by Calculated Risk on 2/17/2011 06:09:00 PM

Thursday, February 17, 2011

The NAR Reponds to Questions of Overstating Sales

The National Association of Realtors (NAR) responded today to recent stories about the NAR overstating sales. This was in response to Calculated Risk posts in January (here, here and here), and to CoreLogic's release on Tuesday. Barry Ritholtz picked up on the story this morning.

From the NAR: Existing Home Sales: Benchmarking FAQ

Home sales measurements have shown to differ at times as reported by NAR and some outside organizations. Here are the facts and background you need to know.So the revisions should come this summer. I expect the NAR to revise down sales for the last 4 or 5 years, with significant downward revisions for 2009 and 2010 (CoreLogic estimated 15% to 20%).

How are NAR home sales computed?

NAR collects sales data from numerous MLSs, with a reporting sample of about 40 percent. If data computes to be a 5 percent increase from one year ago then we say home sales rose 5 percent from one year ago.

What about 5 million home sales? An increase of 5 percent is understood, but how is 5 or 6 million home sales computed?

A base figure is used from Census 2000 where one can compute how many homes were bought. If you recall there was a long-form of Census which asked questions about whether you moved or not and whether or not you bought a home. Based on this, one knows that 5.2 million existing homes were sold in 2000. Note that this benchmarking process does not use any data from MLSs. Hence, it is considered clean. With this base figure, we then apply the percent changes to sales obtained from MLSs. So if MLSs data addition says a 5 percent increase then we would say there were 5.4 million home sales.

How can NAR sales data drift away from true measure?

It is not definitive if NAR data has a measurable drift other than normal small statistical noise that may arise from not using all MLSs and from any data entry error or local MLSs sending wrong data to NAR. In statistics, one just assumes the positive and negative noises cancel each other out. It is however possible for this statistical noise to drift mostly in one direction and hence cumulatively add up over many years. In our last benchmark in year 2000, we found the reported home sales had a 13 percent upward drift compared to what Census data implied. NAR then revised the past 1990s data to match up with the Census data.

How are other home sales data computed?

Most other data comes from courthouse recordings. Generally, they make some assumptions about noncovered areas. Because of improved electronic recordings, they claim to capture more data and more quickly than in the past.

When will the new benchmarking take place?

A: In 2010 Census, a long-form questionnaire was not used. Therefore, the Census no longer asked about whether people moved and bought a home. So another brand new benchmarking process is needed. NAR has already been in contact with all key housing economists in the industry and government agencies and a few in the academia about finding a new benchmarking process. We expect a new clean, agreed-upon benchmark figure by the summer of this year.

In addition, we will be determining a new way to re-benchmark on a more frequent basis, possibly annually, to lessen any drift that can accumulate over time. This frequent re-benchmarking, rather than waiting every 10 years, is needed since the Census no longer collects a long-form questionnaire. With benchmarking, we will be working with various outside housing economists to develop a new-agreed upon method.

Hotel Occupancy Rate: Hotels Struggling in 2011

by Calculated Risk on 2/17/2011 03:14:00 PM

This year has been tough for hotel occupancy, with only a small increase over the very low levels for the same period a year ago. Here is the weekly update on hotels from HotelNewsNow.com: Midscale segment reports weekly decreases

Overall, the U.S. hotel industry’s occupancy increased 1.7% to 54.7%, ADR was up 0.7% to US$97.88, and RevPAR finished the week up 2.4% to US$53.51.The following graph shows the four week moving average of the occupancy rate as a percent of the median occupancy rate from 2000 through 2007.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Note: Since this is the percent of the median from 2000 to 2007, the percent can be greater than 100%.

The down spike in 2001 was due to 9/11. The up spike in late 2005 was hurricane related (Katrina and Rita). The dashed line is the current level.

This shows how deep the slump was in 2009 compared to the period following the 2001 recession. This also shows the occupancy rate improvement has slowed sharply since the beginning of the year (about 90% of the median from 2000 to 2007).

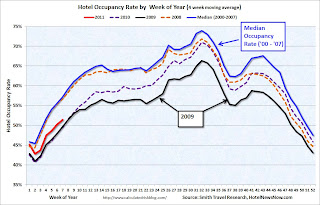

And here is the "spider" graph showing the seasonal pattern for the hotel occupancy rate.

And here is the "spider" graph showing the seasonal pattern for the hotel occupancy rate.The occupancy rate really fell off a cliff in the 2nd half of 2008, and then 2009 was the worst year for the occupancy rate since the Great Depression. The occupancy rate started to improve in the Spring of 2010, and was above the 2008 rates later in the year.

However, so far, 2011 is closer to the weak occupancy rates of 2009 and early 2010 than to the median for 2000 through 2007.

Blame it on the snow ... but if the occupancy rate doesn't pick up soon, Smith Travel will be reporting year-over-year declines in the occupancy rate again.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

MBA: Loans in Foreclosure Tie All-Time Record, fewer Short-term Delinquencies

by Calculated Risk on 2/17/2011 12:56:00 PM

The MBA reports that 12.85 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q4 2010 (seasonally adjusted). This is down from 13.52 percent in Q3 2010.

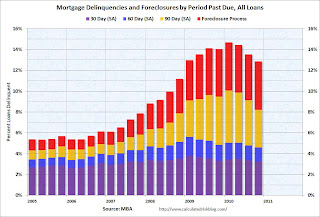

The following graph shows the percent of loans delinquent by days past due.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Loans 30 days delinquent decreased to 3.25% from 3.36% in Q3. This is below the average levels of the last 2 years, but still high.

Delinquent loans in the 60 day bucket decreased to 1.34% from 1.44% in Q3; this is the lowest since Q2 2008.

The biggest decline was in the 90+ day delinquent bucket. This declined from 4.34% in Q3 3.63% in Q4. This is mostly due to modifications or putting the loans in the foreclosure process.

The percent of loans in the foreclosure process increased to 4.63% (tying the record set in Q1 2010). This is due to the foreclosure pause.

Note: the MBA's National Delinquency Survey (NDS) covered "MBA’s National Delinquency Survey covers about 43.6 million first-lien mortgages on one- to four-unit residential properties" and the "The NDS is estimated to cover around 88 percent of the outstanding first-lien mortgages in the market." This gives almost 50 million total first lien mortgages or about 6.4 million delinquent or in foreclosure.

From the MBA: Short-term Delinquencies Fall to Pre-Recession Levels, Loans in Foreclosure Tie All-Time Record

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 8.22 percent of all loans outstanding as of the end of the fourth quarter of 2010, a decrease of 91 basis points from the third quarter of 2010, and a decrease of 125 basis points from one year ago, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey.Note: 8.22% (SA) and 4.63% equals 12.85%.

...

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 4.63 percent, up 24 basis points from the third quarter of 2010 and up five basis points from one year ago.

Jay Brinkmann, MBA's chief economist said ... "While delinquency and foreclosure rates are still well above historical norms, we have clearly turned the corner.Yesterday it was announced that an enforcement action (and probable fines) against the mortgage servicers is imminent. As part of any agreement, I expect the servicers will be moving ahead with both more modifications - and also with more foreclosure sales - so the percent of loans in the foreclosure process might have peaked (or will peak in Q1 2011).

...

Mike Fratantoni, MBA's vice president for single family research said "While the foreclosure starts rate fell during the fourth quarter, the percentage of loans in foreclosure rose to equal the all-time high. The foreclosure inventory rate captures loans from the point of the foreclosure referral to exit from the foreclosure process, either through a cure (perhaps through a modification), a short sale or deed in lieu, or through a foreclosure sale. As we predicted last quarter, the percentage of loans in the foreclosure process increased in the fourth quarter, largely due to the foreclosure paperwork issues that were being addressed in September and October. These issues caused a temporary halt in foreclosure sales, particularly in states with judicial foreclosure regimes, such as New Jersey, Florida, and Illinois. With fewer loans exiting the foreclosure process through sales, the foreclosure inventory rate naturally increased, even as fewer foreclosure starts meant that fewer loans entered the foreclosure process in the fourth quarter."

Core Measures show increase in Inflation

by Calculated Risk on 2/17/2011 11:42:00 AM

The BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in January on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.6 percent before seasonal adjustment.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

Increases in indexes for energy commodities and for food accounted for over two thirds of the all items increase.

...

The index for all items less food and energy rose 0.2 percent in January after increasing 0.1 percent in each of the previous two months.

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.0% annualized rate) in January. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.7% annualized rate) during the month.Over the last 12 months, core CPI has increased 0.95%, median CPI has increased 0.83%, and trimmed-mean CPI increased 0.97% - all less than 1%.

Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows these three measure of inflation on a year-over-year basis.

These measures all show that year-over-year inflation is very low, but have been increasing lately.

However, all three increased in January at a higher annualized rate: core CPI increased at an annualized rate of 2.1%, median CPI 2.0% annualized, and trimmed-mean CPI increased 2.7% annualized. This is just one month, but the annualized rate for these key measures is at or above the Fed's inflation target. With the slack in the system, I have been expecting these core measures to stay below 2% this year.

Note: You can see the median CPI details for January here.

Philly Fed Survey highest since January 2004

by Calculated Risk on 2/17/2011 10:00:00 AM

From the Philly Fed: February 2011 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from 19.3 in January to 35.9 this month. This is the highest reading since January 2004. [anything above 0 shows expansion]That is mostly good news. This was well above the consensus of 21.0.

...

Although the new orders index was virtually unchanged in February, it has increased over the past six months

...

The current employment index increased 6 points [to 23.6], and for the sixth consecutive month, the percentage of firms reporting an increase in employment (29 percent) is higher than the percentage reporting a decline (5 percent).

The concern is the pickup in both prices paid and received:

Price increases for inputs as well as firms’ own manufactured goods were more widespread again this month. Sixty-seven percent of the firms reported higher prices for inputs, compared with 54 percent in the previous month. The prices paid index, which increased 13 points in February, has now increased 55 points over the past five months. On balance, firms also reported a rise in prices for their own manufactured goods.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through February. The ISM and total Fed surveys are through January.

This early reading suggests the ISM index will be in the 60s again this month.

Weekly Initial Unemployment Claims increase to 410,000

by Calculated Risk on 2/17/2011 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

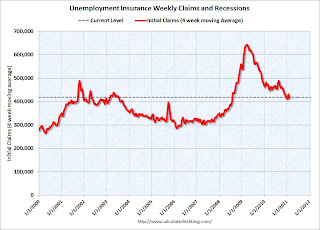

In the week ending Feb. 12, the advance figure for seasonally adjusted initial claims was 410,000, an increase of 25,000 from the previous week's revised figure of 385,000. The 4-week moving average was 417,750, an increase of 1,750 from the previous week's revised average of 416,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the 4-week moving average of weekly claims for the last 10 years. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week by 1,750 to 417,750.

The 4-week average has been just above 400,000 all year after falling sharply during the last few months of 2010. Hopefully claims will fall below the 400,000 level soon.