by Calculated Risk on 4/15/2011 09:15:00 AM

Friday, April 15, 2011

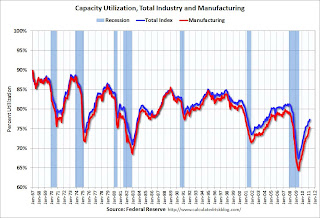

Industrial Production, Capacity Utilization increased in March

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.8 percent in March and rose at an annual rate of 6.0 percent for the first quarter as a whole. Manufacturing output advanced 0.7 percent in March, its fourth consecutive month of strong expansion; factory production climbed at an annual rate of 9.1 percent in the first quarter. Outside of manufacturing, the output of mines rose 0.6 percent in March, while the output of utilities increased 1.7 percent after declining significantly in the preceding two months. At 93.6 percent of its 2007 average, total industrial production was 5.9 percent above its year-earlier level. The rate of capacity utilization for total industry rose 0.5 percentage point to 77.4 percent, a rate 3.0 percentage points below its average from 1972 to 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows Capacity Utilization. This series is up 10 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.4% is still "3.0 percentage points below its average from 1972 to 2010" - and below the pre-recession levels of 81.2% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in March to 93.6, however February was revised down from 93.0 to 92.8. So the increase was reported at 0.8% but would have been 0.6% without the downward revision.

Production is still 7.0% below the pre-recession levels at the end of 2007.

The consensus was for a 0.5% increase in Industrial Production in March, and an increase to 77.4% (from 76.3%) for Capacity Utilization. So this was close to expectations.

Empire State Manufacturing Survey indicates faster growth in April

by Calculated Risk on 4/15/2011 08:30:00 AM

From the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers improved at an accelerated pace in April. The general business conditions index rose for a fifth consecutive month, reaching 21.7, its highest level in a year [up from 17.5]. The new orders index jumped 17 points, to 22.3, and the shipments index shot up 27 points to 28.3. The indexes for both prices paid and prices received rose to their highest levels in more than a year, indicating that price increases continued to accelerate.This was above expectations of a reading of 17.0. This is the first regional survey released for April and shows that manufacturing is continuing to expand.

The index for number of employees climbed to 23.1 [from 9.1], while the average workweek index edged down to 10.3. Future indexes continued to convey great optimism about the six-month outlook, and the capital spending and technology spending indexes were noticeably higher.

Note: I'll post on inflation later when the median CPI is available. The BLS reported:

"The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.5 percent in March on a seasonally adjusted basis ... The index for all items less food and energy rose 0.1 percent in March, a smaller increase than in the previous two months."

Thursday, April 14, 2011

Office Vacancy Rates and New Deliveries for three SoCal Cities

by Calculated Risk on 4/14/2011 11:57:00 PM

Voit released their Q1 CRE reports today. These reports are for several cities in the west: Los Angeles, San Diego, Orange County, Las Vegas, and more (these are for several categories of CRE - offices, retail, industrial). There is plenty of detail for those interested in CRE.

The following graphs show vacancy rate vs. new deliveries for offices in Orange County, San Diego and for the Inland Empire.

The first graph is from Voit for Orange County (not labeled).

New deliveries stopped a little earlier in Orange County than in some other areas, possibly because of all the subprime companies going under in 2007.

The fewer deliveries have helped, and the vacancy rate is starting to fall. But look back at the '90s - it took several years of falling vacancy rates before new deliveries started hitting the market. It will probably be a few years again this time too.

For San Diego, new deliveries didn't stop completely, and the vacancy rate has only declined slightly. Still net absorption is positive, but there probably won't be much new construction for a few years.

Once again new deliveries have slowed sharply, but the vacancy rate still increased slightly in Q1.

The good news for employment and GDP is that new office construction in these areas can't fall much further. The bad news for construction employment and GDP is that construction probably won't increase significantly for a few years.

Study: Suicide Rates Rise and Fall with Economy

by Calculated Risk on 4/14/2011 07:44:00 PM

From the CDC: CDC Study Finds Suicide Rates Rise and Fall with Economy

The overall suicide rate rises and falls in connection with the economy, according to a Centers for Disease Control and Prevention study released online today by the American Journal of Public Health. The study, "Impact of Business Cycles on the U.S. Suicide Rates, 1928–2007" is the first to examine the relationships between age-specific suicide rates and business cycles. The study found the strongest association between business cycles and suicide among people in prime working ages, 25-64 years old.There is no data yet for the recent recession, but suicide rates probably increased significantly. This is another impact of the housing bubble - and there is no recovery for the families who lost someone to suicide.

...

• The overall suicide rate generally rose in recessions like the Great Depression (1929-1933), the end of the New Deal (1937-1938), the Oil Crisis (1973-1975), and the Double-Dip Recession (1980-1982) and fell in expansions like the WWII period (1939-1945) and the longest expansion period (1991-2001) in which the economy experienced fast growth and low unemployment.

• The largest increase in the overall suicide rate occurred in the Great Depression (1929-1933)—it surged from 18.0 in 1928 to 22.1 (all-time high) in 1932 (the last full year in the Great Depression)—a record increase of 22.8% in any four-year period in history. It fell to the lowest point in 2000.

• Suicide rates of two elderly groups (65-74 years and 75 years and older) and the oldest middle-age group (55-64) experienced the most significant decline from 1928 to 2007.

The good news in this study is the long term decline in elderly suicide rates, probably because of improved access to medical care.

Hotels: Occupancy Rate improves in Latest Survey

by Calculated Risk on 4/14/2011 05:03:00 PM

Here is the weekly update on hotels from HotelNewsNow.com: Upper-upscale segment tops weekly increases

Overall, the U.S. hotel industry’s occupancy was up 4.8% to 62.0, ADR increased 4.7% to US$101.22, and RevPAR finished the week up 9.8% to US$62.80.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the seasonal pattern for the hotel occupancy rate.

The occupancy rate is well above the rate in 2009 and 2010, and fairly close to the rate in 2008.

RevPAR is still well below the peak levels prior to the recession. In 2008, RevPAR was $70.76 for the comparable week. It declined 28.1% in the same week in 2009 to $50.85 and is now at $62.80.

The same with ADR. For the same week, ADR peaked at $110.36 in 2008, and is just back over $100 at $101.22.

So even though the occupancy rate has improved, hotel income is still much lower now than prior to the recession.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

LA Port Traffic: Exports increased sharply in March

by Calculated Risk on 4/14/2011 01:32:00 PM

The first graph shows the rolling 12 month average of loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported - and possible hints about the trade report for March. LA area ports handle about 40% of the nation's container port traffic.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

To remove the strong seasonal component for inbound traffic, this graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic is up 17% and outbound up 9%.

The 2nd graph is the monthly data (with strong seasonal pattern).

The 2nd graph is the monthly data (with strong seasonal pattern).

For the month of March, loaded inbound traffic was up 2% compared to March 2010, and loaded outbound traffic was up 11% compared to March 2010. This was the third highest month for exports ever, and the highest since the peak in 2008.

This suggests the trade deficit with China (and other Asians countries) probably decreased in March.