by Calculated Risk on 4/08/2011 08:38:00 PM

Friday, April 08, 2011

Bank Failure #28: Nevada Commerce Bank, Las Vegas, NV

Sloshes down the bankers maw

Eager to consume

by Soylent Green is People

From the FDIC: City National Bank, Los Angeles, California, Assumes All of the Deposits of Nevada Commerce Bank, Las Vegas, Nevada

As of December 31, 2010, Nevada Commerce Bank had approximately $144.9 million in total assets and $136.4 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $31.9 million. .... Nevada Commerce Bank is the 28th FDIC-insured institution to fail in the nation this year, and the first in Nevada.

Bank Failure #27 in 2011: Western Springs National Bank and Trust, Western Springs, Illinois

by Calculated Risk on 4/08/2011 07:46:00 PM

The Patricians gnash and wail

Plebeians rejoice.

by Soylent Green is People

From the FDIC: Heartland Bank and Trust Company, Bloomington, Illinois, Assumes All of the Deposits of Western Springs National Bank and Trust, Western Springs, Illinois

As of December 31, 2010, Western Springs National Bank and Trust had approximately $186.8 million in total assets and $181.9 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $31.0 million. ... Western Springs National Bank and Trust is the 27th FDIC-insured institution to fail in the nation this year, and the fourth in Illinois.If the FDIC agents work on the weekend, will they get paid? Just wondering ...

Five Hours until possible Government Shutdown

by Calculated Risk on 4/08/2011 07:06:00 PM

A few comments ... (midnight ET)

• I still expect an agreement.

• Stan Collender writes: The Shutdown Problem This September is Going to be Even Worse

No matter what happens today with the government shutdown, the situation is going to be even more difficult this September when the House, Senate, and White House fight over the 2012 appropriations. ... Expect another shutdown threat...or an actual shutdown...in less than 6 months.• And from the NY Times Caucus: Conservatives Urge Boehner to Cut a Budget Deal and Move On

[J]ust hours before the first government shutdown in 15 years –some of the most vocal conservatives are urging Republicans to reach a deal before a shutdown occurs.This is probably the cover Boehner needs. But as Collender notes, it will get really ugly in September.

...

Mike Huckabee, the former governor of Arkansas and a possible presidential candidate, said Friday afternoon in an interview that a shutdown would “hurt the Republicans, not the Democrats.”

...

Senator Tom Coburn of Oklahoma, one of the more conservative Republicans in the Senate, told Bloomberg’s Al Hunt that Republicans should “probably” give up on the policy “riders” that have been holding up negotiations.

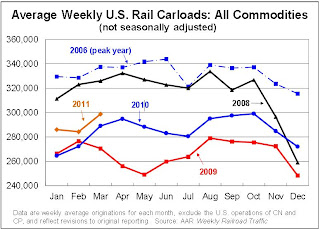

AAR: Rail Traffic increases in March

by Calculated Risk on 4/08/2011 03:03:00 PM

Some "D list" transportation data ...

The Association of American Railroads (AAR) reports carload traffic in March 2011 was up up 3.4% over March 2010 and 11.2% over March 2009, and intermodal traffic (using intermodal or shipping containers) was up 8.5% over March 2010 and up 21.6% over March 2009.

U.S. freight railroads originated an average of 298,711 carloads per week in March 2011, for a total of 1,493,553 carloads — up 3.4% over March 2010 and 11.2% over March 2009. March 2011’s percentage increase is the lowest of any month since rail traffic began its recovery in early 2010, but part of that is because of more difficult comparisons (i.e., year-ago traffic no longer as bleak as it had been).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows U.S. average weekly rail carloads (NSA).

From AAR:

On a seasonally adjusted basis, U.S. rail carloads were up 2.0% in March 2011 from February 2011. That’s the biggest month-to-month increase in six months and the third seasonally-adjusted increase in the past four months.As the first graph shows, rail carload traffic collapsed in November 2008, and now, over 18 months into the recovery, carload traffic has recovered about half way.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):In March 2011, U.S. railroads averaged 222,260 intermodal trailers and containers per week, for a total of 1,111,301 for the month. That’s up 8.5% (86,908 intermodal units) over March 2010 and up 21.6% (197,423 units) over March 2009.Intermodal traffic is close to old highs, but carload traffic is only about half way back to pre-recession levels.

Seasonally adjusted U.S. rail intermodal traffic was up 0.5% in March 2011 from February 2011, the fourth straight monthly increase.

excerpts with permission

Refinance Activity and Mortgage Rates

by Calculated Risk on 4/08/2011 01:58:00 PM

Yesteday Scott Reckard at the LA Times wrote about mortgage lenders laying off workers as refinance activity declined: Home lenders shed workers as mortgage rates climb. Here is a graph of refinance activity and mortgage rates:

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

Although mortgage rates are still below 5%, it takes lower and lower rates to get people to refi (at least lower than recent purchase rates).

With 30 year mortgage rates now about 0.6 percentage points above the lows in October, this is the end of the recent surge in refinance activity - unless rates drop significantly again. With refinance activity down over 50%, and mortgage purchase activity at low levels, the lenders need fewer workers (as Reckard noted).

CNBC: McConnell says Budget Deal Near

by Calculated Risk on 4/08/2011 11:41:00 AM

CNBC: Budget Deal is Near: GOP Senate Minority Leader McConnell

It seemed very unlikely to me that the government would be shut down. I'll have more when the deal is announced.