by Calculated Risk on 1/26/2011 08:14:00 AM

Wednesday, January 26, 2011

MBA: Mortgage Purchase Applications lowest since last October

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 15.3 percent from the previous week and reached its lowest level since January 2010. The seasonally adjusted Purchase Index decreased 8.7 percent from one week earlier. The Purchase Index is at its lowest level since October 2010.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.8 percent from 4.77 percent, with points decreasing to 1.19 from 1.20 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index suggests weak existing home sales through the first few months of 2011.

Tuesday, January 25, 2011

Preview: Financial Crisis Inquiry Commission Report

by Calculated Risk on 1/25/2011 11:21:00 PM

The Financial Crisis Inquiry Commission report will be released on Thursday, but Sewell Chan at the NY Times has some excerpts: Financial Crisis Was Avoidable, Inquiry Finds

The 2008 financial crisis was an “avoidable” disaster caused by widespread failures in government regulation, corporate mismanagement and heedless risk-taking by Wall Street, according to the conclusions of a federal inquiry.When the Financial Crisis Inquiry Commission was announced, I was skeptical if they'd be willing to address the willful lack of regulatory supervision and the role of Wall Street in the crisis.

...

The majority report finds fault with two Fed chairmen: Alan Greenspan, who led the central bank as the housing bubble expanded, and his successor, Ben S. Bernanke, who did not foresee the crisis but played a crucial role in the response. It criticizes Mr. Greenspan for advocating deregulation and cites a “pivotal failure to stem the flow of toxic mortgages” under his leadership as a “prime example” of negligence.

...

[T]he report is harsh on regulators. It finds that the Securities and Exchange Commission failed to require big banks to hold more capital to cushion potential losses and halt risky practices, and that the Fed “neglected its mission.”

It says the Office of the Comptroller of the Currency, which regulates some banks, and the Office of Thrift Supervision, which oversees savings and loans, blocked states from curbing abuses because they were “caught up in turf wars.”

These excerpts give me hope - there is much more in Chan's article - now I'm definitely looking forward to reading the report! Barry Ritholtz is happy too.

Earlier posts on Case-Shiller Home Price indexes:

• Case-Shiller: U.S. Home Prices Keep Weakening as Eight Cities Reach New Lows in November

• House Prices and Months-of-Supply, and Real House Prices

• House Price graph gallery

SOTU 2011 9 PM ET

by Calculated Risk on 1/25/2011 08:42:00 PM

Update:

Text of Obama’s State of the Union speech

From the NY Times: Obama Sees Global Fight for U.S. Jobs

From the WSJ: Obama: Freeze Spending

Earlier posts on Case-Shiller Home Price indexes:

• Case-Shiller: U.S. Home Prices Keep Weakening as Eight Cities Reach New Lows in November

• House Prices and Months-of-Supply, and Real House Prices

• House Price graph gallery

Housing: What Generation Y Wants

by Calculated Risk on 1/25/2011 06:59:00 PM

From Patrick Coolican at the Las Vegas Sun: Generation Y wants housing Las Vegas has in short supply

[D]evelopers filled the valley and made piles of money with suburban tract homes that carry little appeal for the next generation of housing consumers, according to an emerging body of survey data of the so-called Millennials or Generation Y.As Patrick notes, this preference for urban living can partially be explained by their current age:

That’s the generation — about 80 million strong, which is larger than the postwar Baby Boom — born from about the mid-1970s to the early 2000s.

At the recent homebuilders trade show in Orlando, Fla., Melina Duggal of the real estate consulting firm RCLCO laid out the data on the next generation of housing consumers. Her firm asked young renters where they would move to if they had the opportunity. More than 80 percent said they would choose an urban area, or a suburban area that qualified as “urban lite,” such as Arlington, Va., or Bethesda, Md. These are suburbs that feature walkability and easy access to urban amenities.

"[T]hey may want the urban experience now, but eventually they’ll marry and have children and want to live near good suburban schools and have a bigger home with a yard."Maybe ... I'm not in Generation Y (or even close), but I desire walkability and to be close to some urban amenities. Maybe tastes are changing.

State Unemployment Rates: The Decline from Recession Maximum

by Calculated Risk on 1/25/2011 03:55:00 PM

Earlier today I posted the usual graph of the state unemployment rate (with highs and lows since 1976).

Reader picosec suggested comparing the current state unemployment rates against the peak unemployment rates for each state during the recent recession. He writes: "This would indicate the relative rate that each state is recovering and might inspire discussion about why certain states are recovering faster/slower than others."

The following graph shows the current unemployment rate for each state (blue), and the max during the recession (red). If there is no red, the state is currently at the maximum during the recession.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The states are ranked by the largest percentage decline from the peak. New Hampshire's unemployment rate has declined from 7.1% to 5.5% currently (the largest percentage decline). Michigan's rate has declined from 14.5% to 11.7%, the largest percentage point decline, but less as percentage than New Hampshire or Vermont.

The auto states - led by Michigan - tend to be on the left side of the graph with improving employment. The worst housing bubble states - California, Arizona, Florida and Nevada - are mostly on the right side of the graph.

Six states are at the recession maximum (no improvement): Arkansas, Colorado, Idaho, Nevada, Texas and West Virginia.

House Prices and Months-of-Supply, and Real House Prices

by Calculated Risk on 1/25/2011 12:26:00 PM

This morning S&P/Case-Shiller released the monthly Home Price indexes for November (a three month average). Here is a look at house prices and existing home months-of-supply, and also real house prices (2nd graph).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

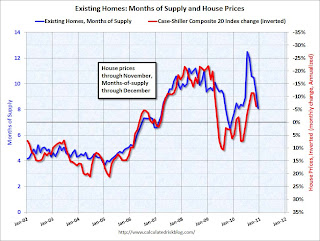

This graph shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

House prices are through November using the composite 20 index. Months-of-supply is through December. Based on this general relationship, I expect house prices to fall further.

The months-of-supply declined to 8.1 months in December, but I think there is a good chance that the months-of-supply will increase again in the spring of 2011. The months-of-supply uses the seasonally adjusted sales rate, but the not seasonally adjusted inventory - even though there is a clear seasonal pattern for inventory (low in December and January and higher during the summer).

We will need to watch inventory and months-of-supply very closely over the next few months for hints about house prices.

Note: there have been periods with high months-of-supply and rising house prices (see: Lawler: Again on Existing Home Months’ Supply: What’s “Normal?” ) so this is just a guide.

The following graph shows the Case-Shiller Composite 20 index, and the CoreLogic House Price Index in real terms (adjusted for inflation using CPI less shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, both indexes are back to early 2001 prices. Also both indexes are at post-bubble lows.

In real terms, both indexes are back to early 2001 prices. Also both indexes are at post-bubble lows.

A few key points:

• The real price indexes are at post-bubble lows. Those who argued prices bottomed some time ago are already wrong in real terms, and will probably be wrong in nominal terms soon.

• Don't expect real prices to fall to '98 levels. In many areas - if the population is increasing - house prices increase slightly faster than inflation over time, so there is an upward slope in real prices.

• Real prices are still too high, but they are much closer to the eventual bottom than the top in 2005. This isn't like in 2005 when prices were way out of the normal range.

• Prices will probably fall some more and my forecast is for a decline of 5% to 10% from the October 2010 levels for the national price indexes. We will need to watch inventory (and months-of-supply) closely over the next few months to forecast house prices.