by Calculated Risk on 1/14/2011 02:31:00 PM

Friday, January 14, 2011

Fed's Rosengren: Two Key Questions about the Economic Recovery

From Boston Fed President Eric Rosengren: Two Key Questions about the Economic Recovery

The first question is, what role will housing play in the recovery? ... housing has traditionally been an important sector of the economy for generating recovery. ... I expect housing will not provide as much support to this recovery as it has in previous ones. My sense is that residential investment, consumer durables, and services related to housing will be less robust than is usual in many recoveries, thus playing a role in what I think will be only a gradual improvement in the economy and employment.

To put it plainly, these housing-related headwinds are part of why I do not expect growth greater than 4 percent this year. And while 4 percent is not terrible, at that rate it will still take a very long time to get back to full employment.

...

The real laggard in this recovery has been housing. While housing is a relatively small component of GDP, it can be quite volatile – and often grows rapidly during an economic recovery. In addition, purchases of appliances, home furnishings, and housing-related services are impacted by slowed housing activity. Given the problems that flow from the bursting of the housing bubble, Figure 5 [below] shows that residential fixed investment is roughly where it was at the trough of the recession – and thus not providing its more usual contribution to growth in the early stages of a recovery.

This shows the lack of contribution from residential investment in the current recovery. If Rosengren had included earlier recessions, many would like the 1982 recovery!

And on inflation:

A second key question involves the concerns about Fed actions stoking inflation. ... Some observers and analysts have voiced great concern that the nascent economic recovery, combined with the actions of the Federal Reserve that have expanded its balance sheet, will lead to significant inflation. However, Figure 11 [see previous post for similar graph] provides a variety of different measures of core inflation; core CPI, core PCE, trimmed core CPI and trimmed core PCE. It is striking how much all four series have declined. In fact many of these series are at their historical lows.I've highlighted this many times: residential investment is usually a strong engine of recovery, but not this time because of the large excess inventory of vacant housing units. I think residential investment will finally add to GDP and employment growth this year, but the increase will not be robust.

...

While we have been experiencing disinflation generally, it is not the case for all prices. ... some prices have risen rapidly. Energy prices in particular have been rising, in response to robust growth in emerging markets. But outside of energy prices, most prices have shown little increase, and in fact a number of the major categories in the CPI index have experienced declines in prices. ... my primary concern about rising energy prices is not so much that they will lead to higher inflation, but that they will subtract from household income and thus weaken the economy.

Core measures of inflation increase in December

by Calculated Risk on 1/14/2011 12:43:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.7% annualized rate) in December. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.6% annualized rate) during the month. ...So these three measures: core CPI, median CPI and trimmed-mean CPI, all increased less than 1% over the last 12 months.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.5% (6.2% annualized rate) in December. The CPI less food and energy increased 0.1% (1.1% annualized rate) on a seasonally adjusted basis.

Over the last 12 months, the median CPI rose 0.6%, the trimmed-mean CPI rose 0.8%, the CPI rose 1.5%, and the CPI less food and energy rose 0.8%

However, all three increased in December at an annualized rate - although still below the Fed's target of around 2%. The headline CPI number reflects the surge in oil prices.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows these three measure of inflation on a year-over-year basis.

They all show that inflation has been falling, and that measured inflation is up less than 1% year-over-year.

Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation

The indexes for rent and owners' equivalent rent both increased in December.

The indexes for rent and owners' equivalent rent both increased in December.By these measures rents have bottomed and are starting to increase again (this fits with earlier reports of falling vacancy rates and rising rents). I don't expect rents to push up inflation very much (I think core inflation will stay low for some time with all the slack in the system), but rising rents suggests that the excess rental housing units are being absorbed - a necessary step for an eventual recovery in residential investment.

Consumer Sentiment declines in January

by Calculated Risk on 1/14/2011 10:09:00 AM

The preliminary Reuters / University of Michigan consumer sentiment index declined to 72.7 in January from 75.2 in December.

This was below the consensus forecast of 75.5.

Sentiment is still at levels usually associated with a recession - and sentiment is well below the pre-recession levels.

In general consumer sentiment is a coincident indicator, and this suggests the recovery is still relatively sluggish.

Industrial Production, Capacity Utilization increased in December

by Calculated Risk on 1/14/2011 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.8 percent in December after having risen 0.3 percent in November. ... At 94.9 percent of its 2007 average, total industrial production in December was 5.9 percent above its level of a year earlier. The capacity utilization rate for total industry rose to 76.0 percent, a rate 4.6 percentage points below its average from 1972 to 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is up 11.5% from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.0% is still far below normal - and well below the pre-recession levels of 81.2% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

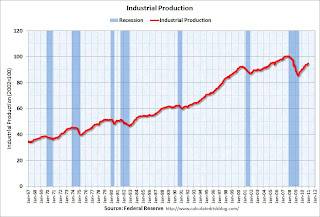

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in December, but production is still 5.8% below the pre-recession levels at the end of 2007.

This was above consensus expectations of a 0.5% increase in Industrial Production, and an increase to 75.6% for Capacity Utilization.

Retail Sales increased 0.6% in December

by Calculated Risk on 1/14/2011 08:30:00 AM

On a monthly basis, retail sales increased 0.6% from November to December(seasonally adjusted, after revisions), and sales were up 7.9% from December 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 13.5% from the bottom, and now 0.2% above the pre-recession peak.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 7.4% on a YoY basis (7.9% for all retail sales).

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for December, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $380.9 billion, an increase of 0.6 percent (±0.5%) from the previous month, and 7.9 percent (±0.7%) above December 2009. Total sales for the 12 months of 2010 were up 6.6 percent (±0.4%) from 2009. Total sales for the October through December 2010 period were up 7.8 percent(±0.5%) from the same period a year ago. The October to November 2010 percent change was unrevised from +0.8 percent (±0.2%).This was below expectations for a 0.8% increase. Retail sales ex-autos were up 0.5%; also below expectations of a 0.7% increase.

Although slightly lower than expected, retail sales are now above the pre-recession peak in November 2007.

Thursday, January 13, 2011

Report: Near Failure of Citigroup in 2008

by Calculated Risk on 1/13/2011 09:13:00 PM

From Shahien Nasiripour at the HuffPo: Citigroup Was On The Verge Of Failure, New Report Finds; Rescue Was Based On 'Gut Instinct'

"We were on the verge of having to close this institution [Citigroup] because it can't meet its liquidity Monday morning," said Sheila Bair, chairman of the Federal Deposit Insurance Corporation, during a meeting the previous Sunday night, according to the report by the Special Inspector General for the Troubled Asset Relief Program.We all knew it was close ...

"Without substantial government intervention," said another FDIC official, bank regulators and Citigroup "project that Citibank will be unable to pay obligations or meet expected deposit outflows next week," according to the report.