by Calculated Risk on 5/18/2011 07:52:00 AM

Wednesday, May 18, 2011

MBA: Mortgage Purchase application activity decreases, Refinance activity increases

The MBA reports: Mortgage Refinance Applications Increase in Latest MBA Weekly Survey

Refinance Index increased 13.2 percent from the previous week and is at its highest level since the week ending December 10, 2010. The seasonally adjusted Purchase Index decreased 3.2 percent from one week earlier.

...

“The 30-year fixed mortgage rate is now 53 basis points below its 2011 peak, and has decreased for five straight weeks,” said Michael Fratantoni, MBA’s Vice President of Research. “Over this five week span, the refinance index has increased by about 33 percent. Refinance application volumes remain about 50 percent below the most recent peak last October. ”

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.60 percent from 4.67 percent, with points decreasing to 0.94 from 1.10 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the lowest 30-year rate recorded in the survey since the end of November 2010.

Click on graph for larger image in graph gallery.

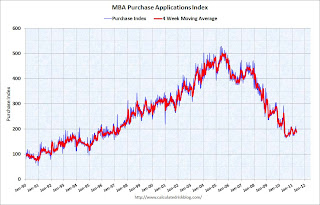

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

Refinance activity increased as mortgage rates fell to the lowest level since November 2010.

The four week average of purchase activity is at about 1997 levels, although this doesn't include the very high percentage of cash buyers. This suggests weak existing home sales through June (not counting cash buyers).