by Calculated Risk on 3/16/2011 09:02:00 PM

Wednesday, March 16, 2011

Japan Nuclear Update: Helicopter Water drop has started, Police water cannon on site

Here is a live video feed.

Two CH-47 helicopters are rotating dumping water. UPDATE: Four drops were completed - now suspended. Water cannons are next.

Also from HNK: Water to be sprayed to cool down No 4 reactor

A Tokyo police unit is set to use water spray vehicles to cool down the No. 4 reactor at the disaster-stricken Fukushima Daiichi nuclear power plant.Earlier:

The police say it will begin the ground operation to spray water from outside the reactor on Thursday morning.

Housing Starts decrease sharply in February

Japan Nuclear Update

by Calculated Risk on 3/16/2011 05:48:00 PM

By request ...

From Reuters: Japan earthquake LIVE (an excellent site to follow events)

From Reuters: Japan scrambles to pull nuclear plant back from brink

From Nikkei: Tepco To Build New Power Source To Aid In Cooling

Tokyo Electric Power Co. (9501) will on Thursday start work to build makeshift electric power sources within the Fukushima Daiichi nuclear power plant, a move intended to inject water more efficiently into the plant's crippled reactors, the company said at a dawn news conference.From Reuters: TSE to keep Japan's trading floors open: report

...

Construction will start as soon as Thursday morning, an official said, but it will be unclear how long the work will take to complete until it begins. The work will be carried out at the same time as cooling efforts under way by police water cannon trucks.

NHK World English TV stream

From the NY Times: U.S. Calls Radiation ‘Extremely High’ and Urges Deeper Caution in Japan

The chairman of the United States Nuclear Regulatory Commission gave a significantly bleaker appraisal of the threat posed by Japan’s nuclear crisis than the Japanese government, saying on Wednesday that the damage at one crippled reactor was much more serious than Japanese officials had acknowledged and advising Americans to evacuate a wider area around the plant than the perimeter established by Japan.From the WSJ: Officials Try to Cool Spent Nuclear Fuel

Earlier:

Housing Starts decrease sharply in February

Best wishes to all.

Multi-Family Housing Starts and Completions

by Calculated Risk on 3/16/2011 02:04:00 PM

Although the number of multi-family housing starts was down in February to 96,000 at a seasonally adjusted annual rate (SAAR) (see Housing Starts decrease sharply in February), the number of multi-family starts can vary significantly month to month.

In general multi-family housing starts are trending up. Apartment owners are seeing falling vacancy rates, and some have started to plan for 2012 and will be breaking ground this year. We can see this in reports from architects and from comments at the NMHC apartment conference:

The expectations are for a record low supply completed this year (2011). Some pickup in completions next year (2012), and then plenty of completions in 2013.The following graph shows the lag between multi-family starts and completions.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The blue line is for multifamily starts and the red line is for multifamily completions. Since multifamily starts collapsed in 2009, completions collapsed in 2010.

Notice that the blue line (Starts) is now trending up, and the red line (completions) is still falling. Since it takes about 13 months on average to complete a multi-family building, the low level of starts in 2010 means a low level of completions in 2011.

In summary: For 2011, we should expect multi-family completions to be at or near a record low, and an increase in multi-family starts.

Japan Nuclear Update

by Calculated Risk on 3/16/2011 11:42:00 AM

By request ...

From Reuters: EU energy chief says Japan reactor "out of control"

Europe's energy chief warned on Wednesday of a further catastrophe at Japan's nuclear site in the coming hours but his spokeswoman said he had no specific or privileged information on the situation.From Reuters: Japan earthquake LIVE (an excellent site to follow events)

"In the coming hours there could be further catastrophic events, which could pose a threat to the lives of people on the island," Guenther Oettinger told the European Parliament. ... "The cooling systems did not work, and as a result we are somewhere between a disaster and a major disaster,"

From the NY Times: Japan Says 2nd Reactor May Have Ruptured With Radioactive Release

NHK English

IAEA Update on Japan Earthquake

Japanese authorities have reported concerns about the condition of the spent nuclear fuel pool at Fukushima Daiichi Unit 3 and Unit 4. Japanese Defense Minister Toshimi Kitazawa announced Wednesday that Special Defence Forces helicopters planned to drop water onto Unit 3, and officials are also preparing to spray water into Unit 4 from ground positions, and possibly later into Unit 3. Some debris on the ground from the 14 March explosion at Unit 3 may need to be removed before the spraying can begin.Best wishes to all.

Housing Starts decrease sharply in February

by Calculated Risk on 3/16/2011 08:30:00 AM

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Total housing starts were at 479 thousand (SAAR) in February, down 22.5% from the revised January rate of 618 thousand, and barely up from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts decreased 11.8% to 375 thousand in February - the lowest level since early 2009.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over two years - with slight ups and downs due to the home buyer tax credit.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over two years - with slight ups and downs due to the home buyer tax credit.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:This was well below expectations of 560 thousand starts, and near the record low.

Privately-owned housing starts in February were at a seasonally adjusted annual rate of 479,000. This is 22.5 percent (±9.8%) below the revised January estimate of 618,000 and is 20.8 percent (±9.0%) below the February 2010 rate of 605,000.

Single-family housing starts in February were at a rate of 375,000; this is 11.8 percent (±10.0%) below the revised January figure of 425,000. The February rate for units in buildings with five units or more was 96,000.

Building Permits:

Privately-owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 517,000. This is 8.2 percent (±3.3%) below the revised January rate of 563,000 and is 20.5 percent (±3.5%) below the February 2010 estimate of 650,000.

Single-family authorizations in February were at a rate of 382,000; this is 9.3 percent (±1.2%) below the revised January figure of 421,000. Authorizations of units in buildings with five units or more were at a rate of 121,000 in February.

This low level of starts is good news for housing, and I expect starts to stay low until more of the excess inventory of existing homes is absorbed. Note: This is the lowest level for Building permits since the Census Bureau started tracking permits.

MBA: Mortgage Purchase Application activity decreases

by Calculated Risk on 3/16/2011 07:13:00 AM

The MBA reports: Mortgage Purchase Applications Decrease in Latest MBA Weekly Survey

The Refinance Index increased 0.9 percent from the previous week and is the highest Refinance Index recorded in the survey since December 2010. The seasonally adjusted Purchase Index decreased 4.0 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.79 percent from 4.93 percent, with points increasing to 1.07 from 0.87 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the lowest contract 30-year rate observed in the survey since the week ending January 14, 2011.

Click on graph for larger image in graph gallery.

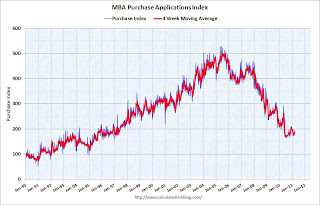

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index is still at 1997 levels, and even with the large percentage of cash buyers recently, this still suggests fairly weak home sales through April. Note: Refinance activity has picked up a little with lower mortgage rates.