by Calculated Risk on 1/17/2011 11:49:00 AM

Monday, January 17, 2011

Hotels: RevPAR up 7.8% compared to same week in 2010

A weekly update on hotels from HotelNewsNow.com: STR: US weekly results for week ending 8 Jan.

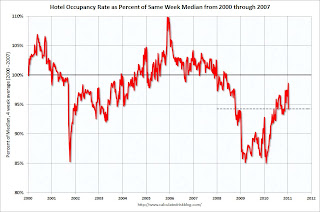

In year-over-year comparisons, occupancy increased 5.7 percent to 42.8 percent, average daily rate was up 2.0 percent to US$93.43, and revenue per available room finished the week up 7.8 percent to US$40.00.The following graph shows the four week moving average of the occupancy rate as a percent of the median occupancy rate from 2000 through 2007.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Note: I've changed this graph. Since this is the percent of the median from 2000 to 2007, the percent can be greater than 100%.

The down spike in 2001 was due to 9/11. The up spike in late 2005 was hurricane related (Katrina and Rita). The dashed line is the current level.

This shows how deep the slump was in 2009 compared to the period following the 2001 recession. This also shows hotels are recovering, but the occupancy rates are still below normal.

RevPAR is up compared to the same week last year, but still down from 2009.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Another State Budget Update

by Calculated Risk on 1/17/2011 09:03:00 AM

Writing in the NY Times, Monica Davey reviews the budget situation in several states: Budget Worries Push Governors to Same Mind-Set

In years past, new governors have introduced themselves in inaugural remarks filled with cheery, soaring hopes; plans for expansions to education, health care and social services; and the outlines of new, ambitious local projects.This is a key issue this year - these budget cuts and tax hikes will be a drag on growth and employment ...

But an examination of more than two dozen opening addresses of incoming governors in recent days shows that such upbeat visions were often eclipsed by worries about jobs, money and budget gaps.

...

While state revenues — shrunken as a result of the recession — are finally starting to improve somewhat, federal stimulus money that had propped up state budgets is vanishing and costs are rising, all of which has left state leaders bracing for what is next. For now, states have budget gaps of $26 billion, by some estimates, and foresee shortfalls of at least $82 billion as they look to next year’s budgets.

Weekend:

• Summary for Week ending January 15th

• Schedule for Week of January 16th

Sunday, January 16, 2011

Spain: "I Live Here Alone"

by Calculated Risk on 1/16/2011 08:22:00 PM

Here is an article on housing in Spain (in Spanish): Aquí vivo solo (ht Jim)

Google translate page:

There is only life in a corner with nothing around, rather than highways, roads, farmland, a corner living Paula and Pavel and another 1,200 people. Un 4% de lo previsto. 4% of schedule. Hay muchas formas de vivir solo. There are many ways to live alone. Esta es una de ellas. This is one of them. La urbanización fue proyectada para 30.000, más de un tercio de la población de Guadalajara capital. The complex was designed for 30,000 ...Check out the photos and captions too! The one guy has a golf course to himself ... at least the grass is green.

Earlier:

• Summary for Week ending January 15th

• Schedule for Week of January 16th

CoStar: Commercial Real Estate Prices declined in November

by Calculated Risk on 1/16/2011 02:22:00 PM

Some interesting comments on the trifurcation of the commercial real estate market ...

From CoStar: CoStar Commercial Repeat-Sale Indices

• CoStar’s three national commercial real estate repeat sales indices were down for the month of November despite notable price increases for high profile core transactions in Washington D.C. and New York City

• The Investment Grade index was down 4.1% for the month giving back some, but not all of the 8.1% net gains observed over August, September and October. Notwithstanding November’s decline, the Investment Grade index is still up 7.6% since its cyclical low earlier this year.

Negative national trends contrast with the strong and increasing interest in trophy properties within core markets where prices have continued to climb during 2010. Collectively they show a market that is not just bifurcated but possibly trifurcated, with trophy assets commanding bidding wars, smaller assets languishing, particularly in secondary and tertiary markets; and distressed properties trickling onto the market as banks recycle assets at a relatively measured pace.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph from CoStar shows the indexes for investment grade, general commercial and a composite index. All three indexes declined in November.

It is important to remember that there are very few CRE transactions (compared to residential), and that there is a high percentage of distressed sales, so prices are very volatile.

Earlier:

• Summary for Week ending January 15th

• Schedule for Week of January 16th

Summary for Week ending January 15th

by Calculated Risk on 1/16/2011 08:24:00 AM

Note: here is the economic Schedule for Week of January 16th.

Below is a summary of the previous week, mostly in graphs.

• Retail Sales increased 0.6% in December

On a monthly basis, retail sales increased 0.6% from November to December(seasonally adjusted, after revisions), and sales were up 7.9% from December 2009.

Click on graphs for larger image in graph gallery.

Click on graphs for larger image in graph gallery.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline). Retail sales are up 13.5% from the bottom, and now 0.2% above the pre-recession peak.

This was below expectations for a 0.8% increase. Retail sales ex-autos were up 0.5%; also below expectations of a 0.7% increase. Although slightly lower than expected, retail sales are now above the pre-recession peak in November 2007.

• Industrial Production, Capacity Utilization increased in December

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.8 percent in December after having risen 0.3 percent in November. ... The capacity utilization rate for total industry rose to 76.0 percent, a rate 4.6 percentage points below its average from 1972 to 2009.

This graph shows Capacity Utilization. This series is up 11.5% from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. This series is up 11.5% from the record low set in June 2009 (the series starts in 1967).Capacity utilization at 76.0% is still far below normal - and well below the pre-recession levels of 81.2% in November 2007.

This was above consensus expectations of a 0.5% increase in Industrial Production, and an increase to 75.6% for Capacity Utilization.

• Trade Deficit declined slightly in November

The trade deficit in November was $38.3 billion, down slightly from $38.4 billion in October This graph shows the monthly U.S. exports and imports in dollars through November 2010.

The trade deficit in November was $38.3 billion, down slightly from $38.4 billion in October This graph shows the monthly U.S. exports and imports in dollars through November 2010.Imports have been mostly flat since May, and exports have started increasing again after the mid-year slowdown.

The petroleum deficit increased in November as import prices continued to rise - averaging $76.81 per barrel in November. Prices will be even higher in December. The deficit with China increased to $25.634 billion from $25,517 in October. Once again oil and China deficits are essentially the entire trade deficit (or even more).

• CoreLogic: House Prices declined 1.6% in November

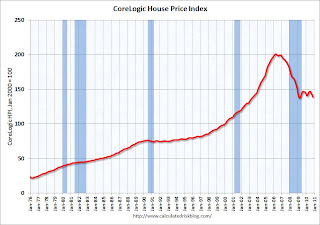

CoreLogic reported that house prices declined again in November. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

CoreLogic reported that house prices declined again in November. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.The index is down 5.07% over the last year, and off 30.9% from the peak.

The index is only 1.2% above the post-bubble low set in March 2009, and I expect to see a new post-bubble low for this index - possibly as early as next month or maybe in early 2011.

• Ceridian-UCLA: Diesel Fuel index increased in December

Ceridian-UCLA reported "The Ceridian-UCLA Pulse of Commerce Index™ (PCI), a real-time measure of the flow of goods to U.S. factories, retailers and consumers, surged 2.4 percent in December and pushed the PCI above its previous 2010 peak established in May."

Ceridian-UCLA reported "The Ceridian-UCLA Pulse of Commerce Index™ (PCI), a real-time measure of the flow of goods to U.S. factories, retailers and consumers, surged 2.4 percent in December and pushed the PCI above its previous 2010 peak established in May."This graph shows the index since January 1999.

• NFIB: Small Business Optimism index declined slightly in December

This graph shows the small business optimism index since 1986. The index decreased slightly to 92.6 in December from 93.2 in November.

This graph shows the small business optimism index since 1986. The index decreased slightly to 92.6 in December from 93.2 in November.According to the NFIB: "This marks the 36th month of Index readings in the recession level".

The decline this month was small, and in general this index has been improving - but very slowly.

• Other Economic Stories ...

• From the Financial Times: Lisbon succeeds with debt auction

• From the NY Times: Portugal Bond Sale Succeeds Despite Budget Woes

• From the WSJ: Strong Demand at European Debt Auctions

• From the Association of American Railroads: AAR: Rail Traffic increased in December

• Fed's Beige Book: "Economic activity continued to expand moderately"

• From RealtyTrac: Record Foreclosure activity in 2010

• Unofficial Problem Bank list increases to 933 Institutions

Best wishes to all!

Saturday, January 15, 2011

State and Local Budget Update

by Calculated Risk on 1/15/2011 11:04:00 PM

State and local budgets are a key issue this year. The HuffPo has some details: State Budgets: Year Ahead Looms As Toughest Yet Here are a few states:

New York Gov. Andrew Cuomo proposed eliminating 20 percent of state agencies by combining duties, such as merging the Insurance Department, Banking Department and the Consumer Protection Board into the Department of Financial Regulation. It's part of "radical reform" to pull his state out of its fiscal crisis.And on and on. As the article notes, state revenue is slowing increasing this year, but the support from the stimulus program is starting to fade - so this will be another very difficult year for the states.

And Gov. Chris Christie in New Jersey skipped a $3.1 billion payment to the state's pension system in a push to cut benefits for public workers, while proposing higher employee contributions and a boost in the retirement age from 62 to 65.

In Illinois, lawmakers voted for a ... hike in personal income tax, from 3 percent to 5 percent, in a bid to resolve a $15 billion deficit ...

In oil-rich Texas ... hard times are looming. The shortfall is projected to be between $15 billion and $27 billion over the coming two-year budget cycle.

In South Carolina, outgoing Gov. Mark Sanford has proposed a spending plan that would end funding for museum and arts programs, slash college funding and give many state employees a 5 percent pay cut.

And from the NY Times: U.S. Bills States $1.3 Billion in Interest Amid Tight Budgets (ht Mr. Slippery)

a new bill is coming due — from the federal government, which will charge them $1.3 billion in interest this fall on the [$41 billion] they have borrowed from Washington to pay unemployment benefits during the downturn ...Ouch. Another straw on the camel's back.

These budget cuts and tax hikes will be a drag on growth and employment this year as the states try to get their fiscal houses in order.

Note: Here is the Schedule for Week of January 16th