by Calculated Risk on 3/24/2011 02:42:00 PM

Thursday, March 24, 2011

Fed to Hold Quarterly Press Conferences

From the Federal Reserve:

Chairman Ben S. Bernanke will hold press briefings four times per year to present the Federal Open Market Committee's current economic projections and to provide additional context for the FOMC's policy decisions.

In 2011, the Chairman's press briefings will be held at 2:15 p.m. following FOMC decisions scheduled on April 27, June 22 and November 2. The briefings will be broadcast live on the Federal Reserve's website. For these meetings, the FOMC statement is expected to be released at around 12:30 p.m., one hour and forty-five minutes earlier than for other FOMC meetings.

The introduction of regular press briefings is intended to further enhance the clarity and timeliness of the Federal Reserve's monetary policy communication. The Federal Reserve will continue to review its communications practices in the interest of ensuring accountability and increasing public understanding.

Freddie Mac eliminates option to foreclosure in the name of MERS

by Calculated Risk on 3/24/2011 12:40:00 PM

From Freddie Mac Bulletin: Eliminating the option to foreclose in the name of Mortgage Electronic Registration Systems Inc. (MERS) (ht Soylent Green is People)

We have updated the Guide to eliminate the option for the foreclosure counsel or trustee to conduct a foreclosure in the name of MERS. Effective for Mortgages registered with MERS that are referred to foreclosure on or after April 1, 2011, Servicers must prepare an assignment of the Security Instrument from MERS to the Servicer and instruct the foreclosure counsel or trustee to foreclose in the Servicer’s name and take title in Freddie Mac's name.This makes sense and avoids some legal battles. Some day all the MERS issues will be behind us (I don't think there are any systemic risks).

As required in Section 66.17, Foreclosing in the Servicer’s Name, Servicers must record the prepared assignment where required by State law. State mandated recording fees are not reimbursable by Freddie Mac, are not considered part of the Freddie Mac allowable attorney fees and must not be billed to the Borrower.

Servicers should refer to updated Section 66.17 and Section 66.54, Vesting the Title and Avoiding Transfer Taxes, for additional information.

Report: Portugal Bailout may be between 50 billion and 70 billion euros

by Calculated Risk on 3/24/2011 10:39:00 AM

From Bloomberg: Portugal Said to Need as Much as $99 Billion in Bailout

A bailout for Portugal may total as much as 70 billion euros ($99 billion), said two European officials with direct knowledge of the matter.It appears a bailout is inevitable and imminent. Here are the 2 year (6.7%), 5 year (8.2%) and 10 year (7.7%) yields on Portuguese government debt - all at new highs.

A financial lifeline would be between 50 billion euros and 70 billion euros ... Portugal has not yet asked for a bailout.

Watch Ireland too - the Irish ten year yield is near 10%.

Weekly Initial Unemployment Claims decline to 382,000

by Calculated Risk on 3/24/2011 08:39:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending March 19, the advance figure for seasonally adjusted initial claims was 382,000, a decrease of 5,000 from the previous week's revised figure of 387,000. The 4-week moving average was 385,250, a decrease of 1,500 from the previous week's revised average of 386,750.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the 4-week moving average of weekly claims for the last 40 years. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 1,500 to 385,250.

This is the 4th consecutive week with the 4-week average below the 400,000 level, and although there is nothing magical about 400,000, this is a small positive step for the labor market.

Wednesday, March 23, 2011

Misc: Portugal, Participation Rate, Japan and More

by Calculated Risk on 3/23/2011 07:27:00 PM

• The CBO has a new report Labor Force Projections Through 2021 (ht Catherine Rampell at Economix). The CBO's estimates are similar to mine (here and here). See Table 1 (on page 3) for their projections of the participation rate over the next decade.

The key is that a large portion of the recent decline in the participation rate is due to demographics, and we shouldn't expect the participation rate to rise back to the pre-recession levels.

• From the BBC: Portugal PM Jose Socrates resigns after budget rejected. This was expected, and it appears Portugal will be next in line for a bailout. The EU leaders meeting starts tomorrow - great timing!

Also, Ireland is expected to complete the next round of bank stress tests by the end of March - and if these show the need for additional capital (expected), then that will put the new Irish government in a difficult situation.

• From the NY Times: New Problems Arise at Japanese Nuclear Plant

The Japanese electricians who bravely strung wires this week to all six reactor buildings at a stricken nuclear power plant succeeded despite waves of heat and blasts of radioactive steam.Progress, but still scary.

... [However] nuclear engineers say some of the most difficult and dangerous tasks are still ahead — and time is not necessarily on the side of the repair teams.

• And the impact on the supply chain continues, from the Detroit Free Press: Toyota and Honda extend auto shutdowns

Toyota ... said in a statement Tuesday that its shutdown of 11 factories would be extended until Saturday because of difficulty securing components, including rubber parts and electronics.Earlier housing posts: Existing Home sales for February:

The shutdown had previously been announced through Tuesday. The automaker has lost production of about 140,000 vehicles since March 14.

...

Honda said its production halt would continue through Sunday

• February Existing Home Sales: 4.88 million SAAR, 8.6 months of supply

• Existing Home Inventory decreases 1.2% Year over Year

• Existing Home Sales and Inventory Graphs

New home sales for February:

• New Home Sales Fall to Record Low in February

• Home Sales: Distressing Gap

• New Home Sales and Inventory Graphs

DOT: Vehicle Miles Driven increased slightly in January

by Calculated Risk on 3/23/2011 04:06:00 PM

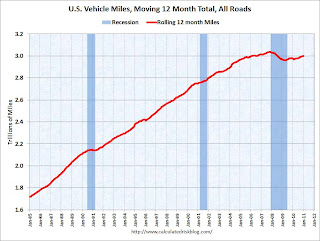

The Department of Transportation (DOT) reported that vehicle miles driven in January were up 0.2% compared to January 2010:

Travel on all roads and streets changed by +0.2% (0.5 billion vehicle miles) for January 2011 as compared with January 2010. Travel for the month is estimated to be 223.5 billion vehicle miles.Miles driven is barely up from last year, although the northeast was the weakest region in January, and driving in the northeast was probably impacted by the weather.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the rolling 12 month total vehicle miles driven.

• Note: in the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months. Currently miles driven has been below the previous peak for 38 months - another record that will be broken in March!

• In January U.S. oil prices averaged $90 per barrel, and we might see $100 oil lead to a decrease in driving in March or April.