by Calculated Risk on 6/04/2011 04:15:00 PM

Saturday, June 04, 2011

Greece Update: Creditors asked to accept longer maturities

From the WSJ: Greece Creditors Must Give €30 billion to Bailout

Euro-zone governments have reached a tentative deal ... that will seek roughly €30 billion in contributions from the country's private-sector creditors ...This will be "voluntary" and not trigger a "credit event", but the alternative - according to one official - is default.

[additional] financing will likely come with the condition that the banks, pensions funds and other investors holding Greek bonds agree to exchange them for new bonds with a longer maturity to help fill Greece's financing gap over the next three years

Earlier:

Summary for Week Ending June 3rd

Friday employment posts:

• May Employment Report: 54,000 Jobs, 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Birth/Death Model and Unemployment by Duration and Education

• Employment graph gallery

Summary for Week Ending June 3rd

by Calculated Risk on 6/04/2011 10:56:00 AM

We expected to see a series of weak economic reports last week - falling house prices, weak auto sales, lower ISM manufacturing index, and a weak labor report - and unfortunately that is exactly what happened.

The employment situation report was very disappointing. There were few jobs created (only 54,000 total and 83,000 private sector), and the unemployment rate increased from 9.0% to 9.1%, even though the participation rate was unchanged at 64.2%.

We have to remember that this is just one month – but it was a dismal month. So far the economy has added 908,000 private sector jobs this year, or about 181 thousand per month. The economy has added 783,000 total non-farm jobs this year or 157 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.95 million fewer payroll jobs than at the beginning of the 2007 recession.

The overall employment numbers are very grim: There are a total of 13.9 million Americans unemployed, another 8.5 million working part time for economic reasons, and probably around 4 million more who have just given up looking for a job. And almost half the unemployed - 6.2 million workers - have been unemployed for more than 6 months.

On house prices, Case-Shiller reported that their National Index, and 20 city Composite Index, both hit new post-bubble lows at the end of Q1. David M. Blitzer, Chairman of the Index Committee at S&P Indices said: "Home prices continue on their downward spiral with no relief in sight. Since December 2010, we have found an increasing number of markets posting new lows." However later in the week - and with little press coverage - CoreLogic reported their house price index increased 0.7% in April.

Both auto sales and manufacturing overall were weak in May, although some of this was probably due to supply chain issues in Japan. The good news is the supply issues are being resolved ahead of schedule, so there will probably be a pickup in auto sales in June or July.

But overall this was a very weak week – and May was a very weak month for economic data.

Below is a summary of economic data last week mostly in graphs:

• May Employment Report: 54,000 Jobs, 9.1% Unemployment Rate

The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The unemployment rate increased to 9.1% (red line).

The Labor Force Participation Rate was unchanged at 64.2% in May (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the decline is due to the aging population.

The Employment-Population ratio was unchanged at 58.4% in May (black line).

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The current employment recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only the early '80s recession with a peak of 10.8 percent was worse).

This was well below expectations for payroll jobs, and the unemployment rate was higher than expected (both worse). Here are the employment posts from yesterday:

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Birth/Death Model and Unemployment by Duration and Education

• Employment graph gallery

• Case Shiller: National Home Prices Hit New Post-Bubble Low

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).The Composite 10 index is off 31.8% from the peak, and down 0.1% in March (SA). The Composite 10 is still 1.6% above the May 2009 post-bubble bottom (Seasonally adjusted).

The Composite 20 index is off 31.6% from the peak, and down 0.2% in March (SA). The Composite 20 is only 0.1% above the May 2009 post-bubble bottom seasonally adjusted, and at a new post-bubble low not seasonally adjusted (NSA).

The next graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 7 of the 20 Case-Shiller cities in March seasonally adjusted. Prices in Las Vegas are off 58.3% from the peak, and prices in Dallas only off 7.7% from the peak.

Prices increased (SA) in 7 of the 20 Case-Shiller cities in March seasonally adjusted. Prices in Las Vegas are off 58.3% from the peak, and prices in Dallas only off 7.7% from the peak.From S&P (NSA):

“Home prices continue on their downward spiral with no relief in sight.” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “Since December 2010, we have found an increasing number of markets posting new lows. In March 2011, 12 cities - Atlanta, Charlotte, Chicago, Cleveland, Detroit, Las Vegas, Miami, Minneapolis, New York, Phoenix, Portland (OR) and Tampa - fell to their lowest levels as measured by the current housing cycle.

• ISM Manufacturing index shows slower expansion in May

From the Institute for Supply Management: May 2011 Manufacturing ISM Report On Business®

From the Institute for Supply Management: May 2011 Manufacturing ISM Report On Business® PMI was at 53.5% in May, down sharply from 60.4% in April. The employment index was at 58.2 and new orders at 51.0. (above 50 indicates expansion).

Here is a long term graph of the ISM manufacturing index.

This was well below expectations of 57.5%, but pretty much in line with the regional surveys.

• U.S. Light Vehicle Sales 11.8 million SAAR in May

Based on an estimate from Autodata Corp, light vehicle sales were at a 11.79 million SAAR in May. That is up 1.5% from May 2010, and down 10.2% from the sales rate last month (April 2011).

Based on an estimate from Autodata Corp, light vehicle sales were at a 11.79 million SAAR in May. That is up 1.5% from May 2010, and down 10.2% from the sales rate last month (April 2011).This graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

This was well below the absurd consensus estimate of 12.8 million SAAR. It is difficult to tell how much of the decline is due to supply chain issues - but my guess is we see a bounce back over the next few months.

• ISM Non-Manufacturing Index indicates slightly faster expansion in May

From the Institute for Supply Management: May 2011 Non-Manufacturing ISM Report On Business®

From the Institute for Supply Management: May 2011 Non-Manufacturing ISM Report On Business® The May ISM Non-manufacturing index was at 54.6%, up from 52.8% in April. The employment index increased in May at 54.0%, up from 51.9% in April. Note: Above 50 indicates expansion, below 50 contraction.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

Both moved up slightly in May, and this was slightly above expectations.

• Construction Spending increased 0.4% in April

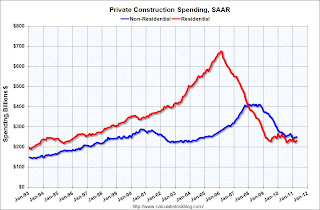

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.The small increase in non-residential in April was mostly due to power. Office and lodging construction spending declined.

Residential spending is 65.7% below the peak in early 2006, and non-residential spending is 39.4% below the peak in January 2008.

I expect residential spending to pick up a little this year (mostly multifamily) - and residential will probably be above non-residential spending by the end of the year.

• Other Economic Stories ...

• The Excess Vacant Housing Supply

• Lawler: Census 2010 and the US Homeownership Rate

• Real House Prices and Price-to-Rent: Back to 1999

• CoreLogic: Home Price Index increased 0.7% between March and April

• Restaurant Performance Index indicates expansion in April

• Chicago PMI shows sharply slower growth, Manufacturing Activity Expands in Texas

• ADP: Private Employment increased by 38,000 in May

Best wishes to all!

Unofficial Problem Bank list at 997 Institutions

by Calculated Risk on 6/04/2011 08:15:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 3, 2011. (new format)

Changes and comments from surferdude808:

It was a quiet week for the Unofficial Problem Bank List as there was only one removal and one addition. Thus, the institution count remains unchanged at 997 but assets increased by $1.3 billion to $416.7 billion.Yesterday ...

The removal was the failed Atlantic Bank and Trust, Charleston, SC ($208 million) and the addition was Tennessee Commerce Bank, Franklin, TN ($1.5 billion Ticker: TNCC).

Given the quiet week, it gives us a chance to circle back to comments we made on March 25th and retraction on April 1st. We originally published commentary on how the FDIC has not enforced cross-guaranty against Capital Bancorp when one of their subsidiaries failed. Subsequently, we issued a retraction and apology on April 1st based on a message sent by Angela Kimber, Director of Communications, Capitol Bancorp Limited, that said the comments were inaccurate as "...none of Capitol Bancorp's subsidiaries have failed."

Well, it feels like we were punked by Angela Kimber, as a bank controlled by Capitol Bancorp -- Commerce Bank of Southwest Florida, Fort Myers, FL -- failed on November 20, 2009 costing the FDIC an estimated $23.6 million, whose cost has been subsequently been raised to $30.6 million (See FDIC Press Release).

The FDIC has issued at least 12 cross guaranty waivers to facilitate sales of Capitol Bancorp affiliates as part of its recapitalization efforts. The latest waiver was issued to a Capital Bancorp affiliate in North Carolina -- Community Bank of Rowan, Salisbury, NC (See from FDIC). Within this waiver, the FDIC states:

" WHEREAS, on November 20, 2009, Commerce Bank of Southwest Florida, Fort Myers, Florida (Commerce) failed and caused a loss to the Federal Deposit Insurance Corporation (FDIC); and WHEREAS, at the time of its failure, Commerce was controlled by Capitol Bancorp, Ltd., Lansing, Michigan, a bank holding company (BHC)."Over the past few weeks, CR has sent several email requests and phone messages to Angela Kimber requesting clarification on the cross-guaranty waivers and the basis for the retraction request (subsidiary versus control). CR also asked for a list of all Prompt Corrective Actions for banks controlled by Capitol. All CR received two weeks ago from Ms. Kimber was a list of PCAs, a web link to Capitol Bancorp's affiliates and their history. Ms. Kimber wrote that the banks with Prompt Corrective Actions are Bank of Las Vegas, Central Arizona Bank, Michigan Commerce Bank and Sunrise Bank of Arizona.

However this is non-responsive on the issue of subsidiary versus control.

Although no clarification was received, it appears the argument put forth by Capitol Bancorp that none of its subsidiaries has failed is highly technical and is essentially nothing more than hair splitting. In short, the ownership threshold to be a "subsidiary" requiring financial consolidation is typically 50 percent. Hence, Capitol Bancorp likely owned less than 50 percent of Commerce Bank of Southwest Florida, but it owned a sufficient share or exercised sufficient management influence to meet the "commonly controlled" definition in the cross-guarantee powers in the FDIC Act. The cross-guarantee provisions would allow the FDIC to assess Capitol Bancorp for the $30.6 million resolution cost. The main thrust of the March 25th comments were that the FDIC has pursued a strategy to let Capitol Bancorp sell certain banks in the hope of avoiding a larger and perhaps more costly failure event and that this strategy could be imperiled by the recent Prompt Corrective Action orders issued against several banks controlled by Capitol Bancorp.

Thus, we withdraw our retraction and stand by the thrust of our comments as originally published on March 25th. Perhaps Ms. Kimber forgot to add April Fools to her retraction request.

• May Employment Report: 54,000 Jobs, 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Birth/Death Model and Unemployment by Duration and Education

• Employment graph gallery

Friday, June 03, 2011

Bank Failure #45 in 2011: Atlantic Bank and Trust, Charleston, South Carolina

by Calculated Risk on 6/03/2011 07:15:00 PM

Slamming into a debt wall

Oceanic fail.

by Soylent Green is People

From the FDIC: First Citizens Bank and Trust Company, Inc., Columbia, South Carolina, Assumes All of the Deposits of Atlantic Bank and Trust, Charleston, South Carolina

As of March 31, 2011, Atlantic Bank and Trust had approximately $208.2 million in total assets and $191.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $36.4 million. ... Atlantic Bank and Trust is the 45th FDIC-insured institution to fail in the nation this year, and the second in South Carolina.

Earlier employment posts (with graphs):

• May Employment Report: 54,000 Jobs, 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Birth/Death Model and Unemployment by Duration and Education

• Employment graph gallery

Birth/Death Model and Unemployment by Duration and Education

by Calculated Risk on 6/03/2011 03:21:00 PM

Last month I mentioned that anyone who subtracts the Not Seasonally Adjusted (NSA) birth/death model numbers from the headline SA payroll employment is making a mistake. Unfortunately some sites are still making this error.

Here is a post I wrote last month Employment: A comment on the Birth/Death Model. The key point is that the Birth/Death model minimizes the primary sampling error due to employment growth generated by new business formations. The model does miss turning points, but the BLS is now updating the estimation quarterly, and this should minimize the errors.

Second, the graph server took the surge in traffic this morning as an "attack". This unfortunately caused some errors when clicking on the graphs for larger images (many readers just saw text). I apologize for the inconvenience.

Second, the graph server took the surge in traffic this morning as an "attack". This unfortunately caused some errors when clicking on the graphs for larger images (many readers just saw text). I apologize for the inconvenience.

Here is a repeat of the offending graph. If you click on the graph, the graph gallery should open with all of the employment related graphs (the tabs at the top of the gallery are for other topics: housing, house prices, manufacturing, etc.)

Here are a few more graphs based on the employment report ...

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.In general, all four categories are trending down, although the "27 weeks and over" category increased sharply this month.

Note that the "less than 5 weeks" used to be much higher, even during periods of strong job growth. This is probably because of a change in hiring practices that resulted in less turnover.

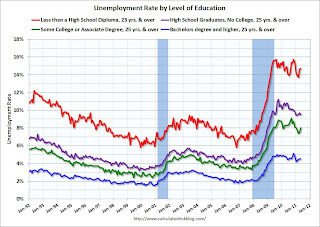

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down, although only "High School Graduates, No College, 25 yrs. & over" decreased in May.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment (all four categories are only gradually declining).

This is a little more technical. The BLS diffusion index for total private employment was at 53.6 in May, and for manufacturing, the diffusion index decreased to 54.9.

This is a little more technical. The BLS diffusion index for total private employment was at 53.6 in May, and for manufacturing, the diffusion index decreased to 54.9. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.The decline in both indexes was another negative in the May employment report.

Best to all

Here are the earlier employment posts (with graphs):

• May Employment Report: 54,000 Jobs, 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Employment graph gallery

ISM Non-Manufacturing Index indicates slightly faster expansion in May

by Calculated Risk on 6/03/2011 12:28:00 PM

Note: The traffic this morning overwhelmed the graph server. I'm working with the provider, and it appears everything is OK now. Here is the Employment graph gallery.

The May ISM Non-manufacturing index was at 54.6%, up from 52.8% in April. The employment index increased in May at 54.0%, up from 51.9% in April. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: May 2011 Non-Manufacturing ISM Report On Business®

activity in the non-manufacturing sector grew in May for the 18th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI registered 54.6 percent in May, 1.8 percentage points higher than the 52.8 percent registered in April, and indicating continued growth at a faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index decreased 0.1 percentage point to 53.6 percent, reflecting growth for the 22nd consecutive month, but at a slightly slower rate than in April. The New Orders Index increased by 4.1 percentage points to 56.8 percent. The Employment Index increased 2.1 percentage points to 54 percent, indicating growth in employment for the ninth consecutive month and at a faster rate. The Prices Index decreased 0.5 percentage point to 69.6 percent, indicating that prices increased at a slightly slower rate in May when compared to April. According to the NMI, 16 non-manufacturing industries reported growth in May. Respondents' comments are mostly positive about overall business conditions. There is a sentiment that there is a degree of stability in the economy; however, a continued concern exists over fuel costs and various volatile commodities."

emphasis added

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

Both moved up slightly in May, and this was slightly above expectations (a first for this week!)

Earlier Employment posts:

• May Employment Report: 54,000 Jobs, 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Employment graph gallery