by Calculated Risk on 4/18/2011 10:00:00 AM

Monday, April 18, 2011

NAHB Builder Confidence index declines slightly in April

The National Association of Home Builders (NAHB) reports the housing market index (HMI) declined slightly to 16 in April from 17 in March. This was below expectations for a reading of 17. Confidence remains very low ... any number under 50 indicates that more builders view sales conditions as poor than good.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the April release for the HMI and the February data for starts (March housing starts will be released tomorrow).

Both confidence and housing starts have been moving sideways at a very depressed level for several years.

Press release from the NAHB: Builder Confidence Slips Back a Notch in April

Builder confidence in the market for newly built, single-family homes slipped back one notch to 16 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for April, released today. The index has now held at 16 for five of the last six monthsBuilders are still depressed, and the HMI has been below 25 for forty-six consecutive months - almost 4 years.

...

“The spring home buying season is getting off to a slow start due to persistent concerns about home values as more foreclosures seem to be hitting the market, increasingly restrictive lending requirements for home buyers and builders, and the slow pace of economic recovery,” acknowledged NAHB Chief Economist David Crowe. “While pockets of improving activity are appearing in some markets, the best sales activity appears to be happening in the lower price ranges, where first-time buyers have greater flexibility than repeat buyers who must sell their current home"

...

Two out of three of the HMI’s component indexes posted declines in April. While the component gauging current sales conditions fell one point to 16, the component gauging sales expectations for the next six months declined three points to 23, its lowest mark since October of 2010. However, the index gauging traffic of prospective buyers rose a single point to 13 in April, marking its highest level since last June.

Greece Bond Yields at Record High following Default Comments

by Calculated Risk on 4/18/2011 08:29:00 AM

The yield on Greece ten year bonds jumped to 14.4% today and the two year yield is up to 19.6%.

From Reuters: Greece asked EU/IMF at Ecofin to restructure debt-paper

Greece told the IMF and the European Union earlier this month that it wants to restructure its debt and discussions on the issue are expected to start in June, Greek daily Eleftherotypia said on Monday.This report has been "dismissed" by Greek, EU and IMF officials, but it is widely expected that Greece will default (aka restructure). Many analysts expect the restructuring to include extending the duration.

...

The paper said U.S. Treasury Secretary Timothy Geithner is also in favour of stretching out repayments of Greece's debt.

"You have to do it, he told Papaconstantinou," the paper said

Here are the ten year yields for Ireland up to 9.8%, Portugal up to a record 9.1%, and Spain at 5.6%.

Sunday, April 17, 2011

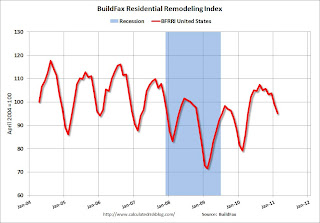

Residential Remodeling Index shows strong increase year-over-year in February

by Calculated Risk on 4/17/2011 10:19:00 PM

The BuildFax Residential Remodeling Index was at 95.1 in February. This is based on the number of properties pulling residential construction permits in a given month.

From BuildFax:

The Residential BuildFax Remodeling Index rose 20% year-over-year—and for the sixteenth straight month—in February to 95.1, the highest February number in the index since 2006. Residential remodels in February were down month-over-month 3.9 points (4%) from the January value of 99.0 ...

All regions posted year-over-year gains, although the West posted a much higher year-over-year gain than the other regions, reaching well above index values for the West in February 2010, 2009, 2008, and 2007.

...

According to Joe Masters Emison, vice president of research and development at BuildFax, “February 2011 was a strong month for the industry, despite the fact that remodeling activity traditionally dips during the winter months. February 2011 was better than or equal to February 2010 in every region of the country.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Although down month-to-month (off 4% from January) this is the highest level for a February since 2006 - and above the level of 2005 (during the home equity and remodel boom).

Note: permits are not adjusted by value, so this doesn't mean there is more money being spent, just more permit activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.The remodeling index is up 20% from February 2010.

Although new home construction is still moving sideways, it appears that two other components of residential investment are increasing in 2011: multi-family construction and home improvement (based on this index). This fits with other reports too.

Data Source: BuildFax, Courtesy of Index.BuildFax.com

Earlier:

• First Look at 2012 Cost-Of-Living Adjustments and Maximum Contribution Base

• Summary for Week ending April 15th

• Schedule for Week of April 17th

Quote of the Day: 15 years of house price appreciation "It's gone"

by Calculated Risk on 4/17/2011 06:17:00 PM

"I bought my first house in 1996, a four-bedroom for $124,000, and I could probably buy that same house for $124,000. All the appreciation we've gained in the last 15 years, it's gone."

Chuck Whitehead, general manager for Coldwell Banker's Southwest Riverside operations, via Eric Wolff at the NC Times.

Earlier:

• First Look at 2012 Cost-Of-Living Adjustments and Maximum Contribution Base

• Summary for Week ending April 15th

• Schedule for Week of April 17th

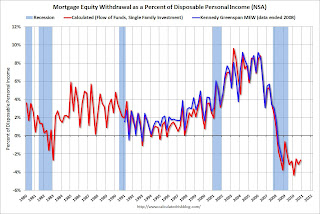

Q4 2010: Mortgage Equity Withdrawal strongly negative

by Calculated Risk on 4/17/2011 02:03:00 PM

Special Note: Dr. James Kennedy has a new method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". I haven't evaluated his method yet (here is a companion spread sheet), so the following is using my old "simple" method.

Note 2: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity (hence the name "MEW", but there is little MEW right now!), normal principal payments and debt cancellation.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q4 2010, the Net Equity Extraction was minus $77 billion, or a negative 2.7% of Disposable Personal Income (DPI). This is not seasonally adjusted.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding declined sharply in Q4. Mortgage debt has declined by $550 billion over the last eleven quarters. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance. Note: most homeowners pay down their principal a little each month unless they have an IO or Neg AM loan, so with no new borrowing, equity extraction would always be slightly negative.

Earlier:

• First Look at 2012 Cost-Of-Living Adjustments and Maximum Contribution Base

• Summary for Week ending April 15th

• Schedule for Week of April 17th

Schedule for Week of April 17th

by Calculated Risk on 4/17/2011 08:15:00 AM

Earlier:

• Summary for Week ending April 15th

• First Look at 2012 Cost-Of-Living Adjustments and Maximum Contribution Base

Three key housing reports will be released this week: April homebuilder confidence on Monday, March housing starts on Tuesday, and March existing home sales on Wednesday.

8:00 AM ET: Citigroup First Quarter 2011 Results (included for possible comments on foreclosures)

10 AM: The April NAHB homebuilder survey. The consensus is for a reading of 17, unchanged from March. Any number below 50 indicates that more builders view sales conditions as poor than good. This index has been below 25 for forty five consecutive months (almost 4 years).

8:00 AM ET: Goldman Sachs First Quarter 2011 Results

8:30 AM: Housing Starts for March. After collapsing following the housing bubble, housing starts have mostly moved sideways at a very depressed level for over two years.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows total and single unit starts since 1968.

Total housing starts were at 479 thousand (SAAR) in February, down 22.5% from the revised January rate of 618 thousand, and barely up from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Single-family starts decreased 11.8% to 375 thousand in February - the lowest level since early 2009.

The consensus is for an increase to 525,000 (SAAR) in March.

10:00 AM: Regional and State Employment and Unemployment for March 2011

Early: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

This graph shows the Architecture Billings Index since 1996. The index showed billings were slightly higher in February (at 50.6).

This graph shows the Architecture Billings Index since 1996. The index showed billings were slightly higher in February (at 50.6).This index usually leads investment in non-residential structures (hotels, malls, office) by 9 to 12 months.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last couple months suggesting weak home sales through May 2011.

8:00 AM: Wells Fargo First Quarter 2011.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for sales of 5.0 million at a Seasonally Adjusted Annual Rate (SAAR) in March, up about 2.5% from the 4.88 million SAAR in February. Economist Tom Lawler is projecting sales of 5.08 million in March.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in February 2011 (4.88 million SAAR) were 9.6% lower than last month, and were 2.8% lower than February 2010.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in February 2011 (4.88 million SAAR) were 9.6% lower than last month, and were 2.8% lower than February 2010. In addition to sales, the level of inventory and months-of-supply will be very important (since months-of-supply impacts prices).

7:30 AM: Morgan Stanley First Quarter 2011

8:30 AM: The initial weekly unemployment claims report will be released. The number of initial claims increased last week to 412,000, but the trend has been down over the last few months. The consensus is for a decrease to 390,000 from 412,000 last week.

10:00 AM: Philly Fed Survey for April. This survey was at the highest level since 1984 in March. The consensus is for a strong reading of 36.8, down from the very high 43.4 in last month.

10:00 AM: Conference Board Leading Indicators for March. The consensus is for a 0.3% increase for this index.

10:00 AM: FHFA House Price Index for February. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

All US markets will be closed for Good Friday.

After 4:00 PM: The FDIC might be working Friday afternoon ...

Best Wishes to All!