by Calculated Risk on 2/08/2011 08:02:00 AM

Tuesday, February 08, 2011

NFIB: Small Business Optimism Index increases in January

From National Federation of Independent Business (NFIB): NFIB Small Business Optimism Index - Up Modestly

The National Federation of Independent Business Index of Small Business Optimism rose 1.5 points in January, a modest increase, opening the new year with a reading of 94.1. The slight overall uptick in optimism might have been higher, but was blunted by small business owners’ skepticism about the future and continued hesitancy to spend and hire. Weak sales is still the most frequently cited top business problem.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

...

“Manufacturing and exporting are leading the recovery—industries and activities that are not labor intensive—while construction, an industry historically dominated by small firms, remains depressed,” said NFIB chief economist Bill Dunkelberg.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the small business optimism index since 1986. The index increased to 94.1 in January from 92.6 in December.

Although still fairly low, this is the highest level for the index since December 2007.

The second graph shows the net hiring plans over the next three months.

The second graph shows the net hiring plans over the next three months.Hiring plans decreased slightly in January but are still positive. According to NFIB: "Over the next three months, 12 percent plan to increase employment (up 2 points), and 8 percent plan to reduce their workforce (down 1 point), yielding a seasonally adjusted net 3 percent of owners planning to create new jobs—a 3 point loss from December."

Weak sales is still the top business problem:

Only 3 percent reported financing as their top business problem, down 2 points from December. Twenty-seven percent of the owners reported that weak sales continued to be their top business problem (down 6 points) in the last month, followed by 19 percent citing taxes and 17 percent government regulations and red tape (taxes that consume capital and entrepreneurial time).The recovery is sluggish for this index (probably because of the high concentration of real estate related companies), but this is the highest level for the optimism index since December 2007.

Monday, February 07, 2011

Housing: Increase in Cash Buyers

by Calculated Risk on 2/07/2011 09:27:00 PM

From Mitra Kalita at the WSJ: Cash Buyers Lift Housing

Cash buyers represented more than half of all transactions in the Miami-Fort Lauderdale area last year ... In the fourth quarter of 2006, they represented just 13% of deals.This is a quite an increase in cash buyers. Most of the cash transactions are at the low end - and are frequently investors - although the article mentioned one buyer paying cash for $1+ million properties.

...

The percentage of buyers in Phoenix paying cash hit 42% in 2010—more than triple the rate in 2008 ... Nationally, 28% of sales were all-cash transactions last year, according to the National Association of Realtors. The rate was 14% in October 2008 ...

The good news is these buyers won't ever have negative equity!

Note: The MBA mortgage index is suggesting weak home sales over the next couple of months, but obviously that index doesn't capture this increase in cash buyers.

Daily Color: Years to Absorb Excess Housing Units

by Calculated Risk on 2/07/2011 06:10:00 PM

This morning I posted some data and analysis from economist Tom Lawler based on the 2010 Census: Lawler: Housing Vacancy Survey appears to massively overstate number of vacant housing units.

Lawler's key point was that when compared to the Census 2010 data, the Housing Vacancy Survey (that most analysts use) "massively overstates" the number of vacant housing units in these four states (and probably nationally).

Note: The Census bureau has released data for only four states so far, and will release data for all 50 states by April 1st.

Here is another question: At the current rate of population growth, how long will it take to lower the vacancy rate back to the Census 2000 level?

| Louisiana | Mississippi | New Jersey | Virginia | |

|---|---|---|---|---|

| Percent Excess Housing Units compared to Census 2000 | 1.7% | 2.6% | 2.1% | 2.1% |

| Excess Housing Units | 33,405 | 33,143 | 74,625 | 70,664 |

| Population Needed to Absorb at current people per household ratio | 87,618 | 88,140 | 204,113 | 185,004 |

| Years to absorb at current rate of population growth | 13.6 | 7.2 | 5.4 | 2.0 |

The above table provides the calculation. Note: This assumes that the people per household in each state will remain the same.

Of course Louisiana, and to some extent Mississippi, are special cases because of hurricane Katrina. The population in both states increased slowly over the last decade - and at that rate of population growth it will take many years to absorb the excess vacant units.

In New Jersey it will take 5.4 years to absorb the excess, and in Virginia (a fast growing state over the last decade) it will still take 2.0 years.

Of course the number of people per household could decline or the population could grow quicker over the next few years - but this suggests there is still a large excess inventory of vacant housing units in these states. This is one of the calculations I'll be looking at as the Census 2010 data is released.

Consumer Credit increases in December

by Calculated Risk on 2/07/2011 03:00:00 PM

The Federal Reserve reports:

Consumer credit increased at an annual rate of 2-1/2 percent in the fourth quarter. Revolving credit declined at an annual rate of 2-3/4 percent,

and nonrevolving credit increased at an annual rate of 5-1/2 percent. In December, consumer credit increased 3 percent at an annual rate.

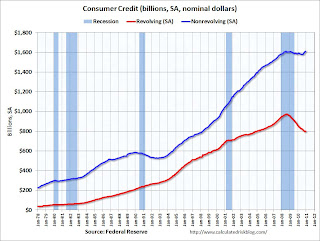

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows consumer credit since 1978. The amounts are nominal (not inflation adjusted).

Revolving credit (credit card debt) is off 17.8% from the peak. Non-revolving debt (auto, furniture, and other loans) is now slightly above the old peak. Note: Consumer credit does not include real estate debt.

Both revolving and non-revolving credit were up slightly in December. This was the first increase in revolving credit since August 2008 following 27 consecutive months of declines. This fits with the recent Senior Loan Officer survey that showed:

Banks again reported an increased willingness to make consumer installment loans, and a small net fraction of respondents reported easing standards for approving consumer credit card applications.

LPS: Overall mortgage delinquencies declined in 2010

by Calculated Risk on 2/07/2011 11:48:00 AM

LPS Applied Analytics released their December Mortgage Performance data. According to LPS:

• The average loan in foreclosure has been delinquent a record 507 days. This is up from 406 days at the end of 2009, and up from 499 days at the end of November.

• Overall, mortgage delinquencies dropped nearly 18% in 2010.

• On the other hand, foreclosure inventories were up almost 10% in 2010, and are now at nearly 8x historical averages

• “First-time” foreclosures are on the decline, with over 30% of new foreclosure starts having been in foreclosure before

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph provided by LPS Applied Analytics shows the percent delinquent, percent in foreclosure, and total non-current mortgages.

The percent in the foreclosure process is trending up because of the foreclosure moratoriums.

According to LPS, 8.83% of mortgages are delinquent (down from 9.02% in November), and another 4.15% are in the foreclosure process (up from 4.08% in November) for a total of 12.98%. It breaks down as:

• 2.56 million loans less than 90 days delinquent.

• 2.12 million loans 90+ days delinquent.

• 2.2 million loans in foreclosure process.

For a total of 6.87 million loans delinquent or in foreclosure.

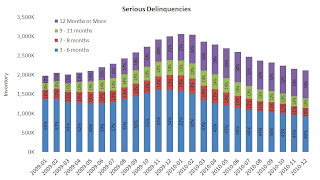

The second graph shows the break down of serious deliquencies.

The second graph shows the break down of serious deliquencies.

LPS reported "the share of seriously delinquent loans that have not made payments in over a year continues to increase.".

Note: I've seen some people include these 7 million delinquent loans as "shadow inventory". This is not correct because 1) some of these loans will cure, and 2) some of these homes are already listed for sale (so they are included in the visible inventory).

Lawler: Housing Vacancy Survey appears to massively overstate number of vacant housing units

by Calculated Risk on 2/07/2011 08:30:00 AM

CR Note: Many analysts use the quarterly Housing Vacancies and Homeownership survey from the Census Bureau to estimate the number of vacant housing units in the United States. This survey probably overstates the number of vacant units.

From economist Tom Lawler ...

Early Look at a Few States’ Housing Stock Numbers from Census 2010 Suggests that Housing Vacancy Survey Massively Overstates Number of Vacant Housing Units

The Census Bureau has starting releasing Census 2010 data for selected states, with the first “batch” being Louisiana, Mississippi, New Jersey, and Virginia. On its website, the data shown include not just population counts, but housing counts as well – occupied as well as vacant. I don’t know if these are the “final, official” housing count totals, but here are the data shown on the website for these states. Also shown are the counts from Census 2000 (NOT adjusted for subsequent “overcounts/undercounts,” as well as the gross vacancy rates (total vacant units – including seasonal – divided by total housing units) for Census 2010, Census 2000, and the gross vacancy rates from the Housing Vacancy Survey HVS) and the ACS for 2009 (2010 data have not yet been released).

| Louisiana | Mississippi | New Jersey | Virginia | |

|---|---|---|---|---|

| Population | 4,533,372 | 2,967,297 | 8,791,894 | 8,001,024 |

| Housing Units | 1,964,981 | 1,274,719 | 3,553,562 | 3,364,939 |

| Occupied | 1,728,360 | 1,115,768 | 3,214,360 | 3,056,058 |

| Vacant | 236,621 | 158,951 | 339,202 | 308,881 |

| Population | 4,468,976 | 2,844,658 | 8,414,350 | 7,078,515 |

| Housing Units | 1,847,181 | 1,161,953 | 3,310,275 | 2,904,192 |

| Occupied | 1,656,053 | 1,046,434 | 3,064,645 | 2,699,173 |

| Vacant | 191,128 | 115,519 | 245,630 | 205,019 |

| Louisiana | Mississippi | New Jersey | Virginia | |

| Census 2010 | 12.00% | 12.50% | 9.50% | 9.20% |

| Census 2000 | 10.30% | 9.90% | 7.40% | 7.10% |

| HVS 2009 | 14.00% | 16.40% | 12.10% | 12.20% |

| ACS 2009 | 14.00% | 14.60% | 10.50% | 10.80% |

What is, of course, especially noteworthy is that the “gross” vacancy rates from the HVS for 2009 (which are yearly average estimates) are massively higher than the Census 2010 estimates for April 1, 2010, as well as being materially higher than those from the ACS for 2009. As I have noted numerous times, the HVS has for at least a decade “found” materially higher gross vacancy rates for most areas (Louisiana being an exception) than the ACS, and “found” materially higher gross vacancy rates for 2000 than was the case for Census 2000. I’ve talked to folks about this, but no one seems to know why.

What is also interesting is that the gross vacancy rate from Census 2010 for the above states is substantially lower than those shown in the ACS for 2009. While given the low level of housing production it would not be surprising that the gross vacancy rate on April 1, 2010 would be lower than the average for 2009, it’s hard to believe that the “actual” gross vacancy rate in these states declined by as much as that suggested by assuming that the ACS 2009 GVR and the Census 2010 GVR were both “correct.”

Not surprisingly, the gross vacancy rates in the above states from Census 2010 were all up significantly from Census 2000. However, it would appear as the GVRs did not increase by as much as suggested either in the HVS (state data are only available back to 2005) or the ACS, and it seems clear that the HVS’ estimates for TOTAL vacant housing units is a boatload higher than the “actuals.”

Next week the Census is scheduled to release Census 2010 data for Arkansas, Indiana, Iowa, Maryland, and Vermont, and the deadline for data releases for all states is, intriguingly, April Fools’ Day.