by Calculated Risk on 5/05/2011 10:07:00 PM

Thursday, May 05, 2011

Japan: Fukushima Daiichi Reactor Update

I haven't posted an update for some time. John Glionna and Kenji Hall at the LA Times provide a rough timeline: Workers enter damaged Fukushima reactor

The recovery team began a project to lower radiation levels by installing six ventilation machines that would absorb isotopes from the air in the No. 1 reactor ...A long slow process.

Tomikawa said it should take two or three days to put in the ventilation system. He estimated that the work to install the reactor's new cooling system could begin as soon as May 16.

... The company plans to add cooling equipment for reactors Nos. 2 and 3 sometime in the next two months ...

Under a two-phase plan, the company expects to spend three months cooling the reactors and plugging radiation leaks. ...

During the second phase, which is expected to take about six months, Tepco hopes to put the reactors into a stable state ... but deactivating the reactors could take years to complete.

Earlier:

• Weekly Initial Unemployment Claims sharply higher

• NMHC Quarterly Apartment Survey: Market Conditions Tighten

• Clear Capital Home Price Index shows Double Dip

Survey: Small Business Hiring in April "Disappointing"

by Calculated Risk on 5/05/2011 05:43:00 PM

The National Federation of Independent Business (NFIB) will release their April survey on Tuesday, May 10th. Here is a pre-release of the employment results from NFIB: NFIB Jobs Statement: Hiring Trends Inconsistent and Disappointing

“Four months into 2011, the trajectory for small-business hiring appears inconsistent and disappointing. February and March gave us some hope, but in April, the average number of net new jobs slipped from 0.17 per firm to 0.04. With fewer increases in new hires and more reports of shrinkage in workforces, we can expect the April job numbers to be a disappointment.

Drilling down into the (seasonally adjusted) numbers:

• 8 percent of those surveyed increased employment;

• 15 percent reduced employment; and,

• 14 percent reported unfilled job openings, down 1 point from last month.

“And the outlook for future employment growth remains unchanged from March: Only 16 percent plan to increase employment, and 6 percent plan to reduce their workforce, yielding a seasonally adjusted net 2 percent of owners planning to create new jobs in the next three months.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the net hiring plans for the next three months.

Hiring plans were unchanged in April and still slightly positive.

Small businesses have a larger percentage of real estate and retail related companies than the overall economy. With the high percentage of real estate (including small construction companies), I expect small business hiring to remain sluggish for some time.

This is another somewhat disappointing employment indicator along with the ISM surveys, the ADP employment report and initial weekly claims.

The consensus for the April employment report is 185,000 with the unemployment rate unchanged at 8.8% (to be released tomorrow at 8:30 AM ET).

Lawler: Census Releases Demographic Profile of 12 States and DC: Confirms Bias of HVS

by Calculated Risk on 5/05/2011 02:47:00 PM

CR Note: The Census Bureau is releasing the demographic profile data for every state this month. Many analysts use the quarterly Census HVS to track the homeownership rate - and to calculate the excess supply of housing units. Important: Estimates using the HVS appear to overstate the excess supply. When all the data is released (by the end of May), we will probably have a better estimate of the excess supply as of April 1, 2010.

From economist Tom Lawler: The Census Bureau released the “Demographic Profile” from Census 2010 for 12 states and DC today, and the release confirmed several of the biases I have noted in the Census’ quarterly Housing Vacancy Survey. As I’ve shown before, the HVS showed higher homeownership rates than either the 2000 decennial Census or the American Community Survey, and that overstatement continued for 2010. Below is a comparison of the homeownership rate from the decennial Census for April 1, 2010 with the HVS average homeownership for the first half of 2010. (The HVS quarterly data are monthly averages). Also shown are the homeownership rates for April 1, 2000 from Census 2000.

| Homeownership Rate (%), Census 2010, Census 2000, and Housing Vacancy Survey | |||||

|---|---|---|---|---|---|

| Census 2010, April 1 | HVS, First Half 2010 | Census vs. HVS | Census 2000, April 1 | Census 2010 vs. Census 2000 | |

| DC | 42 | 45.1 | -3.1 | 40.8 | 1.2 |

| Florida | 67.4 | 70.3 | -2.9 | 70.1 | -2.7 |

| Kentucky | 68.7 | 71.3 | -2.6 | 70.8 | -2.1 |

| Maine | 71.3 | 73.6 | -2.3 | 71.6 | -0.3 |

| Massachusetts | 62.3 | 64.4 | -2.1 | 61.7 | 0.6 |

| Michigan | 72.1 | 74.5 | -2.4 | 73.8 | -1.7 |

| Mississippi | 69.6 | 73.5 | -3.9 | 72.3 | -2.7 |

| New Mexico | 68.5 | 68.8 | -0.3 | 70 | -1.5 |

| North Dakota | 65.4 | 67.4 | -2 | 66.6 | -1.2 |

| Rhode Island | 60.7 | 63.6 | -2.9 | 60 | 0.7 |

| South Carolina | 69.3 | 74.5 | -5.2 | 72.2 | -2.9 |

| Tennessee | 68.2 | 71 | -2.8 | 68.2 | 0 |

| West Virginia | 73.4 | 79.1 | -5.7 | 75.2 | -1.8 |

This early look strongly suggests that there are material sampling problems with the HVS that need to be addressed, and suggests that the HVS data probably should not be used to analyze the US housing stock, or estimate the “excess supply” of housing.

CR Note: A key number for the U.S. economy is the excess supply of vacant housing units. The decennial Census probably provides the best estimate, and that is already over a year out of date.

NMHC Quarterly Apartment Survey: Market Conditions Tighten

by Calculated Risk on 5/05/2011 11:29:00 AM

From the National Multi Housing Council (NMHC): Apartment Sector Sets Records In Market Tightness And Equity Availability, NMHC Market Conditions Survey Finds

The Market Tightness Index, which examines vacancies and rents, rose to a record 90 from 78 last quarter. ... Almost four in five respondents (79%) said markets were tighter (lower vacancies and/or higher rents) and—for the first time ever—not a single respondent thought conditions were looser.

“The apartment industry rebounded strongly in 2010 as demand for apartment residences outpaced the sluggish recovery in the job market nationally,” said NMHC Chief Economist Mark Obrinsky. “These results show the apartment industry continues to do well even though the nation’s overall rate of economic growth has slowed. This is driven largely by the increased appeal of renting generally but also by the large number of young people entering the housing market for the first time—and young people are much more likely to rent than buy.”

Click on graph for larger image in graph gallery.

This graph shows the quarterly Apartment Tightness Index.

The index has indicated tighter market conditions for the last five quarters and increased to a record 90 in April. A reading above 50 suggests the vacancy rate is falling and / or rents are rising. This data is a survey of large apartment owners only.

This fits with the recent Reis data showing apartment vacancy rates fell in Q1 2011 to 6.2%, down from 6.6% in Q4 2010, and 8% in the Q1 2010.

Two key points I've made over and over are 1) with falling vacancy rates and rising rents, the number of multi-family starts will pick up sharply this year (but still be well below normal), and 2) this pickup will lead to a positive contribution to GDP and payroll jobs for construction in 2011, the first positive contribution for either since 2005. This survey reinforces both points.

A final note: This index helped me call the bottom for effective rents (and the top for vacancy rate) a year ago.

Clear Capital Home Price Index shows Double Dip

by Calculated Risk on 5/05/2011 09:41:00 AM

This is one of several house prices indexes I follow in addition to Case-Shiller and CoreLogic. This is especially interesting this month for two reasons: 1) the index is showing a double dip in house prices, and 2) the graph showing house prices and REO saturation.

From Clear Capital: Clear Capital® Reports National Double Dip

Clear Capital (www.clearcapital.com) today released its monthly Home Data Index™ (HDI) Market Report, and reports prices have double dipped nationally 0.7 percent below prior lows experienced in March 2009.

...

“The latest data through April shows a continued increase in the proportion of distressed sales that are taking hold in markets nationwide,” said Dr. Alex Villacorta, director of research and analytics at Clear Capital. “With more than one-third of national home sales being REO, market prices are being weighed down ..."

Click on graph for larger image in new window.

Click on graph for larger image in new window.These graphs from Clear Capital show their home price index and the percent REO saturation.

We know that a higher percentage of distress sales put downward pressure on house prices, and these graphs make that relationship pretty clear.

Note: REO saturation usually peaks early in the year - so some of the recent increase is seasonal.

From Clear Capital:

This comparison leads to concern over home price declines through the rest of 2011. The trends of 2008 were quickly reversed with the introduction of stimulus measures. However, home prices today are already down nearly 25 percent since the 2008 period, creating increasing home affordability, in addition to gradually improving employment measures. Unlike the 2008 period where the downward trend ended in the winter, we're now heading into the home buying seasons of spring and summer. Regardless, the housing market still faces many challenges that will only be solved through increased buying activity or a reduction in the distressed segment―neither of which is assured in 2011.

Weekly Initial Unemployment Claims sharply higher

by Calculated Risk on 5/05/2011 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

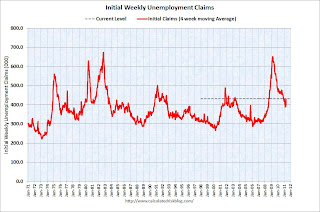

In the week ending April 30, the advance figure for seasonally adjusted initial claims was 474,000, an increase of 43,000 from the previous week's revised figure of 431,000. The 4-week moving average was 431,250, an increase of 22,250 from the previous week's revised average of 409,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the 4-week moving average of weekly claims for the last 40 years. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week to 431,250.

Note: There were special circumstances last week, via MarketWatch:

A Labor official attributed much of the increase to temporary layoffs in the auto sector and in the state of New York, where workers in the educational field such as bus drivers are eligible for compensation during the week of spring break.Even without the special reasons, weekly claims have been increasing in recent weeks.