by Calculated Risk on 3/21/2011 02:50:00 PM

Monday, March 21, 2011

Census 2010 Housing Occupancy and Vacancy Data

Earlier:

• February Existing Home Sales: 4.88 million SAAR, 8.6 months of supply

• Existing Home Inventory decreases 1.2% Year over Year

• Existing Home Sales and Inventory Graphs

The Census Bureau has released data for 42 states so far. These states account for about 83% of the U.S. housing stock based on the 2000 and 1990 Census data. Here is a table of the data released so far - total housing units, Occupied and Vacant - for each state, plus the vacancy rate for 2010, 2000 and 1990. The data is sortable by column.

Here is a spreadsheet of the 2010, 2000 and 1990 for those who want to look at the data.

Once all of the data is released, I'll post some more analysis. This data is useful in estimating the number of excess vacant units, the absorption rate by state, demolitions and more.

The following table shows the increase in percentage points in the vacancy rate by state. This table compares to the 2000 Census and also an average of the 1990 and 2000 Census. (sorted by highest percentage point increase from 2000). The data for the remaining 8 states and D.C. will be released by April 1st.

The "excess units" uses the change in vacancy rate times the total number of housing units.

Some states like Vermont always have a high vacancy rate because of the number of summer homes (the Census is an estimate as of April 1, 2010), so it is important to compare to previous Census vacancy rates.

We can also calculate an absorption rate (not included) by using the increase in occupied units between 2000 and 2010 - as an example, even though Nevada saw the largest increase in vacancy rate, it is a faster growing state than say Ohio - so the excess housing units may be absorbed quicker (of course Nevada also has the highest percentage of borrowers with negative equity - another problem!)

| Change from: | 2000 Census | Average 2000 and 1990 | ||

|---|---|---|---|---|

| Change Vacancy Rate in Percentage Points | Excess Units | Change in Percentage Points | Excess Units | |

| Nevada | 5.1% | 59,338 | 4.6% | 53,996 |

| Florida | 4.2% | 380,887 | 2.9% | 263,512 |

| Georgia | 3.9% | 160,129 | 3.0% | 121,064 |

| Ohio | 3.2% | 162,506 | 3.4% | 176,515 |

| Arizona | 3.1% | 89,502 | 1.0% | 27,463 |

| Wisconsin | 2.9% | 77,083 | 2.4% | 61,696 |

| Tennessee | 2.9% | 80,489 | 2.8% | 79,932 |

| Minnesota | 2.8% | 65,900 | 1.5% | 35,579 |

| Indiana | 2.8% | 76,999 | 2.6% | 72,745 |

| Delaware | 2.7% | 11,135 | 1.9% | 7,666 |

| Illinois | 2.7% | 141,182 | 2.3% | 121,780 |

| Colorado | 2.6% | 56,688 | 0.1% | 2,420 |

| Mississippi | 2.5% | 32,221 | 2.6% | 33,107 |

| North Carolina | 2.3% | 101,068 | 2.6% | 110,489 |

| Missouri | 2.3% | 62,267 | 2.0% | 52,948 |

| Vermont | 2.2% | 7,208 | 0.2% | 640 |

| California | 2.2% | 305,515 | 1.6% | 213,702 |

| Idaho | 2.2% | 14,781 | 1.4% | 9,089 |

| New Jersey | 2.1% | 75,520 | 1.3% | 45,243 |

| Virginia | 2.1% | 71,336 | 1.6% | 52,278 |

| Montana | 2.1% | 10,072 | 1.0% | 4,886 |

| Washington | 1.9% | 54,065 | 1.6% | 46,283 |

| Iowa | 1.8% | 24,589 | 1.7% | 23,357 |

| Connecticut | 1.8% | 26,300 | 1.4% | 20,652 |

| Arkansas | 1.7% | 22,950 | 1.8% | 24,071 |

| Alabama | 1.7% | 37,409 | 2.6% | 56,385 |

| Louisiana | 1.7% | 33,304 | 0.5% | 10,753 |

| Maryland | 1.7% | 40,080 | 1.7% | 41,387 |

| Nebraska | 1.7% | 13,385 | 1.2% | 9,391 |

| Utah | 1.7% | 16,215 | 0.9% | 9,086 |

| Kentucky | 1.6% | 30,786 | 2.0% | 37,740 |

| Kansas | 1.6% | 19,395 | 0.9% | 11,564 |

| Texas | 1.2% | 119,793 | -0.8% | -80,526 |

| Oregon | 1.2% | 19,385 | 1.5% | 24,654 |

| South Dakota | 1.1% | 4,090 | 0.5% | 1,867 |

| Oklahoma | 0.9% | 14,776 | -0.6% | -9,198 |

| Pennsylvania | 0.8% | 47,067 | 0.9% | 48,483 |

| Alaska | 0.8% | 2,592 | -1.0% | -3,080 |

| North Dakota | 0.2% | 657 | -0.6% | -1,890 |

| Hawaii | -0.1% | -469 | 1.8% | 9,499 |

| Wyoming | -0.2% | -393 | -1.9% | -4,956 |

| New Mexico | -0.9% | -8,495 | -1.4% | -12,962 |

| District of Columbia | NA | NA | NA | NA |

| Maine | NA | NA | NA | NA |

| Massachusetts | NA | NA | NA | NA |

| Michigan | NA | NA | NA | NA |

| New Hampshire | NA | NA | NA | NA |

| New York | NA | NA | NA | NA |

| Rhode Island | NA | NA | NA | NA |

| South Carolina | NA | NA | NA | NA |

| West Virginia | NA | NA | NA | NA |

Existing Home Inventory decreases 1.2% Year over Year

by Calculated Risk on 3/21/2011 11:30:00 AM

Earlier the NAR released the existing home sales data for February; here are a couple more graphs ...

The first graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Although inventory increased from January to February (as usual), inventory decreased 1.2% YoY in February. This is a small YoY decrease and follows six consecutive month of year-over-year increases in inventory.

Inventory should increase over the next few months (the normal seasonal pattern), and the YoY change is something to watch closely this year. Inventory is already very high, and further YoY increases in inventory would put more downward pressure on house prices.

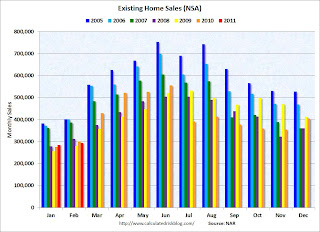

The second graph shows existing home sales Not Seasonally Adjusted (NSA).

The second graph shows existing home sales Not Seasonally Adjusted (NSA).

The red columns in January and February are for 2011.

Sales NSA were about the same level as the last three years. February is usually the second weakest month of the year for existing home sales (close to January). The real key is what happens in the spring and summer - and March sales and inventory will give a clearer picture of existing home sales activity.

The bottom line: Sales decreased in February (using the old method to estimate sales), possibly due to a decrease in investor purchases of distressed properties at the low end and possibly some weather factors. The NAR noted "Investors accounted for 19 percent of sales activity in February, down from 23 percent in January; they were 19 percent in February 2010."

The NAR also mentioned: "Distressed homes – sold at discount – accounted for a 39 percent market share in February, up from 37 percent in January and 35 percent in February 2010." A higher percentage of distressed sales probably means lower prices - and we should expect the repeat sales indexes to show further price declines in February.

Note: The Case-Shiller prices index will be released next Tuesday (March 29th), and will be for January (average of three months) - and the NAR report suggests further price declines in February.

March is the beginning of the selling season for existing homes, so the next report will be much more important.

February Existing Home Sales: 4.88 million SAAR, 8.6 months of supply

by Calculated Risk on 3/21/2011 10:00:00 AM

The NAR reports: February Existing-Home Sales Decline

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, dropped 9.6 percent to a seasonally adjusted annual rate of 4.88 million in February from an upwardly revised 5.40 million in January, and are 2.8 percent below the 5.02 million pace in February 2010.

...

Total housing inventory at the end of February rose 3.5 percent to 3.49 million existing homes available for sale, which represents an 8.6-month supply at the current sales pace, up from a 7.5-month supply in January.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in February 2011 (4.88 million SAAR) were 9.6% lower than last month, and were 2.8% lower than February 2010.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory increased to 3.49 million in February from 3.37 million in January.

Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory peaking in the summer and declining in the fall and winter. Inventory will probably increase significantly over the next several months.

The last graph shows the 'months of supply' metric.

The last graph shows the 'months of supply' metric.Months of supply increased to 8.6 months in February up from 7.5 months in January. The months of supply will probably increase over the next few months as inventory increases. This is higher than normal.

Special Note: Back in January, I noted that it appeared the NAR had overestimated sales by 5% or so in 2007, and that the errors had increased since then (perhaps 10% or 15% or more in 2009 and 2010). I reported in January that the NAR was working on benchmarking existing home sales for earlier years with other industry data, and I expected "this effort will lead to significant downward revisions to previously reported sales". The numbers reported today were estimated using the old method and will probably be revised down significantly, but they are still useful on a month-to-month basis.

These sales numbers were below the consensus of 5.15 million SAAR, and are slightly below what I expected (Lawler's forecast was 5 million). I'll have more soon.

Chicago Fed: Economic Growth Near Average in February

by Calculated Risk on 3/21/2011 08:30:00 AM

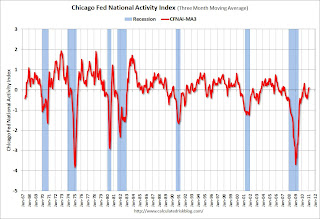

Note: This is a composite index based on a number of economic releases.

From the Chicago Fed: Economic Growth Near Average in February

The Chicago Fed National Activity Index ticked down to –0.04 in February from –0.01 in January. Three of the four broad categories of indicators that make up the index made positive contributions in February, but for the second consecutive month they were offset by continued weakness in the consumption and housing category.

The index’s three-month moving average, CFNAI-MA3, increased to +0.11 in February from +0.05 in January, coming in positive for two consecutive months for the first time since April and May of 2010. February’s CFNAI-MA3 suggests that growth in national economic activity was slightly above its historical trend. With regard to inflation, the CFNAI-MA3 indicates limited inflationary pressure from economic activity over the coming year.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.This index suggests the economy was growing near average in February.

Weekend:

• Summary for Week ending March 18th

• Some preliminary Census 2010 Housing Vacancy Data.

• Schedule for Week of March 20th

Sunday, March 20, 2011

Japan Nuclear Update

by Calculated Risk on 3/20/2011 08:29:00 PM

By request:

Note: The lack of hard information can be frustrating.

From the LA Times: Radiation levels may be falling at stricken nuclear plant

Radiation levels at the stricken Fukushima Daiichi nuclear power plant in Japan are still high but may be tapering off, a senior U.S. nuclear official said Sunday.From the NY Times: Progress at Japan Reactors; New Signs of Food Radiation

Indications from the plant, which houses six nuclear reactors, were levels in the range of hundreds of millisieverts per hour, said Gregory Jaczko, chairman of the U.S. Nuclear Regulatory Commission.

Japan appeared to make moderate progress in stabilizing some of the nuclear reactors at the stricken Fukushima Daiichi power plant on Sunday, but at the same time it disclosed new signs of radioactive contamination in agricultural produce and livestock.A running blog from Reuters: Japan earthquake LIVE

...

The Tokyo Electric Power Company ... appeared to have experienced a serious setback as officials said that pressure buildup at the ravaged No. 3 reactor would require the venting of more radioactive gases. But at a news conference a few hours later, officials from the power company said that the pressure had stabilized ...

The power company also said that on Sunday workers injected 40 tons of water into the storage pool containing spent fuel rods at Unit No. 2, and that firefighters began spraying water into the pool at Unit No. 4. On Saturday, firefighters sprayed water at the storage pool of Unit No. 3 for more than 13 hours.

...

The government said that power was returned to Reactor No. 2 at 3:46 p.m. Sunday, and that other reactors were also expected to gain power early in the week.

Earlier:

• Summary for Week ending March 18th

• Some preliminary Census 2010 Housing Vacancy Data.

• Schedule for Week of March 20th

Supply Chain Stress Test

by Calculated Risk on 3/20/2011 02:43:00 PM

It is hard to guess the impact of the supply chain disruption. A week or two shutdown will probably have minimal impact on sales, but a delay until May would be significant.

From Steve Lohr at the NY Times: Stress Test for the Global Supply Chain

[T]he disaster in Japan, experts say, presents a first-of-its-kind challenge, even if much remains uncertain.And from the WSJ: Supply Shortages Stall Auto Makers

Japan is the world’s third-largest economy, and a vital supplier of parts and equipment for major industries like computers, electronics and automobiles. The worst of the damage was northeast of Tokyo, near the quake’s epicenter, though Japan’s manufacturing heartland is farther south. But greater problems will emerge if rolling electrical blackouts and transportation disruptions across the country continue for long.

Throughout Japan, many plants are closed at least for days, with restart dates uncertain.

A shortage of Japanese-built electronic parts will force GM to close a plant in Zaragoza, Spain, on Monday and cancel shifts at a factory in Eisenach, Germany, on Monday and Tuesday, the company said Friday.And from the WSJ: Nissan to Resume Production in Japan

...

Japanese auto makers Toyota Motor Corp., Honda Motor Co. and Nissan Motor Co. have halted production in Japan in the way of last week's earthquake and tsunami.

... Honda [warned] U.S. dealers that it isn't sure if it will be able to resume full production at certain Japanese plants before May ...

Nissan Motor Co. said Sunday that it will start parts production and vehicle assembly operations this week in Japan, becoming the first car maker to restart its entire auto production process after a devastating quake brought the country's auto industry to a standstill.