by Calculated Risk on 1/11/2011 08:22:00 PM

Tuesday, January 11, 2011

Another Busy Day

The story remains the same - indicators are mixed, but mostly show gradual improvement - and ongoing problems in Europe and falling house prices ...

• NFIB: Small Business Optimism index declines slightly in December

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The first graph shows the small business optimism index since 1986. The index decreased slightly to 92.6 in December from 93.2 in November.

According to the NFIB: "This marks the 36th month of Index readings in the recession level". Here is the NFIB press release: NFIB Small Business Optimism Index Remains Weak

• Ceridian-UCLA: Diesel Fuel index increases in December

The Ceridian-UCLA Pulse of Commerce Index™ (PCI), a real-time measure of the flow of goods to U.S. factories, retailers and consumers, surged 2.4 percent in December and pushed the PCI above its previous 2010 peak established in May.Here is the press release: Year-End Surge Reported in Latest Ceridian-UCLA PCI

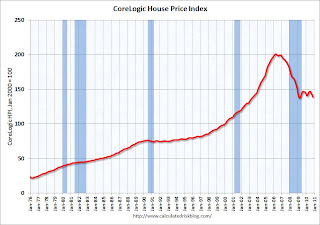

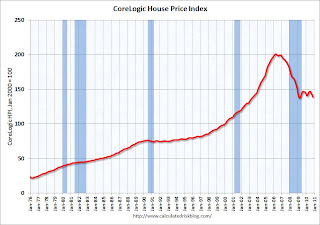

• CoreLogic: House Prices declined 1.6% in November

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.The index is down 5.07% over the last year, and off 30.9% from the peak.

The index is only 1.2% above the low set in March 2009, and I expect to see a new post-bubble low for this index - possibly as early as next month.

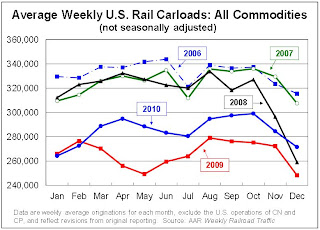

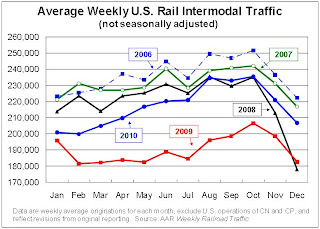

• AAR: Rail Traffic increases in December.

The AAR reports carload traffic in December 2010 was up 9.4% compared to December 2009, and traffic is also above December 2008. Intermodal traffic (using intermodal or shipping containers) is up 13.3% over December 2009 and up over December 2008.

• BLS: Job Openings steady in November, Labor Turnover still Low

• Europe Update: Portugal Bond Auction Wednesday

Europe Update: Portugal Bond Auction Wednesday

by Calculated Risk on 1/11/2011 04:35:00 PM

• This is a key point from Landon Thomas at the NY Times: Foreigners Shun Europe’s Bonds, and Debt Piles Up

With its 10-year debt trading close to the historic high of 7 percent reached last week, Portugal will try Wednesday to sustain what many have come to see as nothing more than a form of bond market charades when it attempts to raise up to €1.25 billion, or $1.62 billion, in long-term financing — debt that is expected to come largely from the country’s already depleted banking system.This has happened in other countries too (there was even story in El Mundo this morning that the Spanish government had contacted local banks about buying bonds without going through an auction process).

An excellent article about the "bond market charades".

• And from Marcus Walker and Stephen Fidler at the WSJ: EU Weighs Boosting Bailout Fund

Top civil servants from EU finance ministries discussed an overhaul of Europe's main bailout mechanism, the €440 billion ($568 billion) European Financial Stability Facility ...Preparing for Spain?

• And from David Oakley, Lindsay Whipp and Peter Spiegel at the Financial Times: Japan pledges to buy eurozone bonds. At least there are buyers for the EFSF bonds.

BLS: Job Openings steady in November, Labor Turnover still Low

by Calculated Risk on 1/11/2011 02:06:00 PM

This was released earlier by the BLS: Job Openings and Labor Turnover Summary

There were 3.2 million job openings on the last business day ofThe following graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

November, the U.S. Bureau of Labor Statistics reported today. The job

openings rate was essentially unchanged over the month at 2.4 percent.

Unfortunately this is a new series and only started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for November, the most recent employment report was for December.

Click on graph for larger image in graphics gallery.

Click on graph for larger image in graphics gallery.Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Note: The temporary decennial Census hiring and layoffs distorted this series over the summer months.

In November, about 4.118 million people lost (or left) their jobs, and 4.210 million were hired (this is the labor turnover in the economy) adding 92 thousand total jobs.

Even with the slight decline in November, job openings are up significantly over the last year.

AAR: Rail Traffic increases in December

by Calculated Risk on 1/11/2011 11:49:00 AM

From the Association of American Railroads: AAR Reports December 2010 Rail Traffic. The AAR reports carload traffic in December 2010 was up 9.4% compared to December 2009, and traffic is also above December 2008. Intermodal traffic (using intermodal or shipping containers) is up 13.3% over December 2009 and up over December 2008.

Total carloads for the year were 14.8 million, up 7.3% over the 13.8 million in 2009. Total intermodal volume in 2010 was 11.3 million trailers and containers, up 14.2% over 2009’s 9.9 million units.

The 7.3% increase in carloads and 14.2% increase in intermodal volume in 2010 over 2009 might be the largest annual percentage increases in history; they’re definitely the largest since 1988, the earliest year for which we have comparable data. Unfortunately, 2010’s increases followed what were probably the biggest annual percentage declines in history in 2009, when carloads were down more than 16% and intermodal traffic was down more than 14% from 2008’s levels. In other words, U.S. railroads have recovered some lost ground, but not nearly all of it.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows U.S. average weekly rail carloads (NSA). Traffic increased in 16 of 19 major commodity categories year-over-year.

From AAR:

• In December 2010, U.S. freight railroads originated an average of 271,568 carloads per week, up 9.4% over December 2009 and the biggest year-over-year percentage monthly increase since June 2010As the first graph shows, rail carload traffic collapsed in November 2008, and now, about 18 months into the recovery, carload traffic has only recovered part way.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):• U.S. railroads also averaged 206,820 intermodal trailers and containers per week in December 2010, up 13.3% over December 2009.As the AAR notes, "U.S. railroads have recovered some lost ground, but not nearly all of it". Traffic is increasing slowly, but still below the 2007 levels.

• Seasonally Adjusted: Carloads in December 2010 increased 1.9% from Nov.

2010; intermodal in December 2010 increased 0.3% over November 2010.

excerpts with permission

CoreLogic: House Prices declined 1.6% in November

by Calculated Risk on 1/11/2011 09:55:00 AM

Notes: CoreLogic reports the year-over-year change. The headline for this post is for the change from October to November 2010. The CoreLogic HPI is a three month weighted average of September,October and November, and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® Home Price Index Shows Decline for Fourth Straight Month

CoreLogic ... released its November Home Price Index (HPI) which shows that home prices in the U.S. declined for the fourth month in a row. According to the CoreLogic HPI, national home prices, including distressed sales, declined by 5.07 percent in November 2010 compared to November 2009 and declined by 3.35 percent in October 2010 compared to October 2009. Excluding distressed sales, year-over-year prices declined by 2.21 percent in November 2010 compared to November 2009 and declined by 2.24 in October 2010 compared to October 2009. ...

“We’re continuing to see the influence of seasonal declines that typically depress home prices during the latter part of the year, but the fact that the rate of decline increased for November is indicative of the uphill battle we’re facing with the housing recovery,” said Mark Fleming, chief economist for CoreLogic.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index is down 5.07% over the last year, and off 30.9% from the peak.

The index is only 1.2% above the low set in March 2009, and I expect to see a new post-bubble low for this index - possibly as early as next month or maybe in early 2011.

Ceridian-UCLA: Diesel Fuel index increases in December

by Calculated Risk on 1/11/2011 09:00:00 AM

This is the new UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce IndexTM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the index since January 1999.

Press Release: Year-End Surge Reported in Latest Ceridian-UCLA Pulse of Commerce Index™

The Ceridian-UCLA Pulse of Commerce Index™ (PCI), a real-time measure of the flow of goods to U.S. factories, retailers and consumers, surged 2.4 percent in December and pushed the PCI above its previous 2010 peak established in May. This performance, combined with November’s 0.4 percent increase, was enough to offset three previous consecutive months of decline.Note:

“The latest PCI data further evidences the positive economic sentiment felt since the start of the New Year,” explained Ed Leamer, chief PCI economist and director of the UCLA Anderson Forecast. “However, we have not entirely escaped the summer doldrums as the three-month moving average is still below its July 2010 level.”

...

The PCI tracks closely on a monthly basis to the Industrial Production Index (to be released later this month) and GDP. Though the forecasts for subsequent growth remain weak, the December surge translates into a very favorable growth of industrial production by .6 percent. Similarly, the PCI outlook for fourth quarter 2010 GDP is more optimistic, but is still expected to be less than current consensus estimates.

...

The Ceridian-UCLA Pulse of Commerce Index™ is based on real-time diesel fuel consumption data for over the road trucking ...

I'm not confident in using this index to forecast GDP growth, although it does appear to track Industrial Production over time (with plenty of noise). Industrial Production for December will be released on Friday.