by Calculated Risk on 2/28/2011 05:23:00 PM

Monday, February 28, 2011

Libya Updates

By request ...

• From the NY Times: Libya Wages Counterattack Against Rebels on 3 Fronts

Colonel Muammar el-Qaddafi’s forces struck back on three fronts on Monday, using fighter jets, special forces units and regular army troops in an escalation of hostilities that brought Libya closer to civil war.• From the NY Times: U.S. Readies Military Options on Libya

The attacks by the colonel’s troops on an oil refinery in central Libya and on cities on either side of the country ... showed that despite defections by the military, the government still possessed powerful assets, including fighter pilots willing to bomb Libyan cities.

• From the Telegraph: West ready to use force against Col Gaddafi amid chemical weapon fears

The Prime Minister disclosed that he would not rule out “the use of military assets” as Britain “must not tolerate this regime using military forces against its own people”. Britain and America are also thought to be considering arming rebel forces in Libya.• From al Jazeera: Live Blog - Libya March 1

...

Mr Cameron told MPs that Britain and its allies were considering using fighter jets to impose a no-fly zone over Libya

Restaurant Performance Index declines in January

by Calculated Risk on 2/28/2011 02:08:00 PM

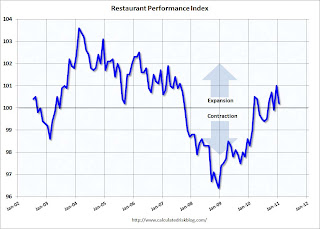

This is one of several industry specific indexes I track each month.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The index declined to 100.2 in January, barely indicating expansion.

More "Blame it on the snow!"

Unfortunately the data for this index only goes back to 2002.

From the National Restaurant Association: Restaurant Performance Index Declined in January Amid Weather-Dampened Sales and Traffic Levels

The National Restaurant Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.2 in January, down 0.8 percent from its December level. Despite the decline, January marked the fourth time in the last five months that the RPI stood above 100, which signifies expansion in the index of key industry indicators.

...

Due in large part to extreme weather conditions in some parts of the country, sales levels were dampened in January. Thirty-nine percent of restaurant operators reported a same-store sales gain between January 2010 and January 2011, down from 48 percent of operators who reported higher same-store sales in December.

...

Restaurant operators also reported a net decline in customer traffic levels in January.

...

For the fourth consecutive month, restaurant operators reported a positive outlook for staffing gains in the months ahead.

Dallas Fed: Texas Manufacturing Activity Picks Up

by Calculated Risk on 2/28/2011 11:31:00 AM

From the Dallas Fed: Texas Manufacturing Activity Picks Up

Texas factory activity increased in February, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose to 10 following a reading near zero in January.This is the last of the regional Fed surveys for February. The regional surveys provide a hint about the ISM manufacturing index, as the following graph shows.

...

Labor market indicators continued to reflect more hiring, a longer workweek and rising labor costs. The employment index came in at a reading of 11, up from 9 last month. The hours worked index was unchanged at 4, while the wages and benefits index fell from 15 to 9.

...

Prices continued to climb in February. The raw materials price index edged up from 62 to 63, with 64 percent of firms noting an increase in input costs compared with only 1 percent noting a decrease.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The New York and Philly Fed surveys are averaged together (dashed green, through February), and averaged five Fed surveys (blue, through February) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through January (right axis).

The ISM index for February will released tomorrow, Mar 1st. The consensus is for a slight decrease to 60.5 from the strong 60.8 in January.

The regional surveys suggest the ISM manufacturing index will be around 60 (strong expansion). The 60.8 reading in January was the highest level since May 2004, and any reading above 61.4 would be the highest since 1983.

Chicago PMI Strong in February, Pending Home Sales decline in January

by Calculated Risk on 2/28/2011 10:00:00 AM

• From the Chicago Business Barometer™ Grew: The overall index increased to 71.2 from 68.8 in January. This was above consensus expectations of 68.0. Note: any number above 50 shows expansion.

"EMPLOYMENT continued to show expansion;". The employment index decreased to a still strong 59.8 from 64.1.

"NEW ORDERS nudged upward, still at the highest level since December 1983;". The new orders index increased to 75.9 from 75.7.

This was another strong report.

• From the NAR: Pending Home Sales Decline in January

The Pending Home Sales Index,* a forward-looking indicator, declined 2.8 percent to 88.9 based on contracts signed in January from a downwardly revised 91.5 in December [revised down sharply from 93.7]. The index is 1.5 percent below the 90.3 level in January 2010 when a tax credit stimulus was in place. The data reflects contracts and not closings, which normally occur with a lag time of one or two months.This suggests existing home sales in February and March will be somewhat lower than in January.

Personal Income and Outlays Report for January

by Calculated Risk on 2/28/2011 08:30:00 AM

The BEA released the Personal Income and Outlays report for January:

Personal income increased $133.2 billion, or 1.0 percent ... Personal consumption expenditures (PCE) increased $23.7 billion, or 0.2 percent.The following graph shows real Personal Consumption Expenditures (PCE) through January (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- decreased 0.1 percent in January, in contrast to an increase of 0.3 percent in December.

...

The January change in disposable personal income (DPI) was affected by two large special factors. Reduced employee contributions for government social insurance ... boosted personal income in January by reducing the employee social security contribution rates ... The January change in DPI was affected by the expiration of the Making Work Pay provisions of the American Recovery and Reinvestment Act of 2009, which boosted personal current taxes and reduced DPI ... Excluding these two special factors ... DPI increased $11.4 billion, or 0.1 percent, in January

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Real PCE declined in January after increasing sharply in Q4. Note: The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter - so this still shows growth over Q4.

Also personal income less transfer payments increased again in January. This increased to $9,427 billion (SAAR, 2005 dollars) from $9,325 billion in December.

This graph shows real personal income less transfer payments as a percent of the previous peak. This has been slow to recover, but has improved recently - and is still 3.2% below the previous peak.

This graph shows real personal income less transfer payments as a percent of the previous peak. This has been slow to recover, but has improved recently - and is still 3.2% below the previous peak.The personal saving rate increased to 5.8% in January.

Personal saving as a percentage of disposable personal income was 5.8 percent in January, compared with 5.4 percent in December.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the January Personal Income report.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the January Personal Income report. When the recession began, I expected the saving rate to rise to 8% or more. With a rising saving rate, consumption growth would be below income growth. But that 8% rate was just a guess. It is possible the saving rate has peaked, or it might rise a little further, but either way most of the adjustment has already happened.

The 1.0% increase in personal income was well above expectations of 0.4%, although spending only increased 0.2% (compared to expectations of 0.4%). The core price index for PCE increased 0.1 percent in January - slightly below expectations.

Overall this is a decent report. Even with the decline in real PCE, the 1.0% increase in income, the increase in the saving rate - and sharp increase in personal income less transfer payments - all were good news.

Weekend on U.S. economy:

• Schedule for Week of February 27th

• Summary for Week ending February 25th

Sunday, February 27, 2011

Ireland to try to renegotiate bail-out terms

by Calculated Risk on 2/27/2011 08:24:00 PM

Earlier on U.S. economy:

• Schedule for Week of February 27th

• Summary for Week ending February 25th

• From the Telegraph: Enda Kenny to call for bail-out to be renegotiated

Ireland's new leader [Enda Kenny] travels to Helsinki on Friday for a meeting ... with the German chancellor and French president over the EU and International Monetary Fund austerity programme.Watch the yield on Ireland's Ten Year bond today.

He will plead with the EU for reduced interest rates .... [and] will also ask that investors, often other European financial institutions, take on some of an £85 billion debt burden of Irish banks, currently carried by taxpayers.

• After the Friday meeting in Helsinki on March 4th, there will be a special eurozone debt crisis summit on March 11th.

• Here are the Ten Year yields for Portugal, Spain, Greece, and Belgium (ht Nemo)