by Calculated Risk on 2/14/2011 10:00:00 AM

Monday, February 14, 2011

NY Fed Q4 Report on Household Debt and Credit

From the NY Fed: New York Fed also releases Q4 2010 Quarterly Household Debt and Credit Report, which reveals lower debt levels in region

Here is the Q4 report: Quarterly Report on Household Debt and Credit. Here are a couple of graphs:

The first graph shows aggregate consumer debt is still declining. Debt is now down over $1 trillion from the peak in 2008. Note: This is a combination of writing down debt and consumers paying down debt.

From the NY Fed:

Aggregate consumer debt continued to decline in the fourth quarter, continuing its trend of the previous two years. As of December 31, 2010, total consumer indebtedness was $11.4 trillion, a reduction of $1.08 trillion (8.6%) from its peak level at the close of 2008Q3, and $155 billion (1.3%) below its September 30, 2010 level. Household mortgage indebtedness has declined 9.1%, and home equity lines of credit (HELOCs) have fallen 6.5% since their respective peaks in 2008Q3 and 2009Q1. For the first time since 2008Q4, consumer indebtedness excluding mortgage and HELOC balances did not fall, but rose slightly ($7.3 billion or 0.3%) in the quarter.

The second graph shows the percent of debt in delinquency. What stands out is that the percent of delinquent debt is declining, but the percent of severely derogatory debt is remaining the same.

The second graph shows the percent of debt in delinquency. What stands out is that the percent of delinquent debt is declining, but the percent of severely derogatory debt is remaining the same.From the NY Fed:

Total household delinquency rates declined for the fourth consecutive quarter in 2010Q4. As of December 31, 10.8% of outstanding debt was in some stage of delinquency, compared to 11.1% on September 30, and 12.0% a year ago. Currently about $1.2 trillion of consumer debt is delinquent and $902 billion is seriously delinquent (at least 90 days late or “severely derogatory”). Compared to a year ago, delinquent balances are down 13.9%, and serious delinquencies have fallen 12.1%.Still a long ways to go. There are a number of credit graphs at the NY Fed site.

Leonhardt: Seattle’s Foreseeable Housing Bust

by Calculated Risk on 2/14/2011 09:03:00 AM

From David Leonhardt at the NY Times Economix: Seattle’s Foreseeable Housing Bust. This is a follow-up to David Streitfeld article: Housing Crash Is Hitting Cities Thought to Be Stable

Leonhardt writes:

When we last listed the price-to-rent ratios in major metropolitan areas, Seattle’s was near the top of the list. Only in the Bay Area of Northern California and in Honolulu were house prices higher, relative to rents.I agree completely with that last sentence - no place is immune.

A sky-high price-to-rent ratio is perhaps the single best sign that an area is in a housing bubble. Real-estate agents, homeowners and even home buyers can tell a lot of stories to justify the bubble — stories about central cities or good school districts being immune to bubbles — but eventually people will realize that renting is a much better deal and more will do so.

There is no such thing as a market price that cannot fall.

Price-to-rent is a great indicator, but some areas have high price-to-rent ratios because of the mix of housing units (rentals units are not perfect substitutes for buying). I prefer tracking price-to-rent over time for a particular city (as opposed to comparing cities), but a high price-to-rent ratio is definitely a warning flag.

Sunday, February 13, 2011

Housing: For many cities "another season of pain"

by Calculated Risk on 2/13/2011 07:13:00 PM

From David Streitfeld at the NY Times: Housing Crash Is Hitting Cities Thought to Be Stable. A few excerpts:

In the last year, Seattle homeowners experienced a bigger price decline than in Las Vegas. Minneapolis dropped more than Miami, and Atlanta fared worse than Phoenix.The amount of pain will depend on the local level of inventory - including the "shadow inventory".

The bubble markets, where builders, buyers and banks ran wild, began falling first, economists say, so they are close to the end of the cycle and in some cases on their way back up. Nearly everyone else still has another season of pain.

And the following excerpt hits on two topics we've discussed ad nauseam over the last 5 year: 1) sellers chasing the market down, and 2) accidental landlords waiting for a "better market" to sell (part of the shadow inventory):

Megan and Ryan Dortch tried to sell their one-bedroom Eastlake condo for $325,000 two years ago. They rejected an offer of $295,000 as inadequate. A year later, they relisted it for $289,000, then $279,000, which was less than they paid. ... They are now renting out their old apartment at a small loss every month ...Watching existing home inventory will be very important this year. Areas with high levels of inventory will probably see more price declines. It is hard to tell about inventory right now - usually inventory is pretty low in December and January, and then increases sharply from February into the early summer - so we will know more about inventory soon.

[W]henever the market finally does pick up, all those accidental landlords will want to unload, putting another burden on the market. “So many sellers are waiting in the shadows,” said Redfin’s chief executive, Glenn Kelman. “The inventory is going to expand and expand and expand. I don’t see any basis for significant price increases.”

Earlier:

• The busy economic schedule for the coming week.

• Summary for Week ending February 12th

FOMC Minutes Preview

by Calculated Risk on 2/13/2011 02:30:00 PM

Earlier:

• The busy economic schedule for the coming week.

• Summary for Week ending February 12th

The minutes for the January FOMC meeting will be released on Wednesday. I'll be looking for any discussion of disagreement on QE2, any discussion of "tapering" off the QE2 purchases (something I think is likely), and also at the updated economic forecasts for GDP, unemployment and inflation.

I expect the FOMC to have revised up their GDP forecast for 2011, revise down their forecast for the Q4 2011 unemployment rate, and perhaps a small upward revision to their inflation forecast. The following table shows the November forecasts:

| November Economic projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| 2010 Actual | 2011 | 2012 | 2013 | |

| Change in Real GDP | 2.8%1 | 3.0 to 3.6% | 3.6 to 4.5% | 3.5 to 4.6% |

| June projections | ... | 3.5% to 4.2% | 3.5% to 4.5% | n.a. |

| Unemployment Rate | 9.6%2 | 8.9 to 9.1% | 7.7 to 8.2% | 6.9 to 7.4% |

| June projections | ... | 8.3% to 8.7% | 7.1% to 7.5% | n.a. |

| PCE Inflation | 1.2%1 | 1.1 to 1.7% | 1.1 to 1.8% | 1.2 to 2.0% |

| June projections | ... | 1.1% to 1.6% | 1.0% to 1.7% | n.a. |

| Core PCE Inflation | 0.8%1 | 0.9 to 1.6% | 1.0 to 1.6% | 1.1 to 2.0% |

| June projections | ... | 0.9 to 1.3% | 1.0 to 1.5% | n.a. |

FOMC definitions:

1 Projections of change in real GDP and in inflation are from the fourth quarter of the previous year to the fourth quarter of the year indicated.

2 Projections for the unemployment rate are for the average civilian unemployment rate in the fourth quarter of the year indicated.

The table also includes the actual numbers for 2010. We can compare this to the January 2010 FOMC forecasts (not included in table).

• Real GDP: Actual was 2.8%, and the January 2010 forecast range was for 2.8% to 3.5% - so this was at the low end of the range (thanks to a fairly strong Q4).

• Unemployment: Actual in Q4 was 9.6%, and the January 2010 forecast range was for 9.5% to 9.7% - so this was right on.

• PCE Inflation: Actual was 1.2%, and the January 2010 forecast range was for 1.4 to 1.7% - so this forecast was too high.

• Core PCE Inflation: Actual was 0.8%, and the January 2010 forecast range was for 1.1 to 1.7% - so this forecast was also too high.

Overall the FOMC forecasts from January 2010 were pretty close.

Summary for Week ending February 12th

by Calculated Risk on 2/13/2011 09:00:00 AM

Here is the busy economic schedule for the coming week.

• Egpyt

From the NY Times: Military Offers Assurances to Egypt and Neighbors

From the WSJ: Egypt's Military Moves to Clear Tahrir Square

From the Financial Times: Egyptian youth groups seek army talks

Below is a summary of the previous week, mostly in graphs.

• Trade Deficit increased in December

Click on graphs for larger image in graph gallery.

Click on graphs for larger image in graph gallery.

The first graph shows the monthly U.S. exports and imports in dollars through December 2010.

December exports were $163.0 billion, up from $160.1 billion in November. December imports were $203.5 billion, up from $198.5 billion in November.

Imports had been mostly flat since May, but increased again in December. Exports have started increasing again after the mid-year slowdown.

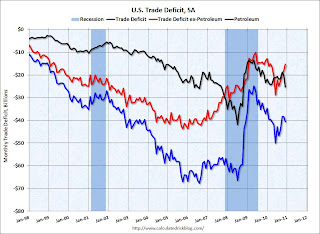

The second graph shows the U.S. trade deficit, with and without petroleum, through December.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. The trade deficit was $40.6 billion, up from $38.3 billion in November.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. The trade deficit was $40.6 billion, up from $38.3 billion in November.

The petroleum deficit increased in December as both quantity and import prices continued to rise - averaging $79.78 in December. Prices will be even higher in January. Once again oil and China deficits are essentially the entire trade deficit (or even more).

• CoreLogic: House Prices declined 1.8% in December

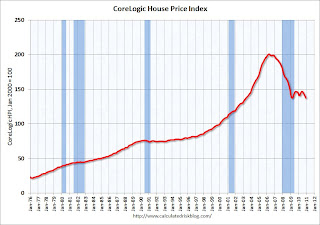

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index is down 5.46% over the last year, and off 31.6% from the peak.

This is the fifth straight month of year-over-year declines, and the sixth straight month of month-to-month declines. The index is only 0.07% above the low set in March 2009 (essentially at the low), and I expect to see a new post-bubble low for this index with the January release.

• NFIB: Small Business Optimism Index increases in January

From National Federation of Independent Business (NFIB): "The National Federation of Independent Business Index of Small Business Optimism rose 1.5 points in January, a modest increase, opening the new year with a reading of 94.1."

From National Federation of Independent Business (NFIB): "The National Federation of Independent Business Index of Small Business Optimism rose 1.5 points in January, a modest increase, opening the new year with a reading of 94.1."

This graph shows the small business optimism index since 1986. The index increased to 94.1 in January from 92.6 in December.

Although still fairly low, this is the highest level for the index since December 2007.

This graph shows the net hiring plans over the next three months.

This graph shows the net hiring plans over the next three months.

Hiring plans decreased slightly in January but are still positive.

The recovery is sluggish for the small business optimism index (probably because of the high concentration of real estate related companies), but this is the highest level for the optimism index since December 2007.

• Consumer Sentiment increases slightly in February

The preliminary Reuters / University of Michigan consumer sentiment index increased to 75.1 in February from 74.2 in January.

The preliminary Reuters / University of Michigan consumer sentiment index increased to 75.1 in February from 74.2 in January.

This was at the consensus forecast of 75.0.

Sentiment is still at levels usually associated with a recession - and sentiment is well below the pre-recession levels.

• Other Economic Stories ...

• From Treasury: Proposed plan for Fannie and Freddie press release and here is the report

• AAR: Rail Traffic increases in January

• Ceridian-UCLA: Diesel Fuel index decreases slightly in January

• Bernanke Testimony: The Economic Outlook and Monetary and Fiscal Policy

• From NY Fed Vice President Brian Sack: Implementing the Federal Reserve’s Asset Purchase Program

• CoStar: Commercial Real Estate prices increased slightly in December

• From RealtyTrac: Foreclosure Activity Increases 1 Percent in January

• Unofficial Problem Bank list at 944 Institutions

Best wishes to all!

Saturday, February 12, 2011

Commentary for the Week

by Calculated Risk on 2/12/2011 08:51:00 PM

Commentary this week:

• Monday: Daily Color: Years to Absorb Excess Housing Units in certain states

• Tuesday: A Dab of Color: Transportation

• Wednesday: Some Praise for Bernanke

• Thursday: Ranking Economic Data Note: This is a first cut at ranking economic data. I've marked several indicators with '***' indicating I think this data is currently more important than usual. For each indicator I've included a link to the source, and a link to the current graph gallery.

• Friday belongs to Egypt (no commentary)

• Saturday: Participation Rate Update

Earlier:

• Schedule for Week of February 13th