 institutions with assets of $416.7 billion.

The three additions include PBI Bank, Louisville, KY ($1.7 billion Ticker: PBIB); The Conway National Bank, Conway, SC ($942 million Ticker: CNBW); and Peoples National Bank, Niceville, FL ($ 121 million).

The failures include McIntosh State Bank, Jackson, GA ($340 million Ticker: MITB); and First Commercial Bank of Tampa Bay, Tampa, FL ($99 million). Action terminations include Heritage Bank of Commerce, San Jose, CA ($1.3 billion Ticker: HTBK); Cornerbank, National Association, Winfield, KS ($231 million); The First National Bank of Northfield, Northfield, MN ($126 million); First National Bank of Scottsdale, Scottsdale, AZ ($60 million); and Gladewater National Bank, Gladewater, TX ($31 million). Removals from unassisted mergers include Wilber National Bank, Oneonta, NY ($895 million Ticker: GIW); and First Community Bank of America, Pinellas Park, FL ($452 million Ticker: FCFL).

Perhaps next week the FDIC will release its actions issued during May 2011, until then practice safe & sound banking.

Friday, June 17, 2011

Here come the downgrades for Q2 GDP Growth

by Calculated Risk on 6/17/2011 10:04:00 PM

Another quarter, another round of growth downgrades ...

Earlier this week, Catherine Rampell at the NY Times Economix wrote: The Great Growth Disappointment

Second verse, same as the first: The quarter when the economy was supposed to stage its comeback is looking just as bad as its disappointing predecessor.And now from Jeff Cox at CNBC: Goldman Cuts GDP View to 2% as Economy Weakens (ht jb)

... after a major bummer of an inflation report, Macroeconomic Advisers, the highly respected forecasting firm, lowered its annualized second quarter G.D.P. forecast to 1.9 percent.

[Goldman Sachs] cut its second-quarter GDP outlook to 2 percent from 3 percent ... Goldman's move comes amid a week of disappointing manufacturing indicators from both the Philadelphia and New York Feds that compounded market fears over debt contagion from Greece and other peripheral eurozone nations. ...And Stehn concluded with this comment about Fed Chairman Ben Bernanke's press conference next week:

On the bright side, [economist Sven Jari] Stehn wrote that the firm still expects economic activity and GDP to pick up later in the year, though the bar has been raised.

"At this point, we still expect a bounceback in Q3 and beyond, but will need to see significant improvement in the data over the next few weeks to maintain that view," he said.

"Most likely, [Bernanke] will be 'balanced' by emphasizing both the disappointment in the activity indicators and the higher inflation data," Stehn said. "So the press conference is unlikely to be pleasant for either the chairman or his audience."Bernanke will also present the June FOMC forecasts and those forecasts should be weaker.

Bank Failures #46 & 47 in 2011: Georgia and Florida

by Calculated Risk on 6/17/2011 06:55:00 PM

Wont' keep the Feds far away

As McIntosh found.

by Soylent Green is People

From the FDIC: Hamilton State Bank, Hoschton, Georgia, Assumes All of the Deposits of McIntosh State Bank, Jackson, Georgia

As of March 31, 2011, McIntosh State Bank had approximately $339.9 million in total assets and $324.4 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $80.0 million. ... McIntosh State Bank is the 46th FDIC-insured institution to fail in the nation this year, and the thirteenth in Georgia.

Not by ye scurvy pirates...

Buccaneer banksters!

by Soylent Green is People

From the FDIC: Stonegate Bank, Fort Lauderdale, Florida, Assumes All of the Deposits of First Commercial Bank of Tampa Bay, Tampa, Florida

As of March 31, 2011, First Commercial Bank of Tampa Bay had approximately $98.6 million in total assets and $92.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $28.5 million. ... First Commercial Bank of Tampa Bay is the 47th FDIC-insured institution to fail in the nation this year, and the sixth in Florida.

Lawler: CAR vs. “Reality,” and the NAR Benchmarking

by Calculated Risk on 6/17/2011 04:09:00 PM

CR Note: The California Association of Realtors (CAR) released their May home sales data this week: May sales and price report

Economist Tom Lawler writes:

Using a “reasonable” estimate of the California Association of Realtors’ (CAR) seasonal factor for May (I have some history of CAR’s NSA numbers), the CAR’s May home sales report would imply an estimate of about 45,000 existing SF detached home sales on an unadjusted basis last month. That number is about 26.6% higher than Dataquick’s (DQ) count of new and existing sales of SF homes and condos in California last May, indicating that the CAR’s existing home sales estimates continue to vastly overstate overall existing home sales in the state.

CAR, of course, uses a methodology similar to the National Association of Realtors (NAR) to estimate existing home sales – it estimated total existing home sales (including sales outside of MLS) in 1999 based on data from the 2000 decennial Census and from the 2001 Residential Finance Survey, and then assumes that total existing home sales growth has been the same as MLS-reported home sales growth since then.

While CAR’s and DQ’s estimates of existing SF home sales in California were reasonably close in 2005 and 2006, they started to diverge significantly in 2007 and by even more so in 2008 and 2009 – with CAR’s estimate materially exceeding DQ’s estimates. Similar “gaps” emerged in other states between the NAR’s estimate of state sales and sales based on property records. Of course, I noted this growing gap back in 2009, and discussed some of the reasons why it was occurring. The gap gained media attention earlier this year following a piece by CoreLogic on the growing disparity between NAR estimates and property records data.

The NAR has pretty much acknowledged that its methodology has probably resulted in an overstatement of existing home sales over the past several years. Normally the NAR would wait for detailed Public Use Microdata Sample (PUMS) data from the decennial Census, as well as data from decennial Residential Finance Survey. These data come out with a long lag, and the NAR’s benchmark revisions for 1999 existing home sales didn’t come out until 2004.

The 2010 decennial Census, however, did not include the “long-form questionnaire” that provided many of the data elements needed for NAR’s decennial benchmarking exercise (the benchmarking methodology, seemed “OK” for principal residence purchases but seemed “iffy” for investor/vacant home sales). As such, the NAR cannot use the same benchmarking methodology as it has done – but just once a decade – in the past.

Recent media attention on what appears to be a growing gap between the NAR’s estimates and “actual” home sales has put pressure on the NAR to accelerate some sort of “rebenchmarking, leading the NAR in February to issue a set of “Q&A’s” on the topic, including this one.

Q: When will the new benchmarking take place?Since I have had discussions in the past with the NAR on this topic, a number of folks have asked me “what’s up” with the NAR’s benchmarking, and when will it release new existing home sales estimates? My answer is, “I don’t know,” and I’m not even sure what methodology the NAR will use.

A: In 2010 Census, a long-form questionnaire was not used. Therefore, the Census no longer asked about whether people moved and bought a home. So another brand new benchmarking process is needed. NAR has already been in contact with all key housing economists in the industry and government agencies and a few in the academia about finding a new benchmarking process. We expect a new clean, agreed-upon benchmark figure by the summer of this year.

In addition, we will be determining a new way to re-benchmark on a more frequent basis, possibly annually to lessen any drift that can accumulate over time. This frequent re-benchmarking, rather than wait every 10 years, is needed since the Census no longer collects the long-form questionnaire. As with all benchmarking, we will be working with various outside housing economists to develop a new-agreed upon method.

One approach NAR had been looking at was whether it could use data from either the American Community Survey (latest 2009) or the American Housing Survey (latest 2009, and small sample), to try to estimate existing home sales (note: the 2009 ACS/AHS would be used to estimate home sales over the second part of 2008 and the first part of 2009). Aside from the fact that (1) these data sources aren’t consistent; and (2) the housing stock estimates are not updated, these data sources also have nothing on investor/second homes. In my view this approach is fatally flawed.

A second approach favored by myself and most other housing economists is for the NAR to use property records wherever available, and to develop methodologies where property records are not available to derive sales estimates in these other areas. Relative to when the NAR first developed its “benchmarking” approach decades ago, there has been a dramatic increase in the availability of/access to property records across most of the country. As a result, in many parts of the country one can directly measure total and existing home sales – though there are some “technical” issues associated with excluding non-arms-length transactions and/or properties acquired by a lender/servicer via foreclosures, as well as in some states identifying new vs. existing homes.

This second approach, however, is not a trivial task. In many states property records are not updated in a timely fashion, and in some cases the lags from sale to recordation in publicly-available files can be pretty long. E.g., CoreLogic’s first published estimate of “non-distressed” existing home sales for the first half of 2010 (published in September 2010) was 1.191 million, but it’s latest count for the first half of 2010 (published in May 2011) was 1.352 million. Last August CL;s count of non-distressed existing homes for 2009 was 2.485 million, but this May’s count was 2.607 million.

There are also often issues on data quality/accuracy, file/data formats, etc., that require significant resources/attention. (The NAR could, of course, contract out this process.)

In addition, estimating sales in areas where no data are available is not a trivial task, and requires certain assumptions that may or may not be valid. Still, this approach is head and shoulders better than any approach using either the ACS or the AHS.

So ..(1) is the NAR going to follow the suggestions of competent housing economists and develop a benchmark based on property records? Don’t know. (2) Will the NAR come out with a new benchmark figure this summer? Don’t know, but if they do I’d bet it would not be based on property records, mainly because I doubt if they have had time to develop robust estimates (unless they have hired a third-party vendor to so do). (3) When they come out with a “benchmark” revision, what year will the benchmark number be for? Don’t know, but if they do it is likely because of data availability to be for either 2008 or 2009, and not 2010. And (4) if/when any benchmark revision comes out, will they show sizable downward revisions? For the 2008-2011 period, absolutely, regardless of what methodology the NAR employs.

CR Note: Now that summer is almost here (starts next week), maybe it is time for the NAR to provide an update on when the benchmark revision will be available - and perhaps some discussion of the new methodology. It is important to understand that the NAR estimates of home sales were probably too high over the last few years (perhaps 10% or more too high last year), and that their estimate of inventory was probably also too high.

This makes it difficult to analyze or use the data - and might have led to policy errors and also means the BEA probably overestimated the Brokers' commissions portion of Residential Investment (slightly) over the last few years!

Hotels: Occupancy Rate increased 3.0 percent compared to same week in 2010

by Calculated Risk on 6/17/2011 01:20:00 PM

Here is the weekly update on hotels from HotelNewsNow.com: STR: US results for week ending 11 June

In year-over-year comparisons for the week, occupancy rose 3.0 percent to 67.7 percent, average daily rate increased 3.5 percent to US$102.09, and revenue per available room finished the week up 6.6 percent to US$69.09.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average for the occupancy rate.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The summer leisure travel season is now starting, and the occupancy rate will increase over the next few of months. Right now the occupancy rate is tracking closer to 2008 than to 2010 - and well above 2009.

Even though the occupancy rate has mostly recovered back to 2008 levels, ADR and RevPAR are still below the pre-recession levels. ADR is about 3.4% below the level of the same week in 2008 and RevPAR is about 4.6% below.

ADR is up 6.6% from 2009 (same week) and RevPAR is up 17.2% (a combination of higher ADR and much higher occupancy rate - 2009 was the worst year for hotels since the Great Depression).

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com