by Calculated Risk on 6/02/2011 08:40:00 AM

Thursday, June 02, 2011

Weekly Initial Unemployment Claims decline slightly to 422,000

The DOL reports on weekly unemployment insurance claims:

In the week ending May 28, the advance figure for seasonally adjusted initial claims was 422,000, a decrease of 6,000 from the previous week's revised figure of 428,000. The 4-week moving average was 425,500, a decrease of 14,000 from the previous week's revised average of 439,500.The following graph shows the 4-week moving average of weekly claims for the last 40 years.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 425,500.

This is the eight straight week with initial claims above 400,000, and the 4-week average is at about the same the level as in January when there were fewer payroll jobs being added.

Wednesday, June 01, 2011

Restaurant Performance Index indicates expansion in April

by Calculated Risk on 6/01/2011 10:29:00 PM

Earlier today the economic data was weak:

• ADP: Private Employment increased by 38,000 in May

• ISM Manufacturing index declines to 53.5 in May

• U.S. Light Vehicle Sales 11.8 million SAAR in May

The restaurant index is one of several industry specific indexes I track each month. The following report is for April.

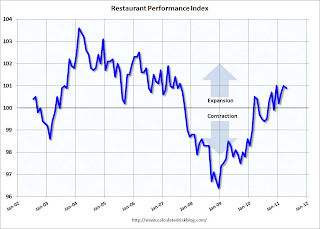

From the National Restaurant Association: Restaurant Industry Outlook Remains Positive as Restaurant Performance Index Stood Above 100 for Fifth Consecutive Month

The National Restaurant Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.9 in April, essentially unchanged from a level of 101.0 in March. In addition, April represented the fifth consecutive month in which the RPI stood above 100, which signifies expansion in the index of key industry indicators.

...

Restaurant operators continued to report net positive same-store sales results in April. ... Restaurant operators also reported a net increase in customer traffic in April, although levels were somewhat softer than the March results.

...

Capital spending activity among restaurant operators trended upward in recent months. Forty-eight percent of operators said they made a capital expenditure for equipment, expansion or remodeling during the last three months, the highest level in nearly three years.

...

For the seventh consecutive month, restaurant operators reported a positive outlook for staffing levels in the coming months.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The index decreased to 100.9 in April (above 100 indicates expansion).

Unfortunately the data for this index only goes back to 2002.

This report was for April, and the economy clearly slowed in May (so the report next month will be interesting). This is a minor report (really not even "D-List" data), but I'd expect discretionary spending to slow sharply if consumers become really worried.

Construction Spending increased 0.4% in April

by Calculated Risk on 6/01/2011 06:55:00 PM

Catching up ... this morning from the Census Bureau reported that overall construction spending increased in April:

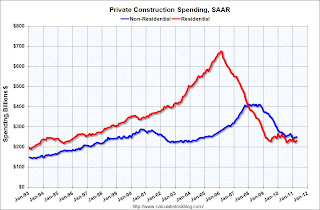

[C]onstruction spending during April 2011 was estimated at a seasonally adjusted annual rate of $765.0 billion, 0.4 percent (±1.6%) above the revised March estimate of $762.1 billion. The April figure is 9.3 percent (±1.6%) below the April 2010 estimate of $843.1 billion.Private construction spending also increased in April:

Spending on private construction was at a seasonally adjusted annual rate of $483.0 billion, 1.7 percent (±1.4%) above the revised March estimate of $474.7 billion. Residential construction was at a seasonally adjusted annual rate of $232.1 billion in April, 3.1 percent (±1.3%) above the revised March estimate of $225.1 billion. Nonresidential construction was at a seasonally adjusted annual rate of $250.8 billion in April, 0.5 percent (±1.4%)* above the revised March estimate of $249.6 billion.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

The small increase in non-residential in April was mostly due to power. Office and lodging construction spending declined.

Residential spending is 65.7% below the peak in early 2006, and non-residential spending is 39.4% below the peak in January 2008.

I expect residential spending to pick up a little this year (mostly multifamily) - and residential will probably be above non-residential spending by the end of the year.

U.S. Light Vehicle Sales 11.8 million SAAR in May

by Calculated Risk on 6/01/2011 04:00:00 PM

A few comments:

• Obviously the Japanese supply chain disruption impacted auto sales significantly in May. This has also negatively impacted manufacturing overall, and at least partially explains why the ISM manufacturing index was down sharply in May. The ISM employment index was still fairly strong, suggesting many manufacturers view this as a short term issue.

• The good news is the supply issues are being resolved ahead of schedule. From Edmunds.com:

“Manufacturing disruptions appear to have peaked in April and May, and recent news points to steady improvements moving forward,” said Lacey Plache, chief economist at Edmunds.com. “Toyota said it expects North American production of its top-selling Camry and Corolla models to be back at 100 percent next month, and Nissan’s key engine plant in Japan is returning to full production next week – ahead of schedule next week. Even Honda, which was the hardest hit of the big three Japanese automakers, is making optimistic statements about its recovery."• The automakers lowered their incentives in May, and this also impacted sales. From TrueCar.com:

“Even though incentives are their lowest in nine years, we believe this is an anomaly and expect incentives to climb again in June.”• It is difficult to tell how much of the recent slowdown is related to supply chain issues, and how much is related to other issues (high oil and gasoline prices, weakness in housing, European financial crisis, government cutbacks, etc), but we should see a bounce back in auto sales over the next few months because most of this decline appears to be from temporary factors.

TrueCar.com estimated that the average incentive for light-vehicles was $2,017 in May 2011, down $822 (28.9 percent) from May 2010 and down $304 (13.1 percent) from April 2011.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Based on an estimate from Autodata Corp, light vehicle sales were at a 11.79 million SAAR in May. That is up 1.5% from May 2010, and down 10.2% from the sales rate last month (April 2011).

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for May (red, light vehicle sales of 11.79 million SAAR from Autodata Corp).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.Note: dashed line is current estimated sales rate.

This was well below the absurd consensus estimate of 12.8 million SAAR. As mentioned above, it is difficult to tell how much of the decline is due to supply chain issues - but my guess is we see a bounce back over the next few months.

CoreLogic: Home Price Index increased 0.7% between March and April

by Calculated Risk on 6/01/2011 01:55:00 PM

Notes: Case-Shiller is the most followed house price index, but CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average of February, March, and April (April weighted the most) and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® Home Price Index Shows First Month-over-Month Increase since mid-2010

CoreLogic ... today released its April Home Price Index (HPI) which shows that home prices in the U.S. increased on a month-to-month basis by 0.7 percent between March and April, 2011, the first such increase since the home-buyer tax credit expired in mid-2010. However, national home prices, including distressed sales, declined by 7.5 percent in April 2011 compared to April 2010 after declining by 6.8 per cent in March 2011 compared to March 2010. Excluding distressed sales, year-over-year prices declined by 0.5 percent in April 2011 compared to April 2010.I was expecting the CoreLogic index to increase over the summer because it is not seasonally adjusted, however the seasonal increases usually start in June (when the Spring home purchases start to closes). This is just one data point, but it is possible this index will have small increases all summer.

...

"While the economic recovery is still fragile and one data point is not a trend, the month-over-month increase based on April sales activity is a positive sign. ..." said Mark Fleming, chief economist for CoreLogic.

I'll have more later (and hopefully a graph).

General Motors: U.S. May sales decrease 1.2% year-over-year

by Calculated Risk on 6/01/2011 11:07:00 AM

From MarketWatch: General Motors U.S. May sales fall 1.2%

[GM] said Wednesday that May U.S. car sales fell 1.2% to 221,192 vehicles from 223,822 a year ago.The key number for the economy is the seasonally adjusted annual sales rate (SAAR) compared to the last few months, not the year-over-year comparison provided by the automakers. Once all the reports are released, I'll post a graph of the estimated total May light vehicle sales (SAAR) - usually around 4 PM ET.

The consensus is for a decrease to 12.8 million SAAR in May from 13.2 million SAAR in April, however I think we will see a sharper decline because of supply chain issues. Sales in May 2010 were at a 11.62 million SAAR. I'll add the reports from the other major auto companies as updates to this post.

Update from MarketWatch: Ford U.S. May sales virtually flat

Ford said Wednesday U.S. May sales were virtually flat, declining 0.1% to 192,102 vehicles, compared with 192,253 in the year-ago period.Yesterday on housing:

• Case Shiller: National Home Prices Hit New Low in 2011 Q1

• Real House Prices and Price-to-Rent: Back to 1999

• The Excess Vacant Housing Supply

• Lawler: Census 2010 and the US Homeownership Rate

• Home Prices Graph Gallery