by Calculated Risk on 1/11/2011 11:49:00 AM

Tuesday, January 11, 2011

AAR: Rail Traffic increases in December

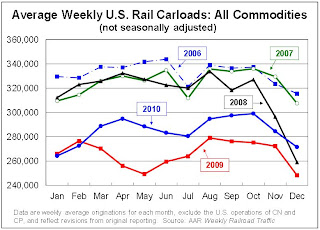

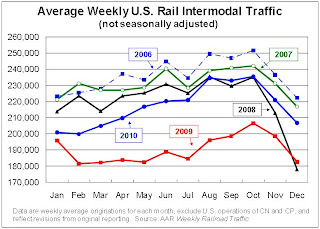

From the Association of American Railroads: AAR Reports December 2010 Rail Traffic. The AAR reports carload traffic in December 2010 was up 9.4% compared to December 2009, and traffic is also above December 2008. Intermodal traffic (using intermodal or shipping containers) is up 13.3% over December 2009 and up over December 2008.

Total carloads for the year were 14.8 million, up 7.3% over the 13.8 million in 2009. Total intermodal volume in 2010 was 11.3 million trailers and containers, up 14.2% over 2009’s 9.9 million units.

The 7.3% increase in carloads and 14.2% increase in intermodal volume in 2010 over 2009 might be the largest annual percentage increases in history; they’re definitely the largest since 1988, the earliest year for which we have comparable data. Unfortunately, 2010’s increases followed what were probably the biggest annual percentage declines in history in 2009, when carloads were down more than 16% and intermodal traffic was down more than 14% from 2008’s levels. In other words, U.S. railroads have recovered some lost ground, but not nearly all of it.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows U.S. average weekly rail carloads (NSA). Traffic increased in 16 of 19 major commodity categories year-over-year.

From AAR:

• In December 2010, U.S. freight railroads originated an average of 271,568 carloads per week, up 9.4% over December 2009 and the biggest year-over-year percentage monthly increase since June 2010As the first graph shows, rail carload traffic collapsed in November 2008, and now, about 18 months into the recovery, carload traffic has only recovered part way.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):• U.S. railroads also averaged 206,820 intermodal trailers and containers per week in December 2010, up 13.3% over December 2009.As the AAR notes, "U.S. railroads have recovered some lost ground, but not nearly all of it". Traffic is increasing slowly, but still below the 2007 levels.

• Seasonally Adjusted: Carloads in December 2010 increased 1.9% from Nov.

2010; intermodal in December 2010 increased 0.3% over November 2010.

excerpts with permission

CoreLogic: House Prices declined 1.6% in November

by Calculated Risk on 1/11/2011 09:55:00 AM

Notes: CoreLogic reports the year-over-year change. The headline for this post is for the change from October to November 2010. The CoreLogic HPI is a three month weighted average of September,October and November, and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® Home Price Index Shows Decline for Fourth Straight Month

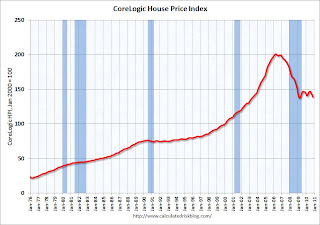

CoreLogic ... released its November Home Price Index (HPI) which shows that home prices in the U.S. declined for the fourth month in a row. According to the CoreLogic HPI, national home prices, including distressed sales, declined by 5.07 percent in November 2010 compared to November 2009 and declined by 3.35 percent in October 2010 compared to October 2009. Excluding distressed sales, year-over-year prices declined by 2.21 percent in November 2010 compared to November 2009 and declined by 2.24 in October 2010 compared to October 2009. ...

“We’re continuing to see the influence of seasonal declines that typically depress home prices during the latter part of the year, but the fact that the rate of decline increased for November is indicative of the uphill battle we’re facing with the housing recovery,” said Mark Fleming, chief economist for CoreLogic.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index is down 5.07% over the last year, and off 30.9% from the peak.

The index is only 1.2% above the low set in March 2009, and I expect to see a new post-bubble low for this index - possibly as early as next month or maybe in early 2011.

Ceridian-UCLA: Diesel Fuel index increases in December

by Calculated Risk on 1/11/2011 09:00:00 AM

This is the new UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce IndexTM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the index since January 1999.

Press Release: Year-End Surge Reported in Latest Ceridian-UCLA Pulse of Commerce Index™

The Ceridian-UCLA Pulse of Commerce Index™ (PCI), a real-time measure of the flow of goods to U.S. factories, retailers and consumers, surged 2.4 percent in December and pushed the PCI above its previous 2010 peak established in May. This performance, combined with November’s 0.4 percent increase, was enough to offset three previous consecutive months of decline.Note:

“The latest PCI data further evidences the positive economic sentiment felt since the start of the New Year,” explained Ed Leamer, chief PCI economist and director of the UCLA Anderson Forecast. “However, we have not entirely escaped the summer doldrums as the three-month moving average is still below its July 2010 level.”

...

The PCI tracks closely on a monthly basis to the Industrial Production Index (to be released later this month) and GDP. Though the forecasts for subsequent growth remain weak, the December surge translates into a very favorable growth of industrial production by .6 percent. Similarly, the PCI outlook for fourth quarter 2010 GDP is more optimistic, but is still expected to be less than current consensus estimates.

...

The Ceridian-UCLA Pulse of Commerce Index™ is based on real-time diesel fuel consumption data for over the road trucking ...

I'm not confident in using this index to forecast GDP growth, although it does appear to track Industrial Production over time (with plenty of noise). Industrial Production for December will be released on Friday.

NFIB: Small Business Optimism index declines slightly in December

by Calculated Risk on 1/11/2011 07:30:00 AM

From National Federation of Independent Business (NFIB): Small Business Optimism declines slightly in December

The National Federation of Independent Business Index of Small Business Optimism lost 0.6 points in December, dropping to 92.6, disappointing those who were anticipating a rebound that might signify more growth in the small business sector. Weak sales remains the top problem, stagnating hiring and spending on capital projects. All of which are sidelining the small business sector from a recovery. This marks the 36th month of Index readings in the recession level.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

"The hope for a pick-up in the small business sector did not materialize, but new weaknesses did not appear either," said William C. Dunkelberg, chief economist for the National Federation of Independent Business. "More owners expect their real sales volumes to rise in the coming months, increasing the odds that more hiring and inventory investments will take place. Overall, owners remain stubbornly cautious and uncertain about the future course of the economy and their business prospects."

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the small business optimism index since 1986. The index decreased slightly to 92.6 in December from 93.2 in November.

According to the NFIB: "This marks the 36th month of Index readings in the recession level".

The second graph shows the net hiring plans over the next three months.

The second graph shows the net hiring plans over the next three months.Hiring plans have turned positive again and are at the highest level since mid-2008. According to NFIB: "Over the next three months, 10 percent plan to increase employment (up one point), and nine percent plan to reduce it (down three points), yielding a seasonally adjusted netsix percent of owners planning to create new jobs, a two point gain from December and the best reading in 27 months."

And the third graph shows the percent of small businesses saying "poor sales" is their biggest problem.

And the third graph shows the percent of small businesses saying "poor sales" is their biggest problem.Usually small business owners complain about taxes and regulations (that usually means business is good!), but now their self reported biggest problem is lack of demand.

The decline this month was small, and in general this index has been improving - but very slowly.

Monday, January 10, 2011

Lower Wages for workers who lost jobs

by Calculated Risk on 1/10/2011 11:22:00 PM

From Sudeep Reddy at the WSJ: Downturn's Ugly Trademark: Steep, Lasting Drop in Wages

Between 2007 and 2009, more than half the full-time workers who lost jobs that they had held for at least three years and then found new full-time work by early last year reported wage declines, according to the Labor Department. Thirty-six percent reported the new job paid at least 20% less than the one they lost.Even for those who can find work, the impact of the great recession lingers ...

The severity of the latest downturn makes it likely that many of the unemployed who get rehired will take wage cuts, and that it will be years, if ever, before many of their wages return to pre-recession levels, says Columbia University labor economist Till von Wachter. "The deeper the recession, the lower the wage you're going to get in the next job and the lower the quality of your next job," he says.

Note: Wages are typically sticky downward for those workers who do not lose their jobs - but for those who lose their jobs, wages can fall sharply when they eventually find new work (this happened in the early '80s too).

More Europe: Portugal, Belgium and Spain

by Calculated Risk on 1/10/2011 06:58:00 PM

Three articles from the Financial Times (excerpts with permission):

• Concerns over Belgian debt levels grow

[Belgian] 10-year debt yields rose 12 basis points to 4.24 per cent ... Belgium now pays a 1.4 percentage point premium, or spread, over benchmark German paper, the highest since January 2009.• ECB intervenes as debt crisis deepens

• And a commentary: Europe must look beyond Portugal

Repeatedly having one’s hand forced by markets is no way to manage financial turmoil. Madrid and the eurozone must prepare for a bond strike against Spain before one happens.