by Calculated Risk on 6/14/2011 07:30:00 AM

Tuesday, June 14, 2011

NFIB: Small Business Optimism Index decreases in May

From National Federation of Independent Business (NFIB): Consumer Spending Remains Weak: Small Business Optimism Dips Lower in May

The Index of Small Business Optimism fell 0.3 points in May to 90.9. This month marks the third monthly decline in a row. The proximate cause is the fact that 1 in 4 owners still report weak sales as their top business problem. Consumer spending is weak, especially for “services,” a sector dominated by small businesses.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

...

Twenty-five (25) percent of the owners reported that weak sales continued to be their top business problem

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The first graph shows the small business optimism index since 1986. The index decreased to 90.9 in May from 91.2 in April.

This has been trending up, although optimism has declined for three consecutive months now.

The second graph shows the net hiring plans for the next three months.

Hiring plans declined in May and are slightly negative.

Hiring plans declined in May and are slightly negative. According to NFIB: “[I]ndications of minimal future growth include the fact that in the next three months, 13 percent plan to increase employment (down 3 points), and 8 percent plan to reduce their workforce (up 2 points). That yields a seasonally adjusted net negative 1 percent of owners planning to create new jobs, a 3 point loss from April."

Weak sales is still the top business problem with 25 percent of the owners reporting that weak sales continued to be their top business problem in May. In good times, owners usually report taxes and regulation as their biggest problems.

Weak sales is still the top business problem with 25 percent of the owners reporting that weak sales continued to be their top business problem in May. In good times, owners usually report taxes and regulation as their biggest problems.The recovery continues to be sluggish for this index, probably somewhat due to the high concentration of real estate related companies.

Monday, June 13, 2011

Q1 2011: Mortgage Equity Withdrawal strongly negative

by Calculated Risk on 6/13/2011 07:04:00 PM

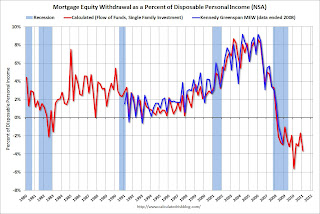

Special Note: Dr. James Kennedy has a new method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". I haven't evaluated his method yet (here is a companion spread sheet), so the following is using my old "simple" method.

Note 2: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity (hence the name "MEW", but there is little MEW right now!), normal principal payments and debt cancellation.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q1 2011, the Net Equity Extraction was minus $107 billion, or a negative 3.7% of Disposable Personal Income (DPI). This is not seasonally adjusted.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding declined sharply in Q1. Mortgage debt has declined by $634 billion over the last twelve quarters. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance. Note: most homeowners pay down their principal a little each month unless they have an IO or Neg AM loan, so with no new borrowing, equity extraction would always be slightly negative.

DataQuick: SoCal Home Sales Slow in May, Record Low New Home Sales

by Calculated Risk on 6/13/2011 02:43:00 PM

From DataQuick: Southland Home Sales, Median Price Post Steeper Declines From 2010

Southern California home sales held at a three-year low last month amid a sluggish move-up market and record-low sales of newly built homes. ...May was another month of sluggish home sales in SoCal, especially for new home sales. National existing home sales will be reported next week on Tuesday, June 21st, and new home sales will reported on June 23rd - and I expect weak reports.

A total of 18,394 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in May. That was up insignificantly – 0.3 percent – from 18,344 in April, and down 17.4 percent from 22,270 in May 2010, according to San Diego-based DataQuick. ... On average, sales between April and May have increased 5.7 percent since 1988, when DataQuick's statistics begin.

The 1,152 newly built homes that sold across the Southland last month marked the lowest new-home total for the month of May since at least 1988.

...

Distressed property sales continued to account for more than half of the Southland resale market last month, with little change from April. Roughly one out of three homes resold was a foreclosure, while about one in five was a “short sale,” where the sale price fell short of what was owed on the property.

Greece Downgraded Again

by Calculated Risk on 6/13/2011 01:02:00 PM

From the WSJ: Greece Gets Yet Another Downgrade (ht Kevin)

Standard & Poor’s just cut Greece’s debt rating to CCC from B, meaning Greek debt is “extremely speculative.” The outlook for Greek debt is “negative.”And from Reuters: LCH.Clearnet ups Irish, Portuguese bond repo marginThe downgrade reflects our view that there is a significantly higher likelihood of one or more defaults, as defined by our criteria relating to full and timely payment, linked to efforts by official creditors to close an emerging financing gap in Greece. This financing gap has emerged in part because Greece’s access to market financing in 2012 and possibly beyond, as envisaged in the current official EU/IMF program, is unlikely to materialize.

This lack of access, in our view, creates a gap between committed official financing and Greece’s projected financing requirements. Greece has heavy near-term financing requirements, with approximately EUR95 billion of Greek government debt maturing between now and the end of 2013 along with an additional EUR58 billion maturing in 2014.

Moreover, the downgrade reflects our view that implementation risks associated with the EU/IMF program are rising, given the increasingly complicated political environment in Greece coupled with its current difficult economic climate.

It raised the additional margin required to 65 percent from 45 percent for long positions on Portuguese government bonds when clearing transactions through its Repoclear service.The yield on the Portugal 10 year is at a new high (10.7%) and Ireland 10 year too (11.35%).

The equivalent Irish rate increased to 75 percent from 65 percent, LCH.Clearnet said in a statement on its website.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Misc: Flippers in Sacramento, and more "Hate" for Housing

by Calculated Risk on 6/13/2011 09:04:00 AM

A couple of articles ...

• From the Sacramento Bee: Real estate scavengers flip foreclosed homes in Sacramento area (ht picosec)

As more Sacramento homes slip into foreclosure, scores of house "flippers" have swooped in to buy properties ... and sell them for quick profits.This is very different than "flippers" during the boom. Back then flippers used highly leveraged financing and held the properties off the market for some time (a type of storage). These new flippers usually pay cash and try to sell as quickly as possible.

... if the price is right, investors pounce. They snag a fifth of foreclosures in the region, according to figures from real estate tracking firm DataQuick Information Systems.

Eighty percent of these homes will be flipped within a year. Typically, they will fetch about $30,000 – or 20 percent – more than the flipper paid.

Flippers often pay cash and buy starter or midlevel homes.

For a discussion of speculation and storage, see my April 2005 post: Speculation is the Key

• And from the TimesUnion: To buy, or not to buy, a home? (ht Justin)

[F]our years after the bubble began losing air, the challenge is to determine where the market is headed. Is the worst behind us? Or is the bubble continuing to deflate?Yes - in 2005 it seemed everyone was getting rich, and people didn't want to be left behind. Besides house prices never went down (Greenspan said so), and it was easy to get a loan - even with no income and no job - and buy a home with no money down. What could go wrong?

Many potential buyers, locally and nationally, seem convinced of the latter. ... Brokers say attitudes among potential buyers have changed. Once the desire to own a home burned red-hot at any price, in part because housing was seen as a way to quickly build a nest egg.

Now, the mood toward housing seems almost indifferent, agents say, despite low interest rates and dramatically improved conditions for buyers.

Weekend:

• Summary for Week Ending June 10th

• Schedule for Week of June 12th

• Updated List: Ranking Economic Data

Sunday, June 12, 2011

Greece Update

by Calculated Risk on 6/12/2011 10:15:00 PM

Everyone is focused on June 20th when the 17 euro zone ministers will meet in Luxembourg. There is also a meeting on Tuesday this week (June 14th), although there will not be a press conference following the meeting. Someone will probably blink before the 20th.

So next Sunday might be the new Monday once again (like during the U.S. financial crisis)!

From Landon Thomas at the NY Times: In Greece, Some See a New Lehman

Bond traders and officials at the European Central Bank have been unified in their warnings that a restructuring of Greece’s debt would set off an investor panic similar to the one that followed the bankruptcy of Lehman Brothers.Here was the article from Kash at the Street Light: Betting On the PIGs

... if they are forced to take a loss, and the ratings agencies declare Greece in default, investors [might] start selling in a panic. And they [might] not sell just the bonds of countries struggling with debt — Portugal, Ireland, Spain and Italy.

...

According to a recent report by Fitch, as of February, 44.3 percent of prime money market funds in the United States were invested in the short-term debt of European banks.

...

Citing recent data from the Bank for International Settlements, the blog points out that in the event of a Greek default, direct creditors would be on the hook for 70 percent of the losses, with credit default insurance picking up the rest. Thus, if one includes credit default exposure, American exposure to Greece increases from $7.3 billion to $41.4 billion.

And an update today from Kash: Greece Endgame, pt. 2

Earlier:

• Summary for Week Ending June 10th

• Schedule for Week of June 12th

• Updated List: Ranking Economic Data