by Calculated Risk on 5/18/2011 10:50:00 AM

Wednesday, May 18, 2011

Is REW the new MEW? (Retirement Equity Withdrawal)

Reader "Soylent Green is People" asks if Retirement Equity Withdrawal is replacing Mortgage Equity Withdrawal (MEW) for those in need?

Borrowing from retirement accounts has definitely increased. From CNBC two weeks ago: More Americans Raiding Retirement Funds Early

... 19 percent of Americans — including 17 percent of full-time workers — have been compelled to take money from their retirement savings in the last year to cover urgent financial needs, the Financial Security Index found.And from a new study by Aon Hewitt: Leakage of Participants’ DC Assets: How Loans, Withdrawals, and Cashouts Are Eroding Retirement Income Note: "DC" is Defined Contribution - like a 401(k) plan.

As of year-end 2010, nearly 28% of active participants had a loan outstanding, which is a record high. Nearly 14% of participants initiated new loans during 2010, slightly higher than previous years. The average balance of the outstanding amount was $7,860, which represented 21% of these participants’ total plan assets.Hmmm ... $7,860 is 21% of total assets? That means the average total balance is less than $40,000 for participants who borrow from a DC plan.

Also - check out page 4 of the Aon Hewitt study. The 2nd graph shows that 32.8% of participants in the 40 to 49 age cohort have DC loans, and 29.0% in the 50 to 59 age cohort have loans. These people have next to nothing in their retirement plans and most will probably have to rely on Social Security if they ever retire.

Note: Politicians are trying to limit this borrowing, from Bloomberg: Senate Bill Would Limit Using 401(k)s as Rainy-Day Funds

My feeling is REW isn't really the new MEW. The size is much smaller, and this borrowing is much more need related as opposed to buying bigger toys, or being used for home improvement. But as "Soylent Green is People" suggested in his email to me, this reliance on REW is "an indicator of financial peril".

MBA: Mortgage Purchase application activity decreases, Refinance activity increases

by Calculated Risk on 5/18/2011 07:52:00 AM

The MBA reports: Mortgage Refinance Applications Increase in Latest MBA Weekly Survey

Refinance Index increased 13.2 percent from the previous week and is at its highest level since the week ending December 10, 2010. The seasonally adjusted Purchase Index decreased 3.2 percent from one week earlier.

...

“The 30-year fixed mortgage rate is now 53 basis points below its 2011 peak, and has decreased for five straight weeks,” said Michael Fratantoni, MBA’s Vice President of Research. “Over this five week span, the refinance index has increased by about 33 percent. Refinance application volumes remain about 50 percent below the most recent peak last October. ”

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.60 percent from 4.67 percent, with points decreasing to 0.94 from 1.10 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the lowest 30-year rate recorded in the survey since the end of November 2010.

Click on graph for larger image in graph gallery.

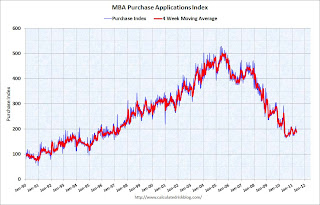

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

Refinance activity increased as mortgage rates fell to the lowest level since November 2010.

The four week average of purchase activity is at about 1997 levels, although this doesn't include the very high percentage of cash buyers. This suggests weak existing home sales through June (not counting cash buyers).

AIA: Architecture Billings Index indicates declining demand in April

by Calculated Risk on 5/18/2011 12:05:00 AM

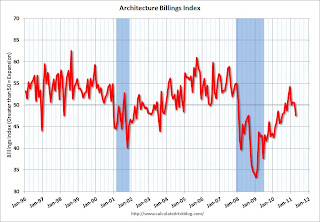

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From Reuters: US architecture billings index falls in April-AIA

The architecture billings index fell almost 3 points last month to 47.6, a level that indicates declining demand for architecture services, according to the American Institute of Architects (AIA).

...

"The majority of firms are reporting at least one stalled project in-house because of the continued difficulty in obtaining financing," said AIA Chief Economist Kermit Baker. "That issue continues to be the main roadblock to recovery, and is unlikely to be resolved in the immediate future."

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the Architecture Billings Index since 1996. The index showed billings decreased in April (index at 47.6, anything below 50 indicates a decrease in billings).

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction.

Tuesday, May 17, 2011

LPS: Delinquencies edge up in April, FNC: Non-Distressed House Prices stable in March

by Calculated Risk on 5/17/2011 10:07:00 PM

A couple of stories:

• From LPS "first look" report: April Month-End Data Shows an Increase in Delinquency Rate and Drop in Foreclosure Inventories. After the sharp drop in delinquencies in March, the delinquency rate edged up in April.

The delinquency rate increased to 7.97% from 7.78% in March. There were an additional 4.14% of mortgage in the foreclosure process, down from 4.21% in March.

A total of 6.39 million loans were delinquent, up slightly from 6.33 million. The full report will be released on May 26th. Note: The Q1 delinquency report from the MBA will be released this Thursday and will probably show a sharp decline in delinquencies.

• From FNC: March Home Prices Show Improving Trends - Rising 0.1% from February. This is one of several house price indexes I'm following in addition to Case-Shiller and CoreLogic. This is non-distressed sales.

FNC announced Wednesday that U.S. home prices in March continue to show signs of stabilization following rather mild declines in February, making March the second consecutive month with better-than-expected price momentum.Note: This is a hedonic price index using both sales and real-time appraisals. In general it has tracked pretty well with Case-Shiller and CoreLogic.

Based on the latest data on non-distressed home sales (existing and new homes), FNC’s Residential Price Index™ 1 (RPI) indicated that single-family home prices in March trended slightly upward since February at a seasonally unadjusted rate of 0.1%, consistent with rising home sales during the month. Despite continued downward price pressure from a relatively high volume of foreclosure sales, March marks the first month that home prices have shown a modest one-month gain since the April 2010 expiration of the homebuyer tax credits.

FNC has data online for 30 MSAs here.

Earlier:

• Housing Starts decline in April

• Industrial Production unchanged in April, Capacity Utilization declines slightly

• Multi-family Starts and Completions, and Quarterly Starts by Intent

High Gasoline Prices impacting consumers

by Calculated Risk on 5/17/2011 07:37:00 PM

From Motoko Rich and Stephanie Clifford at the NY Times: In Consumer Behavior, Signs of Gas Price Pinch

“Our customers are consolidating trips due to higher gas prices,” said Bill Simon, who oversees the [WalMart] United States business.And a similar article from Miguel Bustillo at the WSJ: Fewer Trips to Stores Hurt Wal-Mart, Lowe's

...

“Rising gas and energy prices are cited by homeowners as the top factor affecting future spending plans, followed by the state of the overall economy and inflation in general,” said Lowe’s chief executive, Robert A. Niblock, explaining earnings that missed analyst expectations in a call with investors.

MasterCard Advisors SpendingPulse, which researches consumer spending, reported on Tuesday that the gallons of gas pumped nationwide in the last month fell by 1 percent from the same period a year ago.

The price of gas has remained close to $4 a gallon in May. The national average was $3.94 Tuesday morning, according to the automotive group AAA, up substantially from $2.87 a year ago.These reports from Home Depot, Lowe's and WalMart were all for Q1, and oil prices averaged close to $95 per barrel (WTI) in Q1, and even with the recent decline - that is below the current price of $98 per barrel. So April and May (so far) were probably worse for these retailers since gasoline prices were even higher than in Q1.

Lawler: The “Excess Supply of Housing” War

by Calculated Risk on 5/17/2011 03:45:00 PM

CR Note: A key piece of data for the housing market - and the U.S. economy - is the current number of excess vacant housing units.

Unfortunately it is very difficult to get a good handle on this excess supply (it is large, but how large?). Both Tom Lawler and I are hopeful that we can arrive at a more accurate estimate using the Census 2010 data to be released this month (the estimate will be as of April 1, 2010).

Please excuse Tom's punctuation - but he has been arguing for better housing data for years - and he is clearly frustrated!

By Tom Lawler: The “Excess Supply of Housing” War: Is the 3.5 Million Estimate “Gold” (Man, No!); or Can You Take the 1.2 Million Estimate to the (Deutsche) Bank?

A few weeks ago Goldman Sachs’ analysts made headlines by arguing that the “excess” supply of housing, or actually the number of US housing units sitting vacant “above and beyond normal seasonal and frictional vacancies,” was “about” 3.5 million. This week Deutsche Bank analysts estimated that at the end of 2010 there were about 1.2 million “excess” vacant housing units in the US. Both sets of analysts relied heavily on data “provided” by the US Bureau of the Census in deriving their “estimates.” And, to the best of my knowledge, neither set of analysts was comprised of imbeciles. Yet jiminy cricket, those are pretty huge differences with massively different implications about the prospects for the housing markets and home prices over the next few years!!!!! And the major reasons for these differences? You guessed it, massively disparate sets of data from different areas of the Census Bureau on US housing!!!!

As readers probably guessed, Goldman analysts’ estimates are based on what are almost certainly flawed and biased estimates of the occupied and vacant housing units from Census’ quarterly “Residential Vacancies and Homeownership” Reports, commonly referred to as the Housing Vacancy Survey (HVS). While there had already been strong evidence that the HVS dramatically overstated both homeownership rates and vacancy rates prior to the decennial Census 2010 (from the ACS), the incoming data from Census 2010 pretty much confirm that the HVS data has serious biases, probably related to serious sampling issues.

The Deutsche Bank analysts’ estimates are based on the Census 2010 gross vacancy rate versus a weighted average of the Census 1990 gross vacancy rate (weighted 75% for pretty flimsy reasons) and the Census 2000 gross vacancy rates (weighted, of course, 25%). (DB analysts “walk forward” the April 1 Census 2010 estimates to the end of 2010 using what I believe are “questionable” assumptions about household formations and net demolitions). Census 2010 has not yet released national data on vacant units by status (for rent, for sale, etc., and it was sorta weird that DB analysts didn’t just wait a few weeks to do a more “rigorous’ estimate based on more complete Census 2010 data.

DB’s piece includes a decently long and not “too” bad discussion (though with many errors and/or omissions) of the multiple and disparate sets of data on the US housing stock derived from various surveys done by different areas in the Census Bureau.

What is disturbing, of course, is not necessarily that different sets of analysts can come to different sets of conclusions when analyzing US housing data. Rather, it is that there are multiple and conflicting “official” sets of government-produced data on the US housing stock, with little or no discussion from government officials/analysts are which – if any – dataset should be used by analysts to estimate the “excess” supply of housing in the United States

Earlier:

• Housing Starts decline in April

• Industrial Production unchanged in April, Capacity Utilization declines slightly

• Multi-family Starts and Completions, and Quarterly Starts by Intent