by Calculated Risk on 3/26/2011 05:54:00 PM

Saturday, March 26, 2011

Lawler: Census 2010 and Excess Vacant Housing Units

CR Note: This long and detailed note on the 2010 Census data is from economist Tom Lawler. Here is a spreadsheet for the 50 states (and D.C.) including the 2000 and 1990 Census data.

This starts with a brief excerpt (click read more for the full post). For those not interested in why some data drives demographers to drink, here is the Summary for Week ending March 25th.

Census 2010: Households, Housing Stock, and Vacant Housing Units: Understanding Why Demographers Drink by Tom Lawler

Census has now released the final Census 2010 counts for state and local population and housing units – occupied and vacant. Here are some national totals, as well as a comparison to the “official” Census 2000 counts – which are “known” to be off, but by uncertain amounts.

| Census 2010 | Census 2000 | Change | % Change | |

|---|---|---|---|---|

| Population | 308,745,538 | 281,421,906 | 27,323,632 | 9.7% |

| Total Housing Units | 131,704,730 | 115,904,641 | 15,800,089 | 13.6% |

| Occupied | 116,716,292 | 105,480,101 | 11,236,191 | 10.7% |

| Vacant | 14,988,438 | 10,424,540 | 4,563,898 | 43.8% |

| Gross Vacancy Rate | 11.38% | 8.99% | 2.39% |

For those who follow housing production, one of the “striking” things about the Census 2010 vs. the Census 2000 data is the apparent growth in the housing stock – 15.8 million units.

Summary for Week ending March 25th

by Calculated Risk on 3/26/2011 11:31:00 AM

World events once again dominated the headlines last week, with the Japanese nuclear issues, Libya, the Middle-East (especially Syria) and also the European financial crisis (Portugal, Ireland, Greece - even Spain and more) all on the front page.

In the U.S., the economic data was weaker, mostly because the major economic releases were housing related. New home sales were at a record low, and existing home sales fell sharply. But also durable goods orders were weaker than expected and consumer sentiment declined sharply from February (probably due to high gasoline prices and world events).

On the positive side, initial weekly unemployment claims continued to decline and the Richmond Fed manufacturing survey indicated continued expansion in March.

Below is a summary of economic data last week mostly in graphs:

• New Home Sales Fall to Record Low in February

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The Census Bureau reported New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 250 thousand. This was down from a revised 301 thousand in January.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate. This was a new record low sales rate and well below the consensus forecast of 290 thousand homes sold (SAAR).

The 2nd graph shows "months of supply". Months of supply increased to 8.9 in February from 7.4 months in January. The all time record was 12.1 months of supply in January 2009. This is very high (less than 6 months supply is normal).

The 2nd graph shows "months of supply". Months of supply increased to 8.9 in February from 7.4 months in January. The all time record was 12.1 months of supply in January 2009. This is very high (less than 6 months supply is normal).

The third graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In February 2010 (red column), 19 thousand new homes were sold (NSA). This is a new record low for the month of February.

In February 2010 (red column), 19 thousand new homes were sold (NSA). This is a new record low for the month of February.

The previous record low for February was 27 thousand in 2010. The high was 109 thousand in 2005.

This was a very weak report ...

• February Existing Home Sales: 4.88 million SAAR, 8.6 months of supply

The NAR reported: February Existing-Home Sales Decline

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in February 2011 (4.88 million SAAR) were 9.6% lower than last month, and were 2.8% lower than February 2010.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Although inventory increased from January to February (as usual), inventory decreased 1.2% YoY in February. This is a small YoY decrease and follows six consecutive month of year-over-year increases in inventory.

Although inventory increased from January to February (as usual), inventory decreased 1.2% YoY in February. This is a small YoY decrease and follows six consecutive month of year-over-year increases in inventory.

Inventory should increase over the next few months (the normal seasonal pattern), and the YoY change is something to watch closely this year. Inventory and "months of supply" are already very high, and further YoY increases in inventory would put more downward pressure on house prices.

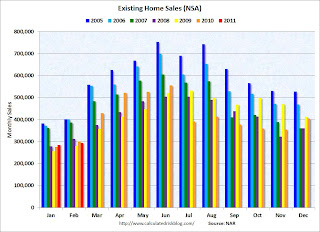

This graph shows existing home sales Not Seasonally Adjusted (NSA).

This graph shows existing home sales Not Seasonally Adjusted (NSA).

The red columns in January and February are for 2011.

Sales NSA were about the same level as the last three years. February is usually the second weakest month of the year for existing home sales (close to January). The real key is what happens in the spring and summer - and March sales and inventory will give a clearer picture of existing home sales activity.

• AIA: Architecture Billings Index increased slightly in February

From the American Institute of Architects: Architecture Firm Billings Increase Slightly in February. Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

This graph shows the Architecture Billings Index since 1996. The index showed billings were slightly higher in February (at 50.6).

This graph shows the Architecture Billings Index since 1996. The index showed billings were slightly higher in February (at 50.6).

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this indicator suggests the drag from CRE investment will end mid-year 2011 or so - but there won't be a strong increase in investment.

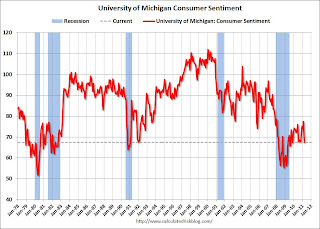

• Consumer Sentiment declines in March

The final March Reuters / University of Michigan consumer sentiment index declined to 67.5 from the preliminary March reading of 68.2 - and down from 77.5 in February. This is the lowest level since November 2009 and was below the consensus forecast of 68.0.

The final March Reuters / University of Michigan consumer sentiment index declined to 67.5 from the preliminary March reading of 68.2 - and down from 77.5 in February. This is the lowest level since November 2009 and was below the consensus forecast of 68.0.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices.

With higher gasoline prices and the scary world news, a low reading isn't that surprising.

• Other Economic Stories ...

• From the Chicago Fed: Economic Growth Near Average in February

• From the Richmond Fed: Manufacturing Activity Continues to Advance in March; Expectations Remain Upbeat

• ATA Truck Tonnage Index declined in February

• Moody's: Commercial Real Estate Prices declined 1.2% in January

• DOT: Vehicle Miles Driven increased slightly in January

• Q4 Real GDP Growth revised up to 3.1%

• Unofficial Problem Bank list increases to 985 Institutions

Best wishes to all!

Unofficial Problem Bank list increases to 985 Institutions

by Calculated Risk on 3/26/2011 08:15:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Mar 25, 2011.

Changes and comments from surferdude808:

The Unofficial Problem Bank List continued to climb as the FDIC released its actions for February 2011. This week, there were eight additions and five removals, which leaves the list with 985 institutions with assets of $431.1 billion.

The removals include the failed The Bank of Commerce, Wood Dale, IL ($163 million); one action termination against First Bank, Williamstown, NJ ($212 million); and three sales to private investors by West Michigan Community Bank, Hudsonville, MI ($123 million); Treaty Oak Bank, Austin, TX ($110 million Ticker: TOAK); and Community State Bank, Austin, TX ($21 million).

Among the eight additions are Plumas Bank, Quincy, CA ($483 million Ticker: PLBC); Country Bank, Aledo, IL ($213 million); and First Financial Bank, Bessemer, AL ($205 million).

Other changes include the issuance of seven and termination of one Prompt Corrective Order. The FDIC terminated the PCA order against Seattle Bank, Seattle, WA and issued orders against The Village Bank, Saint George, UT ($209 million); First Heritage Bank, Snohomish, WA ($179 million); Summit Bank, Prescott, AZ ($81 million); and four subsidiaries of Capitol Bancorp (Ticker: CBCR): Michigan Commerce Bank, Ann Arbor, MI ($934 million); Bank of Las Vegas, Las Vegas, NV ($375 million); Sunrise Bank of Arizona, Phoenix, AZ ($353 million); and Central Arizona Bank, Casa Grande, AZ ($76 million). (Edited by CR: see here for correction on Capitol Bancorp)

With the passage of another quarter, it is time to update the transition matrix. The Unofficial Problem Bank List debuted on August 7, 2009 with 389 institutions with assets of $276.3 billion (see table). Over the past 19 months, 176 institutions have been removed from the original list with 120 due to failure, 40 due to action termination, and 16 due to unassisted merger. Almost 31 percent of the 389 institutions on the original list have failed, which is substantially higher than the 12 percent figure usually cited by the media as the failure rate for institutions on the FDIC Problem Bank List. Failed bank assets have totaled $166.6 billion or 60 percent of the $276.3 billion on the original list.

Since the publication of the original list, another 940 institutions have been added. However, only 772 of those 940 additions remain on the current list as 168 institutions have been removed in the interim. Of the 168 interim removals, 119 were due to failure, 32 were due to unassisted merger, 15 from action termination, and two from voluntary liquidation. In total, 1,329 institutions have made an appearance on the Unofficial Problem Bank List and 239 or 18.0 percent have failed. Of the 344 total removals, failure is the primary form of exit (239 or 69.5 percent) while only 55 or 16.0 percent have been rehabilitated. The average asset size of removals because of failure is $1.04 billion. Currently, the average asset size of institutions on the current list is $438 million versus $710 million on the original list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 40 | (5,853,210) | |

| Unassisted Merger | 16 | (2,478,895) | |

| Voluntary Liquidation | 0 | - | |

| Failures | 120 | (166,633,042) | |

| Asset Change | (16,154,143) | ||

| Still on List at 3/25/2011 | 213 | 85,194,139 | |

| Additions | 772 | 345,874,340 | |

| End (3/25/2011) | 985 | 431,068,479 | |

| Interperiod Deletions1 | |||

| Action Terminated | 15 | 15,245,458 | |

| Unassisted Merger | 32 | 26,763,786 | |

| Voluntary Liquidation | 2 | 833,567 | |

| Failures | 119 | 81,716,210 | |

| Total | 168 | 124,559,021 | |

| 1Institution not on 8/7/2009 or 3/25/2011 list but appeared on a list between these dates. | |||

Friday, March 25, 2011

Liar Loan Prosecution

by Calculated Risk on 3/25/2011 09:38:00 PM

Joe Nocera at the NY Times has a strange tale: In Prison for Taking a Liar Loan

Mr. Engle’s is a tale worth telling for a number of reasons, not the least of which is its punch line. Was Mr. Engle convicted of running a crooked subprime company? Was he a mortgage broker who trafficked in predatory loans? A Wall Street huckster who sold toxic assets?This sounds more like "fraud for housing" than "fraud for profit" - although from Nocera's description, it doesn't sound much like fraud at all (and the reasons Engle was investigated are bizarre). Read the story ... but it is actually rare for the government to prosecute "fraud for housing" cases. Why this one?

No. Charlie Engle wasn’t a seller of bad mortgages. He was a borrower. And the “mortgage fraud” for which he was prosecuted was something that literally millions of Americans did during the subprime bubble. Supposedly, he lied on two liar loans.

Also this story prompted me to reread Tanta's brilliant piece: Unwinding the Fraud for Bubbles

Bank Failure #26 in 2011: The Bank of Commerce, Wood Dale, Illinois

by Calculated Risk on 3/25/2011 07:07:00 PM

Behavior resulting in

No consequences.

by Soylent Green is People

From the FDIC: Advantage National Bank Group, Elk Grove Village, Illinois, Assumes All of the Deposits of The Bank of Commerce, Wood Dale, Illinois

As of December 31, 2010, The Bank of Commerce had approximately $163.1 million in total assets and $161.4 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $41.9 million. ... The Bank of Commerce is the 26th FDIC-insured institution to fail in the nation this year, and the third in IllinoisFriday is here.

State Unemployment Rates generally unchanged in February

by Calculated Risk on 3/25/2011 03:14:00 PM

The BLS reported earlier today that state unemployment rates were generally unchanged in February. A few states showed strong increases in employment led by California. The LA Times reported: California adds nearly 100,000 jobs in February

In February, the Golden State added nearly 100,000 new jobs, the highest monthly increase since the current record system began in 1990, state officials said Friday. ... The number of new jobs created in February alone was almost as high as the total created for the previous 11 months, 99,800, the EDD said.Other states with significant increases were Pennsylvania (+23,700), Florida

and Texas (+22,700 each), Illinois (+17,600), North Carolina (+17,400), South Carolina (+16,400), Massachusetts (+15,400), Georgia (+14,900) and Oregon (+9,800). Unfortunately a number of states saw significant declines in employment too; Kansas (-12,800), Missouri (-10,100) and Washington (-8,500).

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed in February. Twenty-seven states and the District of Columbia recorded unemployment rate decreases, 7 states registered rate increases, and 16 states had no change, the U.S. Bureau of Labor Statistics reported today.The following graph shows the current unemployment rate for each state (red), and the max during the recession (blue). If there is no blue, the state is currently at the maximum during the recession.

...

Nevada continued to register the highest unemployment rate among the states, 13.6 percent in February. The states with the next highest rates were California, 12.2 percent, Florida, 11.5 percent, and Rhode Island,

11.2 percent.

One state, Colorado, set a new series high, 9.3 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The states are ranked by the highest current unemployment rate.

The auto states - led by Michigan - seem to have seen the most improvement (blue area).

Four states are still at the recession maximum (no improvement): Colorado (new high for 2nd month in a row), Idaho, Louisiana, and New Mexico.