by Calculated Risk on 2/12/2011 05:10:00 PM

Saturday, February 12, 2011

Schedule for Week of February 13th

The key releases this week will be retail sales on Tuesday, industrial production on Wednesday, and the consumer price index on Thursday. For housing, the NHAB housing market index will be released on Tuesday, and housing starts on Wednesday.

Morning: New York Fed Q4 Report on Household Debt and Credit

10:00 AM ET: NY Fed President William Dudley speaks in New York, Q1 2011, Household Debt & Economic Activity

8:30 AM: Retail Sales for January.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline). Retail sales in December were up 13.5% from the bottom, and were 0.2% above the pre-recession peak.

The consensus is for a 0.5% increase from December. (and 0.5% increase ex-auto). Sales were probably boosted in January by the payroll tax cut.

8:30 AM: NY Fed Empire Manufacturing Survey for February. The consensus is for a reading of 15.0, up from the reading of 11.92 in January. The regional surveys have been showing fairly strong manufacturing activity recently.

10 AM: The February NAHB homebuilder survey. The consensus is for a reading of 17, up slightly from 16 in January. Any number below 50 indicates that more builders view sales conditions as poor than good. This index has been below 25 for the last 3 1/2 years.

10:00 AM: Manufacturing and Trade: Inventories and Sales for December. The consensus is for 0.7% increase in inventories.

10:00 AM: Cleveland Fed President Sandra Pianalto speaks in Akron, Ohio, "Regional and National Economic Conditions"

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

8:30 AM: Producer Price Index for January. The consensus is for a 0.8% increase in producer prices.

8:30 AM: Housing Starts for January. After collapsing following the housing bubble, housing starts have mostly moved sideways at a very depressed level for the last two years.

This graph shows total and single unit starts since 1968.

This graph shows total and single unit starts since 1968. Total housing starts were at 529 thousand (SAAR) in December, and single-family starts were at a 417 thousand rate - the lowest level since early 2009.

The consensus is for a slight increase to 540,000 (SAAR) in January.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for January. The consensus is for a 0.5% increase in Industrial Production in January, and an increase to 76.3% (from 76.0%) for Capacity Utilization.

2:00 PM: FOMC Minutes, Meeting of January 25-26, 2011. This will include updated forecasts of GDP growth, unemployment, and inflation.

8:30 AM: Consumer Price Index for January.

This graph shows these three measure of inflation - core CPI, median CPI and trimmed-mean CPI - on a year-over-year basis. They all show that inflation has been falling, and that measured inflation is up less than 1% year-over-year.

This graph shows these three measure of inflation - core CPI, median CPI and trimmed-mean CPI - on a year-over-year basis. They all show that inflation has been falling, and that measured inflation is up less than 1% year-over-year. The consensus is for a 0.3% increase for CPI in January and for core CPI to show an increase of 0.1%.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 410,000 from 383,000 last week that was probably low because of weather issues.

10:00 AM: Philly Fed Survey for February. The consensus is for a reading of 21.0, up slightly from the 19.3 in January.

10:00 AM: Conference Board Leading Indicators for January. The consensus is for a 0.2% increase for this index.

10:00 AM: Testimony, Fed Chairman Ben Bernanke, "Implementation of the Dodd-Frank Act" Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

11:30 AM: Atlanta Fed President Dennis Lockhart asks questions of Ireland Ambassador to the U.S., "Ireland and the U.S. Roads to Recovery,"

1:10 PM: Dallas Fed President Richard Fisher speaks on "Federal Reserve Functions and Economic Update"

1:20 PM: Chicago Fed President Charles Evans speaks on the economic outlook

8:00 AM ET: Panel Discussion, Chairman Ben Bernanke, Global Imbalances and Financial Stability, At the Banque de France Financial Stability Review Launch Event, Paris, France

After 4:00 PM: The FDIC might have a busy Friday afternoon ...

Participation Rate Update

by Calculated Risk on 2/12/2011 12:30:00 PM

Last year I looked at some of the cyclical and long term trends for the participation rate: Labor Force Participation Rate: What will happen?. I concluded that most of the decline in the participation rate is due to changes in demographics - not cyclical. I also noted that it is possible that long term trends - especially more older workers participating in the labor force - could push the participation rate up to 66% by 2015 before the participation rate would start to decline again.

Sven Jari Stehn at Goldman Sachs put out a research note last night arguing there would only be a small increase in the participation rate over the next two years as the economy recovers:

• Economic recovery should draw some additional workers into the labor force in the next 1-2 years. But there is little evidence for the idea that an “unduly” low participation rate is masking an even weaker labor market than indicated by the 9% unemployment rate. Instead, we find that most of the drop in participation in recent years reflects changes in the underlying demographics and the “normal” effects of the economic cycle (i.e., the fact that a 9% unemployment rate in itself is very high). Our analysis implies that the overall labor force participation rate will edge up by ¼ to ½ percentage point over the next two years. If so, job growth will need to average 200,000 jobs per month to push the unemployment rateThis analysis is important because it suggests the large decline in the participation rate is mostly because of demographics, and only a portion of because of the decline because of cyclical effects. So the bounce back will probably not be as large as some people expect.

down to 8% by the end of 2012, consistent with our forecast.

• These projections are based on our analysis of the structural and cyclical drivers of labor force participation. Population aging should push down the participation rate as older individuals are less likely to participate in the labor force than their younger counterparts. “Secular trends” in the participation profile of different population groups are likely to reinforce this downward trend, as participation of young workers and (to a lesser extent) of prime-age men continues to decline. In combination these structural trends should push down the participation rate by around ¼ point per year.

• The economic recovery, however, should attract some workers back into the labor force and thus offset the demographic trends above in the next couple of years. Taken together our analysis projects a participation rate of 64.7% at the end of 2012—up a modest 0.4 point from the current rate.

Here is a look at some the long term trends (updating graphs through January 2011):

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the changes in the participation rates for men and women since 1960 (in the 25 to 54 age group - the prime working years).

The participation rate for women increased significantly from the mid 30s to the mid 70s and has mostly flattened out. The participation rate for men has decreased from the high 90s to 88.6% in January 2011.

There will probably be some "bounce back" for men (some of the recent decline is probably cyclical), but the long term trend is down.

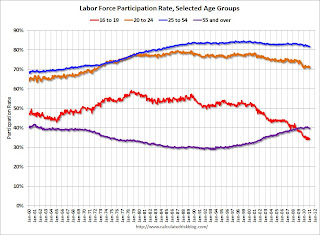

This graph shows that participation rates for several key age groups.

This graph shows that participation rates for several key age groups.There are a few key long term trends:

• The participation rate for the '16 to 19' age group has been falling for some time (red).

• The participation rate for the 'over 55' age group has been rising since the mid '90s (purple), although this has stalled out a little recently (perhaps cyclical).

• The participation rate for the '20 to 24' age group appears to be falling too (perhaps more education before joining the labor force). Also note the sharp decline over the last couple of years - that will probably turn around quickly as the job market improves.

The third graph shows the participation rate for several over 55 age groups. The red line is the '55 and over' total seasonally adjusted. All of the other age groups are Not Seasonally Adjusted (NSA).

The third graph shows the participation rate for several over 55 age groups. The red line is the '55 and over' total seasonally adjusted. All of the other age groups are Not Seasonally Adjusted (NSA).The participation rate is generally trending up for all age groups. And this might push the overall participation rate up over the next 5 years. After that the 'over 55' participation rate will probably start to decline as the oldest baby boomers move into even older age groups.

If these trends for older workers continue, the participation rate might rise a little further than Sven Jari Stehn is forecasting. But the key point is most of the recent decline in the participation rate is due to demographics and not because of cyclical effects - although there will probably be some small bounce back of the next couple of years.

Unofficial Problem Bank list at 944 Institutions

by Calculated Risk on 2/12/2011 09:04:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Feb 11, 2011.

Changes and comments from surferdude808:

After five removals and three additions, the Unofficial Problem Bank List has two fewer institutions this week at 944, but assets increased by $1.8 billion to $413 billion.

Removals include the four failures this week -- Peoples State Bank, Hamtramck, MI ($430 million Ticker: PSBG); Canyon National Bank, Palm Springs, CA ($221 million Ticker: CYBA); Sunshine State Community Bank, Port Orange, FL ($141 million); and Badger State Bank, Cassville, WI ($87 million); and one action termination against Woodforest Bank, Refugio, TX ($141 million).

Additions include Southwest Securities, FSB, Dallas, TX ($1.8 billion Ticker: SWS); Carver Federal Savings Bank, New York, NY ($755 million); and Community Bank-Wheaton/Glen Ellyn, Glen Ellyn, IL ($332 million Ticker: CFIS).

Other changes include Prompt Corrective Action orders issued against Community Banks of Colorado, Greenwood, CO ($1.7 billion); and First Peoples Bank, Port St. Lucie, FL ($241 million Ticker: FPBI). Next week we anticipate the OCC will release its actions through January 2011. Until then, as we always hope for, have a safe banking week.

Friday, February 11, 2011

Fed's Raskin: No improvement in Mortgage Servicer operational performance

by Calculated Risk on 2/11/2011 10:10:00 PM

From Fed Governor Sarah Bloom Raskin: Putting the Low Road Behind Us. Excerpt:

Late last year, the federal banking agencies began a targeted review of loan servicing practices at large financial institutions that had significant market concentrations in mortgage servicing. The preliminary results from this review indicate that widespread weaknesses exist in the servicing industry. The agencies intend to report more specific findings to the public soon, but I can tell you that these deficiencies pose significant risk to mortgage servicing and foreclosure processes, impair the functioning of mortgage markets, and diminish overall accountability to homeowners.This report should be released soon ... and it should be a scathing review of the mortgage servicing industry.

I'm sure this has been said, but I'll say it again because I have seen little to no evidence of improvement in the operational performance of servicers since the onset of the crisis in 2007: Until these operational problems are addressed once and for all, the foreclosure crisis will continue and the housing sector will languish.

...

I do not want to revisit all of the sordid events that brought us to economic crisis in 2008 but, suffice it to say that, in the housing sector, we traveled a very low road that had nothing to do with looking out for the greater good.

Bank Failure #18 in 2011: Canyon National Bank, Palm Springs, California

by Calculated Risk on 2/11/2011 09:20:00 PM

From the FDIC: Pacific Premier Bank, Costa Mesa, California, Assumes All of the Deposits of Canyon National Bank, Palm Springs, California

As of December 31, 2010, Canyon National Bank had approximately $210.9 million in total assets and $205.3 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $10.0 million. ... Canyon National Bank is the eighteenth FDIC-insured institution to fail in the nation this year, and the first in California.Four down today ...

Bank Failure #17: Badger State Bank, Cassville, WI

by Calculated Risk on 2/11/2011 07:08:00 PM

Badger State saw it's shadow

Now no early Spring.

by Soylent Green is People

From the FDIC: Royal Bank, Elroy, Wisconsin, Assumes All of the Deposits of Badger State Bank, Cassville, Wisconsin

As of December 31, 2010, Badger State Bank had approximately $83.8 million in total assets and $78.5 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $17.5 million. .... Badger State Bank is the seventeenth FDIC-insured institution to fail in the nation this year, and the second in Wisconsin.Three down today.