by Calculated Risk on 12/29/2010 11:36:00 AM

Wednesday, December 29, 2010

A few Graphs for 2010

Click on graphs for a larger image in graph gallery.

Click on graphs for a larger image in graph gallery.

The first graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses.

As of November there were 7.4 million fewer payroll jobs in the U.S. compared to the peak of employment in 2007. If the U.S. economy adds 200,000 jobs per month, it will take 3 years to get back to the previous peak (2 years at 300,000 per month). And that doesn't include jobs needed to offset population growth (about 125,000 jobs per month).

The second graph shows the employment population ratio, the participation rate, and the unemployment rate.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate.

Two of the key stories in 2010 were the unemployment rate (red line) stayed near 10% (at 9.8% in November), and the Labor Force Participation Rate declined to 64.5% in November (blue line). This is the percentage of the working age population in the labor force - and the decline suggests that a large number of people have just given up looking for work.

And now to housing ...

This graph shows existing home sales (left axis) and new home sales (right axis) through November.

This graph shows existing home sales (left axis) and new home sales (right axis) through November.

A key story in 2010 was the collapse in home sales following the expiration of the homebuyer tax credit (Note: the tax credit is widely viewed as a failure).

Existing home sales are back to the levels of 1997 / 1998 and new home sales fell to record lows in the 2nd half of 2010.

As existing home sales declined, existing home inventory and months-of-supply increased.

As existing home sales declined, existing home inventory and months-of-supply increased.

This graph shows the year-over-year change in inventory and the months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Inventory increased 5.4% YoY in November and the months-of-supply (9.5 months in November) is well above normal.

And the high level of inventory has pushed down house prices. This graph shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

And the high level of inventory has pushed down house prices. This graph shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

With the increase in inventory (and months-of-supply), it was no surprise that house prices started declining again in the 2nd half of 2010.

The good news is housing starts stayed near record low levels. This is helping to reduce the excess inventory of housing units.

The good news is housing starts stayed near record low levels. This is helping to reduce the excess inventory of housing units.

This graph shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for two years - with a slight up and down over the last six months due to the home buyer tax credit.

Another piece of "good news" is it appears that mortgage delinquencies might have peaked.

This graph based on quarterly data from the MBA shows the percent of loans delinquent by days past due.

This graph based on quarterly data from the MBA shows the percent of loans delinquent by days past due.

Although delinquencies might have peaked, the level is still very high and there are many more foreclosures in the pipeline.

Note: With declining house prices, the number of homeowners with negative equity will increase - and the delinquency rate might start increasing again.

Some "bad news" for housing is that REO (Real Estate Owned) inventories at Fannie, Freddie and the FHA are at record levels.

This graph shows the REO inventory for Fannie, Freddie and FHA through Q3 2010.

This graph shows the REO inventory for Fannie, Freddie and FHA through Q3 2010.

The REO inventory for the "Fs" has increased sharply over the last year, from 153,007 at the end of Q3 2009 to a record 293,171 at the end of Q3 2010.

Remember this is just a portion of the total REO inventory. Private label securities and banks and thrifts also hold a substantial number of REOs, and the overall REO inventory is below the peak in 2008.

On manufacturing, there was a pickup in capacity utilization and industrial production, but there is still a large amount of excess capacity.

On manufacturing, there was a pickup in capacity utilization and industrial production, but there is still a large amount of excess capacity.

This graph shows Capacity Utilization. This series is up 10.3% from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 75.2% is still far below normal - and well below the pre-recession levels of 81.2% in November 2007.

Another key story in 2010 is that the consumer has started spending again.

Another key story in 2010 is that the consumer has started spending again.

This graph shows real Personal Consumption Expenditures (PCE) through November (2005 dollars).

The two-month method of estimating real PCE growth for Q4 (a fairly accurate method), suggests real PCE growth of 4.3% in Q4! So this looks like a pretty strong quarter for growth in personal consumption. The last time real PCE grew at more than 4% was in 2006.

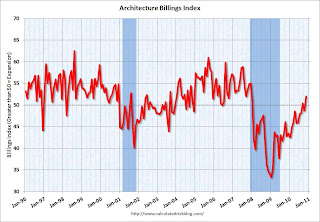

And the final graph is a little bit of good news for commercial real estate.

And the final graph is a little bit of good news for commercial real estate.

In 2010, investment in non-residential structures was a drag on GDP growth. However, this graph of the Architecture Billings Index shows expansion in billings for the first time in almost 3 years. (above 50 is expansion).

This index usually leads investment in non-residential structures by about 6 to 9 months.

Best to all

Leonhardt on 2010: A Year That Fizzled

by Calculated Risk on 12/29/2010 07:57:00 AM

Note: There will be no release this week of mortgage applications from the Mortgage Bankers Association.

From David Leonhardt at the NY Times: In the Rearview, a Year That Fizzled

When 2010 began, hiring and consumer spending were finally picking up. ... By the summer, the unemployment rate was rising again, and Americans’ attitudes about the future were again souring.This graphic has two charts - the second one shows the "long road back" to full employment (below 6% unemployment rate). According to Moody's, if the economy adds 200,000 jobs per months, it will take until 2020. At a 250,000 per month pace, it will take until 2016. A long long time ...

...

To look back at 2010 and to look ahead, we have put together a series of charts. If there is an overall message, it’s that the economy still needs a whole lot of work.

No wonder the Census Bureau is adding another long term unemployed category. From the USA Today (ht Nanette)

Citing what it calls "an unprecedented rise" in long-term unemployment, the federal Bureau of Labor Statistics (BLS), beginning Saturday, will raise from two years to five years the upper limit on how long someone can be listed as having been joblessAnd here are some more graphs from Leonhardt Snapshots of the Economy

Tuesday, December 28, 2010

Misc: Households 'Doubling Up', Bank Failures, Vegas Convention business looking up

by Calculated Risk on 12/28/2010 09:45:00 PM

A few interesting unrelated stories:

• From Michael Luo in the NY Times: ‘Doubling Up’ in Recession-Strained Quarters

Census Bureau data released in September showed that the number of multifamily households jumped 11.7 percent from 2008 to 2010, reaching 15.5 million, or 13.2 percent of all households. It is the highest proportion since at least 1968, accounting for 54 million people.The article discusses the difficulties of 'doubling up', and the strains it puts on families and friends.

Even that figure, however, is undoubtedly an undercount of the phenomenon social service providers call “doubling up,” which has ballooned in the recession and anemic recovery. The census’ multifamily household figures, for example, do not include such situations as when a single brother and a single sister move in together, or when a childless adult goes to live with his or her parents.

• From the WSJ: Hard Call for FDIC: When to Shut Bank. The FDIC disputes that it is dragging its feet closing banks due to a lack of manpower.

• And some upbeat news from Richard Velotta at the Las Vegas Sun: Signs of a surge in Las Vegas conventions

After more than a year of lethargic convention attendance in Las Vegas ... next year’s visitor numbers are expected to reach levels on par with late 2005 or early 2006 ... After stellar 2007, convention traffic tanked.Looking at the Las Vegas visitors data, convention attendance declined in 2008, but really collapsed (off 24%) in 2009. Attendance was about the same this year as in 2009, so this would be quite an increase.

The recession hit Las Vegas in August 2008 when convention traffic fell 22.3 percent from the same month a year earlier. ... In 2009, convention traffic was off 23.9 percent for the year and August 2009 was down a stunning 58.9 percent from that ugly August 2008 number.

Earlier:

• Case-Shiller: Home Prices Weaken Further in October

• House Prices and Months-of-Supply, and Real House Prices

Question #5 for 2011: Employment

by Calculated Risk on 12/28/2010 05:25:00 PM

A week ago I posted some questions for next year: Ten Economic Questions for 2011. I'm working through the questions and trying to add some predictions, or at least some thoughts for each question before the end of year.

5) Employment: The U.S. economy added about 87 thousands payroll jobs per month in 2010 through November. This was extremely weak payroll growth for a recovery. How many payroll jobs will be added in 2011?

The U.S. will add around 1.2 million private sector jobs in 2010. And this despite the construction sector losing over 100 thousand jobs in 2010 (the fourth year in a row of construction job losses).

It now appears that job creation is picking up, and it also appears that the construction sector will add employees for the first time since 2006. There were over 2 million construction jobs lost during the downturn, and a relatively small number will be added next year - but every little bit will help.

This suggests to me that private payroll employment will increase by over 2 million jobs next year, maybe as high as 3 million jobs! My guess is around 2.4 million jobs as shown on the following graph.

Of course state and local governments will probably lose some jobs, but it looks like 2011 will be the best year for private job creation since the '90s.

However, this doesn't mean the unemployment rate will decline significantly. The economy needs to add about 125,000 jobs per month to offset population growth, and I expect the participation rate to increase too - so any decline in the unemployment rate will be slow.

With over 15 million unemployed workers - and 6.3 million unemployed for more than 26 weeks - adding 2.4 million private sector jobs will not seem like much of job recovery for many Americans. Hopefully I'm too pessimistic.

Ten Questions:

• Question #1 for 2011: House Prices

• Question #2 for 2011: Residential Investment

• Question #3 for 2011: Delinquencies and Distressed house sales

• Question #4 for 2011: U.S. Economic Growth

• Question #5 for 2011: Employment

• Question #6 for 2011: Unemployment Rate

• Question #7 for 2011: State and Local Governments

• Question #8 for 2011: Europe and the Euro

• Question #9 for 2011: Inflation

• Question #10 for 2011: Monetary Policy

Misc: Richmond Fed Manufacturing Survey, Consumer Confidence

by Calculated Risk on 12/28/2010 02:32:00 PM

A couple of earlier releases:

• From the Richmond Fed: Manufacturing Activity Expanded at a Solid Pace in December

In December, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — rose sixteen points to 25 from November's reading of 9. Among the index's components, shipments jumped twenty-three points to 30, new orders rose nineteen points to finish at 29, and the jobs index increased four points to 14.This was above expectations of an increase to 11. The last of the regional surveys (Kansas City) will be released on Thursday. I'll update the Fed-ISM graph then.

• The Conference Board reported their consumer confidence index was at 52.5 (1985=100), down from 54.3 in November. This was below expectations of an increase to 57.4. Confidence is a coincident indicator, but this shows consumers remain cautious.

Earlier:

• Case-Shiller: Home Prices Weaken Further in October

• House Prices and Months-of-Supply, and Real House Prices

House Prices and Months-of-Supply, and Real House Prices

by Calculated Risk on 12/28/2010 11:35:00 AM

This morning S&P/Case-Shiller released the monthly Home Price indexes for October (a three month average). Here is a look at house prices and existing home months-of-supply, and also real house prices (2nd graph).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

House prices are through October using the composite 20 index. Months-of-supply is through November.

We need to watch inventory and months-of-supply closely for hints about house prices. The recent surge in existing home inventory - and increase in the months-of-supply - is one of the reasons I expected house prices to fall another 5% to 10%. S&P is also forecasting additional price declines.

Note: there have been periods with high months-of-supply and rising house prices (see: Lawler: Again on Existing Home Months’ Supply: What’s “Normal?” ) so this is just a guide.

The following graph shows the Case-Shiller Composite 20 index, and the CoreLogic House Price Index in real terms (adjusted for inflation using CPI less shelter).

In real terms, both indexes are back to early 2001 prices. Also both indexes are at post-bubble lows.

In real terms, both indexes are back to early 2001 prices. Also both indexes are at post-bubble lows.

A few key points:

• This is worth repeating: the real price indexes are at post-bubble lows. Those who argued prices bottomed some time ago are already wrong in real terms, and will probably be wrong in nominal terms soon.

• Don't expect real prices to fall to '98 levels. In many areas - if the population is increasing - house prices increase slightly faster than inflation over time, so there is an upward slope in real prices.

• Real prices are still too high, but they are much closer to the eventual bottom than the top in 2005. This isn't like in 2005 when prices were way out of the normal range.

• With high levels of inventory, prices will probably fall some more. (I'll update my price forecast soon).