by Calculated Risk on 4/15/2011 07:36:00 PM

Friday, April 15, 2011

Bank Failure #34: Heritage Banking Group, Carthage, Mississippi

Mississippi burning cash

Delta blues for bank.

by Soylent Green is People

Heritage Banking Group, Carthage, Mississippi

As of December 31, 2010, Heritage Banking Group had approximately $224.0 million in total assets and $196.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $49.1 million. ... Heritage Banking Group is the 34th FDIC-insured institution to fail in the nation this year, and the first in Mississippi.That makes six today ...

Bank Failures #29 through #33 in 2011

by Calculated Risk on 4/15/2011 06:16:00 PM

Hot money banks drop like flies

All pits and no peach.

Doom broom sweeps Eastward.

Two South and one North bank fails

West crest approaching?

by Soylent Green is People

Bartow County Bank, Cartersville, Georgia

As of December 31, 2010, Bartow County Bank had approximately $330.2 million in total assets and $304.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $69.5 million. ... Bartow County Bank is the 29th FDIC-insured institution to fail in the nation this year, and the seventh in Georgia.New Horizons Bank, East Ellijay, Georgia

As of December 31, 2010, New Horizons Bank had approximately $110.7 million in total assets and $106.1 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $30.9 million. ... New Horizons Bank is the 30th FDIC-insured institution to fail in the nation this year, and the eighth in Georgia.Nexity Bank, Birmingham, Alabama

As of December 31, 2010, Nexity Bank had approximately $793.7 million in total assets and $637.8 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $175.4 million. ... Nexity Bank is the 31st FDIC-insured institution to fail in the nation this year, and the first in Alabama.Superior Bank, Birmingham, Alabama

As of December 31, 2010, Superior Bank had approximately $3.0 billion in total assets and $2.7 billion in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $259.6 million. ... Superior Bank is the 32nd FDIC-insured institution to fail in the nation this year, and the second in Alabama.Rosemount National Bank, Rosemount, Minnesota

As of December 31, 2010, Rosemount National Bank had approximately $37.6 million in total assets and $36.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $3.6 million. ... Rosemount National Bank is the 33rd FDIC-insured institution to fail in the nation this year, and the first in Minnesota.Superior was a pretty big bank ...

First Look at 2012 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 4/15/2011 04:58:00 PM

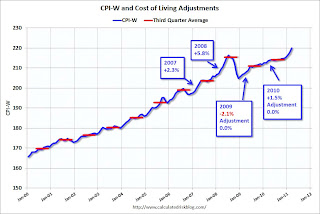

The BLS reported this morning: "The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 3.0 percent over the last 12 months to an index level of 220.024 (1982-84=100). For the month, the index rose 1.1 percent ..."

CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is an explanation ...

The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W1 for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and not seasonally adjusted.

• In 2008, the Q3 average of CPI-W was 215.495. In the previous year, 2007, the average in Q3 of CPI-W was 203.596. That gave an increase of 5.8% for COLA for 2009.

• In 2009, the Q3 average of CPI-W was 211.013. That was a decline of 2.1% from 2008, however, by law, the adjustment is never negative so the benefits remained the same in 2010.

• In 2010, the Q3 average of CPI-W was 214.136. That was an increase of 1.5% from 2009, however the average was still below the Q3 average in 2008, so the adjustment was zero.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

The COLA adjustment is based on the increase from Q3 of one year from the highest previous Q3 average. So a 2.3% increase was announced in 2007 for 2008, and a 5.8% increase was announced in 2008 for 2009.

In Q3 2009, CPI-W was lower than in Q3 2008, so there was no change in benefits for 2010. And CPI-W in Q3 2010 was also lower than in Q3 2008, so once again there was no change in benefits.

Currently CPI-W is above the Q3 2008 average. The recent increase is mostly because of the surge in oil prices. CPI-W could be very volatile this year - and will depend on energy prices - but if the current level holds, COLA would be around 2.1% for next year (the current 220.024 divided by the Q3 2008 level of 215.495).

This is very early - if oil prices fall sharply, COLA might be zero again.

Contribution and Benefit Base

The law prohibits an increase in the contribution and benefit base if COLA is not greater than zero. However if the there is even a small increase in COLA, the contribution base will be adjusted using the National Average Wage Index.

From Social Security: Cost-of-Living Adjustment Must Be Greater Than Zero

... ... any amount that is directly dependent for its value on the COLA would not increase. For example, the maximum Supplemental Security Income (SSI) payment amounts would not increase if there were no COLA.This is based on a one year lag. The National Average Wage Index is not available for 2010 yet, but wages probably didn't change much from 2009. If wages increased back to the 2008 level in 2010, and COLA is positive (seems likely right now), then the contribution base next year will be increased to around $109,000 from the current $106,800.

... if there were no COLA, section 230(a) of the Social Security Act prohibits an increase in the contribution and benefit base (Social Security's maximum taxable earnings), which normally increases with increases in the national average wage index. Similarly, the retirement test exempt amounts would not increase ...

Remember - this is an early look. What matters is CPI-W during Q3 (July, August and September).

(1) CPI-W usually tracks CPI-U (headline number) pretty well. From the BLS:

The Bureau of Labor Statistics publishes CPIs for two population groups: (1)the CPI for Urban Wage Earners and Clerical Workers (CPI-W), which covers households of wage earners and clerical workers that comprise approximately 32 percent of the total population and (2) the CPI for All Urban Consumers (CPI-U) ... which cover approximately 87 percent of the total population and include in addition to wage earners and clerical worker households, groups such as professional, managerial, and technical workers, the self- employed, short-term workers, the unemployed, and retirees and others not in the labor force.

Europe Update: Ireland Downgraded, Greece to default?

by Calculated Risk on 4/15/2011 01:55:00 PM

• Possible Greece default.

From Bloomberg: Greece May Need Debt Restructuring, Schaeuble Tells Die Welt

German Finance Minister Wolfgang Schaeuble said Greece may have to seek debt restructuring if an audit in June questions its ability to pay creditors, Die Welt reported, citing an interview.And from Bloomberg: Germany Would Back Greece Debt Restructuring, Hoyer Says

Greece would have to negotiate to ease its debt burden since creditors can’t be forced to take losses until Europe’s permanent rescue system for the euro starts up in mid-2013, the Berlin-based newspaper cited Schaeuble as saying in comments published today.

“A haircut or a restructuring of the debt would not be a disaster,” said Hoyer, a member of the Free Democratic Party that’s the junior partner in Chancellor Angela Merkel’s government. If Greece’s creditors agreed that talks with the Greek government “would be helpful toward a restructuring of the debt, then of course this would be supported by us.”It seems like a matter of when, not if. The 2 year bond yields for Greece, at 18.5%, suggest this will happen fairly soon. If haircuts are coming, the sooner the better for the people of Greece.

...

The remarks by Hoyer were the most explicit by a European official showing a 110 billion-euro ($159 billion) bailout for Greece may fail to prevent the first default by a euro country.

• And from the WSJ: Moody's Downgrades Ireland

Moody's Investors Service Inc. downgraded Ireland's government debt by two notches Friday, taking the country to the brink of junk status, and kept its outlook negative.Here are the ten year yields for Greece at 13.8%, Ireland at 9.7%, Portugal at 9.0%, and Spain at 5.4%.

The agency, cutting Ireland's bond ratings to Baa3, one notch above junk, from Baa1, said it was responding to a likely deterioration in Ireland's fiscal position due to weak prospects for economic growth and higher borrowing costs as a result of rate rised by the European Central Bank.

If Greece defaults, will Portugal and/or Ireland be far behind?

Core Measures show low inflation in March

by Calculated Risk on 4/15/2011 11:30:00 AM

Earlier today the BLS reported:

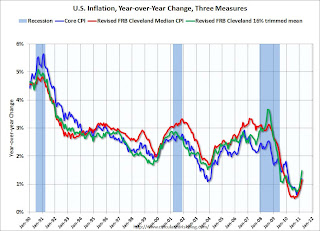

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.5 percent in March on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.7 percent before seasonal adjustment.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

...

The index for all items less food and energy rose 0.1 percent in March, a smaller increase than in the previous two months. ... The shelter index increased 0.1 percent for the sixth month in a row, with rent and owners' equivalent rent both increasing 0.1 percent in March, as they did in February.

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.6% annualized rate) in March. The 16% trimmed-mean Consumer Price Index increased 0.2% (3.0% annualized rate) during the month.Over the last 12 months, core CPI has increased 1.2%, median CPI has increased 1.2%, and trimmed-mean CPI increased 1.5%.

Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows these three measure of inflation on a year-over-year basis.

These measures all show that year-over-year inflation is still low, but increasing lately.

Note: You can see the median CPI details for March here.

A little good news: Core CPI increased at an annualized rate of 1.6% (down from 2.4% in February), median CPI 1.6% annualized in March, and trimmed-mean CPI increased 3.0% annualized (high, but down from 3.8% annualized last month).

With the slack in the system, I expect these core measures to stay below 2% this year.

Consumer Sentiment increases slightly in April

by Calculated Risk on 4/15/2011 10:04:00 AM

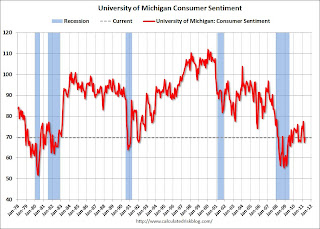

The preliminary April Reuters / University of Michigan consumer sentiment index increased to 69.6 in April from 67.5 in March.

Click on graph for larger image in graphic gallery.

Click on graph for larger image in graphic gallery.

This was slightly above the consensus forecast of 69.0.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices.

This low reading is probably due to $4 per gallon gasoline prices.